Financial Operations

Mastering Annual Recurring Revenue for Scalable Growth

A practical guide to calculating, understanding, and growing your annual recurring revenue. Learn the strategies investors trust to scale your business.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··19 min readKey Takeaway

Annual Recurring Revenue (ARR) is the normalized recurring revenue from all subscriptions over 12 months—the primary metric investors use to value subscription businesses. Calculate it as: Ending ARR = Starting ARR + New ARR + Expansion ARR - Contraction ARR - Churned ARR. Critically, exclude one-time fees, variable usage charges, and consulting projects. Companies with Net Revenue Retention above 120% (negative churn) grow up to 5x faster than S&P 500 peers because existing customers become more valuable over time.

If you're running a subscription business, stop guessing what your company is worth. For companies like yours, Annual Recurring Revenue (ARR) isn't just another metric—it's the metric that defines your value. It represents the predictable, recurring income from all your subscriptions over a twelve-month period, offering a crystal-clear view of your financial stability and growth potential.

Investors aren't interested in one-time revenue spikes from big projects or setup fees. They care about one thing above all else: predictability. Mastering your ARR is the key to proving you have a sustainable, repeatable engine for growth that justifies high valuations and secures funding when you need it.

Why Annual Recurring Revenue Defines Your Company's Value

When you walk into a pitch meeting, investors scrutinize your business's viability far more than your product features. A clearly articulated and accurate ARR tells them you understand the key drivers of a scalable company. Unlike a simple P&L statement that looks backward, ARR provides a forward-looking measure of your company’s trajectory.

It’s a non-negotiable metric for:

- Company Valuation: SaaS and subscription companies are almost always valued as a multiple of their ARR. A higher, more stable ARR directly translates to a higher valuation. It’s that simple.

- Securing Funding: Lenders and venture capitalists use ARR growth as a primary indicator of your company's traction and future potential. Strong ARR growth is proof of product-market fit.

- Strategic Forecasting: Accurate ARR allows you to reliably forecast future cash flow, manage your burn rate, and plan for long-term growth without flying blind.

The Power of Predictable Income

The shift to predictable income isn't a trend; it's a fundamental change in how successful companies are built. The global subscription economy has grown by an explosive 435% over the past decade, and UBS forecasts suggest the market will hit $1.5 trillion by 2025.

The model’s power lies in its predictability, which is why subscription businesses have consistently outperformed the S&P 500. It’s a model built on sustainable customer relationships, not one-off transactions. For leaders guiding their companies from the $500K mark to $20M and beyond, mastering ARR isn't just good financial hygiene—it’s about survival and growth. It’s one of several critical SaaS financial metrics that matter for building a resilient business.

In the following sections, we’ll move from why ARR is important to how you can calculate, manage, and grow it with investor-grade precision.

How To Calculate ARR With Investor-Grade Precision

If you’re gearing up for a funding round or an acquisition, a back-of-the-napkin annual recurring revenue calculation won’t fly. Investors need to see a defensible, precise number that reflects the true, repeatable income of your business. Getting this wrong is one of the fastest ways to erode trust and kill a deal before it starts.

The basic concept is simple, but the real story is in the adjustments. Your ARR is a living number, constantly influenced by every customer action.

