Financial Operations

Financial Reporting Automation: Your Guide to a Faster Close and Smarter Growth

Unlock faster financial closes with financial reporting automation and gain clear cash flow visibility, investor-ready reports, and scalable insights.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

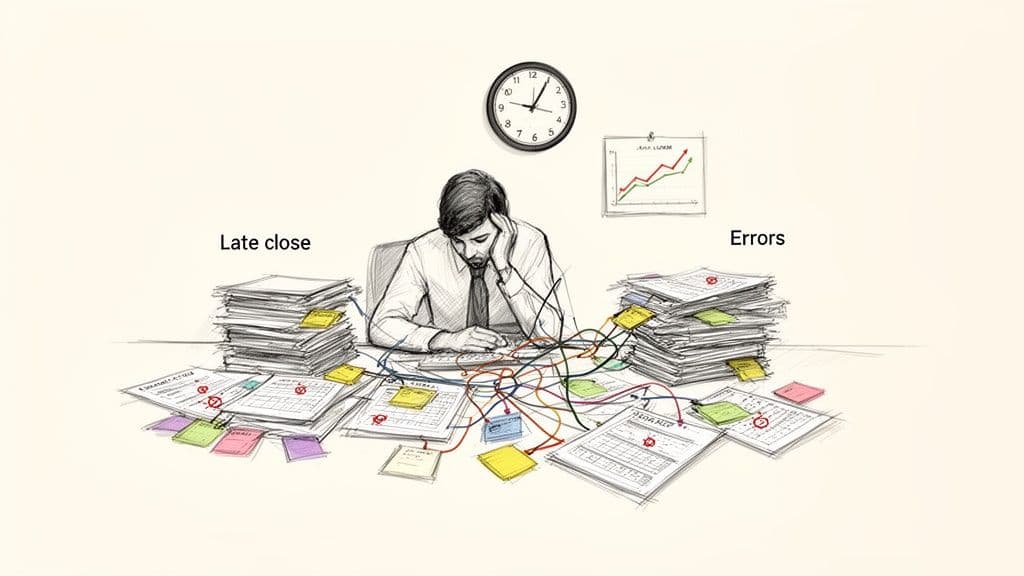

··19 min readIf you're still wrestling with spreadsheets to close your books each month, you're not just losing time—you're actively slowing your company's growth. Manual financial reporting is a bottleneck that clouds your judgment, worries your board, and traps your team in a reactive cycle of fixing yesterday's problems instead of funding tomorrow's opportunities.

for a founder or CEO of a scaling SaaS, agency, or professional services firm, this isn't an inconvenience; it's a critical business risk.

Why Your Manual Reporting Is Costing You Growth

Delayed and inaccurate financial reports are a direct roadblock to scaling. This manual grind forces you to make critical decisions about hiring, marketing spend, and product development based on stale, incomplete information.

The Real Cost of a Slow Close

A slow month-end close isn’t just an annoying delay; it's a business failure. When it takes two or three weeks to understand what happened last month, you are flying blind.

This lag directly kneecaps your ability to manage cash and adjust strategy. A messy, drawn-out close also puts your next funding round in serious jeopardy. Investors expect clean, timely, and accurate financials. If you can't produce them, you're signaling operational weakness and a lack of control. Our complete guide on the monthly close process details the framework for getting this right.

How Inaccurate Data Derails Decisions

Manual reporting is a breeding ground for human error. One broken spreadsheet formula can ripple through your entire financial model, leading to huge miscalculations.

Imagine basing your annual budget on revenue figures that are off by just 5% due to a data entry slip. for a $5M business, that's a $250,000 forecasting error. An error of that size leads you to over-hire, run out of cash, or misallocate resources to the wrong initiatives.

These aren't abstract risks. They have real consequences:

- Misjudged Cash Flow: A faulty forecast convinces you there's enough cash for a new project, only for you to discover a massive shortfall right when payroll is due.

- Eroded Investor Trust: Nothing undermines credibility faster than restating your financials because of preventable mistakes. It makes your board and potential investors nervous.

- Poor Strategic Planning: Without trustworthy data, you can't confidently determine which products are profitable or which customer segments deserve more investment.

Financial reporting automation isn't a luxury; it's the essential upgrade for any founder who is serious about building a predictable, scalable business.

