Financial Operations

Financial Reporting Best Practices That Drive Growth—Not Guesswork

Implement financial reporting best practices to accelerate your month-end close, secure funding, and drive growth. A guide for founders and finance leaders.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··15 min readAs a founder or CEO, your financial reports are supposed to be your roadmap. But for most businesses between $500K and $20M in revenue, they're more like a blurry, out-of-date map leading you in circles.

Let’s be direct: if your financials are late, inaccurate, or confusing, you are flying blind. You can't confidently answer the most fundamental growth questions:

- Can we really afford that new sales hire?

- What is our true customer acquisition cost, and is it sustainable?

- Are we on track to hit our ARR goal, or are we just hoping for the best?

If answering these feels like guesswork, your reporting process is a liability, not an asset. It forces you to react to the past instead of strategically shaping your future. This guide provides the exact framework to install financial reporting best practices that deliver clarity, control, and the credibility you need to scale.

Nailing the 5-Day Month-End Close

If your team is still closing the books on the 15th or 20th of the month, the "insights" you're getting are historical artifacts. You cannot make agile decisions with three-week-old data. A slow close isn't a sign of business complexity; it's a symptom of broken financial operations.

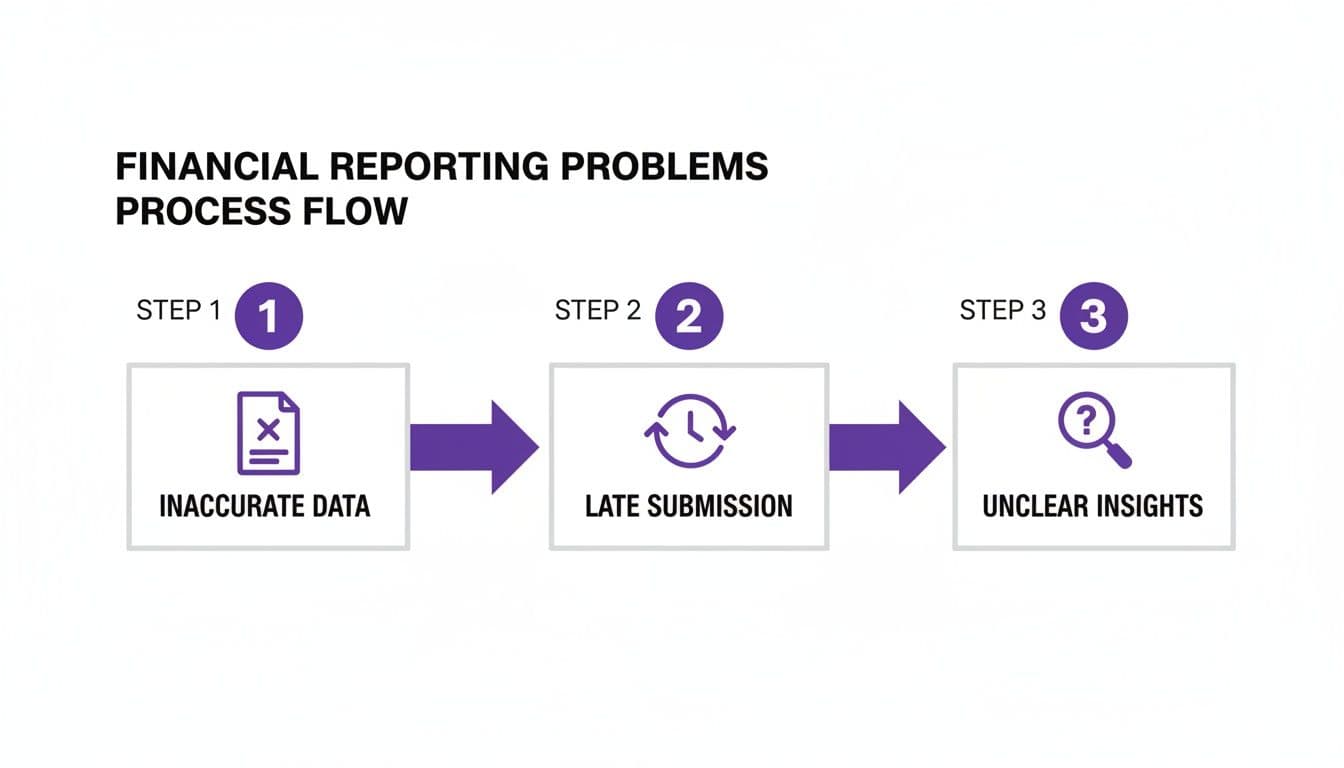

Achieving a 5-day month-end close is the non-negotiable standard for high-performing companies, and it is 100% attainable for your business. It’s the natural outcome of disciplined processes, clear ownership, and the right technology. Without it, you get a predictable spiral of inaccurate data, late reports, and murky insights.

