Financial Operations

How to Prepare for Your First Financial Audit and Pass with Confidence

Learn how to prepare for audit with our comprehensive guide for SaaS and service firms. Get timelines, checklists, and internal control tips for success.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··24 min readYour first financial audit is a critical test—not just of your books, but of your business's maturity. For founders and CEOs of growing SaaS, agency, or professional services firms, it's the rite of passage that unlocks the next funding round, secures a loan, or validates your valuation for an acquisition. A clean audit opinion tells investors your financial house is in order. A messy one erodes trust and brings critical deals to a grinding halt.

This guide moves beyond generic advice. We will provide the specific roadmap, calculations, and benchmarks you need to transform audit prep from a defensive chore into a strategic advantage, proving to investors that your business is built to scale.

Your First Audit Is a Test of Your Business, Not Just Your Books

For a founder guiding a company toward its next big milestone, that first financial audit is so much more than a box-ticking exercise. Think of it as a rite of passage. It’s what validates your entire growth story for investors, lenders, and potential buyers.

A clean audit opinion is a powerful signal. It tells the world your financial house is in order, your revenue recognition is sound, and your internal controls are mature enough for the big leagues. Nail it, and you unlock that next funding round or acquisition. A messy audit, on the other hand, just erodes trust and can bring critical deals to a grinding halt.

More Than Just Numbers

An audit provides an objective, third-party validation of your financial health. It’s not just about proving the numbers add up; it's about proving your business is built on a solid foundation. The process forces you to document and justify the key financial decisions you’ve made while scaling up.

"Many founders see the first audit as an intrusive, expensive headache. But the smart ones reframe it. It's the ultimate stress test for your financial operations and systems. Passing it cleanly is one of the most powerful signals you can send to a potential investor that you're ready for the big leagues." — David V. Lorenzo, Founder of The 60-Second CEO

For SaaS, agency, and service-based businesses, this scrutiny gets particularly intense. Auditors will dive deep into complex areas like revenue recognition under ASC 606, deferred revenue schedules, and how you've capitalized internal-use software. Missteps in these areas are incredibly common and can be very costly to fix.

The Real Cost of Being Unprepared

In the fast-paced world of a growing business, getting audit-ready isn't just about compliance—it's your ticket to smooth fundraising and unshakable investor confidence. The game is changing, too. According to Hyperproof’s 2025 IT and Risk Compliance Benchmark Report, a massive 59% of organizations now test all of their controls, not just the critical ones. That's a huge jump of 26% from the previous year and shows just how critical comprehensive readiness has become.

Sloppy bookkeeping is what really torpedoes an audit. At Jumpstart Partners, we frequently find an average of $47K+ in errors per client when we do a financial cleanup. These are exactly the kinds of mistakes that can turn an audit into a painful, drawn-out process that bleeds resources and kills momentum. A well-organized financial statement is your first line of defense; you can learn more about how to prepare financial statements in our detailed guide.

This guide is designed to reframe audit prep from a defensive chore into a strategic advantage. We’ll show you exactly how to build a rock-solid financial foundation that proves to everyone that you're truly ready to scale.

The 90-Day Audit Readiness Roadmap

A successful audit is won long before the auditors arrive. Too often, audit prep is a last-minute fire drill—a chaotic scramble to pull together documents and answer unexpected questions. This reactive approach is stressful, expensive, and a massive drain on your team's time.

Worse, it creates friction with your auditors and dramatically increases the risk of findings that can delay a funding round or kill a deal.

The key is to transform audit preparation from a frantic event into a structured, manageable process. Breaking it down into a 90-day timeline turns an overwhelming task into a series of achievable milestones. You can allocate resources effectively, anticipate auditor requests, and ensure your team is aligned and ready to go.

This simple flowchart shows the core journey: clean bookkeeping is the foundation for control testing, which ultimately builds the investor confidence you need to grow.

