Financial Operations

QuickBooks Cleanup Services: The Founder's Guide to Investor-Ready Financials

Is your financial data a mess? This guide to QuickBooks cleanup services explains the process, costs, and benefits of getting investor-ready financials.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··18 min readYour business is scaling past $1M ARR, but your QuickBooks account is a liability. Unreconciled transactions, miscategorized expenses, and a balance sheet that feels more like a guess than a fact are holding you back. This isn't just an accounting headache; it's a direct threat to your valuation and your ability to make sound strategic decisions.

When investors or lenders conduct due diligence, a disorganized QuickBooks file is a massive red flag. It instantly erodes trust and signals operational weakness, putting your funding round or credit line at risk before the conversation even begins. You're making critical decisions about cash flow, hiring, and product investment based on faulty data, which is like flying a plane with a broken altimeter.

The Snowball Effect of a Single Miscategorization

A few seemingly small errors compound, creating a distorted view of your company's health.

Imagine your SaaS company miscategorizes $25,000 in annual AWS hosting fees as a general operating expense instead of placing it under Cost of Goods Sold (COGS). Here’s the chain reaction:

- Your Gross Margin is Inflated: The P&L now shows an artificially high gross margin. If a typical SaaS business targets a 75-80% gross margin, this error could push your reported number to 85%, giving you a false sense of unit economic strength. According to OpenView's 2024 SaaS Benchmarks, a best-in-class gross margin is a key indicator of scalability.

- Inaccurate LTV:CAC Ratio: You use this inflated margin to calculate Customer Lifetime Value (LTV), which then skews your LTV:CAC ratio. You might think you have a healthy 4:1 ratio when, in reality, it's closer to a precarious 2.5:1.

- Flawed Strategic Decisions: Based on this faulty data, you greenlight a more aggressive marketing spend, believing your payback period is shorter than it is. Six months later, you're facing a cash crunch because the underlying economics were never as strong as your books suggested.

This is exactly where professional QuickBooks cleanup services become indispensable. It's a systematic project to correct historical errors and ensure every number in your financial statements is accurate and defensible. For a growing company, this isn't optional—it's a prerequisite for sound decision-making and attracting capital. Building on a foundation of proper financial reporting best practices provides the framework for achieving this clarity.

Warning Signs Your QuickBooks Needs a Professional Cleanup

Think of your QuickBooks file as the command center for your company's financial health. When it starts sending out distress signals, it’s a clear sign a deeper issue requires professional attention. Ignoring these warnings is like ignoring a check engine light—it leads to a much bigger breakdown down the road, usually right when you need everything to work perfectly, like during an investor pitch or an audit.

These problems often sneak in through faulty app integrations. When platforms like Shopify or Stripe don't sync perfectly with QuickBooks, they create duplicate entries, miscategorize sales tax, or fail to record processing fees, creating a compliance nightmare hidden in plain sight.

Here’s a quick diagnostic checklist to spot the trouble before it spirals.

Red Flags Your Books are a Liability

Use this table to quickly identify common symptoms of messy books and understand the direct business risk each one poses.

| Red Flag | What It Looks Like in QuickBooks | The Hidden Business Risk |

|---|---|---|

| Mismatched Bank Balances | The balance in your QuickBooks bank register never matches your actual bank statement. | Unreliable cash flow forecasts and zero investor confidence. Your financials are built on guesswork. |

| Bloated Chart of Accounts | You have hundreds of accounts, many with vague names like "Misc." or "Other Expenses." | Inaccurate reporting. You can't see where your money is actually going, making cost control impossible. |

| Growing Undeposited Funds | A large, persistent balance in the "Undeposited Funds" account that never clears to zero. | Inflated assets on your balance sheet and a massive reconciliation headache waiting to happen. |

| "Ask My Accountant" Account | This default account has a balance in the thousands (or tens of thousands) of dollars. | Financial indecision. Critical transactions aren't being properly classified, hiding your true profitability. |

| Unreliable Financial Reports | Your Profit & Loss shows huge profits, but your bank account is always empty. | Poor accrual accounting is likely masking serious cash flow issues, putting your runway at risk. |

If you're nodding along to more than one of these, it's time to take action.

Common Misconception: "My Bookkeeper Handles This."

Many founders assume their bookkeeper is managing these issues. However, a standard bookkeeper's role is typically focused on current transaction categorization and basic reconciliations. A full-scale cleanup—correcting months or years of historical errors, restructuring the chart of accounts, and fixing complex balance sheet issues—is a distinct project that falls outside the scope of routine bookkeeping. It requires a controller-level skill set to diagnose root causes and implement lasting solutions.