What Financial Reporting Automation Actually Is

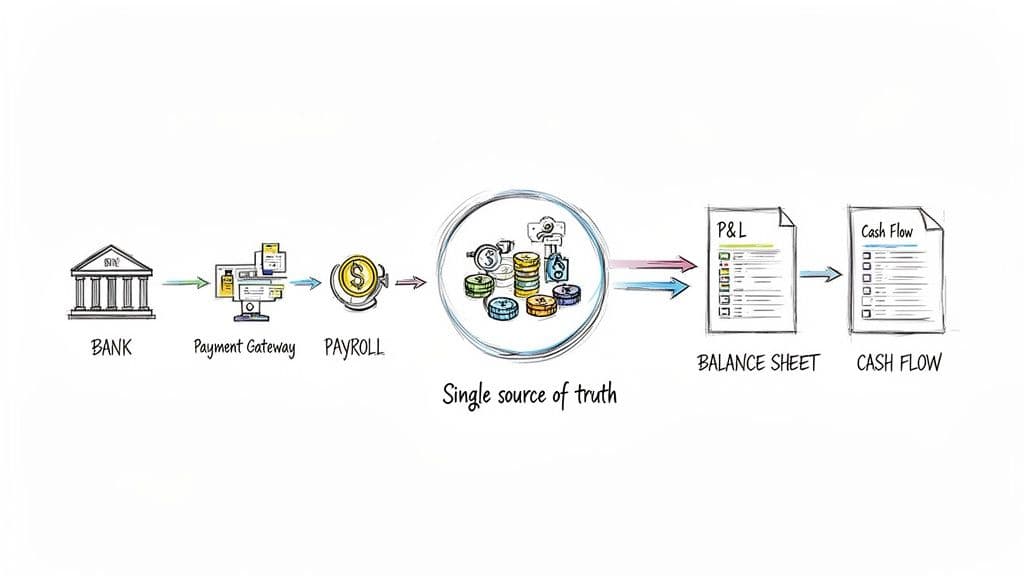

Let's cut through the noise. Financial reporting automation uses software to connect your financial systems, eliminating manual data entry and dramatically speeding up how you create your P&L, Balance Sheet, and Cash Flow Statement. It isn't about firing your finance team; it’s about giving them superpowers.

Think of it as a digital assembly line for your financial data. Instead of someone manually exporting CSVs from Stripe, your bank, and payroll, then wrestling them into a fragile spreadsheet, automation builds the connections for them. The system automatically pulls, cleans, and organizes every transaction into one reliable hub.

This isn't a futuristic concept; it's the standard for high-growth companies. Automation saves an incredible amount of time, slashes costly human errors, and gives you the real-time numbers you need to make smart decisions. for a deeper dive, check out the latest automation trends in finance on mercerbradley.com.

Core Components of an Automated System

An automated system integrates your key business tools to create a single source of truth for your finances. This unified data then feeds directly into your core financial statements, with no manual entry required.

Here’s what that looks like in practice:

- Automated Bank Reconciliations: Your accounting software plugs directly into your bank accounts. It pulls in every transaction and uses smart rules to automatically categorize expenses and match payments to invoices. A tedious, week-long headache becomes a daily, automated task.

- AI-Powered Invoice Processing: You just forward vendor bills to a dedicated email, and AI reads the invoice, extracts the vendor name, amount, and due date, then queues it up for one-click approval and payment.

- Real-Time Revenue Recognition: This is a game-changer for SaaS companies. Automation tools connect to your payment processor (like Stripe) and correctly apply complex ASC 606 rules. Revenue is deferred and recognized each month without anyone touching a spreadsheet, keeping your reporting compliant and accurate.

These pieces work together to turn a chaotic mess of data into an organized, reliable financial picture. It’s the foundation for creating accurate financial reports for small businesses that investors and lenders trust.

From Raw Data to Actionable Reports

With an automated system in place, the journey from a raw transaction to a polished report becomes incredibly efficient. It follows a clear, logical path that guarantees data is clean and consistent at every step.