It’s a straightforward path: foundational accuracy enables rigorous testing, which solidifies the trust you need to scale.

The 90-Day Audit Prep Countdown

A well-planned audit timeline is your best defense against last-minute chaos. This structured approach breaks the work into distinct, manageable phases so you can ensure all documentation is gathered, reconciliations are completed, and your team is fully prepared well before the audit begins.

Here’s a detailed breakdown of the key objectives and actionable tasks for each critical timeframe.

| Timeframe | Key Objective | Actionable Tasks |

|---|---|---|

| 90 Days Out | Strategic Planning & Team Alignment | 1. Finalize Auditor Selection: Confirm the engagement letter, scope, and fees. 2. Internal Kick-off Meeting: Brief your finance team on the audit timeline, roles, and key deadlines. 3. Review Internal Controls: Identify and document key financial processes like cash disbursements and payroll. 4. Initial Data Request: Ask the auditor for a preliminary "Prepared-by-Client" (PBC) list to understand their needs. |

| 60 Days Out | Deep-Dive Data Gathering | 1. Begin Reconciliations: Start reconciling major accounts—cash, AR, AP, and deferred revenue. 2. Assemble Key Documents: Gather bank statements, major contracts, loan agreements, and board meeting minutes. 3. Review Equity Records: Ensure your cap table is up-to-date and accurately reflects all stock option grants and transactions. |

| 30 Days Out | Finalizing the PBC & Pre-Audit Review | 1. Address PBC List Items: Methodically work through the official PBC list, assigning each item to a team member with a clear due date. 2. Complete Complex Schedules: Finalize intricate schedules like ASC 606 revenue recognition and capitalized software costs. 3. Draft Financial Statements: Prepare a draft version of your balance sheet, income statement, and statement of cash flows. |

| 7 Days Out | Final Checks & Logistics | 1. Review Final PBC Package: Conduct a final review of all submitted documents for completeness and accuracy. 2. Schedule Key Personnel: Confirm availability of your finance leader and other key staff for auditor interviews. 3. Set Up a Data Room: Organize all final documents in a secure, shared folder for easy auditor access. |

By following this countdown, you methodically de-risk the audit process and position your team for a smooth, efficient engagement.

The Most Common—and Costly—Misconception About Audit Timelines

Many leaders believe audit prep is purely a finance team responsibility that starts a month before fieldwork. This is a critical error. An audit tests the operational fabric of your entire business, from sales contracts that dictate revenue recognition to HR records that support payroll expenses.

A common mistake is underestimating the time needed for reconciliations. A company at the $10M revenue mark might think a week is enough. But if their deferred revenue schedule has never been properly maintained under ASC 606, it can take 100+ hours just to rebuild it accurately.

Starting early is non-negotiable. For a deeper dive into the specifics of what auditors will request, check out our complete checklist for auditors to get a head start.

Turning the Roadmap into Action

Your next step is to block out time on your calendar and create your company's version of this 90-day plan. Assign a clear owner for the audit preparation process—this is often a controller or finance manager—who will be responsible for tracking progress against these milestones.

Most importantly, open the lines of communication with your chosen audit firm early. Ensure you're aligned on timelines and expectations from day one. By treating audit readiness as a project with a clear plan, you shift from a position of defense to one of control, ready to demonstrate the financial maturity of your business.

Decoding the Prepared-By-Client (PBC) Checklist

The Prepared-by-Client (PBC) list is the backbone of your audit. Think of it less as a suggestion list and more as the auditor's detailed roadmap for verifying every single number on your financial statements.

Delivering a complete, accurate, and well-organized PBC package on time is the single most effective way to build trust and ensure the whole process doesn't become a nightmare. A messy or incomplete submission is a red flag for auditors; it signals that your financial house might be a mess, inviting much deeper, more painful scrutiny. On the other hand, a clean package shows you're in control and sets a collaborative tone from day one.

