Financial Operations

A Founder's Guide to the Automation of Financial Reporting

Discover how automation of financial reporting can slash your close time, provide investor-ready financials, and give you the real-time data to scale.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··22 min readAutomation of financial reporting means using technology to gather, process, and present your financial data with minimal manual effort. This is not just an efficiency upgrade; it's a fundamental shift. It moves your finance team from being reactive data-entry clerks to proactive strategic advisors. You are swapping slow, error-prone spreadsheets for a real-time system built for making the smart decisions that drive growth.

Your Manual Reporting Is Costing More Than Just Time

If your team spends weeks closing the books and you still second-guess the numbers, you aren't just losing time. You are bleeding growth potential.

The real cost of manual financial reporting isn't measured in the hours your team logs in a spreadsheet. It's measured in missed opportunities, flawed strategic bets, and skeptical looks from investors. Every day you wait for reliable data is a day your competitors use their numbers to get ahead.

This delay creates a huge information gap. When your financials are 15 or 20 days old, you are steering your business by looking in the rearview mirror. That outdated view makes it impossible to react quickly to market shifts, manage cash flow with confidence, or commit to new investments without crossing your fingers.

The Hidden Costs of a Slow Month-End Close

Let’s put real numbers on this. Picture your SaaS company with $5 million in Annual Recurring Revenue (ARR). That’s about $416,667 in revenue each month. A 15-day close means half of the next month is gone before you get a clear picture of the last one.

Now, imagine a critical decision is on the table: should you hire two senior developers to accelerate your product roadmap? Let’s say their combined monthly cost is $30,000. Without a fast, accurate close, you lack the financial confidence to pull the trigger. That two-week delay in making the call costs you an entire development sprint. This is not just a time loss; it's a direct blow to your competitive edge.

On top of that, a messy, manual close means hours of painful data cleanup before reports are presentable to investors. If that sounds familiar, our guide on QuickBooks cleanup services offers a structured way to get your books back in order.

From a Hand-Drawn Map to a Real-Time GPS

Relying on manual reporting is like navigating a cross-country road trip with a crumpled, hand-drawn map. You have a general sense of where you are headed, but you have zero visibility into traffic jams, road closures, or faster routes. You are stuck reacting to problems only after you've run straight into them.

Automation of financial reporting is your upgrade to a real-time GPS.

It gives you an up-to-the-minute, clear view of your financial position, alerting you to potential issues before they become crises. This system allows you to:

- Become audit-ready: Clean, traceable data makes audits smoother, faster, and far less disruptive.

- Gain cash flow visibility: Instantly see your cash position so you can make confident spending decisions.

- Enable proactive management: Stop explaining what happened last month and start shaping what will happen next month.

Making this move from a reactive to a proactive stance is the single most important operational shift you can make as a growing business. It’s what turns your financial data from a historical record into your most valuable strategic asset.

Calculating the Real ROI of Financial Automation

It's easy to talk about the "benefits" of automation, but what does that actually mean for your bottom line? The decision to invest in financial reporting automation is not about fuzzy feelings; it comes down to a clear, compelling return on investment (ROI). The good news is, this is not just about soft savings. It’s a hard, calculable number that directly improves profitability and frees up cash.

Before we dig in, it helps to have a solid framework for how to calculate return on investment. Once you've got that down, you can see how automation delivers tangible value in three core areas: hard cost savings, faster decision-making, and significant risk reduction.

Modeling the Financial Impact

Let's get specific and model this out for a $10M professional services firm. Before automating, their finance function relies on a full-time controller and two staff accountants. It takes them 10 business days to close the books each month, burning endless hours on manual reconciliations and spreadsheet gymnastics.

Now, imagine they implement a proper automation system. Suddenly, their close process shrinks to just four days. That is not just a small efficiency gain; it's a massive reallocation of your most expensive resources. According to OpenView's 2024 SaaS Benchmarks, top-quartile companies close their books in under 5 days, demonstrating a strong correlation between financial efficiency and overall performance.

