Financial Operations

A Practical Guide to Fund Accounting for Nonprofits

Master fund accounting for nonprofits. Our guide covers restricted funds, reporting, and compliance to build donor trust and ensure financial stability.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··23 min readAs a nonprofit leader, you know the standard for-profit accounting playbook doesn't apply to you. It’s built to answer one question: are we profitable? But your board, your donors, and your auditors ask something entirely different: are you honoring the specific restrictions placed on your funding?

This is where fund accounting becomes your most critical financial tool. It’s not just about tracking income and expenses; it’s a discipline of accountability. It’s how you prove you’re a good steward of every single dollar entrusted to your mission.

Get this wrong, and you risk compliance failures, eroded donor trust, and a shaky financial future. But get it right, and fund accounting moves your organization from financial uncertainty to strategic clarity. It becomes the engine for smarter decisions, a magnet for new funding, and the proof behind your impact.

The High Stakes of Financial Mismanagement

Financial precarity is a constant threat in the nonprofit world. A recent National State of the Nonprofit Sector Survey painted a concerning picture: 19% of organizations ran a slight deficit, with another 9% facing a significant one.

These situations are made worse by fuzzy lines between different pots of money, leaving many nonprofits, as the Nonprofit Finance Fund puts it, "one unexpected cost away from catastrophe."

Effective fund accounting is your best defense. By building strong internal processes, you create a vital buffer against financial shocks and surprises.

Building a Foundation of Trust and Compliance

Ultimately, fund accounting is about far more than numbers on a spreadsheet. It’s the framework that translates your mission into a financially viable, sustainable operation. It provides the clear, auditable trail that shows everyone—from your board to your most passionate supporter—that you’re using every dollar exactly as intended.

"Accountability is the bedrock of donor trust. When a nonprofit can clearly demonstrate how restricted funds are being used for their intended purpose, it builds a powerful and lasting relationship with its supporters. Fund accounting isn't just a compliance task; it's a strategic tool for retention and growth." - Kate Barr, President & CEO, Propel Nonprofits

To start laying this solid financial foundation for your nonprofit, exploring a comprehensive guide to accounting for not-for-profit organisations can provide invaluable insights. It’s the first real step toward building a system that doesn’t just keep you compliant, but actively supports your mission for years to come.

The Core Concept: Unrestricted vs. Restricted Funds

At the heart of all nonprofit fund accounting is one non-negotiable rule: you must classify money based on the donor's intent. This is a world away from for-profit accounting, where revenue is just revenue. In the nonprofit space, your financial world is split into two distinct buckets.

Following this rule isn't just a "best practice"—it's a requirement under GAAP (Generally Accepted Accounting Principles) through a standard known as ASC 958. Getting this right is the foundation of a clean audit and rock-solid donor trust. It's how you prove you're a responsible steward of their contributions.

This simple hierarchy shows how everything in nonprofit finance connects. Stewardship sits at the top, built on a foundation of accountability and long-term stability.

Think of it this way: responsible fund management (stewardship) is what allows for transparent reporting (accountability), which in turn creates the financial health needed for long-term impact (stability).

Net Assets Without Donor Restrictions (Unrestricted Funds)

Consider unrestricted funds your operational lifeblood. This is the money your organization has complete discretion to use for any legitimate purpose that helps you advance your mission. It pays the salaries, keeps the lights on, covers the rent, and funds investments in new software or staff training.

These funds typically come from sources where the donor hasn't specified a purpose:

- Individual donations from your annual giving campaigns.

- Ticket sales or sponsorships from fundraising events like galas or 5K runs.

- Earned revenue from program services, membership dues, or selling merchandise.

Because of its flexibility, building up a healthy reserve of unrestricted funding is crucial for financial stability. It gives you the agility to handle unexpected costs or seize new opportunities without having to go back to a donor for permission.

Net Assets With Donor Restrictions (Restricted Funds)

Restricted funds, on the other hand, are contributions that come with strings attached. The donor or grant-maker has given you specific instructions on how, when, or for what purpose the money must be used. Ignoring these stipulations isn't just bad practice; it's a serious breach of your fiduciary duty.

These funds represent a donor's specific passion, and your primary job is to honor that intent. For a full breakdown, it's worth digging into resources on understanding the nuances of restricted and unrestricted funds.

Properly managing these funds is all about proving your integrity. The Giving USA 2023 report found that while Americans gave over $499 billion to charity, a staggering 81% of first-time donors don't give a second gift. A major reason for this dismal retention rate is a perceived lack of accountability—a feeling echoed by the Edelman Trust Barometer, which found that only 48% of people trust nonprofits to do what is right.

