Financial Operations

The 7 Best Outsourced Accounting Services for Growing Businesses in 2026

Discover the best outsourced accounting services for SaaS, agencies, and e-commerce. Compare top providers to scale your financial operations and drive growth.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··23 min readYou've crossed the $500K revenue mark, and the financial processes that got you here are now holding you back. Your DIY QuickBooks setup and part-time bookkeeper can no longer handle the complexity of ASC 606 revenue recognition, sales tax nexus, or investor-ready reporting. Your simple P&L doesn't provide the strategic foresight you need to make critical decisions.

This isn't just an administrative headache; it's a direct threat to your growth. The average business at your stage wastes over 15 days just closing the books each month—time you should be spending on strategy, not chasing down receipts. The alternative, hiring a full-time Controller, comes with a hefty price tag of $150,000+ per year, a cost most businesses under $20M can't justify. This creates a dangerous gap between your operational needs and your financial capabilities.

This guide cuts through the noise. We’ve evaluated the best outsourced accounting services specifically for founders and finance leaders at SaaS, professional services, and digital agency firms. Forget generic overviews. Here, you'll find direct comparisons, specific calculations, and clear guidance on which service aligns with your industry, revenue stage, and growth goals.

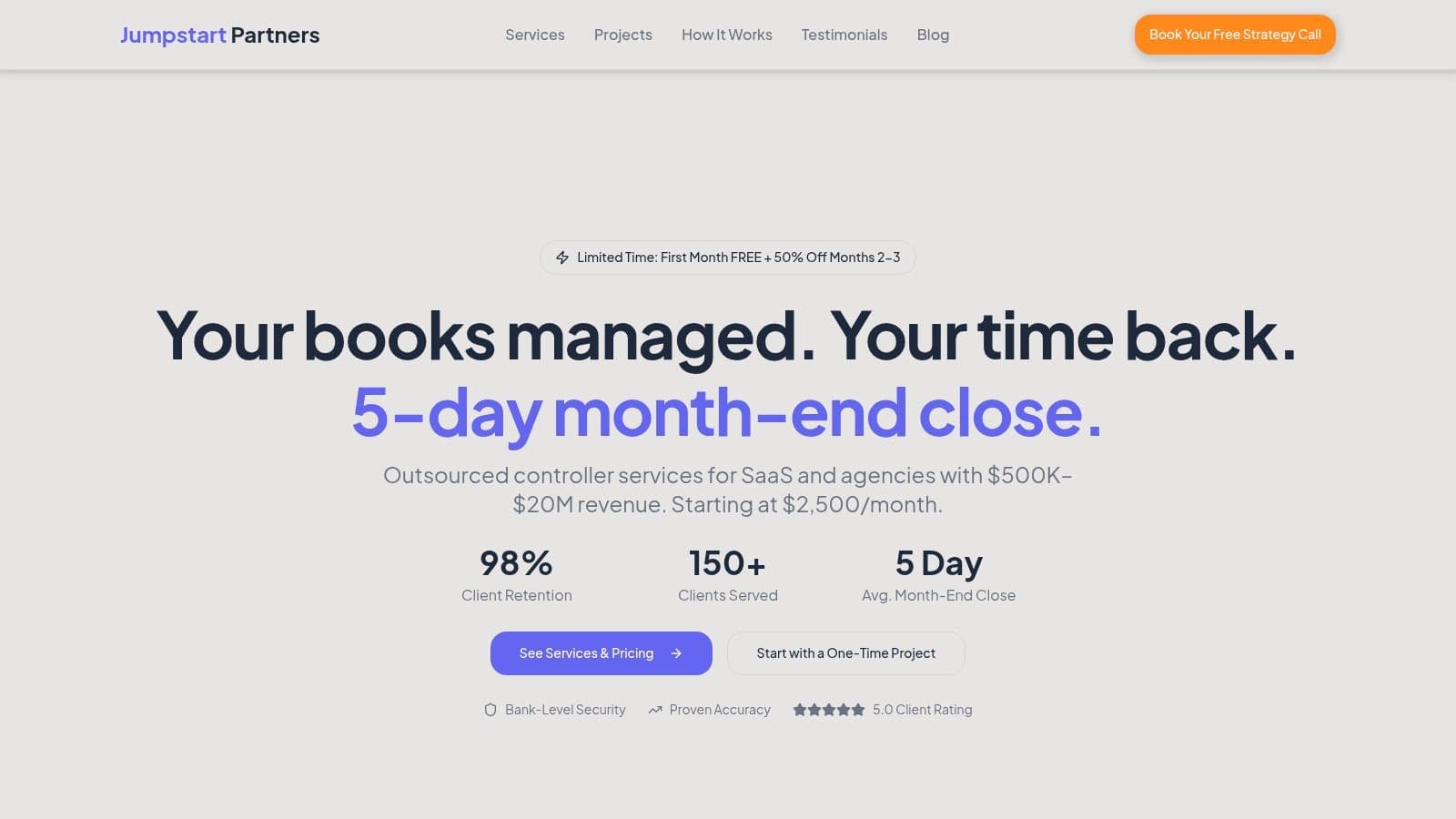

1. Jumpstart Partners

Best for: Investor-Ready Financial Operations & Fast Month-End Close

Jumpstart Partners delivers a complete, investor-grade financial operations engine for high-growth SaaS, agencies, and professional services firms generating between $500K and $20M in annual revenue. They don't just handle your books; they function as your outsourced controller, providing the speed, accuracy, and strategic insight you need to secure funding and scale confidently.

