Financial Operations

How to Reconcile Bank Accounts: A Guide for Founders and CEOs

Learn how to reconcile bank accounts with our guide for SaaS and service firms. Discover how to fix discrepancies and achieve financial accuracy.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··19 min readYour cash balance in QuickBooks is not your real cash balance. Until you’ve completed a bank reconciliation, that number is a guess—and guessing is a fatal mistake when you’re making payroll, hiring, and investment decisions. Bank reconciliation is the non-negotiable process of matching every single transaction in your accounting software to your official bank statements. Its purpose is singular: to prove your cash numbers are 100% accurate and trustworthy.

For a founder leading a business in the $500K-$20M revenue range, skipping this is like flying a plane without an altimeter. You think you know your altitude, but you're just guessing. This leads to disastrous decisions.

Why Unreconciled Accounts Are a Ticking Time Bomb

Ignoring reconciliation gives you a dangerously distorted view of your actual cash position. You might see a healthy $100,000 balance in Xero and decide to approve a new marketing campaign. But what you don’t see is that a $45,000 customer payment just bounced and $15,000 in vendor checks you issued last week finally cleared. Your real cash position isn't $100,000; it's $40,000.

This isn't a theoretical risk. It’s exactly how companies miss payroll, overspend on growth, and make commitments they simply can’t keep.

The Real Costs of Inaccurate Books

The damage from sloppy reconciliation goes far beyond cash mismanagement. It introduces serious operational and financial risks that can derail your company's growth.

These risks are not trivial:

- Undetected Fraud: Without a meticulous reconciliation, unauthorized withdrawals or fraudulent charges can go unnoticed for months, slowly bleeding your company dry.

- Surprise Tax Bills: Inaccurate expense and revenue tracking leads directly to miscalculated tax liabilities. This means underpayment and, eventually, painful penalties and interest from the IRS.

- Failed Due Diligence: During a fundraising round or an acquisition, investors will put your financials under a microscope. A history of unreconciled accounts is a massive red flag that screams "weak internal controls" and can kill a deal on the spot.

For a SaaS company, unreconciled Stripe payouts can artificially inflate your Monthly Recurring Revenue (MRR) figures. For a professional services firm, unrecorded client retainers can hide the grim reality of your cash flow. You need solid data to make decisions, and reconciliation is the process that validates that data. You can learn more about how these issues snowball in our guide to solving small business cash flow problems.

"A messy reconciliation is often the first sign of a deeper financial control issue. When we see a company struggling with this, it tells us they lack visibility into their cash, which is the lifeblood of their business. It's a risk investors are simply not willing to take." – Sarah Jennings, Fractional CFO

Ultimately, a monthly reconciliation is the absolute minimum for maintaining financial control. It’s the foundational discipline that ensures you can trust your numbers and confidently steer your business toward its next milestone. Anything less is just gambling with your company's future.

A Practical Workflow for a Flawless Bank Reconciliation

Nailing a perfect reconciliation isn’t financial wizardry; it is a disciplined, repeatable process. This monthly ritual is your ultimate source of truth for cash. It turns a chaotic list of transactions into clear, actionable intelligence. Skip it, and you're making critical decisions while flying blind.