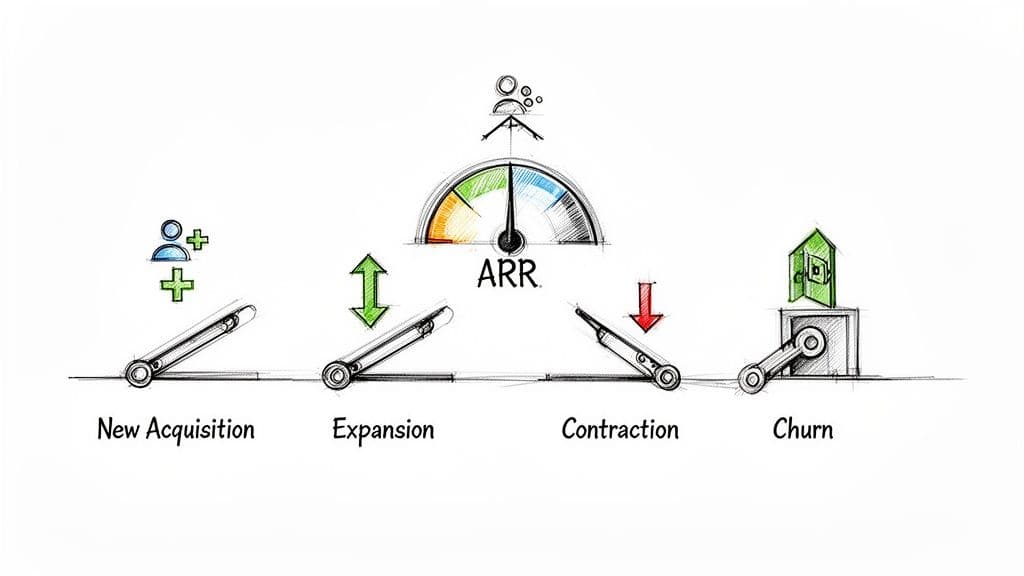

To get it right, you have to track four key movements within any given period:

- New ARR: All the recurring revenue you’ve brought in from brand-new customers.

- Expansion ARR: Increased recurring revenue from existing customers who upgraded, added seats, or bought more services.

- Contraction ARR: The flip side—decreased recurring revenue from customers who downgraded their plans.

- Churned ARR: Recurring revenue lost completely from customers who cancelled their subscriptions.

The Investor-Grade ARR Formula

To figure out your ending ARR, you start with where you were at the beginning of the period and then account for all these movements. The formula looks like this:

Ending ARR = Starting ARR + New ARR + Expansion ARR - Contraction ARR - Churned ARR

This detailed approach gives you a crystal-clear picture of your growth drivers. It immediately answers the most critical questions investors have: is your growth coming from new logos, or are you successfully selling more to your existing customer base? A healthy, scalable business shows a strong balance of both.

Worked Example: Calculating Net New ARR

Let's walk through a specific example. Imagine your SaaS company, "ScaleUp," kicks off the year with $2,000,000 in ARR.

| Metric | Starting Value (Jan 1) | Change in Year | Ending Value (Dec 31) |

|---|---|---|---|

| Starting ARR | $2,000,000 | ||

| New ARR | +$750,000 | ||

| Expansion ARR | +$300,000 | ||

| Contraction ARR | -$100,000 | ||

| Churned ARR | -$250,000 | ||

| Ending ARR | $2,700,000 |

By the end of the year, ScaleUp's Ending ARR is $2,700,000. They added a total of $700,000 in Net New ARR ($750k + $300k - $100k - $250k), proving they can land new customers and grow their existing ones. This component-based calculation is the foundation for predicting future revenue, accurately valuing your company, and scaling your operations with confidence.

As the graphic shows, a precise ARR figure is what allows you to predict performance. That predictability defines your company's value, which in turn enables scalable growth. It all starts with getting the measurement right.

Common Misconception: What Stays Out Of Your ARR Calculation

One of the most common—and costly—mistakes is artificially inflating ARR by including revenue that isn't actually recurring. This is an immediate red flag for any sophisticated investor.

"The combination [of Fivetran and dbt Labs] will form the most complete, most widely-deployed open data infrastructure platform on the market... ~$600 million in ARR with well north of 10,000 customers." — Tristan Handy, Co-Founder and President, dbt Labs

When major players announce mergers, ARR is the headline metric they use to signal scale and market leadership. To report it correctly, you absolutely must exclude:

- One-Time Setup or Implementation Fees: This is professional services revenue, not recurring income.

- Variable Usage or Consumption Fees: Any revenue based on usage that isn't part of a committed, recurring contract does not belong in ARR.

