Financial Operations

A Guide to Cash Flow Management for Small Business

Master cash flow management for small business with this practical guide. Learn forecasting, working capital optimization, and strategies for profit clarity.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··23 min readEffective cash flow management for a small business isn’t just about bookkeeping; it’s the active, ongoing discipline of tracking, analyzing, and optimizing the flow of money in and out of your company. It's what ensures you have enough actual cash to make payroll and pay vendors, preventing that all-too-common scenario where a profitable business collapses simply because it ran out of liquid funds.

Why Your Profitable Business Still Feels Cash-Poor

It’s one of the most maddening paradoxes a founder can face. Your Profit & Loss (P&L) statement is glowing, showing healthy margins and solid growth. Yet you’re nervously refreshing the bank balance, wondering if you’ll have enough to cover payroll next Friday.

This disconnect isn't just a feeling; it's a critical vulnerability that catches too many leaders of growing companies by surprise.

This nightmare scenario is dangerously common. Picture your SaaS company, doing $5M in annual recurring revenue. Things look great on your P&L until a major enterprise client pays their $250,000 annual invoice 60 days late. Suddenly, your cash runway shrinks dramatically, and you’re in a tight spot. This isn't a rare occurrence—it's a leading cause of failure.

In fact, a staggering 82% of small businesses fail because of poor cash flow management. For growing companies in the $500K to $20M revenue range—like SaaS firms, digital agencies, and professional services firms—that statistic is a stark reminder that managing cash is not optional. You can read more about the trends impacting small business cash flow to see just how prevalent this issue is.

The Perils of Mismatched Timelines

The root of this problem is all about timing. Your P&L records revenue when you earn it (revenue recognition), not when the cash actually lands in your bank account. This creates a dangerous gap between perceived success and the cash you have to operate the business.

This timing mismatch is especially brutal for certain business models:

- SaaS Companies: You recognize revenue monthly according to accounting standards (like ASC 606), but you collect payment on an annual contract upfront. That big lump sum of cash feels great, but it can easily mask a high burn rate until you’re suddenly staring at a much shorter runway than you thought.

- Digital Agencies: You finish a huge project, send the invoice, and book the revenue. But the client's Net 60 payment terms mean you've already paid your team, freelancers, and software bills long before their payment arrives. You're essentially acting as the bank for your clients.

- Professional Services Firms: A signed contract is a great win, but if it's based on milestone payments, you are funding months of work—covering salaries and overhead—before you see a single dollar.

This lack of real-time cash visibility directly suffocates your ability to make confident, strategic decisions. You hold off on hiring that crucial engineer. You delay a marketing campaign you know will drive growth. You pass on a game-changing opportunity.

Why? Because you can't be sure the cash will be there when you need it. Strategic leadership devolves into a constant, stressful exercise in reactive crisis management.