To help you visualize these two core fund types, here’s a practical comparison.

Unrestricted vs Restricted Funds: A Practical Comparison

This table breaks down the key differences between unrestricted and restricted funds, providing clear examples and outlining the specific accounting treatments required for each.

| Attribute | Net Assets Without Donor Restrictions (Unrestricted) | Net Assets With Donor Restrictions (Restricted) | | :--- | :--- | :--- | :--- | | Donor Intent | No specific purpose stipulated by the donor. | Donor has specified a clear purpose, time, or project. | | Flexibility | High. Can be used for any mission-related expense. | Low. Must be used exactly as the donor instructed. | | Common Sources | Annual appeals, undesignated gifts, event revenue, earned income. | Grants for specific programs, capital campaign gifts, endowment contributions. | | Example | A $100 donation from a website visitor with no special instructions. | A $10,000 grant from a foundation to fund a summer reading program. | | Use Cases | Paying salaries, rent, utilities, marketing, general operations. | Buying books for the reading program, paying tutors, funding a new building. | | Accounting Treatment | Recorded directly as "Revenue Without Donor Restrictions." | Recorded as "Revenue With Donor Restrictions" until the conditions are met. | | Primary Goal | Provides operational stability and agility. | Fulfills a specific, donor-driven project or initiative. |

Ultimately, both fund types are essential for a healthy nonprofit, but they serve different roles and demand different levels of oversight.

A Practical Example: Tracking a Restricted Grant

Let's walk through how this works in the real world. Imagine a local foundation gives your nonprofit a $100,000 grant specifically to launch a new after-school tutoring program. You cannot touch this money for general operations, fundraising, or anything else.

Step 1: Booking the Contribution

The moment you receive the grant check, you record the full $100,000 as revenue With Donor Restrictions. On your books, your Net Assets With Donor Restrictions account just increased by $100,000. Your cash balance also went up, but that money is now mentally (and systematically) siloed for the tutoring program.

Step 2: Incurring Program Expenses

Over the next three months, you spend $25,000 directly on the tutoring program. Let's say $15,000 went to tutors' salaries and $10,000 was for books and classroom supplies. These expenses are paid out of your organization's main bank account.

Step 3: Releasing the Restriction

Here’s the critical step. Because you fulfilled the donor's conditions by spending $25,000 on the designated program, you can now "release" that amount from its restriction. This is an accounting entry that happens on paper—no actual cash moves between bank accounts.

You’ll make a journal entry that does two things:

- Decreases "Net Assets With Donor Restrictions" by $25,000.

- Increases "Net Assets Without Donor Restrictions" by $25,000.

This transaction appears on your Statement of Activities under a line item like "Net Assets Released from Restriction." It effectively reimburses your unrestricted operating fund for the program expenses it fronted.

After this entry, your restricted fund balance for this grant is now $75,000, ready to be spent on future program costs. This process is far more reliable when handled by robust systems. Check out our guide on choosing accounting software for your growing business to make sure you have the right tools for the job.

Building a Chart of Accounts That Delivers Clarity

Your Chart of Accounts (COA) is the financial backbone of your nonprofit. Using a generic COA from a for-profit business is a recipe for disaster. It guarantees chaos because it cannot track funds by restriction and program. You’ll end up in a nightmare of manual spreadsheet gymnastics just to answer basic questions from your board.

Think of your COA as the filing system for every dollar that flows through your organization. A poorly designed one is like a single, messy junk drawer. A well-structured COA is like having specific, clearly labeled folders, so you can find exactly what you need in seconds.

Getting this structure right is the key to automating the accurate financial reports your board and funders demand.