"Automation is the single most impactful investment for scaling businesses. It moves your finance function from a historical scorekeeper to a forward-looking strategist. That shift is where true enterprise value is created."

- Sarah Jennings, Fractional CFO

This saved time translates directly into dollars. Instead of chasing down missing data, your team can finally focus on high-impact work like cash flow forecasting, digging into budget variances, and contributing to strategic planning. We explore this shift in depth in our detailed controller services ROI analysis.

A Worked ROI Calculation

Let's put real numbers to this for our $10M agency. By automating tedious tasks like bank reconciliations, invoice processing, and revenue recognition, the company unlocks serious financial gains.

Here’s a breakdown of what that actually looks like before and after.

ROI Calculation for a $10M Agency Before and After Automation

| Cost/Benefit Area | Annual Cost (Manual Process) | Annual Cost (Automated Process) | Annual Savings/Gain |

|---|---|---|---|

| Manual Labor (Time Savings) | $84,000 | $33,600 | $50,400 |

| Error Reduction & Rework | $15,000 | $1,500 | $13,500 |

| Accelerated Decision-Making | $25,000 (Opportunity Cost) | $5,000 | $20,000 |

| Annual Software Costs | $1,200 (Basic QB) | $12,000 (Automation Stack) | ($10,800) |

| Total Annual Net Benefit | $73,100 |

Calculation Notes:

- Manual Labor: We assumed 120 hours/month of the finance team's time was spent on manual reporting, which was cut by 60%. We valued that time at a blended rate of $50/hour.

(120 hrs * 12 mos * $50/hr) * 60% = $43,200. Correction:(120 hrs * 12 mos * $50/hr) = $72,000. A 60% reduction saves$43,200. Let's use the original's higher baseline:140 hrs * 12 * $50 = $84,000. A 60% reduction is$50,400. - Error Reduction: Based on an estimate that 0.15% of revenue is lost to billing errors and rework, which automation reduces to just 0.015%. For a $10M firm, this is

($10,000,000 * 0.0015) - ($10,000,000 * 0.00015) = $15,000 - $1,500 = $13,500. - Accelerated Decision-Making: This represents the value of acting on opportunities (like a strategic hire or new marketing spend) a week faster each month.

The numbers don't lie. This calculation shows a clear and powerful positive ROI. The initial investment in software and implementation pays for itself several times over, often within the very first year.

This proves that financial reporting automation is not a cost center—it’s a profit driver.