How to Build a 13-Week Cash Flow Forecast

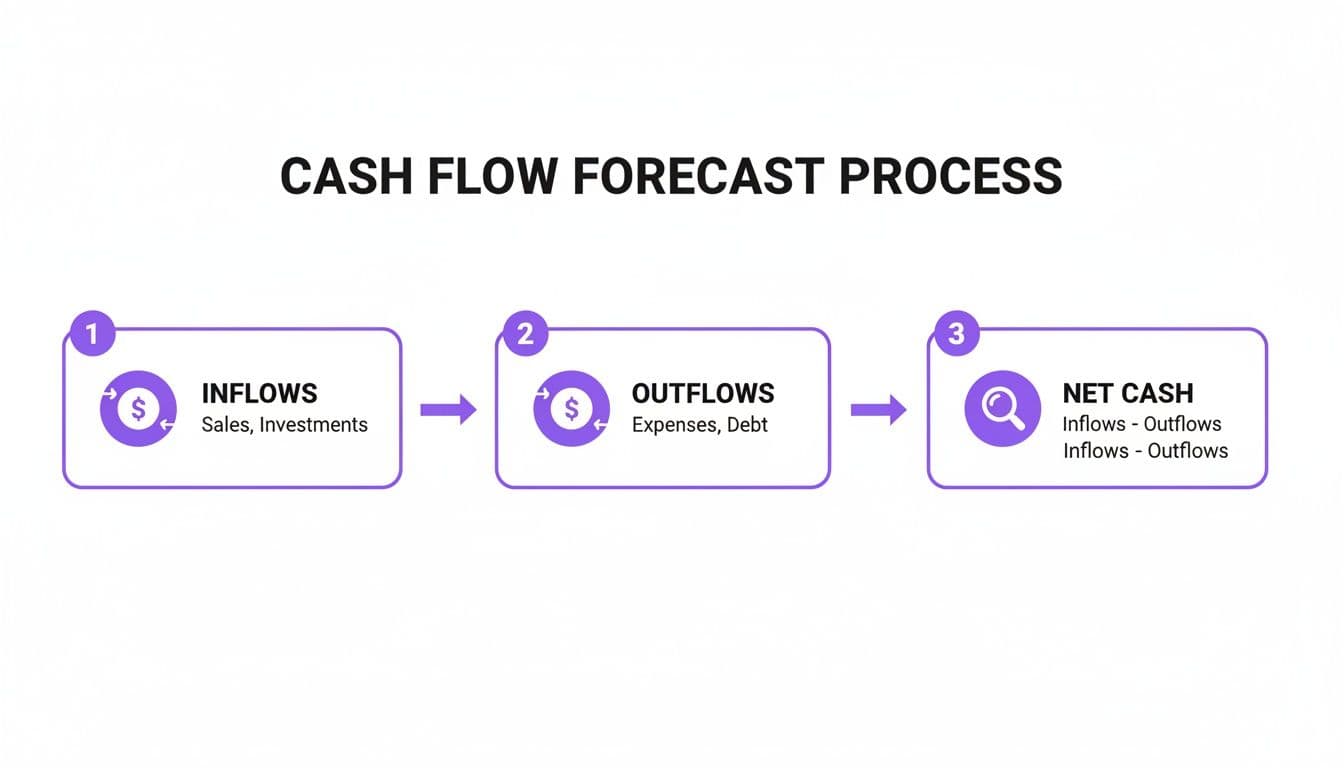

Forget your annual budget for a second. It’s great for high-level planning, but it won't help you navigate the tactical, week-to-week reality of running your business for the next three months. For that, you need a 13-week cash flow forecast. This is the single most powerful tool you have for short-term financial visibility.

This forecast isn’t a stuffy accounting report; it’s your operational roadmap. It forces you to map out every single dollar you expect to come in and every dollar you expect to go out, on a weekly basis. This simple act transforms financial management from a reactive scramble into a proactive strategy. You will see a cash crunch weeks before it hits.

For any business with even mild seasonal swings, this weekly detail is non-negotiable. It’s no surprise that 82% of business failures are tied to poor cash management. Smart leaders don't guess—they use tools like this to manage their cash with precision. You can see more data on the state of small business cash flow and understand just how high the stakes are.

Mapping Your Cash Inflows

First, map out all the cash you actually expect to hit your bank account. This means stepping away from your P&L and thinking purely in terms of cash received.

Your list of inflows needs to be grounded in reality, not hope. Pull the data directly from your CRM, your billing software, and your payment processors.

- Customer Payments: Open up your accounts receivable aging report. Which invoices are due in Week 1? Week 2? Be honest here—if a specific client always pays 15 days late, build that delay into your forecast. Do not model perfection.

- New Sales: Look at your sales pipeline. What deals do you realistically expect to close and collect payment on within the next 13 weeks? Apply a confidence weighting to these projections. A deal at 90% likely to close is different from one at 50%. For example, a $50,000 deal at 80% confidence should be forecasted as $40,000 in cash inflow.

- Subscription Renewals (SaaS): Map out every single monthly and annual renewal coming up. A critical detail here is payout timing. If you use Stripe, for example, remember there's a 2-7 day lag between the charge and when the cash actually lands in your account.