- Consulting or Professional Services Projects: Unless it's a fixed, recurring monthly retainer, project-based work is not ARR.

Failing to separate these items isn’t a simple calculation error; it’s a compliance issue. The rules for SaaS revenue recognition under ASC 606 demand this separation. Your ARR must only reflect the contractually obligated, predictable portion of your revenue. Period.

Decoding the SaaS Alphabet Soup: ARR vs. MRR, TCV, and ACV

Walking into a pitch meeting and mixing up your metrics is one of the quickest ways to lose credibility. Precision isn't just a nice-to-have—it's everything. Showing you grasp the subtle but critical differences between ARR and other common acronyms proves you have a handle on what truly drives your business.

Each metric tells a unique part of your company’s financial story. Let's clear up the confusion so you can speak about your business with total authority.

MRR (Monthly Recurring Revenue)

Monthly Recurring Revenue (MRR) is the lifeblood of any subscription business. It’s the predictable revenue you can count on from all active subscriptions in a given month. Think of MRR as your company's short-term pulse. It's the foundational building block for ARR; the simplest way to get a snapshot of your annual run rate is to multiply your current MRR by 12. It’s perfect for month-to-month operational planning, seeing how your sales team is tracking against quota, and spotting granular trends.

We break this down even further in our complete guide to ARR vs. MRR for SaaS companies.

TCV (Total Contract Value)

Total Contract Value (TCV) represents the entire financial commitment a customer makes over the full lifetime of their contract. This bundles both recurring subscription fees and any one-time charges, like setup fees.

For example, if a client signs a 3-year contract at $2,000/month and pays a $5,000 one-time setup fee, the TCV is $77,000 (($2,000 x 36 months) + $5,000). While TCV is a fantastic indicator of future cash flow and a great way to measure a big sales win, it is absolutely not a measure of your current, sustainable revenue.

ACV (Annual Contract Value)

Annual Contract Value (ACV) takes a contract's recurring revenue and smooths it out over a one-year period. Unlike TCV, ACV deliberately ignores any one-time fees and focuses exclusively on the core subscription value. It answers the simple question: "What is this customer worth to us on an annual basis?"

Let's take that same 3-year deal worth $72,000 in recurring revenue. The ACV is $24,000 ($72,000 / 3 years). ACV is incredibly useful for businesses that sign multi-year deals because it helps you understand the average annual revenue per customer, which is vital for calculating other key metrics like your Customer Acquisition Cost (CAC) payback period.

Key Takeaway: The metrics you choose to track directly impact your ability to grow. While nearly all companies plan for growth, many fall short because they focus on the wrong indicators.

A recent study revealed that while 96% of companies expect to grow their revenue, half are at risk of missing their own targets because their monetization strategies are out of sync. This often happens when founders confuse front-loaded metrics like bookings or TCV with the true, sustainable health of the business, which is best measured by ARR. You can learn more about these revenue strategy findings and how they impact growth.

Key Revenue Metrics At a Glance

| Metric | Definition | Primary Use Case | Key Differentiator from ARR |

|---|---|---|---|

| ARR | The normalized recurring revenue from all subscriptions over a 12-month period. | Valuing the company, long-term strategic planning, and reporting to investors. | It's a momentum metric, reflecting the current state of predictable annual income. |

| MRR | The predictable recurring revenue generated from all active subscriptions in one month. | Short-term operational planning, tracking monthly growth, and sales compensation. | It's a granular, short-term view. ARR is simply MRR x 12. |

| TCV | The total value of a contract, including all recurring fees and one-time charges. | Understanding total potential cash flow from a single customer deal. | It includes non-recurring fees and the value of multi-year contracts upfront. |

| ACV | The average annual value of a customer's subscription contract, excluding one-time fees. | Analyzing the value of new business on an annual basis and guiding pricing strategy. | It normalizes multi-year deals into an annual figure, unlike ARR which is a point-in-time total. |

Mastering this alphabet soup isn’t just about sounding smart in meetings—it’s about making smarter decisions. ARR is the North Star for your company's health and valuation, but the other metrics provide the essential context you need to manage operations, drive sales, and understand the long-term value of your customer relationships.