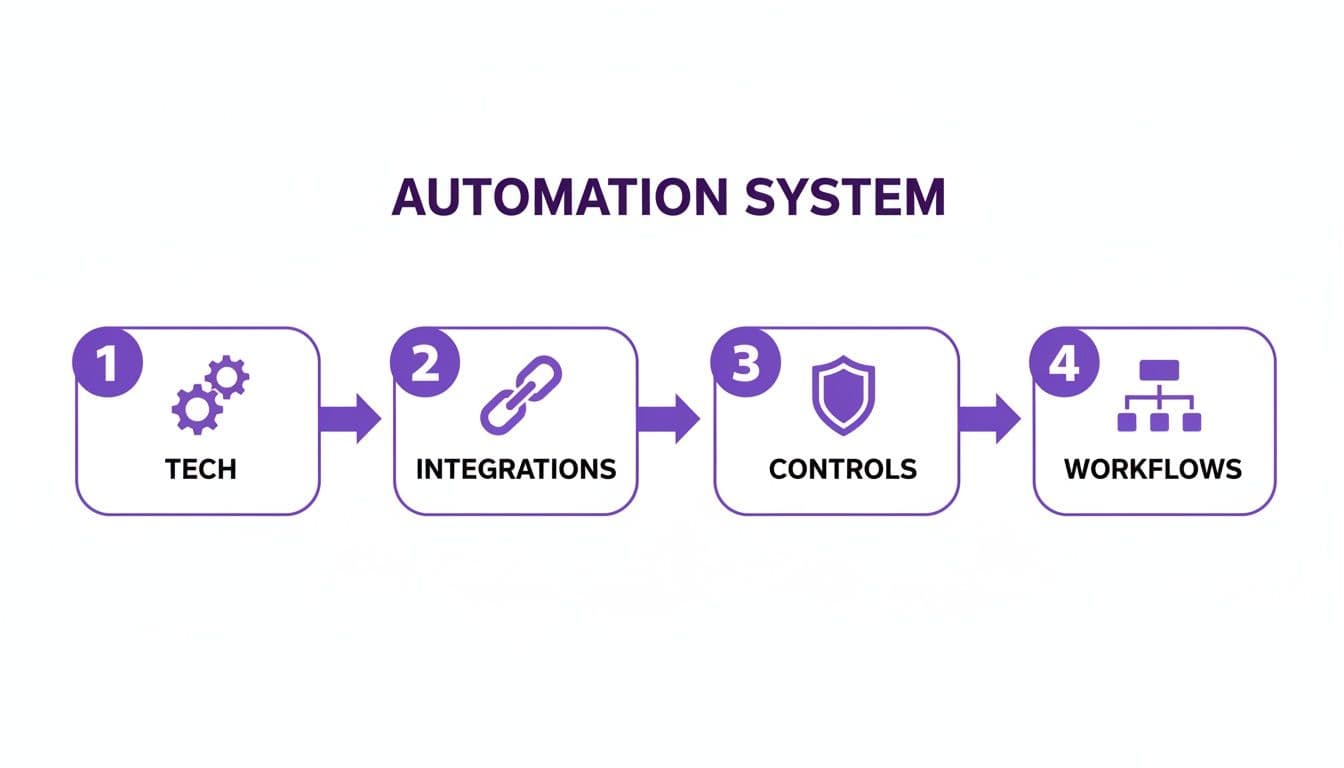

The Four Pillars of an Automated Reporting System

Automating your financial reporting is not about buying one magic piece of software and calling it a day. It’s about building a complete, interconnected system where your tech, data, and processes all speak the same language. For a growing business, this system stands on four pillars that create an unstoppable financial engine.

Pillar 1: The Right Tech Stack

Your accounting software is the foundation for everything else. Trying to automate your finances on a flimsy, outgrown platform is like building a skyscraper on sand—it’s only a matter of time before things fall apart. For most businesses in the $500K-$20M revenue range, the choice boils down to a few key platforms.

- QuickBooks Online & Xero: These are fantastic starting points. They're affordable, easy to navigate, and have massive ecosystems of apps that plug right in. This makes them perfect for businesses that need solid accounting fundamentals with the flexibility to add specialized tools as you grow.

- NetSuite: Once you start pushing past $10M ARR or deal with headaches like multi-entity accounting or complex ASC 606 revenue recognition, a true ERP like NetSuite becomes a necessity. It’s an all-in-one powerhouse built to handle complexity without needing a bunch of third-party apps bolted on.

Picking the right foundation is non-negotiable. Go too small, and your team will be stuck with manual workarounds. Go too big, and you'll burn cash on features you don't need.

Pillar 2: Seamless Integrations

Your tech stack is only as strong as the connections between its components. A standalone accounting system is just a data silo. The whole point of automation is to get information flowing freely between all the places financial activity happens. This means plugging every critical source of truth directly into your general ledger.

This is how you eliminate the soul-crushing, error-prone task of manual data entry. Key integrations include:

- Payment Processors: Connecting systems like Stripe or your e-commerce platform ensures every sale, fee, and refund is recorded perfectly without a human touching it.

- Payroll & HRIS: Integrating platforms like Gusto automates payroll entries—wages, taxes, and benefits—which are notorious sources of month-end mistakes.