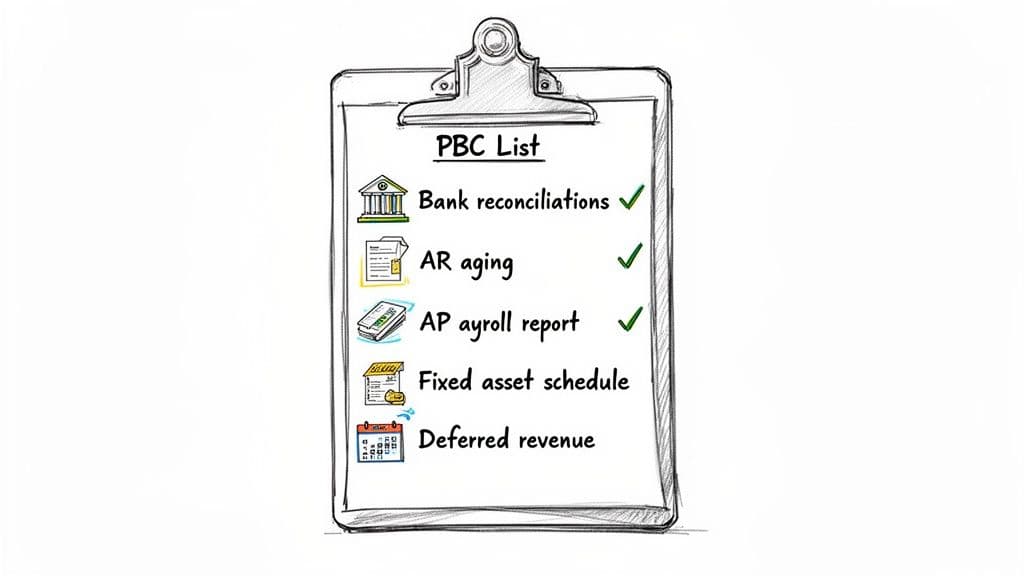

Core Components of the PBC Checklist

Every audit is a little different, but for a growing SaaS or professional services firm, the PBC list will always hammer on the same core financial areas. Auditors don’t just want your final numbers; they want the paper trail that proves how you got there.

These are the non-negotiable items you absolutely must get right:

- Bank Reconciliations and Statements: This is ground zero. Auditors need every monthly bank and credit card statement for the fiscal year, plus the matching reconciliation reports from your accounting software. It’s the first thing they check to verify cash. (If this process isn't airtight, check out our guide on how to reconcile bank accounts).

- Accounts Receivable (AR) Aging: This report breaks down who owes you money and for how long. Auditors live in this report, using it to test whether your receivables actually exist, often by sending confirmation letters directly to a sample of your customers.

- Accounts Payable (AP) Aging: The flip side of AR, this report shows exactly what you owe your vendors. It’s critical for verifying your liabilities and making sure expenses are booked in the right period.

- Fixed Asset Schedule: This is a detailed list of all your significant physical assets—think laptops, servers, and office furniture. It needs to show purchase dates, costs, and accumulated depreciation. Auditors will pick a few recent additions and trace them right back to the original invoices.

- Payroll Reports: Expect requests for all your quarterly payroll tax filings (like Form 941), annual filings (W-3), and detailed payroll registers from specific pay periods. This verifies your largest expense category and all the related tax liabilities.

- Capitalization Table (Cap Table): A critical document for any company with equity financing. It shows every detail of ownership, from common stock to options and warrants. Auditors will scrutinize this to ensure every equity transaction is recorded perfectly.

Mastering the ASC 606 Deferred Revenue Schedule

For any SaaS or service-based company with contracts, the deferred revenue schedule is where audits get tricky. ASC 606 accounting standards require you to recognize revenue as you earn it, not just when a customer pays you. This is a massive area of focus for auditors, and they will dig in.

Let’s walk through a real-world example.