This service is built for founders who are preparing for a due diligence process, struggling with a 15+ day month-end close, or need accurate SaaS metrics to drive decisions. Jumpstart professionalizes your finance function without the high cost and long ramp-up time of an in-house hire.

Why It Stands Out: Speed, Security, and Strategic Insight

Jumpstart Partners distinguishes itself with specialized expertise, rigorous security protocols, and a results-driven approach that delivers tangible business outcomes.

- Rapid, Reliable Month-End Close: Jumpstart consistently delivers a 5-day average month-end close. This speed gives you a real-time view of your financial health for agile decision-making. For a SaaS company with a standard 15-day close, that’s 10 extra days every month to act on accurate data. For SaaS companies, this includes precise ASC 606 revenue recognition, a non-negotiable for audits and investor reporting.

- Institutional-Grade Trust and Security: Trust is paramount. Jumpstart addresses this with a US-based, CPA-led team, SOC 2 Type II compliance, and bank-level security. They back their work with a 99.8% accuracy guarantee and a promise to fix any errors at their own expense, minimizing your financial risk.

- Actionable SaaS & Agency Metrics: Beyond standard financials, Jumpstart delivers KPI dashboards tracking critical metrics like MRR/ARR, Customer Acquisition Cost (CAC), and cash flow. This transforms your financial data from a historical record into a forward-looking strategic asset.

Key Features & Pricing

Jumpstart's service model is designed for flexibility. They offer tiered monthly plans, month-to-month contracts, and fixed-fee projects to meet specific, immediate needs.

| Service Tier/Project | Ideal For | Starting Price | Key Deliverables |

|---|---|---|---|

| Starter Plan | Businesses solidifying financial processes | $2,500/month | Core bookkeeping, reconciliations, 5-day close, standard reporting |

| Growth Plan | Scaling companies needing deeper insights | $4,500/month | All Starter features + KPI dashboards, ASC 606, AR/AP management |

| Scale Plan | Companies preparing for audit or seeking a CFO-lite function | $7,500/month | All Growth features + investor relations support, advanced forecasting |

| QuickBooks Cleanup | Companies with messy or backlogged books | $3,500-$5,000 (Fixed) | Reconciling past accounts, correcting errors, creating an audit-ready ledger |

| Cash Flow Sprint | Businesses needing immediate cash management help | $2,500-$4,000 (Fixed) | 13-week cash flow forecast and management plan to improve liquidity |

They mitigate adoption risk with promotional pilots, such as a first-month-free offer, and a 30-day money-back guarantee. For leaders weighing this model, their guide on an in-house vs. outsourced controller provides a detailed decision framework.

Pros and Cons

Pros:

- Fast, Investor-Ready Reporting: The 5-day close and ASC 606 compliance are major advantages for scaling SaaS companies.

- High Trust & Security: SOC 2 Type II compliance and a CPA-led, US-based team provide institutional-level peace of mind.

- Proven Results: Strong social proof includes a 98% client retention rate and an average of $47K+ in errors found per client.

- Flexible Engagement: Month-to-month contracts and fixed-fee projects offer flexibility that annual commitments do not.

Cons:

- Price Point: With starter plans at $2,500/month, it is a premium service best suited for businesses with established revenue ($500K+), not pre-revenue startups.

- Not a Full CFO Replacement: While providing controller and CFO-level insights, companies with highly complex, multi-national tax or legal structuring will still need specialized local advisors.

Learn more by visiting Jumpstart Partners.

