Financial Operations

The Founder's Guide to Bookkeeping Services for Small Businesses

Discover how bookkeeping services for small businesses provide the financial clarity needed to scale, secure funding, and make smarter growth decisions.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··22 min readYour business is scaling fast, but are your books keeping up?

As your company blows past the $1M revenue mark, your focus is on product, sales, and growth—not on reconciling Stripe payouts or digging through emails for receipts. But here's the problem: the very growth you're driving creates a level of financial complexity that spreadsheets and a part-time bookkeeper can no longer handle. This is the exact point where promising companies hit a scalability wall.

Delayed or messy financials aren't just an administrative headache; they are a direct threat to your ability to scale. Bad books hide your true cash position, bring investor due diligence to a grinding halt, and lead to expensive compliance mistakes that quietly bleed your company dry.

The True Cost of Flying Blind

The problem goes much deeper than just a messy QuickBooks file. When you lack a clear, real-time view of your finances, you make critical decisions in the dark.

This leads to major judgment errors:

- Hiring Decisions: You over-hire because you’re looking at inflated revenue numbers, or you hesitate on a critical hire because you have zero confidence in your cash flow projections.

- Expansion Plans: Launching a new product or entering a new market demands precise capital allocation. Bad data leads to miscalculated burn rates and underfunded projects that are doomed from the start.

- Investor Confidence: Nothing kills a fundraising conversation faster than disorganized financials. It’s an immediate red flag that signals operational weakness, forcing investors to either slash your valuation or walk away.

The sheer size of the bookkeeping market—a massive $191.48 billion slice of the global accounting industry—is driven by this exact reality. Scaling businesses like yours move beyond DIY solutions because they need professional oversight to stay compliant and make strategic moves.

Ultimately, professional bookkeeping isn't just about cleaning up the books. It's about turning your financial operations from a reactive, chaotic mess into a proactive, strategic asset. It gives you the clarity you need to steer your company's growth with confidence. If you're starting to see the cracks in your current process, it's time to find out if these are the signs you've outgrown your bookkeeper.

The Four Pillars of High-Impact Bookkeeping

Let's be blunt: most bookkeeping just checks boxes. It tells you where your money went last month. That’s it.

High-impact bookkeeping is different. It builds the financial foundation your business needs to make smart, forward-looking decisions. It’s the difference between looking in the rearview mirror and having a clear GPS for the road ahead. This isn’t just about entering transactions; it’s about creating the operational clarity you need to manage cash, keep investors happy, and plan your next big move.

These four pillars are what you should expect from any professional bookkeeping service worth its salt. They are non-negotiable.

When you're growing fast, it's incredibly easy for things to spiral into financial chaos. This is precisely why a solid bookkeeping foundation is so critical.

As you can see, messy books aren't just an annoyance; unmanaged growth leads directly to mismanaged financials, which poses a serious threat to your company's ability to scale.

Here’s a breakdown of the core services that prevent this from happening, what they actually involve, and why they’re so important.

Core Bookkeeping Services Breakdown

| Service Component | Key Activities | Business Impact | Red Flag if Missing |

|---|---|---|---|

| Reconciliations | Matching every transaction in your accounting software to bank and credit card statements. | Guarantees every dollar is accounted for, preventing cash leaks and ensuring data accuracy. | Your reports are based on guesswork, not reality. A huge audit risk. |

| Revenue Recognition | Correctly recording revenue as it's earned, not just when cash is received (accrual basis). | Provides a true picture of performance; critical for GAAP compliance and investor trust. | Inflated or deflated monthly numbers, leading to terrible strategic decisions. |

| Payroll Admin | Recording payroll runs, tax withholdings, and benefit contributions in the general ledger. | Ensures accurate labor cost tracking and tax compliance, avoiding costly penalties. | Labor costs are a mystery, and your P&L is fundamentally wrong. |

| Month-End Close | Reviewing and finalizing all accounts to produce accurate financial statements on a tight deadline. | Delivers timely, reliable data so you can make decisions based on what happened last month, not six weeks ago. | Decisions are based on stale data, making you slow and reactive. |

These aren't just tasks on a checklist; they are interconnected processes that create a reliable financial picture of your business. Let's dig into what each one really means for you.

Pillar 1: Meticulous Reconciliations

At its heart, this is the simple act of making sure the numbers in your accounting software perfectly match your bank and credit card statements. Down to the penny.