- Other Income: Do not forget anything else. This could be loan proceeds, cash from an asset sale, or an anticipated tax refund.

Projecting Your Cash Outflows

Next is mapping every single expense. This is where most forecasts fall apart because of overlooked costs. You have to be brutally thorough and hunt down every recurring bill and one-off payment.

“Forecasting isn’t about predicting the future with perfect accuracy. It’s about understanding the key drivers of your cash position so you can make smarter, faster decisions under pressure.” — Brooke S., Fractional CFO at Paro

The best way to tackle this is to break your outflows into logical categories. It helps you see exactly where the money is going.

Common categories include:

- Payroll & Benefits: This is usually your biggest and most predictable cash hit. Make sure you include gross wages, employer taxes, and any benefits contributions.

- Operating Expenses: List out all your recurring software subscriptions (your SaaS tools), rent, utilities, and marketing spend like Google Ads campaigns or contractor payments.

- Variable Costs: For an agency, this would be payments to freelancers tied to specific projects. For a SaaS company, it might be server costs that scale directly with customer usage.

- "Lumpy" Expenses: These are the forecast killers. Do not forget quarterly tax payments, annual insurance premiums, loan repayments, and credit card bills that come due.

Putting It All Together: A Worked Example

Let’s walk through a model for a $3M ARR SaaS company. We'll assume they start with a cash balance of $250,000. The forecast simply shows how that balance changes week over week based on the inflows and outflows we just discussed.

Here’s a simplified snapshot of what the first four weeks look like.

Sample 13-Week Cash Flow Forecast Snippet

This table shows a simplified view of the first four weeks. The goal is to track cash on a rolling weekly basis to anticipate shortfalls and opportunities.

| Category | Week 1 | Week 2 | Week 3 | Week 4 |

|---|---|---|---|---|

| Beginning Cash Balance | $250,000 | $237,500 | $255,000 | $237,500 |

| Cash Inflows | ||||

| Stripe Payouts (MRR) | $15,000 | $15,000 | $15,000 | $15,000 |

| Annual Renewal Payment | $0 | $30,000 | $0 | $0 |

| Total Inflows | $15,000 | $45,000 | $15,000 | $15,000 |

| Cash Outflows | ||||

| Payroll & Taxes (Bi-weekly) | ($25,000) | $0 | ($25,000) | $0 |

| Rent & Utilities (1st of month) | ($2,500) | $0 | $0 | $0 |

| Software Subscriptions | ($5,000) | ($2,500) | ($2,500) | ($2,500) |

| Marketing Spend | ($5,000) | ($5,000) | ($5,000) | ($5,000) |

| Total Outflows | ($27,500) | ($7,500) | ($32,500) | ($7,500) |

| Net Cash Flow | ($12,500) | $37,500 | ($17,500) | $7,500 |

| Ending Cash Balance | $237,500 | $275,000 | $257,500 | $245,000 |

This simple model immediately highlights that payroll weeks cause a significant cash dip, but a large annual renewal in Week 2 provides a crucial buffer. By extending this out for the full 13 weeks, you gain the foresight needed to plan ahead—maybe by pulling another renewal forward or delaying a non-critical expense.

For a much deeper dive, check out our complete guide on building a 13-week cash flow forecast model, which includes downloadable templates to get you started.

Get Your Working Capital Cycle Dialed In for Better Cash Flow

Think of your working capital cycle as the time it takes to turn your team’s work or your products into actual cash in the bank. A long cycle means your money is constantly tied up—in unpaid invoices or sitting on a shelf as inventory—unavailable for payroll, marketing, or unexpected repairs.

Shortening this cycle is one of the fastest ways to improve your cash flow, and it’s not an abstract accounting exercise. It's about taking direct control over how and when money moves.

We’re going to get into the specific, calculated tactics for getting paid faster and managing your own payments more strategically. At its core, it’s a simple balancing act.