Ditch the Standard COA for a Segmented Structure

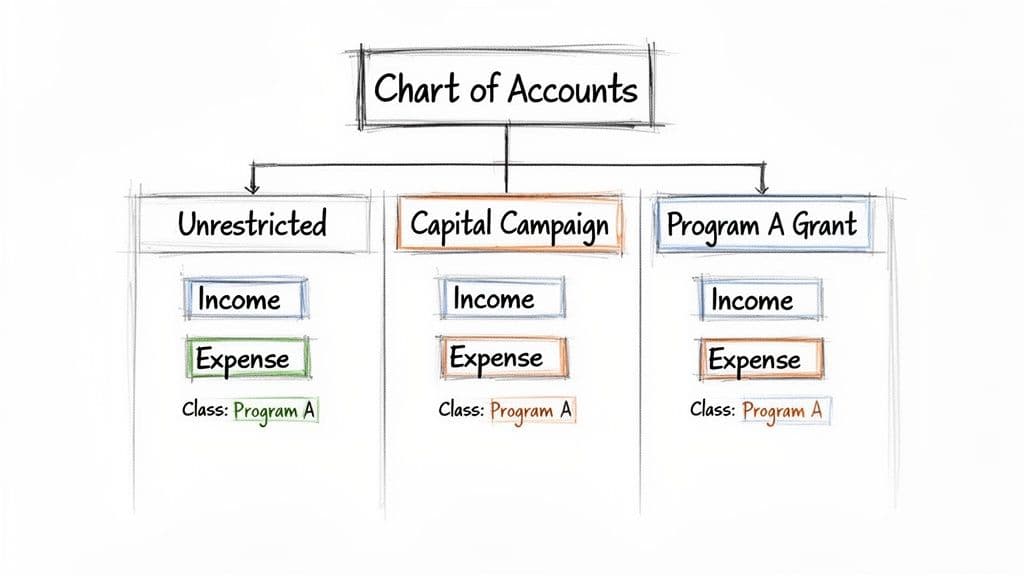

The most damaging misconception is that a simple list of accounts is enough. For effective fund accounting for nonprofits, you absolutely must segment transactions on two different levels: the fund itself and the specific program or function it supports.

Modern accounting software like QuickBooks Online handles this with features like Classes or Locations. This lets you tag every single transaction—every grant received, every payroll run, every supply purchase—to both a fund and a program.

"A well-designed Chart of Accounts is more than an accounting tool; it's a strategic asset. It should tell the story of your organization's financial health by fund, program, and restriction, giving leaders the clarity to make mission-critical decisions." - Nonprofit Finance Fund

This dual-tagging system is what allows you to instantly generate a report showing exactly how much of a specific grant has been spent on a particular program—a task that is nearly impossible with a flat, one-dimensional COA.

A Practical Example of a Nonprofit COA Structure

Let's walk through a simplified COA for a nonprofit juggling a major restricted grant and a capital campaign, alongside its general day-to-day operations. Notice how we use specific, numbered accounts to create a logical hierarchy that software can easily sort.

| Account Number | Account Name | Type | Description |

|---|---|---|---|

| 4000s - Revenue | |||

| 4010 | Unrestricted Contributions | Income | General donations, annual appeal. |

| 4210 | Grant A - Revenue | Income | Restricted revenue from Grant A. |

| 4215 | Grant A - Released from Restriction | Income | Contra-account for tracking released funds. |

| 4310 | Capital Campaign - Revenue | Income | Restricted gifts for the new building. |

| 6000s - Expenses | |||

| 6100 | Salaries - Program A | Expense | Staff time dedicated to Grant A activities. |

| 6200 | Salaries - Admin | Expense | G&A staff salaries. |

| 6500 | Supplies - Program A | Expense | Materials specifically for Grant A. |

| 6800 | Rent & Utilities | Expense | General operating overhead. |

This is just a small snapshot. A full COA would include dozens of accounts, but the principle is the same: create unique income and expense accounts for each major restricted funding source. When you receive a $50,000 check for Grant A, it's coded directly to account 4210. When you pay a $5,000 salary for work on that grant, it's coded to 6100.

This level of detail eliminates all the guesswork and provides an ironclad audit trail. If your current COA looks more like a jumbled mess than a strategic tool, it's time for a reset. Our team offers a thorough QuickBooks cleanup to fix messy books and build a solid foundation for financial clarity. Building this structure correctly from the start is the single most important step you can take to achieve real financial control.

Generating Your Key Nonprofit Financial Statements

Your fund accounting system is the engine that produces a unique set of financial reports telling a story of stewardship and impact. A for-profit P&L is all about the bottom line. Yours is about proving you honored every single donor's intent.

These reports are the ultimate proof of your financial integrity. They answer the critical question every board member and donor is asking: did you do what you said you would do with their money? Let's walk through the three essential statements that turn your fund accounting efforts into a clear, compelling financial narrative.

The Statement of Financial Position

Think of the Statement of Financial Position as your nonprofit’s version of a balance sheet. It’s a snapshot of your financial health on a specific day, showing what you own (assets), what you owe (liabilities), and what’s left over (net assets).