But it’s about more than just catching a bank error. It’s about verifying that every single dollar that came in or went out of your business has been correctly categorized. This is the bedrock of trustworthy financial data.

A key part of this is having a clear system for tracking business expenses. Without one, reconciliations become a nightmare of mystery charges and uncategorized transactions, making it impossible to get an accurate view of your profitability.

Pillar 2: Accurate Revenue Recognition

This is absolutely critical for any business with contracts, like SaaS companies, digital agencies, or professional services firms. You cannot just book the full value of a yearly contract in the month a client signs.

Let's say you sign a $120,000 annual contract on January 1st. A rookie bookkeeper logs the whole $120,000 as January revenue. This dangerously inflates your monthly metrics and gives you a completely false sense of security.

The right way—the GAAP-compliant way—is to recognize only the revenue you've actually earned each month.

- Total Contract Value (TCV): $120,000

- Contract Term: 12 months

- Monthly Recognized Revenue: $120,000 / 12 = $10,000

- Deferred Revenue (End of Jan): $110,000 (This is a liability on your balance sheet, representing the service you still owe the client).

This approach provides a true picture of your Monthly Recurring Revenue (MRR) and is the only way investors or auditors will take your financials seriously.

Pillar 3: Streamlined Payroll Administration

Payroll is so much more than just cutting checks. It’s a complex web of withholdings, tax filings, benefits administration, and compliance with a mess of state and federal rules. Mistakes here are painful, leading to steep penalties and unhappy employees.

A quality bookkeeping service doesn’t just run payroll; it ensures every run is perfectly recorded in your general ledger. They integrate directly with platforms like Gusto or BambooHR, correctly posting entries for gross wages, taxes, and benefit costs. This is a vital piece of any financial reporting automation strategy.

"A common mistake I see is founders treating payroll as a separate, isolated task. In reality, it's deeply integrated into your financial health—affecting cash flow, tax liability, and your P&L. Getting it wrong creates messy data that takes weeks to unwind." — Jonathan Wu, CPA

Pillar 4: A Disciplined Month-End Close

The month-end close is the process of reviewing, adjusting, and locking down all your accounts to produce accurate financial reports. For a growing business, speed and accuracy are everything.

If your close takes 30 or 45 days, you're making decisions based on data that is six weeks old. That’s an eternity in a competitive market.

A disciplined 5-day close is not a vanity metric; it’s a competitive advantage. It gives you a near-real-time view of your performance so you can react quickly. Think of it as your company's financial sprint at the start of every month.

Here’s what a tight, professional process looks like:

| Day | Key Activities | Outcome |

|---|---|---|

| Day 1 | Reconcile cash, credit cards, and accounts payable. | Cash position confirmed. |

| Day 2 | Record accruals for expenses incurred but not yet paid. | Expense accuracy improved. |

| Day 3 | Finalize revenue recognition and deferred revenue entries. | Revenue metrics are accurate. |

| Day 4 | Reconcile all balance sheet accounts and run variance analysis. | Financial statement integrity verified. |

| Day 5 | Final review and delivery of the financial reporting package. | Actionable insights for leadership. |

This disciplined cycle is what transforms your financial data from a historical record into a powerful tool for making smarter, faster decisions.

How to Evaluate and Choose Your Financial Partner

Not all bookkeeping services are created equal. A firm that’s brilliant with local construction companies won't understand the first thing about your SaaS deferred revenue schedule. Choosing the right financial partner isn't about finding a data entry clerk; it's about hiring a specialist who understands your industry’s unique financial DNA.

This is a critical decision. The right partner gives you the financial clarity to scale, while the wrong one creates costly messes that take months—or even years—to unravel. This choice directly impacts your ability to raise capital, manage cash flow, and make informed strategic bets.

Outsourcing is now the standard for SaaS firms and agencies scaling past the $1M ARR mark. Founders slash overhead by handing off their ledgers to experts, freeing themselves up to chase growth instead of reconciling Stripe payments.

Critical Questions for Potential Providers

Before you sign any engagement letter, you need to do your homework. Think of this as interviewing a key executive for your team, because that’s exactly what you’re doing. Arm yourself with these questions to separate the true experts from the generalists.