The root cause of mismatched balances is almost always a breakdown in bank statement reconciliation. Without this crucial monthly check-up, your financial reports are built on a foundation of sand. For a scaling company, this means your cash flow forecasts are useless, and any financial model you present to investors is immediately shredded under scrutiny.

If this sounds familiar, it might also be a sign that it's time to re-evaluate your internal finance function.

Your Financial Reports Don't Pass the Gut Check

Ultimately, the real test is whether your financial statements tell the true story of your business. If you pull a Profit & Loss statement and your first thought is, "There's no way we made that much profit last month," trust your gut. You're right.

"A Profit & Loss statement that doesn’t align with your cash flow is a classic symptom of poor accrual accounting. For a SaaS business, this could mean you’re recognizing a full year of revenue from an annual contract upfront, dangerously inflating your short-term profitability while masking catastrophic cash flow problems." — Jessica Martin, Lead Controller at Jumpstart Partners

This disconnect between your reports and reality directly cripples your ability to run the business. You can't set accurate budgets, calculate your true customer acquisition cost (CAC), or confidently know your runway when the data is fundamentally flawed. This is the exact moment a professional QuickBooks cleanup stops being an administrative task and becomes a strategic necessity.

The Professional QuickBooks Cleanup Process Demystified

A professional QuickBooks cleanup isn't about randomly fixing transactions. It's a structured project designed to turn a chaotic file into a strategic asset. The goal isn't just "clean" books, but accurate, defensible financials that withstand investor scrutiny and guide critical business decisions.

The process goes beyond simple bank reconciliation. It involves a deep diagnostic review, a strategic re-categorization of every transaction, and an overhaul of your financial reporting framework. This structured approach is what separates a professional service from a DIY attempt.

The Cleanup Workflow: From Chaos to Clarity

| Phase | Key Activities | Your Time Commitment |

|---|---|---|

| 1. Diagnostic & Scoping | We perform a forensic analysis of your QuickBooks file to identify root causes (e.g., sync errors, process gaps), quantify the cleanup effort, and establish a transparent, fixed-fee quote. | 60-90 minutes (initial call and file access) |

| 2. Core Cleanup Execution | Our team executes a multi-step process: bank/credit card reconciliation, transaction re-categorization, Chart of Accounts optimization, A/R & A/P cleanup, and a final Balance Sheet tie-out. | 0 hours (we handle everything) |

| 3. Delivery & Final Review | We deliver a fully reconciled QuickBooks file, corrected investor-ready financial reports, and schedule a final review session to walk you through the "before and after" and answer your questions. | 60 minutes (review session) |

Phase 1: The Diagnostic and Scoping

Before touching a single transaction, our team performs a thorough diagnostic review. This is a forensic analysis to understand the scope and depth of existing issues. We pinpoint root causes—bad app integrations, lack of process, or accounting misunderstandings—to prevent the mess from recurring. Based on this deep dive, you get a transparent, fixed-fee proposal, eliminating the risk of runaway hourly billing.

Phase 2: The Core Cleanup Execution

With a clear plan, the hands-on cleanup begins. This is a systematic process to restore order and accuracy to your financial data.

- Bank and Credit Card Reconciliation: Every bank, credit card, and loan account is reconciled against its statement for the entire cleanup period. This establishes the cash-basis truth of your financial position.

- Transaction Re-categorization: We go line-by-line, moving transactions from vague buckets like "Misc Expense" to correct Chart of Accounts categories. This makes your P&L accurately reflect where your money is going.

- Chart of Accounts Streamlining: We optimize your Chart of Accounts for your business model, merging duplicate accounts and structuring it to deliver meaningful reports for a SaaS or service business.

- Accounts Receivable (A/R) and Payable (A/P) Cleanup: Old, uncollectible invoices in A/R are addressed, and every outstanding vendor bill in A/P is verified. Understanding practical ways to clean up your accounts receivable is a key part of this.

- Balance Sheet Tie-Out: Finally, we ensure all balance sheet accounts—assets, liabilities, and equity—are correct and substantiated, confirming the integrity of your entire financial picture.