Imagine your SaaS company signs a new customer on October 1, 2024. The deal is for $120,000 for a 12-month subscription, and the customer pays the full amount upfront.

On October 1, your bookkeeper makes this journal entry:

- Debit Cash: $120,000

- Credit Deferred Revenue: $120,000

Notice the money doesn't hit your revenue line yet. It sits on your balance sheet as a liability called Deferred Revenue because you haven't earned it. Each month, you'll recognize $10,000 of it ($120,000 / 12 months).

Your deferred revenue schedule is the document that tracks this for every single contract.

| Month | Beginning Deferred Balance | Monthly Revenue Recognized | Ending Deferred Balance |

|---|---|---|---|

| Oct-24 | $120,000 | $10,000 | $110,000 |

| Nov-24 | $110,000 | $10,000 | $100,000 |

| Dec-24 | $100,000 | $10,000 | $90,000 |

By your year-end on December 31, 2024, you will have recognized $30,000 in revenue from this one contract. The remaining $90,000 is the correct deferred revenue balance that should appear on your year-end balance sheet. Your auditors will test this calculation contract by contract.

Beyond the Financials: The New Scope of Audits

Audits today are about more than just the numbers. For growing tech and service firms, cyber risks and complex internal controls are now front and center. The World Economic Forum’s 2025 Outlook found that 39% of organizations see a skills shortage as their top hurdle in managing these new risks. This means that for a growing company, nailing your IT and internal control audits is becoming just as critical as the financial review.

"The PBC list is your first conversation with the auditor. A clean, well-referenced submission tells them you're organized and take financial reporting seriously. A messy one tells them to dig deeper, which costs you time and money." — Jessica Smith, CPA, former Big Four Audit Manager

Assembling a Bulletproof Audit Package

Knowing what documents to pull is half the battle; how you present them is the other half. Don't just dump a thousand files into a shared folder and call it a day. A professional, organized package builds instant credibility.

- Create a Secure Data Room: Use a platform like Dropbox, Google Drive, or a dedicated audit portal. The key is to create a folder structure that mirrors the PBC request numbers exactly (e.g., Folder "1.1 - Bank Statements," Folder "1.2 - Bank Reconciliations"). This makes life unbelievably easier for the audit team.

- Use a Master Checklist: A shared spreadsheet is your best friend. List every single PBC item, assign an owner from your team, set a due date, and track the status (Not Started, In Progress, Submitted). This becomes your command center for the entire preparation process.

- Provide Explanations: For complex areas like your revenue recognition policy or a significant one-time expense, write a brief memo explaining your methodology or the business context. This proactive communication answers auditors' questions before they even have to ask them.

When you treat the PBC checklist with this level of seriousness, you reframe the audit from an adversarial process to a collaborative one. You’re showing them you're a competent and reliable steward of your company’s finances—which is exactly the assurance your investors and stakeholders are looking for.

Financial Hot Spots That Attract Scrutiny

Auditors are trained to spot the weak points in your financials. They know exactly where high-growth SaaS and service companies tend to cut corners or make mistakes, and they go straight for those areas. Knowing their playbook gives you a massive advantage.

Think of this as your "red flag" guide. When you proactively tackle these common problem areas, you're not just getting ready for an audit—you're building a more resilient, transparent business. The goal is to create an unshakeable documentation trail that answers auditors' questions before they even think to ask them.

Revenue Recognition Under ASC 606

For any business with subscriptions or complex contracts, ASC 606 is the single biggest audit hurdle. It’s where auditors spend the most time, and for good reason—it's notoriously complex and easy to get wrong. They aren't just checking your math; they're dissecting your entire revenue recognition policy.

Auditors will put your process under a microscope, testing how you handle the five core steps for every single contract:

- Identifying the contract.

- Identifying all the distinct performance obligations (the specific promises you've made).

- Determining the transaction price.

- Allocating that price across the different performance obligations.

- Recognizing revenue only when (or as) you deliver on each promise.