The goal is to speed up what’s coming in (inflows) while strategically pacing what’s going out (outflows).

Speed Up Your Accounts Receivable

The single biggest lever you can pull for an immediate cash flow boost is shrinking your Days Sales Outstanding (DSO). That’s the average number of days it takes you to collect payment after you’ve sent an invoice. Every single day you can shave off your DSO is cash you can use today instead of waiting for it.

"A common misconception is that profit is the most important metric. In reality, cash is king. You can be profitable on paper but out of business if you don't collect your receivables in a timely manner." — David F, Founder of a B2B SaaS Company

One of the most effective tactics is offering an early payment discount. The classic “2/10, net 30” term offers a 2% discount if the invoice is paid within 10 days instead of the usual 30.

At first glance, a 2% discount seems like you're just giving away money. But when you do the math, it's an incredible deal for you. Paying a 2% fee to get your cash 20 days sooner is equivalent to an annualized interest rate of 36.5%. You would never get a loan that cheap.

Here’s how it plays out:

- You send an invoice for $25,000.

- Your customer pays on day 10 to get the $500 discount.

- You receive $24,500 a full twenty days sooner than you otherwise would have.

For just $500, you unlocked almost $25,000 of working capital you can use for payroll or a new marketing campaign—all without touching a line of credit.

How Do You Stack Up?

You can't fix what you don't measure. Comparing your key working capital metrics against industry benchmarks tells you exactly where you stand and what your biggest opportunities are.

Working Capital Benchmarks By Industry

If your numbers are significantly higher than the benchmarks in this table, it's a clear signal that it's time to take action.

| Metric | SaaS (Source: OpenView) | Digital Agency (Source: Deltek) | Professional Services (Source: Deltek) |

|---|---|---|---|

| Days Sales Outstanding (DSO) | 45-60 days | 60-75 days | 60-75 days |

| Days Payables Outstanding (DPO) | 30-45 days | 30-45 days | 30-45 days |

| Cash Conversion Cycle (CCC) | 15-30 days | 30-45 days | 30-45 days |

For SaaS and agency founders, a high DSO is a major red flag. According to OpenView's 2024 SaaS Benchmarks, a best-in-class DSO is under 45 days. If you are sitting at 75 days, you have a critical problem to solve.

Strategically Manage Your Accounts Payable

While getting paid is all about speed, paying your own bills is about pacing. The goal is to extend your Days Payables Outstanding (DPO)—the average time you take to pay your suppliers—without hurting those critical vendor relationships.

This isn’t about paying late; it's about smart negotiation from day one. When you bring on a new vendor, make Net 45 or Net 60 your standard starting point. For your current partners, just have a candid conversation. Explain that you’re a growing business focused on cash flow and ask if they can support you with extended terms. Many will. To get a better handle on your outflows, our guide on what is a cash disbursement breaks down the mechanics.