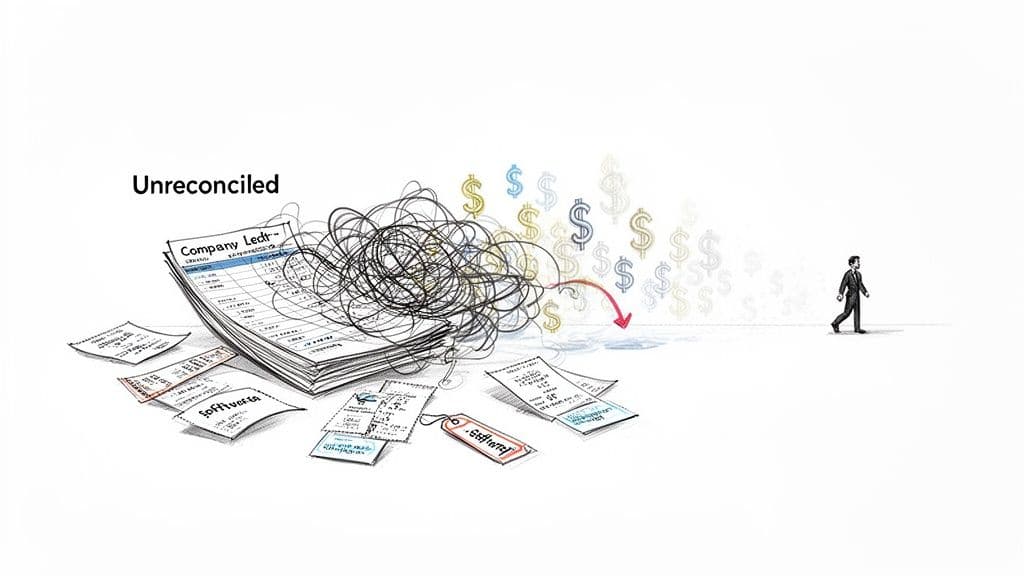

This diagram highlights how unresolved mismatches and errors create a cascade of financial uncertainty—exactly what a structured cleanup is built to solve.

Phase 3: Delivery and Final Review

The project concludes with the delivery of a fully reconciled QuickBooks file. You receive a set of investor-ready financial reports and a clear understanding of your company's true financial health. The entire process is designed to give you a clean slate and a rock-solid foundation for the future. You can learn more about our specific QuickBooks cleanup project workflow.

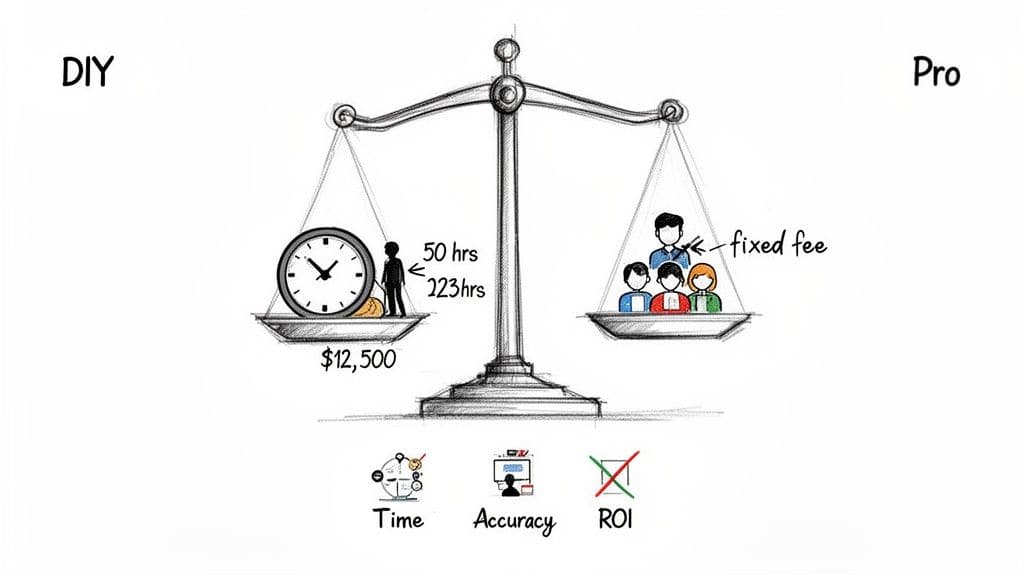

The Real Cost of DIY Cleanup vs. Professional Services

The first question from founders is always, "Why can't I just clean this up myself?" On the surface, the DIY route seems free. But when you calculate the real cost, doing it yourself becomes one of the most expensive decisions you can make. The currency you're really spending isn't cash—it's your time, focus, and strategic energy.