The big difference for nonprofits is in that last section. Instead of a single "equity" line, your net assets must be broken down into two distinct categories:

- Net Assets Without Donor Restrictions: This is your flexible, operational capital—the money you can use for your core mission as you see fit.

- Net Assets With Donor Restrictions: These are funds earmarked for specific programs, projects, or timeframes as dictated by the donor.

This separation is non-negotiable. It instantly shows anyone reading the report how much of your net worth is ready for general use versus how much is already committed.

The Statement of Activities

This is the nonprofit equivalent of an income statement, but it packs a much bigger punch. The Statement of Activities shows your financial performance over a period—like a quarter or a full year—through the lens of your different funds. It tracks all your revenue and expenses in columns, clearly separating the activity for funds with and without donor restrictions.

This is where your carefully designed Chart of Accounts really shines. It allows you to present a crystal-clear picture of how money flowed through the organization. You can see not just what you spent money on, but which pot of money it came from.

To illustrate, here's a simplified example of how revenue and expenses are split out.

Example Statement of Activities Breakdown

| Line Item | Without Donor Restrictions | With Donor Restrictions | Total |

|---|---|---|---|

| Revenue & Support | |||

| Contributions | $150,000 | $0 | $150,000 |

| Grant Revenue | $0 | $100,000 | $100,000 |

| Program Service Fees | $50,000 | $0 | $50,000 |

| Net Assets Released from Restriction | $60,000 | ($60,000) | $0 |

| Total Revenue & Support | $260,000 | $40,000 | $300,000 |

| Expenses | |||

| Program Services | $180,000 | $0 | $180,000 |

| Management & General | $40,000 | $0 | $40,000 |

| Fundraising | $25,000 | $0 | $25,000 |

| Total Expenses | $245,000 | $0 | $245,000 |

| Change in Net Assets | $15,000 | $40,000 | $55,000 |

That line in italics, Net Assets Released from Restriction, is the most important and misunderstood entry in all of nonprofit accounting.

Releasing Funds from Restriction: The Critical Journal Entry

When you spend money that fulfills a donor’s stipulation, you must "release" those funds from their restricted status. This is not a physical transfer of cash. It’s a crucial accounting entry that shows you've met the donor's intent, allowing you to reclassify those funds.

Let's use the table above. Your organization received a $100,000 restricted grant. During this period, you spent $60,000 on the specific program the grant was for.

Your bookkeeper will make a journal entry that moves $60,000 out of the "With Donor Restrictions" column and into the "Without Donor Restrictions" column. It has a net-zero effect on your total revenue but correctly shows that you've satisfied the donor's rules.

This entry signals that your unrestricted funds were effectively reimbursed for covering the program expenses. Mastering this process is absolutely fundamental to accurate reporting. For a deeper dive into the mechanics, check out our guide on how to prepare financial statements the right way.

The Statement of Cash Flows

Finally, the Statement of Cash Flows gives you a clear view of how cash is actually moving in and out of your organization. It breaks everything down into three buckets:

- Operating Activities: Cash used for your day-to-day mission-driven work and administrative functions.

- Investing Activities: Cash spent on or generated from long-term assets, like buying a new vehicle or selling securities.

- Financing Activities: Cash from borrowing money or receiving contributions restricted for long-term purposes, like an endowment.

Together, these three statements paint a complete picture of your nonprofit's financial story, ensuring total transparency for your board, auditors, and—most importantly—the donors who make your work possible.