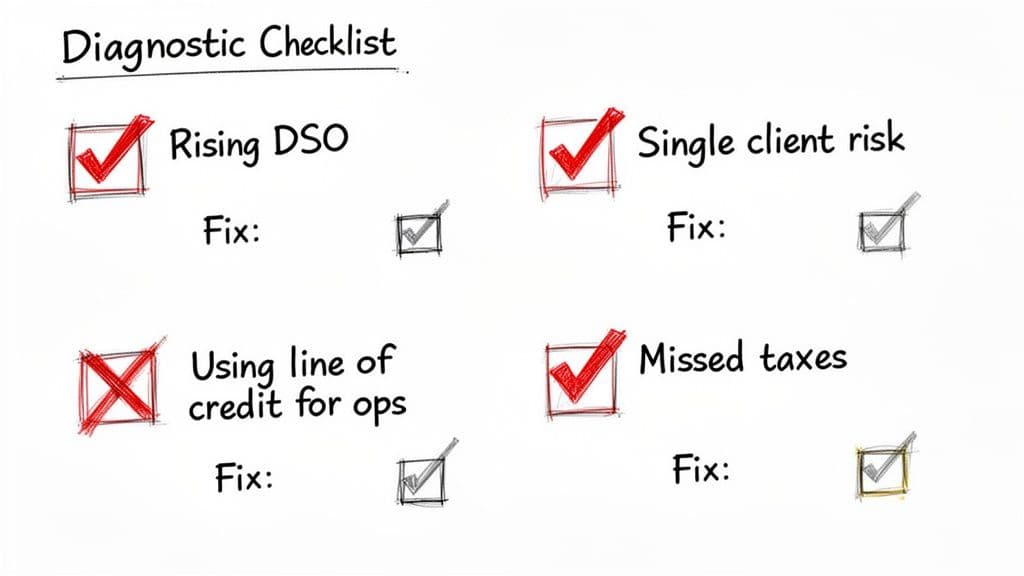

Red Flags: Common Cash Flow Mistakes to Avoid

Ignoring the warning signs of poor cash flow is a fast track to failure. Profitable, growing businesses collapse under the weight of simple, avoidable financial mistakes. Think of this section as your diagnostic toolkit—these are the critical red flags that demand your immediate attention.

For each mistake, I'll give you a clear, actionable solution to get you back on track.

Mistake 1: Confusing Profit with Cash (The #1 Misconception)

This is the most fundamental and dangerous error in cash flow management for a small business. Your P&L statement shows you’re profitable, yet you’re constantly stressed about making payroll.

The Objection: "But my accountant says we're profitable! Why are we always short on cash?"

The Reality: Profit is an accounting concept; cash is the oxygen your business needs to survive. A signed $100,000 contract with Net 60 terms adds to your recognized revenue, but it does absolutely nothing to help you pay your team this Friday. You cannot spend profit.

Actionable Next Step: Stop making decisions based on your P&L alone. Your 13-week cash flow forecast is your true source of operational truth. It tracks actual cash movements, not just accounting entries, giving you a real-world view of your liquidity.

Mistake 2: Using Your Bank Balance as a Forecast

Glancing at your bank account and seeing a healthy balance provides a dangerous, false sense of security. That number is just a snapshot of a single moment in time, completely ignorant of all your future obligations.

That $300,000 in the bank looks great today. But it doesn’t account for the $120,000 payroll run next week, the $45,000 quarterly tax payment due in three weeks, or the $20,000 annual insurance premium after that. Your actual available cash is far less than what that balance suggests.

Running a business this way is like driving a car by only looking in the rearview mirror. You have zero visibility into the road ahead.

Mistake 3: Letting Your DSO Creep Up

Your Days Sales Outstanding (DSO)—the average number of days it takes to collect payment after you’ve sent an invoice—is a direct measure of your collection efficiency. Letting it slowly increase is a silent killer of cash flow.

For a SaaS company, a DSO should typically be in the 45-60 day range, according to benchmarks from OpenView. If yours has crept from 55 days to 75 days over the last six months, you have a serious problem.

Let’s run the numbers for a digital agency with $5 million in annual revenue.

- A 55-day DSO means $753,425 of your cash is tied up in receivables.

- A 75-day DSO means $1,027,397 is tied up.

That 20-day increase has locked up over $273,000 in cash—money you could be using to hire, invest, or build a buffer.

Actionable Next Step:

- Calculate Your DSO Monthly: Track it like a hawk. If it rises for two consecutive months, investigate immediately.

- Automate Your Collections: Implement automated reminders for upcoming and overdue invoices. Do not rely on manual follow-up.

- Mandate ACH or Credit Card Payments: Make it standard practice in your contracts to eliminate "the check is in the mail" excuses and processing lags.

Mistake 4: Relying on a Line of Credit for Operations

Using your line of credit to cover routine operational expenses like payroll or rent is a major red flag. A credit line is a tool for strategic opportunities or true emergencies, not a crutch to prop up a flawed cash cycle.