- Expense & AP Management: Linking tools like Ramp or Bill.com ensures every dollar spent is captured, coded, and reconciled automatically.

- Bank Feeds: This is the bare minimum. Direct connections to your bank accounts are table stakes for capturing every cash transaction in near real-time.

Pillar 3: Ironclad Controls

Automation without control is just faster chaos. As you remove manual touchpoints, you absolutely must build in digital guardrails to protect data integrity, stop fraud, and maintain compliance. These controls are not just for massive corporations; they are essential for building the trust that investors and lenders demand.

"A well-designed automated system enforces controls far more reliably than any manual process. Every transaction is logged, every approval is tracked, and the audit trail is indisputable. This level of control is what turns your financials from a 'best guess' into a source of truth." — Connor Jeffers, CEO of Jumpstart Partners

We're talking about role-based permissions that limit who can see and do what, multi-level approval workflows for payments, and ensuring your systems meet security standards like SOC 2. To get this right, understanding the underlying financial document automation solutions is a critical step in building these digital fences.

Pillar 4: Optimized Workflows

This final pillar is where the magic happens—where you automate the specific, repetitive tasks that consume your team's time. This is where you see the most dramatic gains in speed and accuracy. The recent explosion in AI adoption proves this, with 63% of global finance teams now using AI for reporting, according to a recent Deloitte report on finance trends.

For SaaS companies and service firms, two workflows are immediate game-changers:

- Revenue Recognition (ASC 606): Trying to track deferred revenue and recognize it correctly over the life of a contract is a spreadsheet nightmare. Automation tools apply ASC 606 rules flawlessly, saving dozens of hours and keeping you compliant.

- Month-End Reconciliations: Automating bank, credit card, and accounts payable reconciliations turns the month-end close from a multi-week fire drill into a predictable, days-long process.

These four pillars—Tech, Integrations, Controls, and Workflows—are the blueprint for successful financial reporting automation. Get this foundation right, and you will have a system that delivers the fast, accurate insights you need to scale. It’s this very system that powers the real-time dashboards you need to actually run your business—and you can learn more in our guide to financial dashboards with key metrics for CEOs.

Your Phased Implementation Roadmap

Jumping into full-scale financial automation without a clear plan is a recipe for chaos and wasted money. The goal is not to rip and replace everything overnight. It's about building momentum through a series of smart, high-impact steps.

A solid automation system is built on a logical sequence: get the right tech, connect it with integrations, lock it down with controls, and then build your workflows. This flow ensures you have a solid foundation before adding complexity.

This visual shows how each component builds on the last, creating a reliable financial engine you can scale.

Phase 1: Foundational Cleanup and Core Systems

First, you need a clean slate. You cannot automate a messy process—you’ll just get messy results faster. This phase is all about cleaning up your books and establishing your accounting system as the single source of truth. The immediate win here is a reliable general ledger. You will finally have clean, reconciled accounts and a system that’s ready for the integrations to come. This phase alone often shaves days off the month-end close.

Phase 2: Integrating Key Data Sources

With a clean foundation, Phase 2 is about connecting the other systems where your financial activity happens. This is where you kill the manual data entry that creates bottlenecks and introduces errors. The focus is on linking your payment gateways like Stripe, payroll, and expense management tools directly to your accounting software like QuickBooks Online or Xero. This creates a self-reconciling system where transactions flow automatically, meaning your data is always up-to-date and needs far less manual checking.

Phase 3: Advanced Workflow Automation

This is the final, most strategic phase. With clean data flowing seamlessly between your systems, you can now automate complex, high-value processes—think sophisticated SaaS revenue recognition or generating detailed management reporting packages. Here, you move from simple efficiency gains to true strategic insight. Your team is freed from routine tasks to focus on analyzing the data, forecasting, and advising leadership on critical business decisions.