The Opportunity Cost Calculation: A Worked Example

As a founder or CEO of a scaling business, your time has a high dollar value. A conservative blended rate for a founder in the $500K-$20M revenue range is $250 per hour. A DIY cleanup for a year of messy books takes a non-expert 40 to 60 hours of focused work.

Here’s what that "free" cleanup actually costs you:

- Founder's Time: 50 hours

- Effective Hourly Rate: $250/hour

- Total Opportunity Cost: 50 hours x $250/hour = $12,500

That "free" project just cost your business $12,500 in lost strategic value. This is time that could have been invested in activities with a direct ROI, like closing a major client, recruiting a key hire, or refining your pricing strategy.

Comparing DIY vs. Professional QuickBooks Cleanup

When you compare the DIY approach to a professional service, it's about trading a high-risk, high-cost administrative task for guaranteed accuracy and strategic clarity. A professional QuickBooks cleanup service doesn't just save you time; it delivers expertise you can't replicate. A seasoned team understands the nuances of ASC 606 revenue recognition for SaaS or project-based accounting for agencies. They ensure your financials are not just clean, but audit-ready and investor-grade.

Here's how the two options really stack up:

| Factor | DIY Approach | Professional Service |

|---|---|---|

| True Cost | $12,500+ in lost founder time and opportunity cost. | A predictable fixed fee, typically a fraction of the DIY opportunity cost. |

| Time Investment | 40-60 hours of your direct, hands-on involvement. | 2-4 hours of your time for initial scoping and final review. |

| Accuracy | High risk of recurring errors and missed compliance issues. | Guaranteed accuracy with CPA oversight. |

| Expertise | Limited to your own accounting knowledge. | Deep industry-specific expertise in SaaS, agency, and professional services accounting. |

| Strategic Value | Zero. It's a purely administrative and backward-looking task. | High. Delivers investor-ready financials and a solid foundation for growth. |

The math is clear. Outsourcing to a dedicated team is a high-ROI decision. You trade a predictable fee for guaranteed accuracy and, more importantly, you buy back dozens of hours of your most valuable strategic time. You can see a detailed breakdown in our controller services ROI analysis.

How to Choose the Right QuickBooks Cleanup Partner

Picking a partner for your QuickBooks cleanup is a high-stakes decision. You’re not just handing over your login; you’re entrusting a firm with the financial DNA of your company. This is not the time to bargain hunt. The wrong partner can lead to recurring errors and a "cleanup" that needs to be cleaned up again in six months. The right partner becomes a strategic asset, delivering financials that stand up to investor scrutiny.

Non-Negotiable Partner Criteria

When vetting potential firms, a few non-negotiables separate top-tier providers from the rest.

- US-Based Teams: Insist on a firm with a team based in the United States for data security, GAAP compliance, and clear communication.

- CPA Oversight: The cleanup must be managed or overseen by a Certified Public Accountant (CPA) to guarantee professional standards and audit-readiness.

- Robust Security Credentials: Look for firms with SOC 2 Type II compliance, demonstrating bank-level security for your sensitive financial data.

These three factors are the bedrock of a trustworthy partnership. If a firm can’t check these boxes, you’re exposing your business to unnecessary risk.

Key Questions to Ask Potential Providers

Once you've confirmed the basics, dig deeper to find the right fit. A generic bookkeeper won't understand the nuances of SaaS revenue recognition or agency project accounting.

"The difference between a good cleanup and a great one is industry context. A great partner doesn't just reconcile accounts; they structure your financials to highlight the key metrics that matter to your investors and your leadership team." — David Smith, CPA, Head of Client Success

Use this table as your guide to evaluate providers effectively.

| Question Category | Specific Questions to Ask | Why It Matters |

|---|---|---|

| Industry Expertise | "What's your experience with [SaaS/Agency] companies at our revenue stage?" "How do you handle ASC 606 revenue recognition?" | You need a partner who speaks your language and understands your business model, not a generalist. |

| Tech Stack Familiarity | "Are you familiar with our tech stack (e.g., Stripe, Gusto, NetSuite)? How do you manage the integrations?" | Sync errors are a primary cause of messy books. Their team must be an expert at managing the data flow from your core platforms. |

| Process & Deliverables | "Can you walk me through your step-by-step cleanup process?" "What specific reports and deliverables will we receive at the end?" | A transparent, structured process signals professionalism. Vague answers are a major red flag. |

| Team & Communication | "Who will be my primary point of contact?" "What's your communication cadence and typical response time?" | You need a dedicated, responsive contact who knows your account inside and out—not a generic support inbox. |

Choosing the right partner for your QuickBooks cleanup services is a strategic investment in your company’s future. Prioritizing expertise, security, and a proven process sets you up to find a firm that will deliver lasting value and true financial clarity.