Constantly drawing on debt to meet predictable expenses signals a fundamental issue with your business model or working capital management. You're just paying interest to keep the lights on, which erodes your margins and masks deeper problems that need to be addressed.

Actionable Next Step: Dig into why you have a shortfall. Is your pricing too low? Are your collection processes too slow? Is your client concentration too high? Fix the root cause instead of just patching the symptom with expensive debt.

Leveraging Technology for Financial Clarity

You cannot manage what you do not measure. For a growing business, that old cliché is painfully true. Trying to run your finances on a patchwork of disconnected spreadsheets and manual data entry isn’t just slow—it’s a recipe for disaster. The only real solution is to build a modern tech stack that gives you a single, real-time source of truth for your finances.

Solid cash flow management lives and dies by this kind of visibility. It all starts by getting your core financial systems to talk to each other. When your accounting software (like QuickBooks or Xero), payment processor (Stripe), and payroll system (Gusto) are all integrated, the guesswork vanishes. You eliminate the manual errors that cloud your true cash position.

This integration turns static, historical data into a dynamic, forward-looking view of your company's health, letting you make smarter decisions much, much faster.

Creating Your Single Source of Truth

The whole point of a tech stack is to automate the flow of information. You want to track every dollar from the moment a customer pays you to the second it leaves your bank account. A well-integrated system gives you instant answers to the questions that keep you up at night.

For instance, simply connecting Stripe to QuickBooks means every single customer payment, processing fee, and bank payout gets reconciled automatically. That one connection kills the soul-crushing task of manually matching bank deposits to invoices, giving you a constantly updated picture of your accounts receivable.

A modern, effective financial stack includes these key players:

| Category | Recommended Tools | Purpose |

|---|---|---|

| Accounting Core | QuickBooks Online, Xero | Central nervous system for all financial data. |

| Payment Processing | Stripe, Shopify | Syncs revenue data for an immediate pulse on cash inflows. |

| Payroll & HR | Gusto, BambooHR | Automates payroll, taxes, and benefits with precision. |

| Expense Management | Expensify, Ramp | Captures employee spending as it happens to prevent budget surprises. |

When you connect these platforms, you’re not just buying software; you’re building a powerful foundation for financial control. This level of automation is a massive step in strengthening your internal processes, a topic we explore more in our guide to financial reporting automation.

When to Bring in Expert Reinforcement

An integrated tech stack provides the what—the raw data. But you still need the why—the expertise to interpret it and build a strategy around it. As your business grows, certain trigger points are clear signals that it’s time to stop DIY-ing your finances and partner with an outsourced controller service.

“Strategic vision is the anchor that guides you. Make sure projections and forecasts together support where the CEO is going.” — Brooke S., Fractional CFO at Paro

Recognizing these triggers early will keep you from outgrowing your financial infrastructure and making mistakes that can cost you dearly down the road.

Key Triggers for Outsourced Controller Services

| Trigger Event | Why It Signals a Need for Help | The Strategic Benefit |

|---|---|---|

| Preparing for a Fundraise | Investors demand sophisticated, audit-ready financials (think GAAP compliance and SaaS metrics). Your current bookkeeping simply will not pass muster. | An expert team prepares investor-grade reports, builds airtight financial models, and ensures you fly through due diligence. |

| Month-End Close Takes Weeks | A slow closing process means you’re steering the ship using last month's map. The market moves faster than your data. | A professional service guarantees a 5-day month-end close, arming you with timely information to seize opportunities. |

| Losing Track of Key Metrics | You cannot confidently report on crucial KPIs like MRR, Customer Acquisition Cost (CAC), or Days Sales Outstanding (DSO). You're guessing. | Specialists implement systems to track and report on the specific metrics that actually drive your business model (SaaS, agency, professional services). |

| Board or Bank Reporting Demands Increase | Suddenly, stakeholders need formal, detailed, and frequent reports. The accuracy required is a level above what your team can produce. | Outsourced controllers deliver professional, accurate reporting packages that build trust and satisfy even the most demanding stakeholders. |

Partnering with an outsourced controller isn’t just another line-item expense; it's an investment in the accuracy, speed, and strategic guidance you need to scale with confidence. You get CFO-level insight without the full-time executive salary, turning your financial operations into a source of strength, not stress.