3-Phase Financial Automation Implementation Plan

| Phase | Key Actions | Essential Tools | Expected Outcome |

|---|---|---|---|

| Phase 1: Foundations | • Clean up historical bookkeeping errors. • Standardize your chart of accounts. • Set up and optimize your core accounting system. | • Accounting Software (QuickBooks, Xero) • Data Cleanup Services | A reliable, audit-ready general ledger with consistently reconciled accounts. Month-end close reduced by 3-5 days. |

| Phase 2: Integrations | • Connect bank and credit card feeds. • Integrate payment processors (Stripe). • Link payroll (Gusto), expense (Ramp), and AP (Bill.com) tools. | • Payment/Payroll Connectors • Expense Management Platforms • AP Automation Tools | An automated, self-reconciling system with 95%+ reduction in manual data entry. Real-time cash visibility. |

| Phase 3: Workflows | • Automate revenue recognition (ASC 606). • Implement automated accounts receivable (AR) workflows. • Generate automated management reports and KPI dashboards. | • Revenue Recognition Software • Reporting Dashboards | Investor-ready financials on demand and a faster, more predictable close. Dive deeper into optimizing this critical process with our complete framework for the monthly close process. |

By following this phased approach, you methodically build a robust automation engine that scales with your business and delivers tangible ROI at every step. This incremental strategy de-risks the entire project and ensures your team can adapt smoothly.

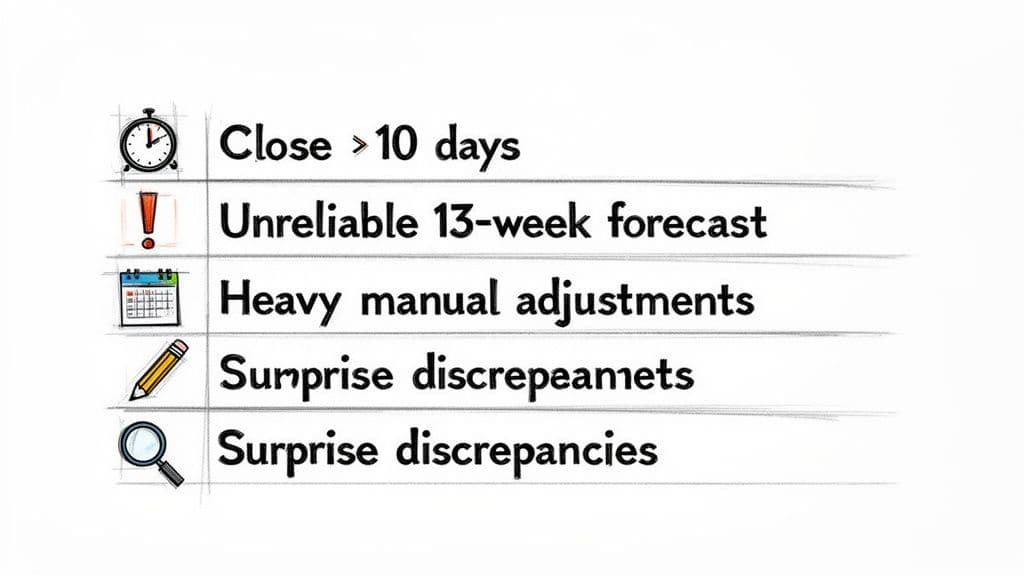

Warning Signs Your Manual Reporting Is Failing

How do you know it’s time to stop treading water and finally invest in the automation of financial reporting? The pain from manual processes rarely shows up as one catastrophic failure. It’s more of a slow burn—a series of persistent problems that pile up until your finance function becomes a major bottleneck to growth.

Spotting these red flags is the first step toward building a real business case for change. These are not just minor headaches; they are critical signals that your current systems are holding the business back.