A classic rookie mistake is recognizing all the cash from a multi-year deal the moment it hits your bank account. That’s a critical error under ASC 606. For a deeper dive into getting this right, you can learn more about SaaS revenue recognition and ASC 606 in our article.

Capitalization of Software Development Costs

If you’re a SaaS company building your own platform, how you account for development costs is a huge deal. You can't just expense every dollar a developer earns. ASC 350-40 has very specific rules about which costs must be capitalized—treated as an asset and depreciated over time—versus which must be expensed immediately.

Auditors will demand detailed records to justify every decision. Be ready to provide:

- Time-tracking records for developers that clearly separate time spent on new features (capitalizable) versus bug fixes and maintenance (expensed).

- Project plans or internal memos that pinpoint the exact date your software reached "technological feasibility," which is the trigger to start capitalizing costs.

- A clear, consistent policy for how you determine the useful life of the capitalized software.

Without this paper trail, you’re looking at a guaranteed audit finding. You have to prove you have a systematic process.

Accounts Receivable and Your Allowance for Doubtful Accounts

Your Accounts Receivable (AR) aging report tells a story about your company's health, and auditors read it like a novel. They run two key tests here. First, they confirm the receivables actually exist, often by sending letters directly to a sample of your customers to verify what they owe.

Second, they dig into the more subjective part: your allowance for doubtful accounts. This is your estimate of invoices you don’t think you'll ever collect. Simply picking a flat percentage won't cut it. Auditors will challenge your methodology.

You need a defensible policy, grounded in historical data. For instance:

- Current (0-30 days): 1% allowance

- 31-60 days past due: 5% allowance

- 61-90 days past due: 25% allowance

- Over 90 days: 75% allowance

You'll be expected to justify these percentages and prove you apply them consistently. Maintaining perfect books is key, which starts with a solid reconciliation process like the one in this accounting reconciliation example.

Equity Compensation and Your Cap Table

For any venture-backed company, equity is a core part of compensation, and auditors will put your cap table under a microscope. Their job is to verify that every single stock option grant, exercise, and forfeiture is recorded perfectly.

The most common errors they hunt for include:

- Outdated 409A Valuations: Using an old 409A valuation to set the strike price for new option grants is a major red flag.

- Mismatched Records: Finding discrepancies between what the board approved in its meeting minutes and what’s actually in your cap table software.

- Incorrect Expense Recognition: Failing to properly calculate and record stock-based compensation expense on your income statement every month.

"Your cap table is a legal and financial document of record. Any mistake, no matter how small, creates a ripple effect that complicates future funding rounds and frustrates auditors. Absolute precision is the only standard." — Jessica Smith, CPA, former Big Four Audit Manager

The Rise of Continuous Auditing

As digital agencies and service firms grow past the $1M ARR mark, waiting around for a year-end audit is quickly becoming an outdated strategy. Financial audit trends for 2025 show a massive shift toward real-time, continuous auditing. A recent KPMG survey of global leaders found that nearly 80% want auditors using larger data samples and advanced tech for data gathering.

This means having clean, auditable data on demand is no longer a nice-to-have; it's a necessity. Tackling these financial hot spots isn't just a once-a-year scramble—it requires constant vigilance to keep your books ready for inspection at any time.