The difference is night and day.

| Step | Manual Process (Weeks) | Automated Process (Days) |

|---|---|---|

| 1. Data Collection | Exporting CSVs from Stripe, banks, payroll, and expense platforms. | Systems sync data automatically and continuously. |

| 2. Reconciliation | Manually matching thousands of lines in spreadsheets. | AI suggests matches and flags only the true exceptions for review. |

| 3. Journal Entries | Manually calculating and posting entries for payroll, depreciation, and deferred revenue. | Rules-based workflows post recurring entries automatically. |

| 4. Report Generation | Building P&L, Balance Sheet, and Cash Flow statements in Excel. | Core reports are generated instantly with a single click. |

The result? You close your books and generate an accurate Profit & Loss, Balance Sheet, and Statement of Cash Flows in just a few days after the month ends, not weeks. This speed gives you the clarity to make smart, proactive decisions that drive growth.

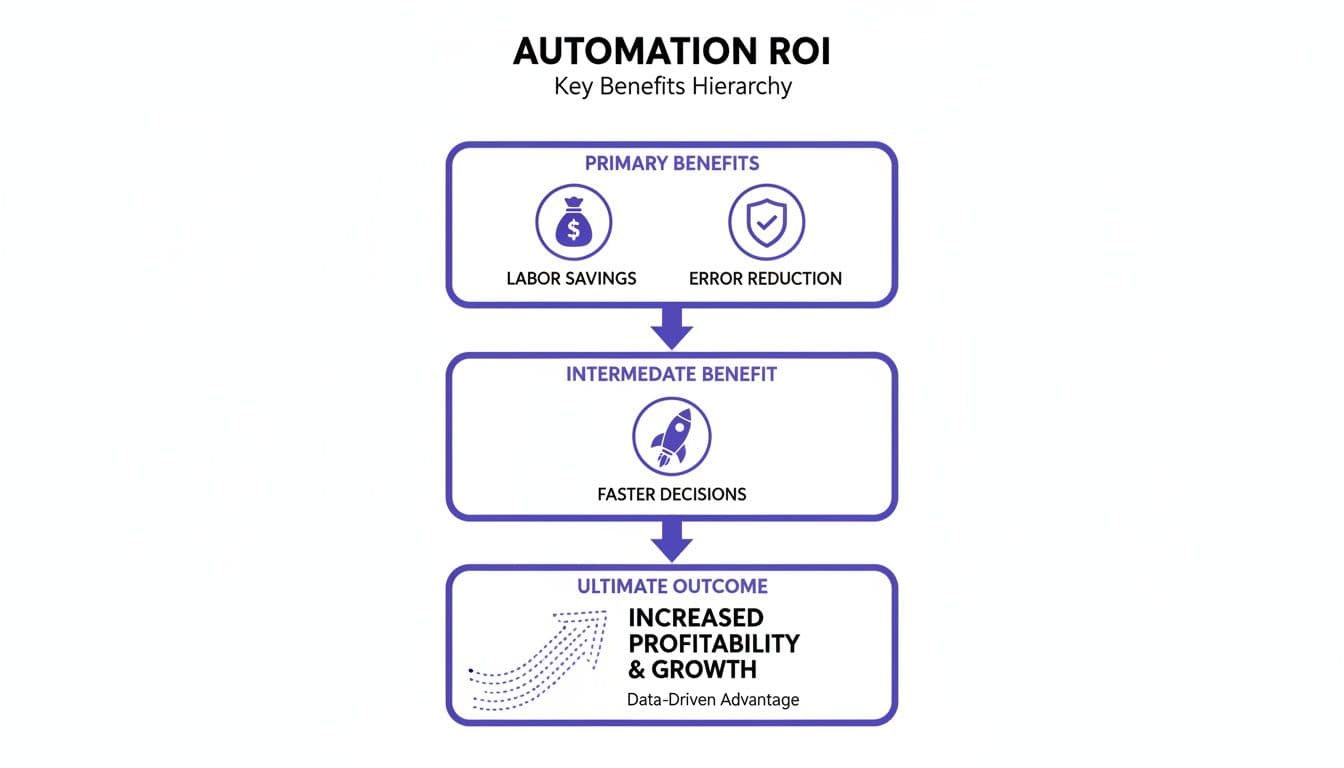

Calculating the True ROI of Automation

Too many founders see financial reporting automation as just another tech expense. That’s a mistake. It’s not a cost center; it’s a direct investment in profitability and operational leverage.

To build the business case, you must move past vague promises of "efficiency" and get into the hard numbers. The return on investment (ROI) comes from three concrete areas: slashing manual labor costs, eliminating expensive errors, and making smarter, faster decisions that capture growth.