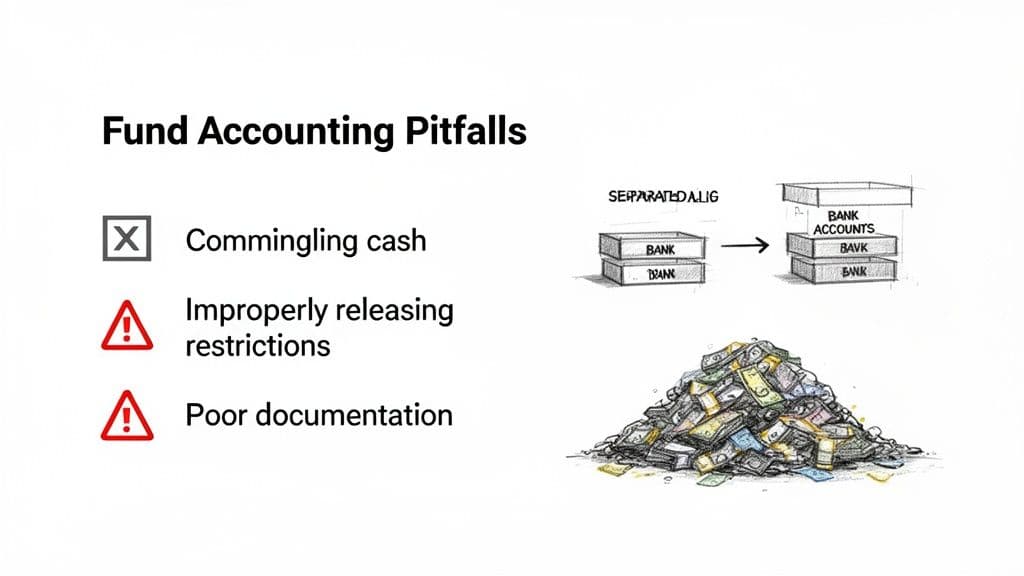

Red Flags: Critical Fund Accounting Mistakes to Avoid

Even the most dedicated nonprofit can stumble into fund accounting mistakes that put its funding and reputation on the line. These aren't just small bookkeeping errors; they're strategic failures that can trigger audit findings, grant clawbacks, and a total collapse of donor trust.

Knowing where the landmines are is the first step to building a financial system that can withstand scrutiny.

By far, the most dangerous and common mistake is commingling cash. This is when you "borrow" from a restricted grant to cover a totally unrelated operational need, like making payroll. It feels like a temporary fix, but it's a massive compliance breach. It fundamentally misrepresents your financial reality to your board, your donors, and your auditors.

Improperly Releasing Restrictions

Another major pitfall is releasing funds from restriction the wrong way. This usually happens when expenses aren't properly documented, or when the release is based on budget projections instead of actual, incurred costs.

This one error directly misstates your net assets on the balance sheet. It makes your unrestricted funds look bigger than they really are, which leads to disastrous strategic decisions about spending money you don't actually have.

"A huge red flag for auditors is a misalignment between development reports and the official accounting statements. This gap is almost always a result of poor fund accounting, where fundraising promises aren't reconciled with GAAP-compliant revenue recognition rules for restricted grants." - Tim Jipping, Partner, BDO

This issue chips away at your board's confidence and signals that your internal controls are weak. The financial health of nonprofits is often delicate; a recent Forvis Mazars report showed that while 52.5% saw net income growth, a worrying 30.28% saw it shrink. You simply cannot afford inaccuracies that hide your true financial position. You can read the full report on nonprofit trends to see just how critical accurate reporting has become.

A Checklist of Common Red Flags

Run through this quick checklist to audit your current process and spot your biggest risks.

- Relying on Outdated Software: Still using generic accounting software or spreadsheets? You are making proper fund tracking nearly impossible. This forces manual work, invites human error, and leaves you without a clear audit trail.

- No Formal Fund Accounting Policy: Without a written policy, your team is guessing how to handle restricted grants. This is a recipe for inconsistent coding, improper expense allocation, and chaos when a key staff member leaves.

- Inadequate Expense Documentation: You cannot release funds from restriction without proof. Failing to collect and attach invoices, timesheets, and receipts for every single restricted expense makes your financial statements indefensible under audit.

- Ignoring Indirect Cost Allocations: Many grants allow for an indirect cost rate (often 10-15% for overhead). If you're not properly calculating and applying this, you're leaving unrestricted money on the table and putting unnecessary strain on your operational budget.

Each of these errors is a crack in your financial foundation. The good news? They are all fixable with clear processes and the right expertise. A solid system means you're always ready when the auditors call, a process you can learn more about in our guide on how to prepare for an audit.

Action Plan: Implementing Fund Accounting the Right Way

Moving from theory to practice is where the real work begins. You cannot wing fund accounting—that’s a surefire way to end up with messy books and compliance headaches.

For any organization pulling in over $500K in revenue, a structured implementation isn’t a nice-to-have; it’s the only way to build a financial operation that can scale with your mission.

Get this right from day one, and you’ll have audit-ready financials that let your team focus on their real jobs instead of wrestling with spreadsheets to fix mistakes.

“The number one mistake I see is nonprofits trying to bolt on fund accounting to a system that was never designed for it. You have to build the foundation—the policies, the chart of accounts, and the team training—before you can expect clear reporting.” - Scott Z. Lod C.P.A., Partner, Marks Paneth LLP

A successful rollout isn't just about picking new software. It's about creating a documented, repeatable system that everyone on your team understands and follows.