Common Objection: "My Business Is Too Complex for a Fast Close."

This is the most common misconception we hear, and it's wrong. Whether you're a SaaS company wrestling with ASC 606 or a digital agency juggling project P&Ls, the solution isn't your business's simplicity—it's process standardization.

Your biggest lever is system integration. When your payment processor (Stripe), payroll system (Gusto), and expense software feed directly into your general ledger (QuickBooks, Xero, NetSuite), you eliminate the manual data entry that creates bottlenecks and errors.

A Day-by-Day Blueprint for a Fast Close

A fast close starts before the month ends with a "pre-close" checklist. This is where you get ahead by reviewing payables, updating fixed asset schedules, and prepping recurring journal entries.

"A great close process isn't about the heroics of one person working all weekend. It's about a well-documented, repeatable checklist that the team can execute like clockwork. The goal is to make the process boringly predictable." – Tiffany Highstrom, Attorney at Stafford Rosenbaum LLP

Once the month ends, your team executes a specific, daily plan. There is zero ambiguity about who owns what.

Sample 5-Day Month-End Close Checklist

| Day | Key Tasks | Owner (Example) |

|---|---|---|

| Day 1 | - Complete all bank and credit card reconciliations. - Record cash transactions and journal entries. | Staff Accountant |

| Day 2 | - Finalize accounts receivable and payable aging. - Post all payroll and benefit accruals. | AP/AR Specialist |

| Day 3 | - Calculate and record deferred revenue (ASC 606). - Post prepaid expense amortizations. | Controller |

| Day 4 | - Perform balance sheet account reconciliations. - Conduct preliminary P&L variance analysis. | Controller |

| Day 5 | - Finalize financial statements (P&L, BS, CF). - Prepare management dashboard and board package. | CFO / Controller |

This table shows a clear division of labor that systematically turns raw data into decision-ready reports. for a much deeper dive, check out our complete framework for a monthly close process.

Actionable Next Steps:

- Map Your Current Process: Document every step your team takes to close the books. Identify the single biggest bottleneck that slows you down.

- Create a Checklist: Build your own version of the 5-day close table. Assign every task to a specific person with a hard deadline.

- Automate Data Entry: Integrate at least one major system (like your payment processor) with your accounting software this quarter.

Building Your Investor-Ready Reporting Package

When a VC asks for your financials, sending a generic P&L is like showing up to a marathon in flip-flops. It signals you aren’t serious. Investors demand a sophisticated, data-driven narrative that proves you have absolute command of your business. A simple P&L shows what happened; an investor-ready package explains why and projects what’s next.

Beyond the Three Core Statements

Your reporting must start with the three core statements—Income Statement, Balance Sheet, and Statement of Cash Flows—prepared on an accrual basis. That’s just table stakes. for SaaS, agency, and service businesses, the real story is in your unit economics.

Your package must include detailed reporting on:

- Monthly Recurring Revenue (MRR): Broken down into new, expansion, churn, and net new MRR.

- Customer Acquisition Cost (CAC): The total, fully-loaded cost to acquire a customer.

- Lifetime Value (LTV): The gross profit you expect from a customer. The LTV:CAC ratio is a critical indicator of a healthy business model.

- Revenue and Customer Churn: Tracked monthly and annually.

- Cohort Analysis: Grouping customers by sign-up month to track retention over time. This is the clearest way to show if your product is improving.

Calculating Your True Customer Acquisition Cost

A common mistake is understating CAC by only including ad spend. Investors see right through this. A true CAC calculation includes every cost associated with acquiring new customers.

