Financial Operations

Solving Cash Flow Problems in Your Business: A Founder's Guide

A practical guide to diagnosing and solving cash flow problems in small business. Learn actionable tactics to stabilize your finances and drive growth.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··16 min readEven when you're crushing revenue targets and your Profit and Loss statement looks fantastic, you can still find yourself scrambling to make payroll. It's a common and incredibly dangerous trap for growing businesses.

The hard truth is that revenue is not cash in the bank. Confusing the two is the root cause of nearly every cash flow problem you will face. This guide will give you the tools to diagnose the real issues, forecast with confidence, and build a financially resilient company.

Why Your Profit and Loss Statement Is Misleading You

If you feel a disconnect between the growth on paper and the actual cash you have to run the business, you're not alone. This gap between profitability and liquidity is exactly where successful service firms and SaaS companies get into serious trouble. A healthy P&L easily masks underlying issues that are draining your cash reserves, turning your impressive growth into a liability.

The numbers don't lie: an astonishing 82% of small business failures are a direct result of poor cash flow management. This isn't just an old statistic; it's a persistent threat that sinks otherwise solid companies, far outpacing problems like a lack of market demand.

Profitability vs. Liquidity: The Critical Difference

Understanding this distinction is the first step toward real financial control. Your P&L is a historical record of revenues you've earned and expenses you've incurred over a period. It says absolutely nothing about when cash actually enters or leaves your bank account.

So, what's creating this gap? It comes down to a few common culprits:

- Delayed Client Payments: Your P&L shows revenue the second you issue an invoice. But if your clients pay on Net 30, Net 60, or even later, that "profit" is just an IOU sitting in your accounts receivable.

- Upfront Project Costs: This is a killer for agencies and service firms. You often pay for your team's time and contractor expenses weeks or months before the final payment for a project lands in your account. This creates a cash deficit even on highly profitable jobs.

- Lumpy, Unexpected Expenses: Big bills like annual insurance premiums, quarterly tax payments, or biannual software renewals don't show up on your monthly P&L, but they create huge, sudden demands on your cash.

- Rapid Growth: Ironically, growing too fast is one of the biggest causes of cash strain. You have to invest in hiring, marketing, and new tools before you collect the revenue from that growth, creating a classic working capital squeeze.

Warning Signs: Your Top Cash Flow Red Flags

Use this table to pinpoint the most common sources of cash strain in your business. Be honest with your answers—the first step to fixing the problem is admitting you have one.

| Symptom | Potential Cause | Immediate Action Item |

|---|---|---|

| P&L shows profit, but bank account is low | High Accounts Receivable (A/R) balance | Run an A/R aging report. Call every client over 60 days past due today. |

| Struggle to pay bills right before payroll | Mismatched timing of payables and receivables | Map out your major monthly vendor due dates against your typical client payment dates. |

| Constantly surprised by large, one-off bills | Lack of a forward-looking cash forecast | List all annual/quarterly payments (insurance, taxes, software) and their due dates. |

| Landed a huge new client but now feel broke | High upfront costs to service new business | Review the new client's payment terms. Can you bill for a deposit or milestone payments? |

This diagnostic isn't exhaustive, but it will help you identify the immediate fires you need to put out. Your P&L is a valuable tool, but it’s just one piece of the puzzle. You can learn more in our guide on effective profit and loss management to see how it fits into the bigger picture. For now, let's focus on solving the immediate cash issues that threaten your stability.

Pinpointing the Root Cause of Your Cash Crunch

You're looking at your P&L statement, and it's painting a pretty picture of profitability. But then you glance at your bank balance, and it’s telling a completely different, much scarier story. Sound familiar?