The Levers That Drive ARR Growth and Retention

Your ARR isn’t a static figure on a spreadsheet; it’s the living pulse of your business. Sustainable growth doesn’t happen by accident. It's the direct result of deliberately managing the four key levers that control your company's momentum.

The Four Core ARR Levers

Your Net New ARR—the total change in recurring revenue over a period—is the sum of these four movements. Mastering them is essential for building a scalable business.

- New Customer Acquisition: This is the most obvious lever—the ARR you add by signing brand-new customers. While it’s the engine of top-line growth, it's also the most expensive way to grow because of high sales and marketing costs.

- Expansion Revenue (Upgrades): This is where real capital efficiency lives. Expansion ARR comes from your existing customers upgrading to higher-tier plans, adding more seats, or buying new features.

- Contraction Revenue (Downgrades): The opposite of expansion, this is the ARR you lose when current customers downgrade their plans or reduce their seat count. It’s a warning sign that you have a value or pricing problem.

- Customer Churn (Cancellations): This is the ARR you lose completely when customers cancel their subscriptions. High churn is a business killer, actively erasing the hard-won growth from new customer acquisition.

Focusing only on landing new logos is a common—and costly—mistake. The most valuable, high-growth SaaS businesses are masters of expansion. Why? Selling to an existing happy customer is far cheaper and easier than acquiring a new one from scratch.

From Retention to Expansion: The Holy Grail of SaaS Growth

Investors don't just glance at your top-line ARR; they scrutinize how you're growing it. This is where two critical metrics come into play: Gross Revenue Retention (GRR) and Net Revenue Retention (NRR).

Gross Revenue Retention (GRR) measures your ability to hold onto revenue from your existing customers, completely ignoring any expansion. It answers the question: "Excluding any upsells, how much of last year's revenue did we keep?"

Net Revenue Retention (NRR) is the more powerful metric. It takes your starting ARR, subtracts churn and contraction, and then adds in expansion revenue. NRR reveals if your existing customer base is, on its own, a growth engine.

The ultimate goal is to achieve an NRR of over 100%, a state often called "negative churn." This means your expansion revenue from existing customers is greater than the revenue you lose from churn and downgrades. Your business grows even if you don't sign a single new customer.

This metric is a powerful indicator of strong product-market fit. In fact, the ability to drive high NRR is a key reason why subscription businesses have grown up to 5x faster than their S&P 500 peers over the last decade. You can read more about the power of recurring revenue models to understand this massive outperformance.

Industry Benchmarks: What is a Good Retention Rate?

To know if your numbers are strong, you have to benchmark them against industry standards. According to OpenView's 2023 SaaS Benchmarks, performance varies by the customer segment you serve.

| Customer Segment | Median Gross Retention (GRR) | Median Net Retention (NRR) |

|---|---|---|

| SMB (Small & Midsize Business) | 89% | 101% |

| Mid-Market | 91% | 106% |

| Enterprise | 94% | 113% |

Source: OpenView, 2023 SaaS Benchmarks

If your NRR is lagging behind these benchmarks, it's a clear signal to focus on your customer success and product roadmap to drive more value for your existing base. Understanding these levers is a core part of mastering your SaaS unit economics and the metrics that actually matter for scalable, profitable growth.

Investor Red Flags: Common ARR Reporting Mistakes

Getting your ARR wrong is one of the fastest ways to kill a fundraising round or acquisition. When investors dig into your financials, they aren't just looking for a killer growth curve; they're looking for integrity. Misrepresenting ARR, even unintentionally, signals a lack of financial discipline and can vaporize trust in an instant.