Quantifying the Cost of Manual Processes

First, let’s tackle the most obvious drain: the time your team sinks into low-value, repetitive work. for a typical $5M ARR SaaS company, the manual accounting grind is a constant drag on resources. It's not just about salaries; it’s about the massive opportunity cost of what your best people could be doing instead.

Let's run a conservative calculation for a lean finance team:

- Senior Accountant: Spends 40 hours every month on manual data entry, reconciliations, and building reports. At a blended rate of $60/hour, that's $2,400 per month.

- Controller/Finance Lead: Wastes 20 hours per month reviewing manual work and hunting down errors. At a $100/hour blended rate, that’s another $2,000 per month.

That adds up to $4,400 per month, or a staggering $52,800 annually. All that time and money is spent looking in the rearview mirror, not planning the road ahead.

The Hidden Costs of Inaccuracy and Delay

Next are the costs that don't show up neatly on a P&L but do far more damage: errors and delays. A single mistake in a manual revenue recognition spreadsheet misstates your financials, which erodes investor trust and can trigger compliance issues.

"A top-quartile private SaaS company with over $20 million in ARR can operate with a finance team of just three people. This level of efficiency is only possible with a highly automated financial reporting process." - OpenView's 2024 SaaS Benchmarks

Relying on outdated reports is like driving with a blindfold. What’s the price of a delayed hiring decision? What's the cost of getting blindsided by a cash flow crunch because your forecast was three weeks old? These strategic missteps can easily cost a scaling business hundreds of thousands in lost revenue or expensive emergency financing. Our deep-dive on controller services ROI shows how expert oversight, powered by automation, prevents these exact failures.

A Worked ROI Calculation for a $5M ARR SaaS Company

Let's put the pieces together into a clear ROI model for that same $5M ARR SaaS company. We'll assume the all-in annual cost for the right automation software and implementation support is $25,000.

This table breaks down the tangible financial benefits.

| Cost Category | Annual Cost (Manual Process) | Annual Cost (Automated Process) | Annual Savings |

|---|---|---|---|

| Direct Labor Costs | $52,800 | $10,560 (80% reduction) | $42,240 |

| Error & Rework Costs | $15,000 (Conservative estimate) | $1,500 (90% reduction) | $13,500 |

| Software & Implementation | $0 | $25,000 | -$25,000 |

| Total Annual Cost | $67,800 | $37,060 | $30,740 |

In this scenario, the net annual savings come out to $30,740. To find the ROI, we use a simple formula: (Net Savings / Investment) x 100.

($30,740 / $25,000) x 100 = 123% ROI in the first year.

That impressive number doesn't even touch the immense strategic value of having faster, more reliable data for making critical business decisions. The business case is crystal clear: financial reporting automation pays for itself and unlocks both cash and the strategic clarity you need to scale.

How to Build Your Automated Finance Stack

Your automated finance stack is the engine that drives your reporting process. Building it isn't about collecting random apps; it's about designing a seamless, integrated system where data flows automatically from its source straight to your financial statements. Get this wrong, and you’ll trade spreadsheet chaos for software chaos.

Think of your accounting software—like QuickBooks Online or Xero—as the central hub. Every other tool must feed clean, timely data directly into this hub. A well-designed stack tears down data silos and creates a single source of financial truth.

The benefits of automation compound, starting with cost reduction and building all the way up to accelerated, predictable growth.

The Non-Negotiable Components

for a scaling SaaS or professional services firm, your stack needs to solve specific, high-friction problems. Focus on these core components first.

- Automated Bank & Credit Card Feeds: This is the absolute foundation. Your accounting software must have direct, real-time connections to every bank and credit card account. This feature vaporizes hours of manual transaction entry.

- Specialized Revenue Recognition Software: for any SaaS company, this is non-negotiable. Manually managing deferred revenue schedules in a spreadsheet is a recipe for disaster and a massive red flag for investors. A dedicated tool integrates with your payment processor (e.g., Stripe) to automatically handle ASC 606 compliance.

- Integrated Payroll & HR Platform: Your payroll system (like Gusto) should sync directly with your accounting software, automatically posting journal entries for wages, taxes, and benefits. This eliminates a huge source of month-end errors.

- Streamlined Expense Management: Stop chasing receipts. Tools like Expensify or Divvy let employees submit expenses on the go, automating approvals and syncing coded transaction data directly into your accounting hub.