Let's walk through an example for a digital agency that landed 10 new clients in Q1.

| Expense Category | Q1 Total Expense | Percentage Attributable to New Customer Acquisition | Allocated Expense |

|---|---|---|---|

| Sales Team Salaries & Commissions | $75,000 | 100% | $75,000 |

| Marketing Team Salaries | $45,000 | 100% | $45,000 |

| Paid Advertising Spend (Google, LinkedIn) | $30,000 | 100% | $30,000 |

| Marketing Software (e.g., HubSpot) | $6,000 | 100% | $6,000 |

| Total Sales & Marketing Costs | $156,000 | $156,000 |

Now, calculate the real CAC:

Total Sales & Marketing Costs / New Customers Acquired = CAC $156,000 / 10 = $15,600

Your fully-loaded CAC for Q1 is $15,600. This number gives you the real cost of growth, empowering you to make accurate decisions about sales quotas, marketing budgets, and pricing.

The Metrics VCs Actually Scrutinize

"Investors are looking for proof of product-market fit in your numbers. Strong net revenue retention, especially above 120% for SaaS companies, shows that your existing customers not only stay but also spend more over time. That's the hallmark of a product that delivers undeniable value." – David Cummings, Founder, Atlanta Ventures

According to OpenView's 2024 SaaS Benchmarks, a healthy LTV:CAC ratio for a growing SaaS company must be at least 3:1. If your CAC is $10,000, your LTV needs to be $30,000 or more to prove you have a profitable growth model. Tracking Annual Recurring Revenue (ARR) is also mission-critical; learn more about ARR calculation and its impact on valuation.

Actionable Next Steps to Build Your Package

- Define Your Metrics: Get crystal clear on the exact formulas for CAC, LTV, and churn. Document them. Consistency is everything.

- Automate Data Collection: Integrate your CRM, payment processor (Stripe, Shopify), and accounting software to pull data automatically.

- Build a Monthly Reporting Cadence: Review these metrics with your leadership team every single month. This builds the discipline required to speak fluently and confidently about your business.

Mastering Revenue Recognition Under ASC 606

for any SaaS or professional services company, your revenue recognition policy is the single most scrutinized area during due diligence. Getting it wrong is a deal-killer. Flawed rev rec isn't just a math error; investors see it as a sign of a weak finance function and a fundamental misunderstanding of your business model.

This is where ASC 606 comes in. It’s the accounting standard that dictates how you report revenue, ensuring your financials reflect the value you’ve delivered, not just the cash you’ve collected. The core principle: you recognize revenue when you satisfy a performance obligation. for a SaaS business, this means recognizing subscription fees over the life of the contract, not all at once.

Common Objection: "ASC 606 is Only for Big Public Companies."

This is a dangerously false assumption. The moment you seek venture capital or an exit, your financials will be judged against this standard. VCs expect ASC 606 compliance because it demonstrates financial maturity and proves you understand the crucial difference between cash flow and earned revenue.

The Five-Step Model in Action

Let’s apply the ASC 606 five-step model to a real-world SaaS example.

Scenario: You sign a $13,000 annual contract: a $1,000 one-time setup fee and a $12,000 subscription fee ($1,000/month). The customer pays the full $13,000 upfront on January 1st.

- Identify the contract: The signed customer agreement.

- Identify performance obligations: You have two: (1) software setup and (2) ongoing software access.

- Determine the transaction price: The total price is $13,000.

- Allocate the price: You assign $1,000 to setup and $12,000 to the subscription.

- Recognize revenue: You recognize revenue as you fulfill each promise.

From Cash to Accrual The Right Way

On a cash basis, you’d recognize the full $13,000 in January, wildly inflating your P&L. ASC 606 demands disciplined accounting.

"Proper revenue recognition under ASC 606 isn't just about compliance; it's about telling the true story of your company's performance over time. It gives investors confidence that your growth is real and sustainable, not just a function of lumpy cash collections." – Takis Makridis, CEO, Equity Methods

Here’s the correct way to record the revenue over time:

| Month | Subscription Revenue Recognized | Setup Revenue Recognized (over 12 months) | Total Monthly Revenue |

|---|---|---|---|

| Jan | $1,000.00 | $83.33 | $1,083.33 |

| Feb | $1,000.00 | $83.33 | $1,083.33 |

| Mar | $1,000.00 | $83.33 | $1,083.33 |

| ...etc. | ... | ... | ... |

| Total | $12,000.00 | $1,000.00 | $13,000.00 |

At the end of January, you've correctly recognized $1,083.33 in revenue. The remaining $11,916.67 sits in Deferred Revenue on your Balance Sheet—a liability you will earn over the next 11 months. This is the correct, investor-ready approach. Our complete guide to SaaS revenue recognition under ASC 606 dives deeper into these nuances.