Here’s a checklist to guide your conversations:

- Industry Expertise: "Can you walk me through how you handle revenue recognition for a SaaS company under ASC 606?" Or, "How do you manage project-based accounting for a digital agency?" Their answer will instantly reveal if they have genuine experience or are just reading from a script.

- Team & Credentials: "Who will be my day-to-day contact, and what are their qualifications? Are they a US-based, CPA-certified professional?" You need to make sure you won’t be handed off to an inexperienced junior associate after the sales pitch.

- Tech Stack Integration: "Our stack is QuickBooks, Stripe, Gusto, and NetSuite. What's your experience integrating these tools, and how do you ensure data flows accurately?" A top-tier provider acts as a hub, seamlessly connecting your financial ecosystem.

- Security & Compliance: "What are your data security protocols? Are you SOC 2 compliant?" Handing over your financial data requires absolute trust. Bank-level security is the bare minimum.

- Reporting & Cadence: "What does your standard monthly financial package include? Can you show me a sample P&L, Balance Sheet, and Cash Flow Statement?" Vague answers are a huge red flag. They should have a clear, polished deliverable they’re proud to show you.

Remember, finding the right software is just as crucial as finding the right service partner. Dive deeper with our guide on choosing accounting software for your growing business for more on that.

Red Flags to Watch Out For

Just as important as asking the right questions is recognizing the warning signs of a low-quality provider. In your conversations, stay alert for these red flags that signal a provider simply can't deliver the level of service a scaling business demands.

"The biggest mistake founders make is hiring a bookkeeper who only knows how to record history. You need a partner who understands your business model and can translate the numbers into forward-looking insights. If they can't talk fluently about your key metrics, they're the wrong fit." — Alex Williams, Fractional CFO

Here are the immediate deal-breakers:

- Vague Answers on Industry Nuances: If they stumble when asked about MRR, ARR, churn, or deferred revenue, they don't understand your business. For a SaaS company, this is non-negotiable.

- No Accuracy Guarantee: A confident firm will stand behind its work. If they don’t offer any guarantee of accuracy, it suggests they either lack confidence in their processes or don't have adequate quality controls in place.

- Lack of a Dedicated Team: Being passed around a call center or a generic support desk is inefficient and beyond frustrating. You need a consistent point of contact who knows your business inside and out.

- Outdated Technology: If their process leans heavily on manual data entry, spreadsheets, and email, they are inefficient and prone to error. Look for firms that embrace automation and modern financial tools like Xero and Shopify.

Choosing the right bookkeeping partner is a strategic decision that pays dividends in operational efficiency, investor confidence, and your own peace of mind. Take the time to evaluate providers thoroughly to find a partner who will truly support your growth journey.

Budgeting for Bookkeeping Services: A Practical Breakdown

How much should professional bookkeeping really cost? If you’re only thinking about the monthly invoice, you’re missing the bigger picture. The true cost isn’t just the fee you pay; it’s the massive hidden expense of running on messy, outdated financials versus the value you unlock with accurate, timely numbers.

Investing in expert bookkeeping is not an expense line item. It's a strategic move that directly sharpens your cash flow management, boosts your company's valuation, and gives you the confidence to make smart growth decisions. The goal here is to shift the conversation from "How much does it cost?" to "What's the return on this investment?"

Unpacking Common Pricing Models

As you start looking for a provider, you'll run into three main ways they structure their fees. Getting a handle on these is the first step to setting a realistic budget and making sure there are no surprises down the road.

- Hourly Rates: Common for messy cleanup projects or one-off consulting gigs. It seems flexible, but it’s a nightmare for budgeting ongoing work and creates an incentive for inefficiency—the longer it takes, the more they make.

- Fixed Monthly Fees: This is, hands down, the best model for most scaling businesses. You pay a predictable amount each month for a clearly defined set of services. This predictability is huge for budgeting, and it aligns everyone’s goals. Your provider is incentivized to be efficient and accurate.

- Project-Based Fees: You’ll see this for specific, one-time engagements like a historical books cleanup, migrating accounting systems, or getting you ready for an audit. It gives you a clear, upfront cost for a single, intensive effort.

For any business in the $500K to $20M revenue range, a fixed monthly fee delivers the best mix of predictable costs and comprehensive service. It lets you budget like a grown-up and build a real partnership with your finance team.