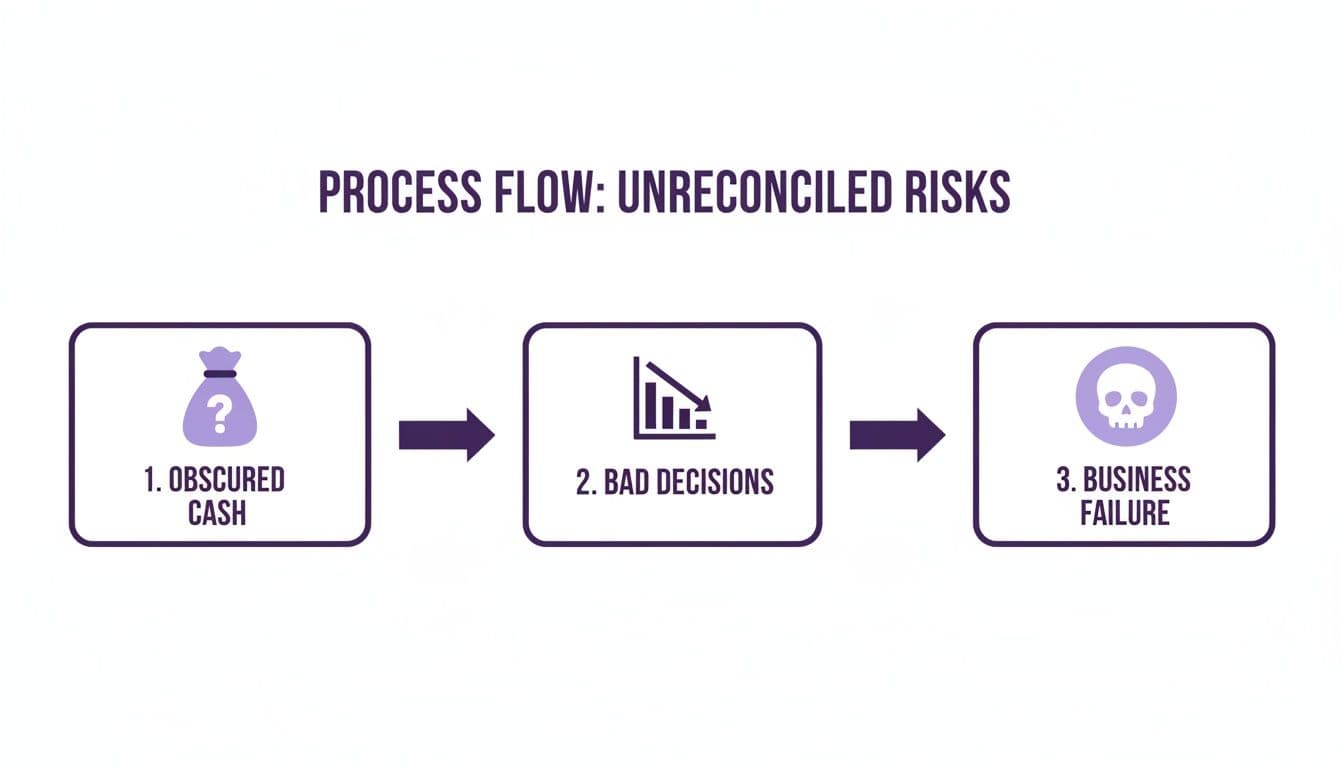

The consequences of unreconciled accounts cascade quickly, obscuring your true cash position. That leads to bad decisions, which ultimately puts the entire business at risk.

This simple flow chart illustrates a deadly chain reaction. It starts with a simple lack of financial clarity and can end in total failure. Your monthly reconciliation is the circuit breaker that stops this before it starts.

Get Your Docs in a Row First

Before opening your accounting software, gather your sources of truth. The goal here is to collect all the data that represents cash moving in and out of the business for the period you're reconciling—for example, the month of July.

Here’s your pre-flight checklist:

- Official Bank and Credit Card Statements: Don't just look at the running balance online. Download the official PDF statements for every single checking, savings, and credit card account for the period.

- Payment Processor Reports: This is critical. Pull the detailed settlement or payout reports from Stripe, Shopify, PayPal, or whatever processor you use. These reports break down gross sales, transaction fees, and refunds before a net deposit ever hits your bank.

- Your Accounting General Ledger: Have your accounting software, like QuickBooks or Xero, open and ready with all the cash transactions you've recorded for the period.

Getting these documents ready upfront prevents the constant back-and-forth that turns a two-hour task into a two-day headache.

The Core Match-Up: Books vs. Bank

Now for the main event. Here you methodically match every single line item. The best way to do this is with your bank statement on one screen and your accounting software's reconciliation module on the other. You will systematically check off each transaction that appears on both documents.

Anything that matches perfectly gets ticked off. That $1,500 rent check that cleared? Check. A $5,000 client payment that was deposited? Check. The real work begins when you're left with a list of items on either side that don't have a match. These are your discrepancies.