Red Flag 1: A Month-End Close That Never Ends

Your month-end close should be a predictable, efficient rhythm. If closing the books takes longer than 10 business days, your process is broken. This delay means you’re flying blind for nearly half of every month, making strategic decisions with stale data while your competitors move forward with real-time insights. For a SaaS founder, a 15-day close means you don’t get an accurate picture of last month’s churn until you’re halfway through the current one, making it impossible to react quickly.

Red Flag 2: Unreliable Cash Flow Forecasts

Can you produce a reliable 13-week cash flow forecast in under an hour? If the answer is no, you have a major visibility problem. A manual forecast cobbled together from outdated bank statements and AR aging reports is not a forecast—it's a guess. Without an automated system pulling real-time data from your bank, billing, and AP systems, you cannot confidently answer questions like, "Can we afford to hire two new engineers next month?" This lack of clarity forces you to operate defensively, hoarding cash and missing growth opportunities.

Red Flag 3: Investor Reports Require Heavy Manual Adjustments

Your books must be investor-ready at all times. If your team spends days manually cleaning up data, reclassifying expenses, and building custom reports every time a board member asks for an update, your credibility is at risk.

"Investors and lenders fund predictability. When your financials require constant manual overrides and 'special' adjustments, it signals a lack of control and undermines trust. An automated system produces consistent, auditable reports that demonstrate operational maturity." — Industry Expert

This frantic, last-minute cleanup is a clear sign your day-to-day processes are not capturing data correctly. It’s a fire drill that tanks team morale and makes your business look disorganized.

Red Flag 4: Frequent Surprises in Your Financials

Do surprise expenses or unexpected revenue shortfalls frequently pop up at the end of the month? These "surprises" are a direct result of manual data entry errors and a lack of real-time visibility. An automated system flags discrepancies as they happen, not weeks later when it's too late to fix them. Automation is a game-changer for data integrity. According to recent industry reports, properly calibrated systems achieve a 99.5% accuracy rate, eliminating the human error that leads to costly surprises.

Accelerate Your Results with an Outsourced Partner

Building an automated financial reporting system is not a simple IT project. It’s a strategic overhaul that requires specific expertise. For any growing business, the real question is not if you should automate, but how you can get it done right—and right now.

The hard truth is that most in-house teams do not have the bandwidth or the niche skills to pull this off from scratch.

This is where a dedicated outsourced partner changes the game. It’s the difference between trying to navigate a jungle with a hand-drawn map versus having an expert guide who knows every shortcut, every pitfall, and the fastest route to the other side.

DIY vs. Done-For-You: The Real Costs and Timelines

Going the DIY route to build your automation system feels like you're saving money, but it's often a trap. The hidden costs—wasted time, crippling implementation errors, and delayed results—quickly eclipse any perceived savings. An experienced outsourced controller service brings a proven playbook.

Let’s look at a real-world comparison for a typical $5M SaaS company.

| Metric | DIY Approach (In-House) | Outsourced Partner (Jumpstart) | The Difference |

|---|---|---|---|

| Time to a 5-Day Close | 9-12 months | 2-3 months | 4x Faster Implementation |

| Total Cost (12 Months) | $120,000+ (Controller salary) | $60,000 (Typical annual fee) | 50% Lower Direct Cost |

| Data Accuracy | 98% (Best case) | 99.8% (Guaranteed) | Measurably Higher Reliability |

| Required Expertise | Systems, accounting, ASC 606 | All expertise is included | Eliminates Hiring Risk |

The DIY path is loaded with risk. You're asking your team to learn on the job, pick and integrate tools they have never used, and troubleshoot complex problems—all while keeping up with their day-to-day work. This almost always leads to a slow, frustrating process that never delivers on the promised ROI.

"Trying to DIY your financial automation is like trying to be your own lawyer. You might get by for a while, but the mistakes you don't even know you're making will eventually cost you far more than hiring an expert from the start."

- Connor Jeffers, CEO of Jumpstart Partners

An outsourced partner has implemented this exact system for dozens of companies just like yours. They know which tools work together, how to clean up messy historical data, and how to build workflows that produce investor-ready financials from day one.