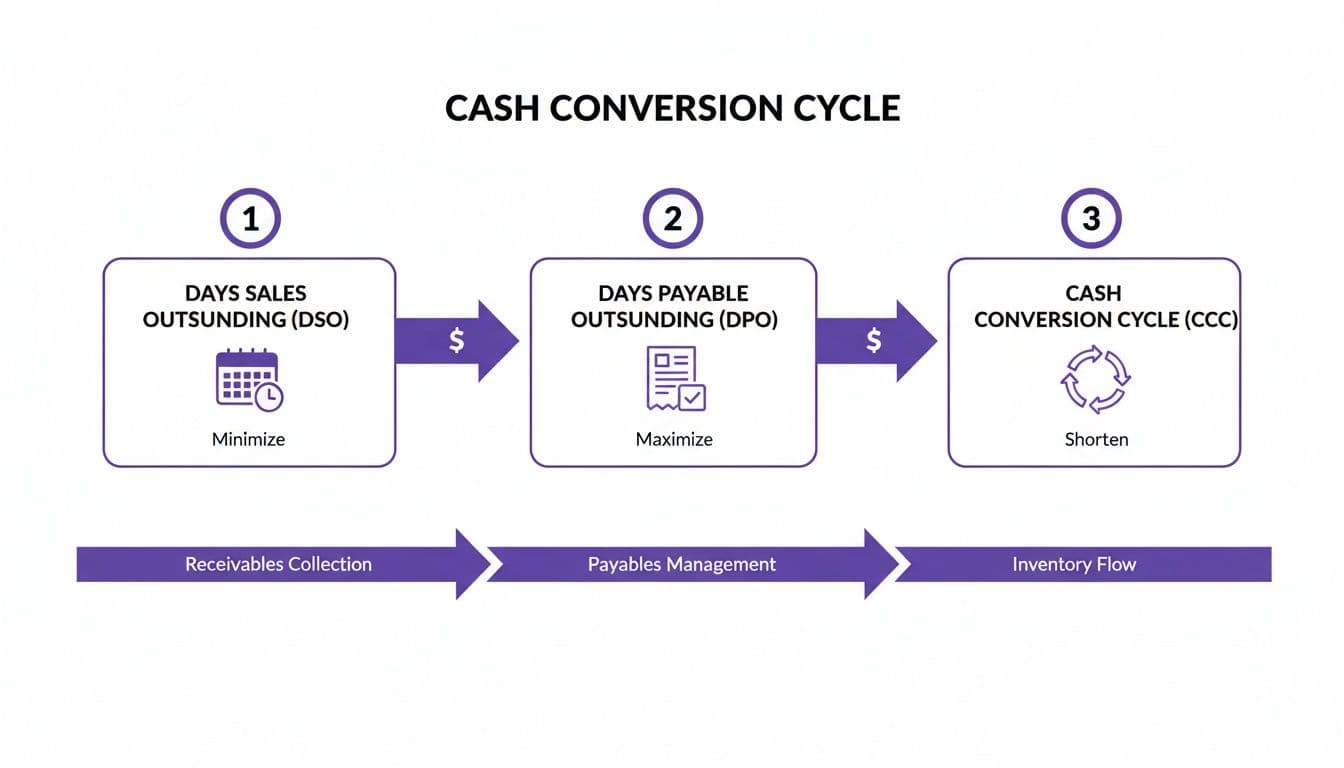

This is a classic sign that you need to stop treating symptoms and perform a real diagnosis. To solve your cash flow problems for good, you must find the true source of the crunch. That means getting under the hood of your financial engine to see exactly how quickly cash moves through your business. Three metrics will give you this visibility: Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), and the Cash Conversion Cycle (CCC). These are the practical tools you need to see exactly where your cash is trapped.

Decoding Your Days Sales Outstanding (DSO)

Your Days Sales Outstanding (DSO) is one of the most critical health metrics for any service or SaaS business. It measures how long it takes you to get paid after you’ve done the work and sent the invoice. A high DSO means your customers are effectively using you as a free bank, and it's strangling your cash flow.

Let's run the numbers for a digital agency with $5M in annual revenue.

- Current Accounts Receivable: $820,000

- Total Sales (for the quarter): $1,250,000

- Number of Days in Quarter: 90

The calculation is straightforward: ($820,000 Accounts Receivable / $1,250,000 Total Credit Sales) x 90 Days = 59 Days

This means it takes nearly two months on average to get paid. A recent analysis on small business cash flow found that delayed customer payments are the single biggest cash flow killer. If your peers are collecting in 45 days, your 59-day DSO puts you at a significant competitive disadvantage.

Analyzing Your Days Payable Outstanding (DPO)

Next is your Days Payable Outstanding (DPO). This metric measures how long it takes you to pay your own bills—your vendors, contractors, and suppliers. While it might seem smart to stretch out your payments as long as possible, an excessively high DPO can damage vendor relationships and tank your reputation. Finding the right balance is key.