Handling Discrepancies: Timing, Fees, and Errors

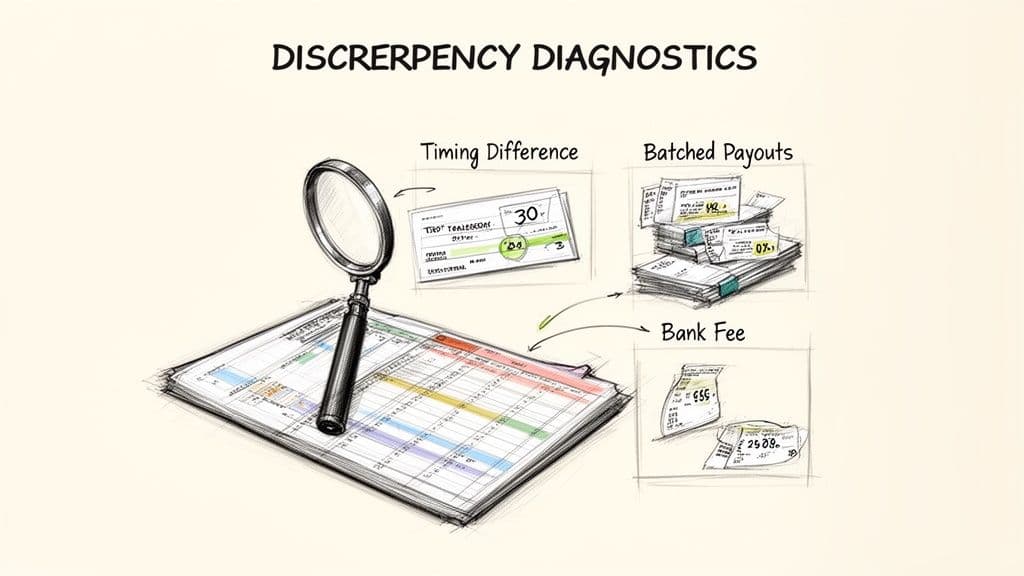

Once you've matched everything you can, you'll be left with the reconciling items. These aren't always "errors"—many are just a matter of timing—but they all must be accounted for.

Here are the usual suspects and how to handle them:

- Outstanding Checks: You mailed a check for $2,500 to a vendor on July 30th and recorded it in your books. They haven't cashed it yet, so it won't be on your July bank statement. This is a classic timing difference. No journal entry is needed; it gets listed as a reconciling item on your report and will clear next month.

- Deposits in Transit: You deposited $5,000 worth of checks on the afternoon of July 31st. It's in your books, but it didn't clear the bank until August 1st. Like an outstanding check, this is a timing difference that will resolve itself in the next period.

- Bank Service Fees: The bank charged you a $50 monthly service fee. This shows up on your bank statement, but it's not in your books yet. You must record this as a bank fee expense.

- Interest Earned: Your business checking account paid you $15 in interest. That's income, and you must record it in your books to match what the bank is showing.

To give you a clearer picture, let's walk through a simple, worked calculation.

Sample Bank Reconciliation Walkthrough

This table shows how you use those reconciling items to make the two balances match perfectly.

| Item | Book Balance (QuickBooks/Xero) | Bank Balance (Bank Statement) |

|---|---|---|

| Starting Balance | $10,250 | $12,735 |

| Add: Interest Earned | +$15 | |

| Less: Bank Service Fees | -$50 | |

| Adjusted Book Balance | $10,215 | |

| Add: Deposits in Transit | +$5,000 | |

| Less: Outstanding Checks | -$7,520 | |

| Adjusted Bank Balance | $10,215 |

Once you’ve identified, categorized, and recorded all the adjusting entries for these discrepancies, your adjusted book balance will match your adjusted bank balance. When those two numbers are identical, the reconciliation is complete. You've confirmed your cash position is accurate, setting a rock-solid foundation for your entire monthly close process.

Decoding and Fixing Common Reconciliation Discrepancies

A perfect reconciliation where every single line item matches instantly is a rare luxury. For fast-growing companies, the real skill isn't just finding discrepancies—it's decoding what they mean and fixing them with surgical precision.

Ignoring these small mismatches is a classic mistake. An unexplained $150 difference might seem trivial, but it could be the tip of an iceberg. It signals a systemic issue like an unrecorded cash disbursement, a misconfigured payment processor, or even fraud.

“A discrepancy isn't an inconvenience; it's a question your financials are asking you. Answering it builds a stronger, more reliable business. Ignoring it is how small cracks in your foundation become catastrophic failures.” – Alexander Hewson, Fractional CFO

Timing Differences: The Usual Suspects

More often than not, the reason for a mismatch isn't an error at all—it’s just timing. Your business moves in real-time, but bank processing follows its own, slightly slower schedule.