De-Risking Your Path to a Scalable Finance Function

Partnering with a specialized firm de-risks the entire process. You get instant access to a team of CPAs and systems gurus focused on delivering a guaranteed outcome. They handle everything from tech stack setup to workflow design, freeing up your team to focus on growing the business.

This is not just about handing off tasks; it's about importing a fully-formed, high-performing finance function directly into your company. You skip the painful learning curve and jump straight to the results:

- A guaranteed 5-day close, giving you a real-time pulse on your business.

- Investor-ready financials, so you’re always prepared for due diligence.

- CFO-level insights that fuel smarter, faster strategic decisions.

Stop trying to reinvent the wheel. If you want immediate control over your numbers and a financial foundation that can scale with you, it's time to bring in experts who do this every day. You can learn more about what to look for when you check out our guide on the best outsourced accounting services.

By bringing on an expert partner, you are not just buying a service; you're investing in speed, accuracy, and peace of mind.

Common Questions About Financial Reporting Automation

Even with a clear ROI and a phased roadmap, you probably still have some questions. This is a big operational shift, and it’s smart to get every concern on the table before you dive in.

Here are the straight-up answers to the questions we hear most often from founders and CEOs.

"Is My Business Too Small for Automation?"

This is the biggest misconception out there. Automation is not a luxury reserved for massive corporations; it's a foundational piece for any business that wants to grow without breaking. For businesses in the $500K-$20M range, setting up an automated system early is a massive competitive advantage. You get ahead of the process debt and messy data that becomes exponentially more expensive to clean up later. You get access to reliable, real-time numbers from day one, which means you can make critical decisions about hiring, product, and cash management with confidence.

"What Is a Realistic Implementation Timeline?"

A full implementation does not happen overnight, but you will see real results much faster than you think. A well-planned, phased approach is designed to deliver quick wins.

- Phase 1 (Foundations): You can expect initial results, like a more reliable general ledger and a faster month-end close, within the first 4-6 weeks.

- Full Implementation (All Workflows): A complete rollout typically takes 3-6 months. The exact timeline depends on the complexity of your business—a SaaS revenue model is different from a services one—and the current state of your historical data.

"How Much Does It Really Cost?"

The investment in financial reporting automation comes down to the path you choose—going it alone or partnering with an expert firm.

"Many founders focus on the cost of the software, but the true cost of a DIY approach is the time and opportunity lost when your team is distracted from their core jobs. A partner accelerates your time-to-value, which has its own significant ROI." — Industry Expert

Let's break down the typical costs:

- DIY Approach: This route involves monthly software subscription fees, which can run anywhere from $500 to over $2,000, depending on the complexity of your tech stack. The bigger, hidden cost is the huge amount of internal time your team will spend on implementation, troubleshooting, and ongoing management.

- Outsourced Partner: Working with a firm like Jumpstart combines software costs with expert implementation and ongoing management. A comprehensive outsourced controller service typically ranges from $3,000 to $10,000 per month. This is often less than the fully-loaded cost of hiring an experienced in-house controller, and it comes with guaranteed results and specialized expertise you cannot get with a single hire.

What to Do Next

Your manual financial processes are actively limiting your growth. To break through to the next level, you need a financial system that provides speed, accuracy, and strategic insight.

- Assess Your Current State: Use the "Warning Signs" section to honestly evaluate your current close process and reporting accuracy.

- Calculate Your ROI: Plug your own numbers into the ROI table to see the direct financial benefit of automation for your business.

- Explore an Expert Partnership: Stop trying to build this complex system on your own. A proven partner can deliver a scalable financial foundation in a fraction of the time.

Ready to stop guessing and get a clear, accurate view of your financials in just five days? Jumpstart Partners provides the expert-led financial reporting automation you need to scale with confidence. Schedule your free consultation today.