Choosing Tools That Scale With You

A classic mistake is choosing "starter" tools you'll outgrow in 12 months, forcing a painful migration later. Your selection criteria must prioritize scalability and the depth of its integrations. A tool might be cheap, but if it doesn't have a robust API that connects seamlessly with your other systems, it’s a liability, not an asset.

"Founders often underestimate the complexity of building a truly integrated finance stack. The goal isn't just to automate tasks but to create a single source of truth. Without a strategic design, you'll end up with fragmented data and more problems than you started with." - Leo F. Bodine, CPA & Founder of Jumpstart Partners

Designing and implementing this stack requires expertise. It's not just an IT project; it's a strategic finance initiative. This is precisely where an experienced partner makes all the difference, ensuring the architecture supports your growth for years to come. Understanding what a fractional controller actually does is key to seeing how this expertise can accelerate your automation journey.

Red Flags Your Reporting Process Is Broken

Those nagging frustrations with your finances aren't just minor annoyances. They are symptoms of a broken reporting process that is actively capping your company's growth. Recognizing these red flags is the first step to fixing the problem.

The Month-End Close That Never Ends

The most glaring red flag is a month-end close that drags on forever. If you aren’t looking at final, accurate financials by the 10th business day of the following month, you’re operating with a dangerous blind spot.

According to SaaS Capital, the median close time for private SaaS companies is 10 days. Best-in-class companies close their books in under 5 days—a benchmark that is impossible to hit without automation. A slow close means every strategic decision you make is based on stale data.

Inability to Forecast Cash Reliably

Can you produce a reliable 13-week cash flow forecast right now? If the answer is no—or if it would take your team a week of spreadsheet gymnastics to build one—your reporting process is failing a critical test.

A solid forecast is your early warning system. Without it, you’re vulnerable to surprise cash crunches that force reactive, expensive decisions, like drawing on a line of credit at a terrible rate. for a professional services firm, this might mean miscalculating project profitability because delayed expense reports obscure the true cost of delivery, leading you to underprice new business.

Common Objection: "My bookkeeper handles the reports, isn't that enough?" A bookkeeper is essential for recording transactions, but their role is fundamentally historical. A broken reporting process becomes painfully obvious when you need forward-looking, strategic insights and all you have are rearview-mirror reports. This often signals it's time to assess if you've outgrown your current bookkeeping setup and need a more robust financial engine.

Constant Questions from Your Board

Another huge red flag is when your board, investors, or leadership team constantly question the numbers. If your reports are frequently restated or if you can't confidently answer basic questions about key metrics like Customer Acquisition Cost (CAC) without a week of digging, your data lacks integrity.

This isn't just embarrassing; it’s a serious risk. It suggests your entire financial foundation is unstable, a perception that can jeopardize your next funding round. Clean, trustworthy, and immediate data is the currency of a well-run, scalable business.

Your Implementation Roadmap to Automation

Jumping into financial reporting automation is a structured project. If you bolt new software onto messy books, you are building a house on quicksand. It will collapse. A phased, deliberate approach is the only way this works. This roadmap breaks the process into a proven four-step journey.

Step 1: Assess and Clean Your Books

Before you automate anything, you need a clean starting point. Automation amplifies whatever you give it—if your books are a tangle of miscategorized transactions, all you’ll do is generate flawed reports faster.

The first move is a deep diagnostic review. This means methodically cleaning up historical data, standardizing your chart of accounts, and making sure every balance sheet account is fully reconciled. This foundational work is non-negotiable and is often the hardest part of the project.

Step 2: Design Your Ideal Stack

With clean books as your foundation, you can architect your automated system. This is about selecting the right combination of tools—your finance stack—that talk to each other seamlessly.

As we covered earlier, this usually includes:

- Your core accounting software (like QuickBooks Online or Xero)

- A revenue recognition platform for SaaS, or a project profitability tool for agencies

- An expense management tool like Expensify

- An integrated payroll system

The goal is to build an ecosystem where data flows automatically, killing off manual entry points. This design phase is where an experienced controller adds huge value, helping you pick tools that will scale with your business.

Step 3: Implement and Integrate the Tools

Now, the plan becomes reality. You configure and connect each piece of software according to the blueprint from Step 2. It’s a technical process that involves setting up integrations, defining automation rules, and carefully mapping data fields between systems.