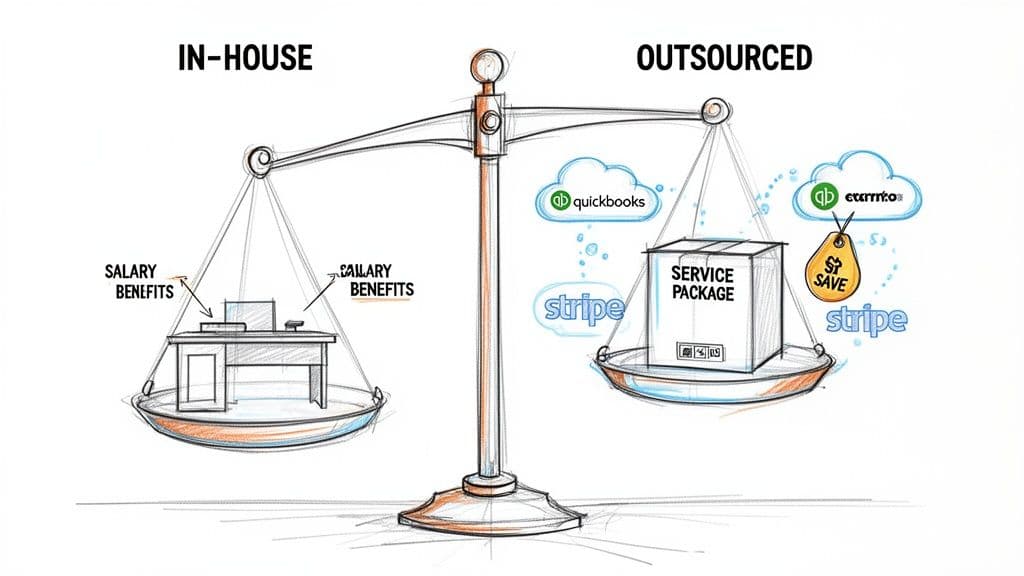

In-House vs. Outsourced: A Worked Calculation

So, why not just hire someone? It's the default move for many founders, but the real cost of an employee is so much more than their salary.

Let's run the numbers for a hypothetical $5M ARR SaaS company based in a major tech hub to see how this plays out.

A great rule of thumb comes from OpenView's 2024 SaaS Benchmarks, which shows that companies in the $1M-$20M ARR range typically spend 1-2% of their revenue on their finance function (G&A, not counting executive pay). For a $5M business, this puts your target annual finance spend between $50,000 and $100,000.

Let’s put the fully-loaded annual cost of a senior in-house bookkeeper head-to-head with a comprehensive outsourced service.

Cost Comparison: In-House vs. Outsourced Bookkeeping ($5M ARR SaaS Co.)

Here’s a side-by-side breakdown of the real annual costs you can expect.

| Cost Component | In-House Bookkeeper (Annual Cost) | Outsourced Service (Annual Cost) |

|---|---|---|

| Base Salary / Service Fee | $75,000 | $48,000 ($4,000/month) |

| Payroll Taxes & Benefits (30%) | $22,500 | $0 |

| Recruiting & Onboarding | $10,000 | $0 |

| Software & Training | $2,500 | Included |

| Overhead (Office, IT) | $5,000 | $0 |

| Total Annual Cost | $115,000 | $48,000 |

The results are stark. In this scenario, the outsourced service delivers a $67,000 annual savings—that's a 58% reduction in cost. And this calculation doesn't even touch on the opportunity cost of your time spent managing an employee versus partnering with a team of experts.

The numbers don't lie. For most businesses in this revenue bracket, outsourcing gives you access to a much higher level of expertise—often including controller oversight and CPA review—for a fraction of what a single full-time hire would cost. You get an entire finance team for less than the price of one employee.

This isn't just about saving money. It's about freeing up critical capital and leadership bandwidth so you can focus on what you actually do best: growing the business. The right financial partner doesn't just manage your books; they create the operational leverage you need to scale.

The Real-World ROI of Expert Bookkeeping

It's one thing to talk about pricing models and service features. It's another thing entirely to see the actual financial impact in your bank account. Investing in a professional bookkeeping service isn't just another operational cost—it's a direct driver of profitability, efficiency, and a massive strategic advantage. You will stop making decisions based on old data and gut feelings and start executing with precision, backed by reliable, investor-ready financials.