Your Next Step: From Liability to Strategic Asset

Recognizing your financials are a liability is the first step. The decision to act on that knowledge separates stagnant companies from those built to scale. The hidden costs of doing nothing—flawed strategies, shaky investor confidence, and missed opportunities—are always greater than the investment in getting it right. Clean, reliable financials are the bedrock of every strategic decision you make.

Actionable Next Steps

- Stop Flying Blind: Acknowledge that you cannot make critical business decisions with unreliable data. The risk is too high.

- Quantify the Problem: Schedule a complimentary, no-obligation financial health check with an expert firm. Understand the specific scope of your cleanup needs.

- Execute with Experts: Engage a specialized team to handle the cleanup efficiently. This allows you to reclaim your time and focus on what you do best: growing the business.

This is where expert QuickBooks cleanup services offer a clear path forward. Instead of burning dozens of your own valuable hours, you hand the process over to a specialized team and get guaranteed, investor-ready results.

Get a Complimentary Financial Health Check

We make this an easy decision. Start with a no-obligation consultation where our team will perform a complimentary review of your QuickBooks file. We’ll pinpoint the top three critical issues hurting your financial accuracy.

After the review, you’ll get a transparent, fixed-fee quote for a complete cleanup project. No hourly rates, no surprises—just a clear investment for a defined outcome. This takes the guesswork out of the equation. For more on the fundamentals, see our guide on bookkeeping services for small businesses.

Stop letting messy financials dictate your company's future. Schedule your complimentary QuickBooks review today and take the definitive step toward the financial clarity your business deserves.

QuickBooks Cleanup FAQs: The Nitty-Gritty Details

We’ve walked through the what, why, and how of getting your QuickBooks file in order. Now, let's get to the questions every founder and finance leader asks before kicking off a cleanup project.

How Much Does a QuickBooks Cleanup Cost?

There's no single price tag for a QuickBooks cleanup service. Most firms will give you a fixed-fee quote after a diagnostic review, but projects typically range between $1,500 and $7,500, with more complex situations exceeding that.

Key cost drivers include:

- The Lookback Period: Correcting three months of transactions is different than correcting three years.

- Transaction Volume: The number of transactions to be corrected is a major factor.

- Number of Accounts: Reconciling two bank accounts and one credit card is simpler than untangling ten bank accounts, five credit cards, and multiple loan accounts.

- Complexity: Multi-currency transactions, inter-company loans, or specific revenue recognition rules (like ASC 606 for SaaS) add layers to the project.

View this as a one-time investment in building a reliable financial foundation to prevent costly strategic mistakes.

How Long Does the Cleanup Process Take?

A founder trying to DIY a cleanup will sink 40-60 hours into it over several months. A dedicated firm is significantly faster.

Most cleanup projects are completed within 10 to 20 business days from kickoff. This timeline allows for a thorough diagnostic, meticulous reconciliation of every account, transaction re-categorization, and a final review session with your team. The goal is to get you clean, trustworthy financials fast, so you can get back to business.

What Specific Deliverables Should I Expect?

A professional cleanup is more than just tidying up your file; it's about delivering a complete solution.

"A successful cleanup delivers two things: perfectly accurate historical financials and a clear, optimized system so the mess doesn't happen again. One without the other is a job half-done." – Jessica Martin, Lead Controller at Jumpstart Partners

You should expect a package that includes:

- A Fully Reconciled QuickBooks File: Every bank, credit card, and loan account is reconciled to its statement. The balance sheet is fully substantiated, meaning every number has a clear source of truth.

- Corrected Financial Reports: You receive an accurate, investor-ready Profit & Loss statement, Balance Sheet, and Statement of Cash Flows covering the entire cleanup period.

- A Final Review Session: We schedule a meeting to walk you through the corrected reports, explain the key changes we made, and answer all of your questions.

This process ensures you not only get clean books but also truly understand the story your new, accurate numbers are telling.

Stop letting messy financials create uncertainty and risk. The expert team at Jumpstart Partners delivers a comprehensive, fixed-fee QuickBooks cleanup that provides the clarity you need to scale with confidence. Schedule your complimentary QuickBooks review today.