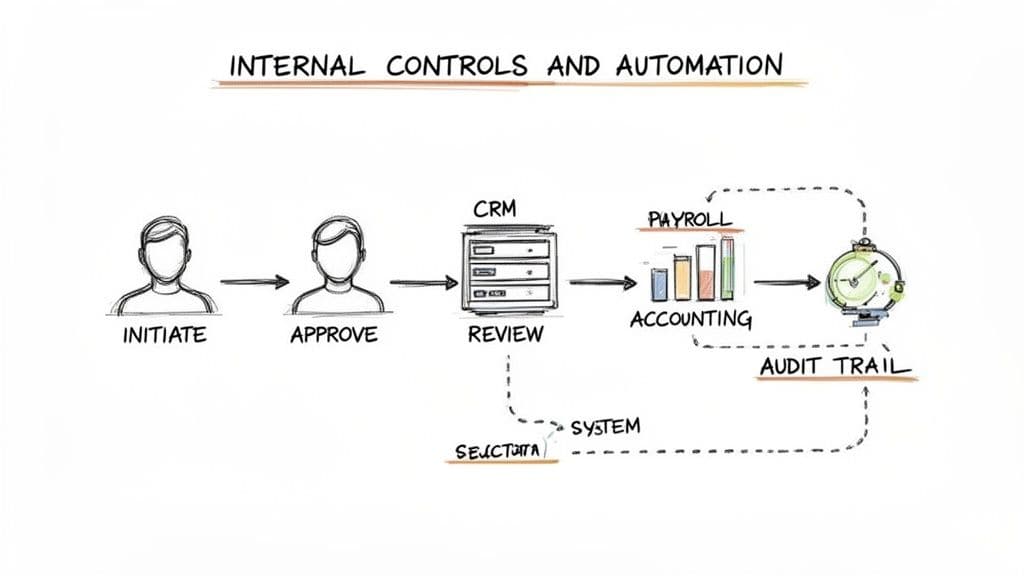

Building a Foundation of Trust: Internal Controls and Automation

As you scale, scrappy financial habits like shared bank logins or one person handling invoicing and payments become serious liabilities. Without solid internal controls, you leave the door open to fraud, errors, and compliance headaches that can stop your growth cold. Practical controls aren't red tape; they are the bedrock of trustworthy financial reporting.

The Golden Rule: Segregation of Duties

The cornerstone of internal controls is segregation of duties. The person who tees up a payment should never be the same person who approves it and reconciles the bank account. This separation creates a natural system of checks and balances.

This means splitting up the work:

- Initiating a transaction (creating a bill to be paid).

- Approving the transaction (a manager gives the green light).

- Recording the transaction (entering it into your accounting software).

- Reconciling the accounts (matching bank statements to the general ledger).

Implementing these financial controls for growing businesses is a critical step in maturing your finance function.

Red Flags Your Controls are Weak

Trying to enforce these duties manually is a nightmare. This is where automation tools like Bill.com or Ramp become essential, hardwiring controls directly into your workflows.

| Warning Signs Your Financial Controls Are Insufficient | | :--- | :--- | :--- | | Red Flag | Associated Risk | Recommended Best Practice | | The same person approves and pays bills. | A single person can create and pay a fraudulent invoice to themselves with no oversight. | Implement an AP automation tool with multi-step approval workflows. | | Shared bank account or software logins. | No audit trail to see who made changes, making it impossible to assign responsibility. | Assign unique user logins with role-based permissions for every system. | | Approval happens via email or Slack. | Approvals are easily lost, forged, or lack context, creating a messy audit trail. | Use a system like Bill.com that attaches approvals directly to the transaction record. | | No formal expense reimbursement policy. | Employees submit unreasonable expenses, leading to uncontrolled spending. | Create a documented expense policy and enforce it with an expense management tool. |

This isn't just about efficiency; it's about building a system that investors and auditors can trust implicitly. Strong controls and automation create a seamless flow of data, creating a rock-solid audit trail. Cybersecurity is also a financial reporting issue. Investors expect to see security best practices like SOC 2 Type II certification. You can discover more insights about these disclosure trends from Deloitte.