Red Flag 1: Including Non-Recurring Revenue

This is the cardinal sin of ARR reporting. You cannot lump one-time setup fees, professional services projects, or variable usage charges into your recurring revenue. Doing so inflates your numbers and creates a misleading view of your company's stability. Investors will immediately dissect your revenue streams. If they see implementation fees propping up your ARR, they will question if you understand your own business model.

How to Fix It: Your accounting system must enforce a clean separation between recurring subscription revenue and everything else. Set up distinct general ledger accounts for "Subscription Revenue," "Implementation Services," and "Consulting Revenue." Your ARR calculation must only pull from the subscription account.

Red Flag 2: Mismanaging Discounts and Credits

How you account for discounts can seriously distort your ARR. Imagine you sign a customer on a $24,000 annual plan but give them a $4,000 discount for the first year. Reporting the full $24,000 as new ARR is wrong. The actual recurring revenue for that year is $20,000. This problem gets even messier with prorated credits or mid-cycle plan changes. Without a rock-solid system, you will overstate your true revenue base—a mistake that will be exposed during due diligence.

Red Flag 3: Relying Solely on Payment Processor Data

Your Stripe dashboard is not your source of truth for ARR. While these tools are fantastic for processing payments, they don't understand GAAP, ASC 606 revenue recognition, or the nuances of your contracts.

They often fail to properly account for:

- Failed Payments: A dunning payment isn't churned ARR until the recovery process officially fails and the subscription is canceled.

- Refunds and Credits: These tools don't always separate refunds from recurring revenue cleanly, which can throw off your calculations.

- Contractual Commitments: A customer might be on a monthly payment plan for an annual contract. Your payment processor sees monthly cash, but your ARR should reflect the full annual commitment from day one.

How to Fix It: You must reconcile data from your payment processor with a proper accounting system like QuickBooks or NetSuite. This is non-negotiable. This process ensures your reported ARR aligns with recognized revenue under actual accounting standards, creating a single, defensible source of truth.

Actionable Next Steps: Building Systems to Scale Your ARR

Knowing your ARR is one thing. Building a company that can predictably grow it is another. The chasm between a business stuck in the low seven figures and one scaling confidently toward $20M boils down to a single word: systems. Moving from theory to execution means building a financial infrastructure that supports your growth instead of holding it back.

To build real, durable value and get your company investor-ready, you must implement specific processes that create a single source of truth for your financial performance.

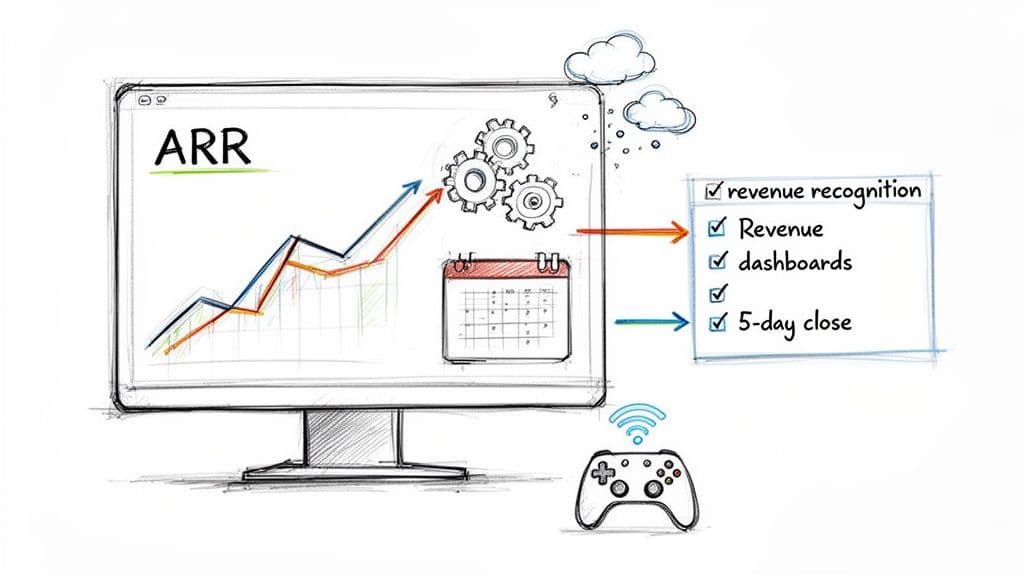

Your Roadmap for Scalable ARR

Building a scalable financial engine requires a fundamental shift from reactive bookkeeping to proactive financial management. Your immediate priorities should be putting the systems in place that give you real-time visibility and bulletproof accuracy. Here is exactly what you need to do:

- Implement Proper Revenue Recognition: Adopt ASC 606 standards to correctly separate recurring subscription revenue from one-time fees. This isn't just an accounting rule; it's what makes your ARR defensible under scrutiny from investors or auditors.

- Automate Financial Reporting: Implement dashboards that automatically track your ARR movements in real time—new, expansion, contraction, and churn. You should know your Net Revenue Retention rate at a glance, not just once a quarter.

- Establish a Fast Month-End Close: A lengthy close process means you're flying blind for weeks at a time. A disciplined process to close your books within the first week of the month gives you timely data to make faster, smarter decisions.

"A robust administrative and finance team to support reporting requirements to investors, including regular board meetings and audits, is a key reason equity-backed companies spend more on G&A." — SaaS Capital, 2025 Spending Benchmarks

As SaaS Capital's research highlights, investors expect a higher level of financial rigor. A reliable financial partner not only builds this system for you but also provides critical insights, like those found in a detailed SaaS cash flow forecasting guide, to make sure you're managing your growth sustainably.

Your ARR is the most important asset you have. Protecting its integrity with professional, scalable systems is one of the highest-ROI investments you will ever make.

Got Questions About ARR?

Even when you’ve nailed the basics, a few tricky questions about ARR always pop up. Here are straight answers to the common curveballs we hear from founders and finance leaders.

How Does ASC 606 Affect My ARR Calculation?

Here’s the short answer: ASC 606 doesn't change your ARR calculation. ARR is an operational metric—a snapshot of your committed revenue—not a formal accounting figure. However, ASC 606 is the rulebook for how you recognize the revenue that underpins your ARR. It forces you to recognize revenue as you deliver the service, not just when a customer pays you. For a standard annual SaaS contract, you recognize just 1/12th of the total value each month. A proper ASC 606 implementation proves you understand the difference between cash, recognized revenue, and recurring revenue, which is a huge sign of financial maturity.

Can a Service-Based Business Use ARR?

Yes, but you must be disciplined about it. A digital agency that lives by one-off, project-based work can't use ARR. But if you have clients on fixed-fee monthly retainers for SEO, managed IT, or ongoing content creation? You absolutely should calculate ARR for that revenue stream. The key is a contractually committed, predictable source of income. Just take the monthly retainer, multiply it by 12, and add it up across all your retainer clients. The critical mistake to avoid is mixing in variable project fees—doing so misrepresents your company's stability.

What Is a Good ARR Growth Rate?

A "good" growth rate depends completely on your company's stage and scale. Benchmarks from firms like OpenView and SaaS Capital give you clear targets.

- Under $1M ARR: Investors look for triple-digit growth—sometimes 200% or more.

- $1M-$10M ARR: A strong rate is typically 70% to 100%.

- Over $20M ARR: Growth of 30%-50% is considered excellent.

Investors used to obsess over the "T2D3" trajectory (triple, triple, double, double, double). Today, the focus has shifted. The new gold standard is sustainable, capital-efficient growth, not just burning cash to grow at all costs. Your growth rate tells a story about your market traction, but your efficiency tells a story about your business model.

Your Annual Recurring Revenue is more than just a metric; it’s the financial heartbeat of your company. Calculating it with precision is the first step toward building scalable growth and earning investor confidence. Jumpstart Partners delivers the expert financial systems and oversight you need to get your ARR reporting right, every single time.

Schedule a consultation to build an investor-ready financial foundation today.