These are temporary differences that resolve themselves in the next accounting period, but you still have to identify and track them correctly.

-

Outstanding Checks: You mailed a check for $4,200 to a vendor on May 30th. You recorded it correctly in your books, but the vendor didn't deposit it until June 3rd. Your May reconciliation will show a $4,200 difference because the cash is still in your account. This is a classic outstanding check. Note it on the reconciliation report; no further action is needed until it clears in the following month.

-

Deposits in Transit: Your team deposited $8,500 in client checks at the bank late on the last day of the month. It’s logged in your books, but it won't appear on the bank statement until the first business day of the next month. This is a deposit in transit, another normal reconciling item that doesn't require a journal entry.

The key is to document these items and confirm they clear in the next month's reconciliation. If an outstanding check is still hanging around a few months later, it’s time to investigate.

Payment Processor Payouts: A Common Misconception

Here is a frequent objection: "Our payment processor automatically deposits our money, so we don't need to reconcile it." This is a dangerous misconception. Platforms like Stripe, Shopify, or PayPal batch transactions, lumping multiple customer payments, refunds, and their own processing fees into a single deposit.

Let's walk through a common Stripe payout scenario.

The Problem: Your Stripe report shows $15,000 in gross sales, but the deposit that actually hits your bank account is only $14,485. Where did the other $515 go?

The Fix: You cannot just record $14,485 as revenue, because your actual revenue was $15,000. You must break that batched transaction down. The $515 difference is Stripe's processing fee.

Your journal entry must reflect that reality:

| Account | Debit | Credit |

|---|---|---|

| Cash | $14,485 | |

| Stripe Processing Fees | $515 | |

| Sales Revenue | $15,000 | |

| To record gross sales and associated fees from Stripe payout |

This entry correctly recognizes the full revenue you earned while properly categorizing the transaction fee as a business expense. Failing to do this understates your revenue and overstates your gross margins.

Unrecorded Transactions and Simple Errors

Beyond timing and processor fees, you will find items on the bank statement that never made it into your books. These require immediate adjusting entries to get your records back in alignment.

Common examples include:

- Bank Service Fees: The bank charged you a $35 monthly account fee.

- Interest Income: You earned $22 in interest on your checking account balance.

- NSF Checks: A client's $2,000 check bounced due to non-sufficient funds (NSF).

Let's create the journal entry for that bounced check. The original deposit must be reversed, and you need to re-establish the accounts receivable from that client so you can pursue the payment.

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable (Client ABC) | $2,000 | |

| Cash | $2,000 | |

| To reverse deposit for NSF check from Client ABC |

After you record this entry, your next step is to get on the phone with the client to arrange a new payment. By methodically identifying each discrepancy, diagnosing its root cause, and recording the precise correcting entry, you ensure your books aren't just balanced—they're an accurate reflection of your business's financial reality.

Red Flags That Your Reconciliation Process Is Broken

Bank reconciliation is a diagnostic tool for your company’s financial health. When it's broken, it doesn't just create messy books—it actively hides risks and prevents you from making agile, informed decisions.

If any of these warning signs feel familiar, your process needs an immediate overhaul.

Your Month-End Close Takes Weeks, Not Days

For a business in the $500K to $20M revenue range, closing the books must be a swift, predictable process. If you consistently take more than five to seven business days to finalize your monthly financials, your reconciliation is the bottleneck.

According to the 2024 SaaS Benchmarks from OpenView, top-quartile companies get their close done in under five days. A delayed close means you're operating on stale data. You're making strategic decisions about hiring and ad spend based on a financial picture that's weeks out of date.

"A slow close is a symptom of a larger problem. It almost always points to foundational issues in transaction recording and reconciliation. You can't steer a ship if you're looking at a map from last month." – David Worrell, President of Fuse Financial Partners

A Growing 'Unreconciled Differences' Balance

In your accounting software, there’s an account likely called "reconciliation discrepancies" or "unreconciled differences." This is the financial junk drawer where your software dumps unexplained variances to force a balance.

If this account has any balance at all, your books are not truly reconciled. Period.

If you see this balance growing month after month, it's a huge warning sign. It means your team is giving up on finding the real discrepancies and is just plugging the numbers to get the close done. Each dollar in that account represents an unknown error—a missed expense, unrecorded revenue, or worse—that is actively distorting your financial statements.