Your Five-Step Implementation Checklist

A real fund accounting implementation requires a structured approach that gets your policies, technology, and people all on the same page. Follow these five critical steps to build (or fix) your system for maximum clarity and control.

-

Develop a Formal Fund Accounting Policy: This is your rulebook. Your written policy needs to spell out what counts as a restricted fund, what documentation is needed for every expense, and the precise steps for releasing funds from restriction. This document is your single source of truth.

-

Redesign Your Chart of Accounts: Your current chart of accounts probably isn't built for this. Work with an expert to rebuild it, creating unique income and expense accounts for your major restricted grants and programs. The goal is to use classes or tags to slice and dice every transaction by both its fund and its function.

-

Select and Configure the Right Software: Generic accounting software will fail you. You absolutely need a platform designed for the complexities of nonprofit fund accounting, like QuickBooks Online Advanced or a more specialized nonprofit ERP. The magic isn't just in the software itself, but in configuring it correctly to automate the specific reports you need.

-

Train Staff and Board Members: A system is only as strong as the people using it. This means hands-on training for everyone who touches the financials—from the program manager coding expenses to the board member reading the reports. Critically, make sure they understand the why behind fund segregation, not just the how.

-

Establish a Rigorous Monthly Close: This is non-negotiable. Implement a formal monthly closing process that forces you to reconcile every account, check fund balances against their grant agreements, and verify that every restriction has been properly released. This regular discipline stops tiny errors from snowballing into massive audit findings.

Common Questions About Nonprofit Fund Accounting

As a nonprofit leader, you’re constantly balancing mission impact with financial realities. Here are some straightforward answers to the questions we hear most often about managing nonprofit fund accounting correctly to keep your organization compliant and build unshakable donor trust.

Can We Use Restricted Funds for Administrative Overhead?

Only if the donor or grant agreement explicitly says so. Many grants will spell out an approved indirect cost rate—often around 10-15%—that you can pull from the grant to cover general and administrative (G&A) expenses. Think of it as the donor agreeing to help keep the lights on while you do the mission-critical work.

But if the grant agreement is silent on this point, you absolutely cannot use those restricted funds for general operating costs like rent or administrative salaries. It's on you to meticulously track any allowable indirect costs and factor them into your calculations when you release funds from their restrictions.

What Is the Difference Between Temporarily and Permanently Restricted Funds?

This is a great question because the rules actually changed, simplifying things for the better. Under the current GAAP standards (specifically ASU 2016-14), the old terms "temporarily restricted" and "permanently restricted" have been retired.

Today, all funds are classified as either Net Assets With Donor Restrictions or Without Donor Restrictions. The "With Donor Restrictions" bucket now covers everything that isn't completely flexible—whether it's restricted for a specific program, for a certain period of time (what used to be called temporary), or funds that have to be held forever, like an endowment. The specific nature of the restriction is now explained in the notes to your financial statements, giving readers clearer context.

"A common misconception is that using Excel for fund accounting is 'good enough' for smaller nonprofits. It's a significant risk. Spreadsheets lack the audit trail, internal controls, and real-time reporting capabilities of a proper accounting system, making compliance and accurate decision-making nearly impossible." - Curt Klotz, CPA, Former CFO of Propel Nonprofits

Is Using Excel to Track Funds Sufficient for Our Nonprofit?

No. While Excel is a familiar tool, it's not built for the rigor that fund accounting for nonprofits demands. It’s like trying to build a house with a screwdriver—you might make some progress, but the foundation will be shaky.

Relying on spreadsheets exposes your nonprofit to serious risks:

- High Probability of Human Error: One wrong formula or a copy-paste mistake can throw off your entire financial picture. These aren't just numbers; they represent your promises to donors.

- Lack of an Audit Trail: Excel leaves no reliable record of who changed what and when. This is a red flag for auditors and a fundamental gap in financial control.

- It Simply Doesn't Scale: As you secure more grants and donations, managing everything in spreadsheets becomes an administrative nightmare, pulling your team away from the work that actually drives your mission.

Investing in a dedicated accounting system like QuickBooks Online isn't a luxury; it's essential for maintaining compliance, ensuring accuracy, and running your organization efficiently.

Your mission is too important to leave your finances to chance. The Jumpstart Partners team provides expert, outsourced bookkeeping and controller services for nonprofits, ensuring your fund accounting is accurate, compliant, and audit-ready from day one. Schedule a free consultation to see how we can give you complete financial clarity.