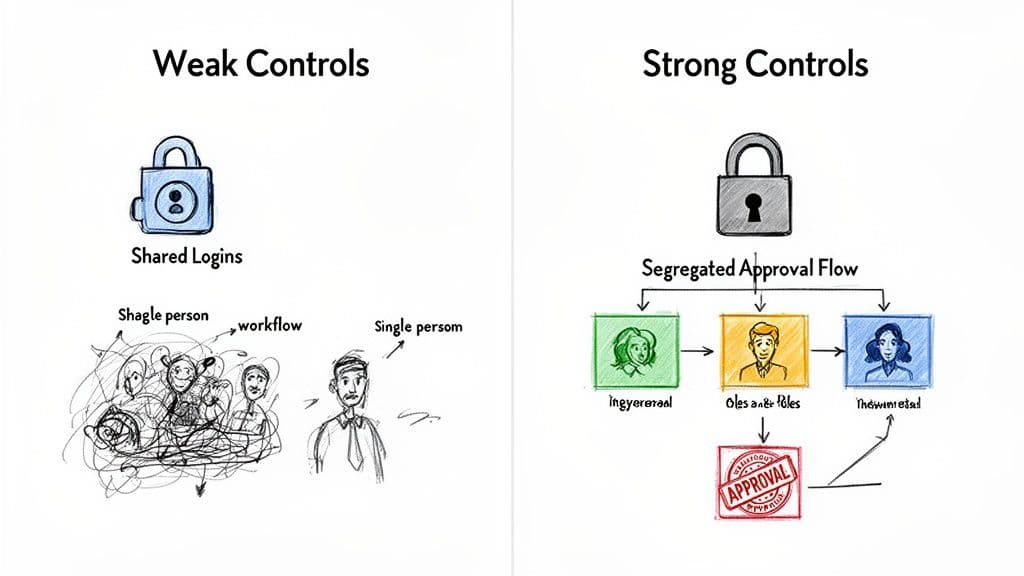

Building Internal Controls That Actually Work

Strong internal controls aren't just for Fortune 500 companies. They're your best defense in an audit and, frankly, the sign of a business that's built to last. I've seen too many founders dismiss controls as bureaucratic red tape that just slows things down. That's a dangerous mistake.

The hard truth is that a lack of controls is a neon sign for auditors that says, "Don't trust these numbers." When they see chaos, they have no choice but to dig deeper, test more transactions, and ask endless questions. That painful process costs you a ton of time and money.

Core Controls You Cannot Ignore

For a growing business, implementing controls doesn't mean building a slow, corporate machine. It means creating smart, scalable guardrails that protect your cash and prove your financials are solid. The goal is to build practical, high-impact processes that impress auditors without getting in your team’s way.

Here are the absolute non-negotiables:

- Segregation of Duties: Even if you only have a small team, this is critical. The person who approves payments should never be the same person who initiates them or reconciles the bank account. Splitting these duties is your single most effective defense against fraud.

- Formal Approval Workflows: No more verbal approvals or spending based on a quick Slack message. You need a clear, documented process for all significant expenses. Use software to create digital paper trails for vendor bills, expense reports, and new hires.

- System Access Controls: Shared logins for your bank, payroll system, or accounting software are a massive red flag to any auditor. You have to implement role-based permissions, making sure people only have access to what they absolutely need to do their jobs.

- Documented Month-End Close: A disciplined, checklist-driven month-end close is the foundation of reliable financials. It ensures all accounts are reconciled, accruals are booked, and your statements are reviewed on a consistent schedule. Our guide on financial controls for growing businesses provides a step-by-step framework to get this done.

Weak vs. Strong Control Environments

The difference between a company with weak controls and one with strong controls is night and day to an auditor. One looks like a chaotic startup held together with duct tape; the other looks like a mature, scalable business they can trust. This table shows exactly what auditors are looking for.

Internal Control Environment Comparison

| Process Area | Weak Control Environment (Red Flag) | Strong Control Environment (Best Practice) |

|---|---|---|

| Cash Disbursements | One person handles everything from vendor setup to payment approval and bank reconciliation. Shared login for the company bank account. | The person entering a bill cannot approve it. A separate manager approves payments, and a third person reconciles the bank account. |

| Expense Reimbursement | Employees submit expenses via email with little oversight. The CEO provides verbal approval for large expenses. | All employees submit expenses through a system like Expensify, which enforces policy rules. A formal, multi-level approval workflow is required. |

| Payroll Processing | The same person can add new employees, change pay rates, and process the payroll run. Changes are not reviewed by a second person. | HR is responsible for adding employees and setting pay rates. A finance team member reviews the payroll register for accuracy before it's processed. |

| Financial Reporting | The month-end close is informal and often late. Financial statements are not reviewed by management before being finalized. | A formal month-end close checklist is used. The controller or finance leader reviews and signs off on the final financial package. |

The best practices outlined here aren't just about passing an audit—they're about building a more resilient and trustworthy company from the ground up.