Frequent Cash Flow Surprises

Are you regularly blindsided by a low cash balance when it’s time to run payroll or pay a major vendor? This is the most painful symptom of a broken reconciliation process. Properly reconciled books give you a clear and accurate view of your real-time cash position.

If you cannot confidently produce a reliable cash flow forecast for the next 30, 60, or 90 days, it’s because you don't trust the foundational data. Frequent cash crunches are a clear signal that your book balance and your bank balance are telling two different stories, and nobody is investigating why.

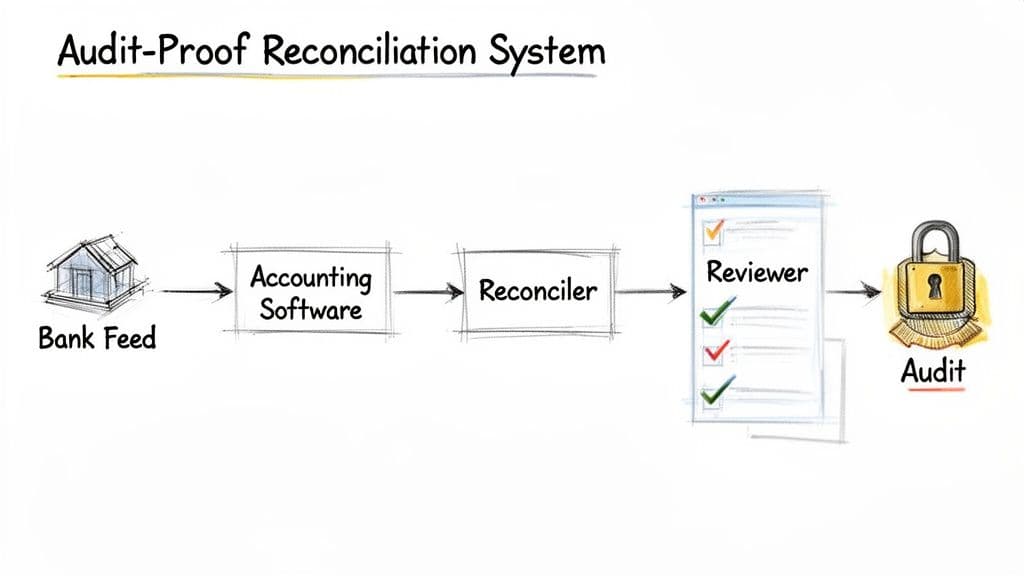

Building an Audit-Proof Reconciliation System

Simply “doing” a reconciliation isn’t the endgame. To scale your business, fundraise, or face an audit, you need a system. A repeatable, secure, and documented process is a strategic asset. It is your proof to investors and auditors that you have strong internal controls, building trust that makes due diligence smoother and helps get deals done.

Embrace Automation with Bank Feeds

First, stop manual data entry. The foundation of a scalable system is automation. Direct bank feeds in software like QuickBooks or Xero are non-negotiable.

When you connect your bank, credit card, and payment processor accounts directly to your accounting software, you create a real-time flow of transaction data. This simple step automates the most tedious part of reconciliation, saving your team dozens of hours a month and slashing the risk of human error. The software’s matching rules handle routine transactions, freeing up your team to focus only on the exceptions.

This isn't just about convenience; it’s about keeping up. Regulatory pressures are changing how businesses handle reconciliations. As part of a larger trend detailed in reports on the future of fintech and payment dominance, solid reconciliation is becoming even more critical for compliance.

Segregate Duties to Enhance Security

Even in a lean company, you cannot have the same person recording transactions, performing the reconciliation, and approving the final report. This is a bedrock principle of internal control called segregation of duties.

Skipping this creates a massive blind spot for fraud or major errors. A single person could, intentionally or not, hide a problematic transaction or make a critical mistake that goes unnoticed for months.

Your audit-proof workflow must look like this:

| Role | Responsibility |

|---|---|

| Transaction Recorder | A bookkeeper or staff accountant responsible for the day-to-day recording of invoices, bills, and payments. |

| Reconciler | A different person, like a senior accountant or controller, who performs the monthly reconciliation. |

| Reviewer/Approver | A third person—the founder, CEO, or CFO—who gives the completed reconciliation report a final review and sign-off. |

This three-step verification ensures at least two sets of eyes are on your cash movements, drastically cutting down your risk and giving you a clean audit trail.