CRITICAL BEST PRACTICE: Run your old and new systems in parallel for at least one full accounting cycle.

This lets you compare the outputs side-by-side and validate that the new, automated system is producing accurate and reliable numbers. This step is your ultimate safety net; it prevents major errors from slipping through the cracks.

Step 4: Optimize and Scale Operations

Automation is not a "set it and forget it" project. It's an operational shift that requires ongoing attention. Once your new system is live, the focus turns to refining workflows, training your team, and using the new data streams for strategic insight. This is where you really see the payoff.

Financial reporting automation slashes manual efforts by 30-50% for growing businesses. This newfound efficiency lets companies ditch chaotic spreadsheets for streamlined dashboards, delivering investor-ready financials in as little as five days—a massive advantage for firms in the $500K to $20M revenue range. You can find more insights on 2026 data accuracy benchmarks on atidiv.com.

4-Step Financial Reporting Automation Roadmap

| Phase | Key Actions | Success Metric |

|---|---|---|

| 1. Assess & Clean | - Perform a diagnostic review of historical financials. - Standardize the Chart of Accounts. - Reconcile all balance sheet accounts. | All historical data is clean, and every account is fully substantiated with supporting documentation. |

| 2. Design Stack | - Map out required data flows. - Select and vet integrated software tools. - Create a detailed integration blueprint. | A complete tech stack is designed where data flows automatically, eliminating manual entry points. |

| 3. Implement & Integrate | - Configure each software platform. - Set up API integrations and data mapping. - Run old and new systems in parallel for one month to validate data. | The new automated system produces financial reports that perfectly match the validated legacy system. |

| 4. Optimize & Scale | - Train the team on new workflows. - Create and monitor KPI dashboards. - Continuously refine automation rules and processes. | Month-end close time is reduced by over 30%, and real-time financial data is available for decision-making. |

Following this roadmap ensures you avoid the common pitfalls and build a system that supports your growth. An expert partner, like an outsourced controller, can accelerate each stage, providing the strategic oversight and technical expertise needed to get it done right the first time.

From Automated Reports to Actionable Strategy

Automating your financial reporting is just the first step. The real win isn’t the report itself—it’s the time and mental space you and your leadership team reclaim to use the data for growth.

With a solid automated system, you finally stop putting out financial fires and start thinking ahead. You can now confidently answer the questions that drive the business forward: Which customer segments are our most profitable? What’s our real cash runway for the next six months? Where should we invest our next dollar for the highest return?

Your Immediate Action Plan

Don't let the momentum stop. The insights are worthless if they just sit in a folder. Here are three concrete steps to take immediately to capitalize on your new financial clarity.

- Schedule a "Data Deep Dive." Get your leadership team in a room for 90 minutes with the new automated reports. The only goal: find one critical insight that was completely invisible before. This builds immediate buy-in.

- Hunt Down the Last Bottleneck. Even with automation, one process is still causing friction. Is it your complex SaaS revenue recognition? Or project-based billing for your agency? Find that single biggest pain point and dedicate resources to smoothing it out completely.

- Define Three "Cannot-Miss" KPIs. Pick three key performance indicators you’ve always wanted to track daily but couldn’t because the data was too slow—think Customer Acquisition Cost, Net Revenue Retention, or daily cash burn. Get them on a real-time dashboard and make it a daily habit for your leadership.

Why an Expert Partner Is Your Accelerator

Going it alone is the slow road, paved with costly mistakes and dead ends. An outsourced controller doesn't just build the system; they bring the strategic and technical experience to make sure your automation project delivers maximum ROI from day one.

Think of them as a co-pilot. They help you build the engine, but more importantly, they teach you how to fly the plane using the instruments.

"Many founders see automation as the finish line, but it's really the starting line. The true value comes from having an expert who can help you interpret the data, ask the right questions, and model future scenarios with confidence." - Leo F. Bodine, CPA & Founder of Jumpstart Partners

An experienced partner ensures your system is built to scale, your team knows how to use it, and your leadership is equipped to turn financial data into a powerful strategic weapon. That guidance is what transforms a tech project into a fundamental business advantage.

Ready to see what a 5-day close and investor-ready financials can do for your business? Jumpstart Partners delivers the expert guidance and proven systems to turn your financial function into a strategic asset. Schedule a free consultation to discover how we can help you achieve financial clarity and accelerate your growth.