Let's look at the same digital agency, which relies on contractors and software subscriptions.

- Ending Accounts Payable: $150,000

- Cost of Goods Sold (for the quarter): $600,000

- Number of Days in Quarter: 90

Here's the math: ($150,000 Accounts Payable / $600,000 COGS) x 90 Days = 22.5 Days

This agency pays its bills in under 23 days. When you compare that to their 59-day DSO, you can immediately see the problem: cash is flying out the door more than a month before it's coming back in.

Putting It All Together: The Cash Conversion Cycle (CCC)

The Cash Conversion Cycle (CCC) brings DSO and DPO together to show you the total time it takes for a dollar you spend on delivering your service to make its way back into your bank account.

The formula is brutally simple: CCC = DSO - DPO

Let's use our digital agency example:

- DSO: 59 Days

- DPO: 22.5 Days

Plugging these into the formula: 59 Days (DSO) - 22.5 Days (DPO) = +36.5 Days

That positive number means there's a 36.5-day gap where the agency has paid its expenses but is still waiting on revenue. This forces the business to fund its own operations for over a month on every single project. As you scale, that gap widens, consuming more and more of your precious working capital.

"Your Cash Conversion Cycle is the ultimate measure of your company's financial efficiency. A negative CCC means your customers are funding your operations. A positive CCC means you are funding your customers' operations—a dangerous position for any growing business." — Tim Berry, Founder of Palo Alto Software

This analysis gives you the diagnosis you need. The root cause of your cash flow problems isn't a lack of profit; it’s an inefficient cash conversion cycle. Now, you can stop worrying about the symptoms and start surgically addressing the underlying issues.

How to Build Your 13-Week Cash Flow Forecast

Your annual budget is the roadmap, but your 13-week cash flow forecast is the turn-by-turn GPS that gets you through the next quarter. It’s the single most important tool for moving from reactive, hair-on-fire crisis management to proactive, confident decision-making.

This isn't an abstract accounting exercise. It's about knowing, with near certainty, when you can afford that next hire, when to greenlight a new marketing campaign, and when you need to pull back on spending. A static P&L or balance sheet simply can't provide this kind of forward-looking clarity.

The Core Components of Your Forecast

Putting together your first forecast is more straightforward than you think. It boils down to tracking three key things on a weekly basis for the next 13 weeks.

- Opening Cash Balance: The total cash you have in all bank accounts at the start of Week 1.

- Cash Inflows: All the cash you realistically expect to collect. Don't just plug in your revenue forecast; base this on when you actually expect checks to clear, using your historical DSO. This includes client payments, loan funds, and any other cash injections.

- Cash Outflows: Every single dollar you know you have to spend. This includes payroll, rent, software subscriptions, and contractor payments. The real discipline here is remembering the lumpy expenses that ambush your cash balance, like quarterly tax payments and annual insurance premiums.

This simple process forces you to see how the timing of your receivables and payables directly impacts your bank account week to week.

A Practical Forecasting Example

Let’s walk through a one-week calculation for a small digital agency.

- Week 1 Opening Cash Balance: $50,000

First, map out the specific client invoices you expect to collect that week.

Cash Inflows (Week 1)

- Client A (Invoice #101): $15,000

- Client B (Invoice #104): $25,000

- Total Weekly Inflows: $40,000

Next, list out all the committed payments for the same period.

Cash Outflows (Week 1)

- Payroll & Taxes: -$22,000

- Contractor Payments: -$10,000

- Software (Adobe, Slack): -$1,500

- Rent & Utilities: -$5,000

- Total Weekly Outflows: -$38,500

Finally, do the simple math to find your ending cash position.

Ending Cash Calculation: $50,000 (Opening) + $40,000 (Inflows) - $38,500 (Outflows) = $51,500

This $51,500 becomes the opening balance for Week 2, and you repeat the process. By Week 4 or 5, you'll spot future cash crunches long before they happen, giving you precious time to act.

Common Misconception: "I have a budget, so I'm covered."

A budget is not a cash flow forecast. A budget is a plan for profitability, often set annually. A cash flow forecast is a plan for liquidity, managed weekly. Your budget might show a $50,000 profit for the quarter, but your forecast will show you that your bank account will dip into the red in week seven because of a large, one-time tax payment. You need both tools to run your business effectively.