Make Reconciliation a Non-Negotiable Closing Step

Finally, bank reconciliation must be formally baked into your monthly close checklist. This document is the official playbook for your finance team. It outlines every single task required to close the books each month, who is responsible, and the deadline for each step.

Putting reconciliation on this checklist elevates it from a "we'll get to it when we can" task to a mandatory part of your operations. It creates accountability and guarantees the process is completed consistently, every single month. For auditors, this checklist is concrete proof that you have a standardized, reliable financial process.

If you want to know more about what auditors really care about, check out our comprehensive checklist for auditors.

Actionable Next Steps: Turning Reconciled Books Into Strategic Growth

So, you’ve wrestled with bank statements and made everything match. What now? The real win isn’t just getting the numbers to balance. It’s what those clean, reconciled numbers empower you to do next. Reconciliation transforms your financials from a rearview mirror into a GPS for the future.

With truly reconciled books, you gain the financial clarity to make aggressive, confident moves. You can accurately forecast cash flow to decide when to pull the trigger on a key hire. You can spot potential fraud before it spirals. And you can hand over financials that give investors immediate confidence. It’s the absolute bedrock of a well-run finance function.

Your Next Steps

- Mandate a Monthly Close: If you don't have one, create a formal month-end close process immediately. Set a hard deadline of the 5th business day of the following month.

- Implement Segregation of Duties: Review who handles cash and accounting. Assign the roles of Recorder, Reconciler, and Reviewer to three separate people, even if the "Reviewer" is you.

- Audit Your "Reconciliation Discrepancies" Account: Go into your accounting software right now and look at this account. If the balance is anything other than zero, assign someone to investigate and clear every single transaction until it is empty.

"For founders, the goal isn't to become an expert bookkeeper. The goal is to build a company with financials so clean and reliable that you can make critical decisions instantly and with total confidence." – Jumpstart Partners

At Jumpstart, we take this entire process off your plate. We implement these best practices to deliver a guaranteed 5-day close with investor-ready financials you can trust. You get to stop chasing down discrepancies and start making strategic growth decisions. You can learn more about how we pull this off through financial reporting automation.

If you’re ready to stop wrestling with your books and start using them to drive growth, schedule a free consultation with us today. Let us show you what it feels like to have perfect financial clarity.

Your Bank Reconciliation Questions, Answered

Even with a rock-solid process in place, founders and finance leaders still run into questions during the month-end close. Here are the straight answers to the most common questions we hear.

How Often Should I Reconcile My Business Bank Accounts?

You must reconcile every single business bank account, credit card, and payment processor account (like Stripe and PayPal) every single month. This is the absolute, non-negotiable minimum for keeping your financials accurate.

For businesses with high transaction volumes—like e-commerce stores or SaaS companies—move to a weekly reconciliation. It gives you a much clearer, near-real-time view of your cash flow and lets you spot and fix problems before they snowball.

What’s the Most Common Reason for a Bank Reconciliation Not Balancing?

Nine times out of ten, it’s timing differences. These are transactions that have happened on your end but haven't hit the bank yet.

The two biggest culprits are:

- Outstanding checks: You’ve mailed a check to a vendor, recorded it in your books, but they haven't cashed it yet.

- Deposits in transit: You’ve deposited a check or received a payment at the end of the month, but it hasn't cleared the bank by the statement cutoff date.

After timing differences, the next most common issue is unrecorded bank transactions, like monthly service fees or interest earned.

My Bookkeeper Says They Reconciled, But the Numbers Still Seem Off. What Should I Do?

This is a massive red flag. Do not take their word for it. Your first step is to ask for the formal bank reconciliation report generated directly from your accounting software (QuickBooks and Xero both produce these).

A real reconciliation report isn't a verbal confirmation. It must show the bank balance, the book balance, a detailed list of every single reconciling item (like outstanding checks), and a final, undeniable difference of zero. If they cannot produce this report, or if there's any amount sitting in a "reconciliation discrepancy" account, the account is not truly reconciled. This situation requires an immediate third-party review to find out what's really going on.

At Jumpstart Partners, we build rigorous, audit-proof reconciliation processes into our guaranteed 5-day month-end close, so you never have to second-guess your numbers. If you're ready for financials you can trust to make critical growth decisions, schedule a free consultation with us today.