This isn't about small, incremental improvements. We’re talking about a fundamental shift in how you manage and scale your company. Let’s get out of the abstract and look at a concrete example of the returns you should expect.

Case Highlight: A Digital Agency’s Turnaround

Picture a typical $10M digital agency. Before they brought in expert help, their financial operations were a complete mess. The month-end close dragged on for a painful 45 days, which meant the leadership team was always running the business based on information that was six weeks out of date. Their books were a tangled web of miscategorized project costs and improperly recognized revenue, making it impossible to see which clients were actually profitable.

This financial fog had real consequences. Banks repeatedly denied them a favorable line of credit because they simply couldn't trust the numbers. Cash flow was a constant source of anxiety, and they had no clear line of sight into their financial runway.

But after transitioning to a professional outsourced bookkeeping service, the change was immediate and profound.

From Chaos to Clarity: The Financial Payback

Within just 90 days, the agency achieved a disciplined 5-day close. This newfound speed and accuracy unlocked several critical wins that perfectly illustrate the tangible ROI of expert bookkeeping services for small businesses.

Here’s a breakdown of the specific, calculated outcomes:

- Improved Access to Capital: With clean, timely financials, the agency finally secured a line of credit with a 1.5% lower interest rate. On a $500,000 credit line, this translated directly to $7,500 in annual interest savings. Cold, hard cash back in their pocket.

- Uncovered Profitability: A deep dive into their revenue recognition practices revealed significant errors. By correctly aligning project revenue with the costs incurred under accrual accounting, they uncovered $47,000 in previously unrecognized profit from the prior fiscal year.

- Enhanced Cash Flow Management: The new service implemented a rigorous cash flow forecasting process. This clarity allowed the agency to optimize its billing cycles and vendor payments, slashing its cash conversion cycle from 75 days down to just 45—a 40% improvement. This freed up a huge amount of working capital, allowing them to invest in a key hire without taking on new debt. You can explore similar strategies with our guide to the 13-week cash flow forecast.

The "after" state was a completely transformed business. They had investor-ready financials on demand, clear KPIs to track performance, and the operational confidence to make bold, strategic moves. Expert bookkeeping gives you the clear insights needed to use powerful tools, like a Profit and Loss Analyzer, to truly understand performance. This agency didn't just clean up its books; it built a financial engine for scalable, predictable growth.

Your Action Plan for a Seamless Switch

Reading a guide is one thing. Actually making the move is where the real growth happens. It's time to go from understanding why you need professional bookkeeping to actually getting it done.

A smooth transition is not an accident. It's the result of a clear, structured plan that keeps business running as usual and gets you to the good stuff—valuable financial insights—as fast as possible. This is your roadmap for getting started from day one.

This isn’t just about handing over your passwords. It's a collaborative kickoff designed to get your new financial partner completely in sync with your business goals, ensuring they deliver the exact insights you need to scale.

The Migration and Onboarding Checklist

A fast, effective start begins with getting your documents and system access in order. The more prepared you are, the faster your new team can hit the ground running. Your provider will absolutely guide you, but having these items ready shaves days, or even weeks, off the process.

Here’s where to begin:

- Gather Your Documents: Pull together the last 12 months of bank and credit card statements, your prior year's tax returns, payroll records from providers like Gusto, and any existing financial reports you have.

- Provide System Access: Grant secure, user-limited access to your accounting software (QuickBooks or Xero), payment processors like Stripe or Shopify, and your bank accounts. Any reputable firm will use bank-level security to keep this data locked down.

- Define Your Needs: Get specific about what you need to see. What are the top 3-5 metrics that drive your business? Do you need reports formatted for investors or specific dashboard integrations?