Actionable Next Steps:

- Lock Down System Access: Right now, pull a report of who has admin access to your bank accounts and accounting software. If they don’t absolutely need it, revoke it.

- Implement AP Automation: This is a quick win. Pick a platform like Bill.com and set up an approval workflow that separates duties.

- Document Policies: Create a simple document outlining your rules for expense reimbursement and who can approve bills up to certain dollar amounts.

Your Roadmap to a Professional Finance Function

You understand the principles. Now it's time to execute. Transforming your finance function from a DIY mess into a strategic asset can happen in one focused quarter with a clear roadmap that prioritizes cleanup, process, and technology—in that order.

This is about building a scalable financial engine that gives you clarity to make better decisions and credibility to attract investors.

Your First 90 Days: From DIY to Done Right

-

Month 1 (Days 1-30) — System Cleanup & Diagnostics: This is a deep, surgical dive into your general ledger (QuickBooks, Xero) to correct historical errors, clean up your chart of accounts, and reconcile every balance sheet account to the penny. You cannot build on a cracked foundation.

-

Month 2 (Days 31-60) — Process Documentation & Workflow Implementation: With clean books, you now document and standardize key processes. You implement a formal month-end close checklist and establish segregation of duties for bill payments using tools like Bill.com. No more guessing.

-

Month 3 (Days 61-90) — Technology Integration & Reporting Automation: Finally, you connect the dots. You integrate payment processors (Stripe, Shopify), payroll (Gusto), and your CRM with your accounting system to eliminate manual data entry. You then build the automated, investor-ready reporting package that tracks MRR, CAC, and LTV in near real-time.

Why You Can’t Be the Expert in Everything

As a founder, your time is your most finite asset. Wrestling with bank reconciliations or ASC 606 is a terrible use of that time. Recognizing this is a sign of leadership.

"Internal controls are the guardrails of your financial reporting. They ensure that the numbers you rely on to make critical decisions are accurate, timely, and trustworthy. Without them, you’re just driving in the fog." – Tiffany Highstrom, Attorney at Stafford Rosenbaum LLP

Partnering with an outsourced controller service is a strategic decision to install expertise you don't have time to develop. It is the fastest path to implementing the best practices we've covered without derailing your focus on product, sales, and customers. Your business has graduated from the startup sandbox; it’s time your financial operations did, too.

Got Questions? Let's Get Practical.

Here are the most common questions we get, with the direct answers you need.

When do we actually need to worry about ASC 606?

The moment you sign a contract that isn't dead simple (e.g., a subscription bundled with a setup fee). Investors expect this discipline even at $500K in ARR. Putting it off forces a massive, painful cleanup that can stall or kill a deal.

Is a 5-day close a realistic goal for a small team?

Absolutely. A fast close is about process, not headcount. When you standardize your chart of accounts and integrate core systems like Stripe and Gusto, you create a repeatable workflow that just works. A small, disciplined team will run circles around a larger, disorganized one every time.

We’re a services firm. What KPIs should we be tracking instead of MRR?

for services firms, you must prove your revenue is predictable and operations are efficient. Focus on:

- Project Profitability: The true, all-in margin on every client engagement.

- Utilization Rate: Your team's billable hours divided by their total available hours.

- Revenue Per Employee: A dead-simple measure of your team's productivity.

- Backlog: Your pipeline of signed, future work, which demonstrates visibility into future revenue.

What’s the real difference between a bookkeeper and a controller?

A bookkeeper records history—handling data entry and reconciling accounts. A controller turns that history into intelligence. A controller designs the month-end close, prepares the investor-ready reporting package with KPI analysis, implements internal controls, and provides forward-looking guidance like cash flow forecasting. They build and run your entire financial engine.

Ready to implement financial reporting that gives you clarity, control, and credibility with investors? Jumpstart Partners provides outsourced controller services that deliver a 5-day close and audit-ready financials. Schedule a free consultation to see how we can professionalize your finance function.