Actionable Tactics to Improve Your Cash Position Now

A forecast gives you a map, but it doesn't put gas in the tank. When you're staring down a cash crunch, you need to pull some levers—right now. This is your tactical playbook for generating and preserving cash this week, focused on the two areas you can influence immediately: how quickly you get paid and how you manage paying your own bills.

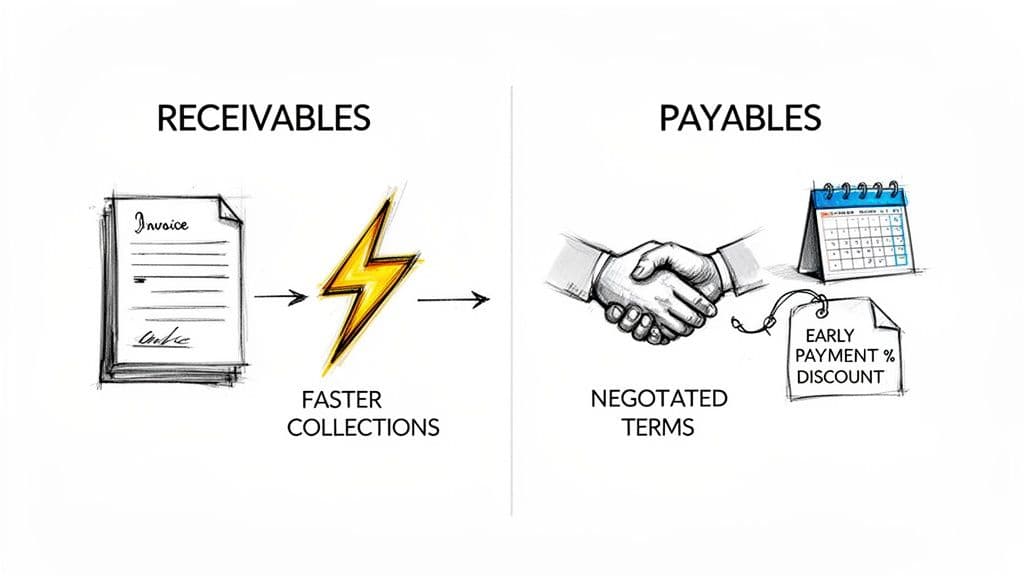

1. Accelerate Your Accounts Receivable

Every day you shave off your collection time is a direct cash injection into your business. The goal is to make it easy for clients to pay you on time and systematically harder for them to pay you late.

- Offer Early Payment Discounts—But Do the Math. The classic "2/10, net 30" offer (a 2% discount if paid in 10 days) is a powerful way to speed up payments. But is it profitable for you? Let's say you have a $20,000 invoice with a 20% net margin ($4,000). A 2% discount costs you $400, eating 10% of your profit. You must decide if getting $19,600 twenty days sooner is worth that $400 hit.

- Automate Your Invoicing and Reminders. If you're sending invoices manually, you're losing money. Use your accounting software to automate invoicing and send polite-but-firm payment reminders at 7, 15, and 30 days past due. This system removes emotion and ensures no invoice slips through the cracks.

- Get Serious About Your Collections Process. Don't be passive. At 45 days past due, make a direct phone call. By 60 days, a senior leader should be making the call. This escalation shows you're serious and that this isn't a debt you're willing to forget.

2. Strategically Manage Your Payables

Getting paid faster is only half the battle; you also have to manage the cash going out. The goal isn't to dodge your bills. It's to optimize the timing without burning bridges with critical vendors. Start by asking for better terms. If a key software vendor puts you on Net 15, ask for Net 30. Good vendors want to keep good partners and are often more flexible than you think. Next, get disciplined with a payment schedule. Instead of paying bills as they land in your inbox, batch them. Schedule all payments to go out on one specific day each week. This creates predictability and lets you hold onto your cash for a few extra, crucial days. For a deeper dive, check out our post on holistic cash flow management for small business.

3. The Most Powerful Lever: Pricing Strategy

Finally, let's talk about the most potent tactic of all: your pricing. Many founders are terrified to raise prices, but a small, strategic price increase is often the single fastest way to fix a cash flow problem. A digital agency with $1M in revenue and a 15% net margin has $150,000 in profit. A modest 5% price increase adds $50,000 straight to the bottom line—a 33% jump in available cash from one decision.