"Internal controls are the financial immune system of your company. They aren't about restricting people; they are about protecting the business from human error and bad actors. A strong control environment is the clearest signal to an auditor that you take financial stewardship seriously." — David V. Lorenzo, Founder of The 60-Second CEO

For your controls to truly satisfy auditors, they must be robust enough to prevent both accidental misstatements and deliberate fraud. You can find a more comprehensive guide on implementing strong internal controls to prevent fraud.

So, what's your next step? Take an honest look at the "Weak Control" column in the table above. If any of those descriptions hit a little too close to home, that’s your starting point. Focus on implementing the corresponding "Best Practice" to immediately strengthen your financial foundation and get yourself audit-ready.

Common Questions We Hear About Audit Prep

Even with the best plan, you’re going to have questions, especially if it’s your first time through the audit gauntlet. Here are the most common things founders and finance leaders ask us before they dive in.

How Much Should We Budget For a First-Time Audit?

For a business doing between $5M and $20M in revenue, a first-time audit usually lands somewhere between $40,000 and $75,000. That's a big range, and the final number really depends on a few key things: the complexity of your business, how clean your financial records are, and which firm you hire.

The single biggest driver of that cost? The state of your books. If your revenue recognition is a tangled mess or you have months of unreconciled accounts, the auditors will have to spend way more time digging, testing, and verifying. That extra time goes straight to their invoice.

What’s The Real Difference Between an Audit and a Review?

Think of it like this: an audit provides the highest level of assurance possible. The auditors are giving their official opinion on whether your financials are free from major errors. To get there, they do extensive testing on your internal controls, account balances, and individual transactions. It's a deep dive.

A review, on the other hand, is much less intense. It’s more about inquiry and high-level analysis, not detailed testing of every nut and bolt. Because it's less comprehensive, a review provides only limited assurance. It's cheaper, for sure, but it often won't cut it for serious investors, lenders, or a potential acquisition.

What Happens If We Disagree With the Auditors?

It happens. Disagreements are pretty common, especially around subjective topics like estimating bad debt or deciding how to capitalize software development costs. The trick is to treat it like a professional discussion, not a fight.

First, make sure you fully understand their point of view and the accounting standard they're citing. Then, come back with your own well-documented argument, backed by specific accounting principles (like ASC 606) and industry best practices. If you're still at a stalemate, you can always get a second opinion from another accounting expert.

"A disagreement with your auditor isn’t a crisis; it’s a test of your process. If you've built a strong case with clear documentation and a logical application of accounting principles, you can have a productive conversation. It’s when your position is based on 'how we've always done it' that you run into trouble." — David V. Lorenzo, Founder of The 60-Second CEO

Can We Make Adjustments After the Audit Has Started?

Technically, yes, but you really shouldn't. Auditors almost always find things that need to be fixed, and they'll give you a list of Proposed Adjusting Journal Entries (PAJEs) to correct them. That's a normal part of the process.

What you want to avoid is making your own major changes once they've started their fieldwork. It complicates their job and can make them question the reliability of your records. The best approach is to have a "hard close" before you hand anything over. Make sure the trial balance you send is the final, locked-down version. Making changes after the fact erodes the auditor's confidence in your financial controls.

An audit is a high-stakes event, but you don't have to navigate it alone. The expert team at Jumpstart Partners provides audit-ready financials and strategic guidance to ensure you pass with confidence. If you're ready for a smoother close and a stress-free audit, schedule a consultation with us today.