Your 30-60-90 Day Plan for Cash Flow Mastery

We've covered the concepts. But knowing this stuff does not change a thing in your bank account. The real goal is to turn all that reactive financial stress into proactive control over your cash.

This is your tangible, step-by-step roadmap for the next three months.

| Timeframe | Key Objective | Actionable Next Steps |

|---|---|---|

| Days 1-30 | Build Foundational Visibility | 1. Build Your 13-Week Cash Flow Forecast: This is priority one. Map out every dollar in and out, week by week. It will immediately expose any looming shortfalls. 2. Identify Top 3 Cash Leaks: With the forecast complete, pinpoint three non-essential expenses (e.g., underused software, redundant subscriptions) to cut or renegotiate immediately. |

| Days 31-60 | Optimize Your Processes | 1. Tighten AR Policies: Implement automated invoice reminders. Make ACH the default payment method for all new clients. Offer a "2/10, net 30" discount to incentivize early payment. 2. Renegotiate AP Terms: Have a straightforward conversation with your top three non-critical vendors. Ask to extend payment terms from Net 30 to Net 45. |

| Days 61-90 | Lock In a Strategic Rhythm | 1. Establish a Monthly Financial Review: Hold a mandatory meeting with your key leadership to review the forecast vs. actuals, track KPIs like DSO and burn rate, and make decisions based on data, not gut feelings. |

This consistent, disciplined cadence is what separates businesses that just survive from those that truly master cash flow management for a small business. For more detail, check out our guide on cash flow forecasting best practices.

Frequently Asked Questions

Even the most seasoned founders get tripped up managing cash. Here are some direct answers to the questions we hear most often from leaders of growing businesses.

What’s the Difference Between Cash Flow and Profit?

This is easily the most critical distinction in finance. Profit is an accounting calculation (Revenue - Expenses) that shows how your business performed on paper. Cash flow is the real money moving in and out of your bank account.

You can be wildly profitable but still run out of cash. It happens all the time. A client pays you in 90 days, but you have to pay your team and your software bills now. Your P&L statement might look fantastic, but if you do not have the actual cash to make payroll, you are out of business.

How Often Should I Forecast My Cash Flow?

For day-to-day, tactical decisions, you absolutely need a 13-week cash flow forecast that you update every single week. Your annual budget is for high-level strategy, but the 13-week forecast is your early warning system. It shows you potential cash crunches weeks in advance, giving you time to act before it becomes a crisis.

This rolling forecast is what gives you the confidence to manage payroll, pay vendors on time, and greenlight that next marketing campaign.

What Is a Good Days Sales Outstanding (DSO)?

Your Days Sales Outstanding (DSO) measures the average number of days it takes you to get paid after sending an invoice. A lower DSO means you get cash in the door faster. It definitely varies by industry, but here are solid benchmarks to shoot for:

- SaaS: According to OpenView, a healthy DSO is between 45-60 days.

- Digital Agencies: Aim for 60-75 days, as noted by Deltek.

- Professional Services: Similar to agencies, keeping it under 75 days is a strong goal.

If your DSO is creeping above these numbers, it’s a major red flag that you need to get serious about your collections process. You can learn more about the crucial financial KPIs for your small business in our detailed guide.

When Should I Use a Line of Credit?

Think of a line of credit as a tool for seizing strategic opportunities or handling genuine, unexpected emergencies—not for papering over operational shortfalls.

If you find yourself constantly dipping into your credit line just to make payroll or pay rent, it’s a sign of a deeper problem with your working capital cycle. That’s something you need to fix, not mask with debt.

Ready to move from reactive stress to proactive control over your company's cash flow? The expert team at Jumpstart Partners provides the visibility and strategic guidance you need to scale confidently. Schedule your free consultation today.