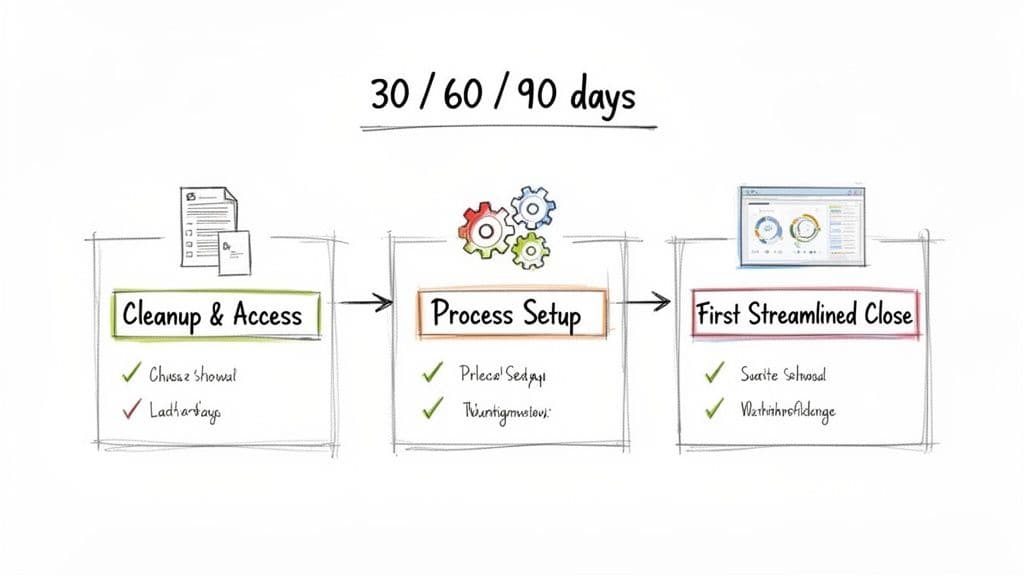

The First 90 Days: What to Actually Expect

The first few months are all about cleanup, system building, and stabilization. This is where the foundation for long-term financial clarity gets laid. If your books are a mess, the process will likely start with a dedicated cleanup project.

You can learn more about what that entails in our detailed guide to the QuickBooks cleanup process.

Here's what that timeline usually looks like:

- First 30 Days: Discovery and Cleanup. Your new team dives in to reconcile past accounts, hunt down legacy errors, and build a chart of accounts that actually reflects your business model.

- First 60 Days: Building the Machine. With a clean foundation, the team builds and refines your month-end close process. They will work on automating data feeds from your tech stack and produce the first complete financial package for you to review.

- First 90 Days: Smooth Sailing. By now, the process should be running like clockwork. You get your first 5-day close, review your new KPI dashboard, and have a strategic call to discuss what the accurate, timely numbers are telling you.

You've done the research. You know the value. The only thing left is to get a plan tailored for your business.

Ready to transform your financial operations? Schedule a consultation with our team today to build your seamless transition plan.

Common Objections & Burning Questions

Even after mapping everything out, most founders still have a few nagging questions before handing over their books. We get it. Here are the straight answers to the questions and common objections we hear most often from leaders of growing companies.

"Can't I just wait until we're bigger?"

The honest answer? Yesterday was the right time.

The real trigger is when your finances become a bottleneck. If you're spending more than a couple of hours a month wrestling with your books, if your month-end close drags on for more than a week, or if you feel a pit in your stomach when trying to use your numbers for strategic planning, it's time. For businesses pulling in between $500K and $20M in revenue, the game changes. Transaction complexity, payroll, and compliance rules demand an expert. The goal is to make the switch before messy books blow up a funding round or trigger a painful tax audit.

"What’s the difference between a bookkeeper and an accountant?"

This is a crucial one, and people mix them up all the time.

Think of a bookkeeper as the person meticulously recording the daily financial plays of your business—reconciling accounts, logging payroll, and categorizing every single transaction. Their job is to keep your general ledger clean and current. They’re in the trenches, every day.

An accountant or CPA is like the head coach. They take the data the bookkeeper organizes and use it for higher-level strategy. They prepare official financial statements, map out tax strategies, and give you advice on the financial health of your business. A top-tier outsourced service bundles both, giving you a bookkeeper for the daily grind and a controller or CPA for review and strategic oversight.

"Can I switch if I already have a bookkeeper?"

Absolutely. This happens all the time. A professional firm will quarterback the entire transition so you don't have to.

The process usually involves a secure handoff of your accounting file (like a QuickBooks backup), setting up new permissions, and a final review of the old bookkeeper's work. This last step is key—it lets us catch and fix any lingering errors from the past.

The whole thing is designed to be completely seamless with zero interruption to your daily operations. A good provider will have a clear communication plan from day one, so everyone knows exactly what's happening and when.

Ready to get the financial clarity your growing business demands? The team at Jumpstart Partners delivers investor-ready financials with a guaranteed 5-day close, freeing you to focus on scaling your company. Schedule a free consultation today.