The key is communication. Don't apologize. Frame the change around the increasing value you deliver.

Evaluating Your Financing and Outsourcing Options

Sometimes, even your best internal efforts aren't enough to bridge a critical cash gap. This is where strategic financing and expert support become critical tools for smart leadership, not signs of failure.

Choosing the Right Financing Lifeline

Not all funding is created equal. The wrong choice can saddle you with terrible terms that create a whole new set of cash flow problems. Here’s a clear-headed look at the most common options for your business.

| Financing Option | Best For | Pros | Cons |

|---|---|---|---|

| Business Line of Credit | Managing day-to-day working capital fluctuations. | Flexibility: Draw funds as needed, repay, and draw again. You only pay interest on what you use. | Hard to Get: Requires a strong credit history and often a personal guarantee. |

| Invoice Factoring | Businesses with high-value invoices and slow-paying clients. | Fast Cash: Get an advance of 80-90% of your invoice value within days. | High Cost: Fees can be significant, eating into your profit margins on each job. |

| Revenue-Based Financing | Predictable recurring revenue models (like SaaS companies). | Founder-Friendly: No dilution of equity. Repayments are a percentage of monthly revenue. | Scales with You: As your revenue grows, so do your payments, which can get costly in high-growth periods. |

A SaaS company with strong MRR is a perfect match for revenue-based financing. A digital agency waiting on a massive project payment is a textbook candidate for invoice factoring. Your business model dictates the right choice.

When to Stop DIY-ing Your Finances

The jump from a basic bookkeeper to a professional financial partner is a major turning point. Ignoring this transition leads directly to cash flow fires. You simply can't make forward-looking decisions with backward-looking data.

"A bookkeeper tells you what happened last month. A controller tells you what’s likely to happen next month. A CFO tells you what should happen in the next three years. Founders need to know which answer they’re paying for." — Jonathan Gass, Founder & CEO of Nomad Financial

It's time to bring in professional support when:

- You're Spending More Than 5 Hours a Week on Books: Your time is the most valuable asset in the company. It should be spent driving growth.

- Your Month-End Close Takes More Than 10 Days: A slow close means your data is stale. According to OpenView's 2024 SaaS Benchmarks, top-performing finance teams close their books in under five days.

- You Need a 13-Week Cash Flow Forecast—Yesterday: If you're constantly blindsided by cash shortages, it's a blaring signal you lack the forward visibility that a fractional controller provides.

- You're Preparing for a Fundraise or Audit: Investors demand clean, defensible financials. Trying to clean up messy books during due diligence is a nightmare that can kill a deal.

An outsourced controller does more than keep the numbers straight; they build the financial infrastructure that stops cash flow emergencies before they start. For a deeper dive, learn more in our in-house vs. outsourced controller decision guide.

Next Steps: Build Your Financial Cadence

Fixing today's cash fire is one thing. Building a company that never catches fire again is the real win. The goal is to move past the frantic, reactive scramble for cash and embed financial discipline right into your company’s DNA.

Sustainable cash health doesn't come from a one-time heroic effort. It comes from a consistent, repeatable process.

| Cadence | Action | Purpose |

|---|---|---|

| Weekly | Cash Flow Review (30 min): Update and review your 13-week forecast. | Stay ahead of short-term surprises and maintain immediate liquidity. |

| Monthly | Budget vs. Actual Analysis: Compare your P&L to your budget. | Identify spending trends, diagnose performance issues, and refine future forecasts. |

| Quarterly | Strategic KPI Review: Analyze your DSO, DPO, and Cash Conversion Cycle trends. | Make big-picture decisions on pricing, contracts, and long-term financial strategy. |

This financial cadence turns your financial data from a rearview mirror into a set of headlights, letting you make decisions proactively. It’s the system that allows you to stop managing financial crises and start building a resilient, scalable business.

At Jumpstart Partners, we build and manage these exact systems for high-growth companies. We deliver the investor-ready financials and forward-looking cash forecasts you need to scale with confidence.

If you’re ready to move from reacting to financial fires to proactively building a more resilient business, book a free consultation today. https://jumpstartpartners.finance