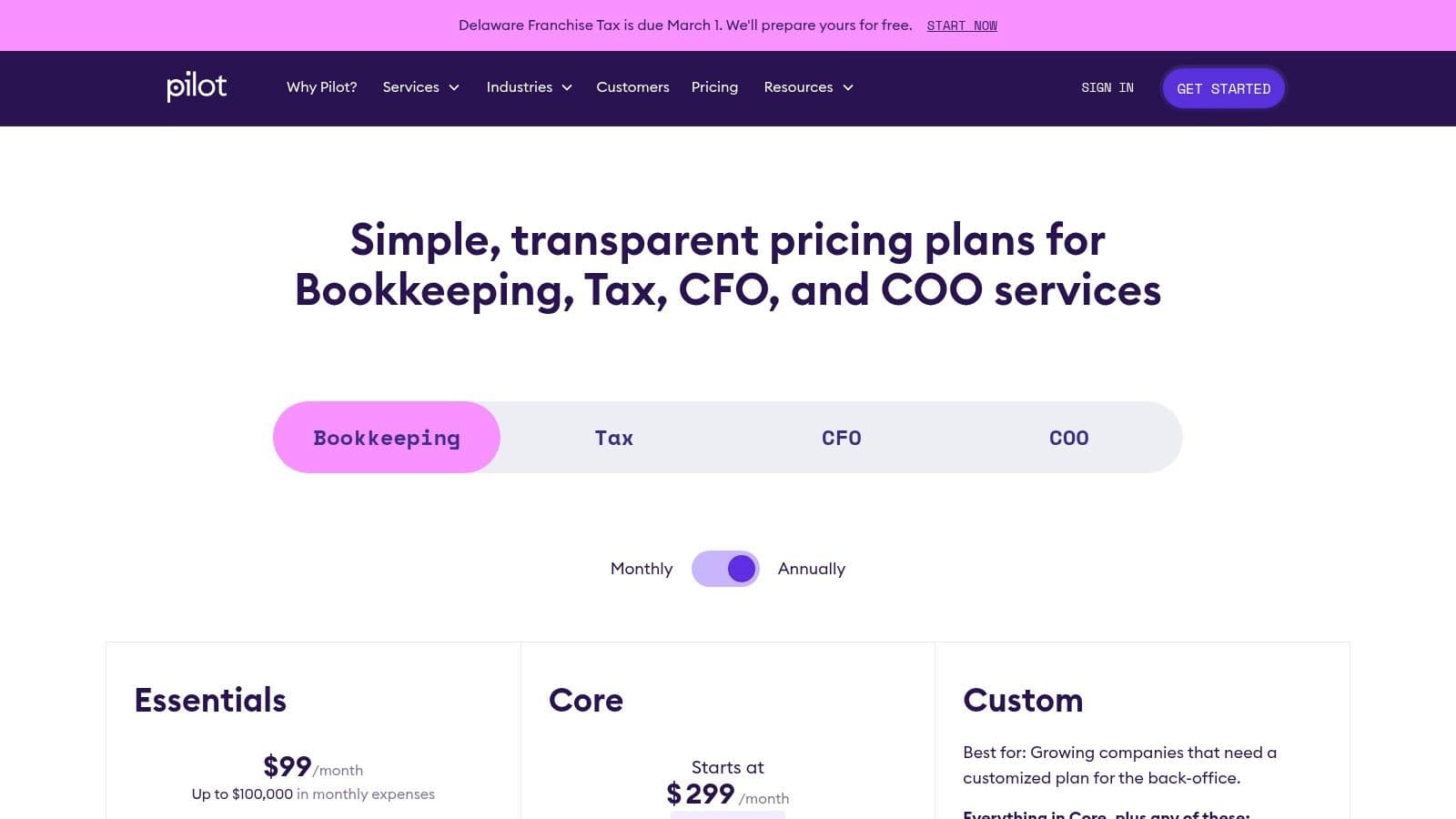

2. Pilot

Pilot is purpose-built for technology startups and high-growth companies that need meticulous, investor-grade financials without the in-house overhead. It excels at serving venture-backed SaaS, e-commerce, and professional services firms that are scaling quickly and require a clear path from simple bookkeeping to more complex financial operations. What makes Pilot one of the best outsourced accounting services is its hybrid approach, combining AI-powered automation for efficiency with dedicated, US-based finance experts for accuracy and strategic guidance.

This structure allows you to start with an automated, cash-basis solution and seamlessly upgrade to a human-led, accrual-basis model as your business complexity and reporting requirements increase, such as when you’re preparing for a funding round or need to manage deferred revenue.

Key Features and Ideal Fit

Pilot offers a tiered service model designed to grow with your startup.

- Essentials Plan: This AI-assisted plan is ideal for early-stage startups with straightforward finances. It automates transaction categorization and bank reconciliations to deliver monthly, cash-basis financial statements. It's a cost-effective way to get clean books from day one.

- Core Plan: As you grow, the Core plan provides a dedicated, US-based bookkeeper, a custom chart of accounts, and the choice between cash or accrual-basis bookkeeping. This is the right fit when you need to track SaaS metrics like MRR, manage inventory, or prepare financials for investors and board members.

- Startup-Centric Integrations: Pilot integrates directly with the startup tech stack, including Stripe, Gusto, QuickBooks, NetSuite, and inventory management platforms, ensuring data flows seamlessly without manual entry.

- Strategic Financial Tools: Beyond bookkeeping, Pilot offers industry-specific KPI dashboards and scenario planning. This gives you forward-looking insights, which are critical for effective financial management. To build on this, you can explore advanced techniques by learning more about cash flow forecasting best practices for a complete financial picture.

Pricing and Onboarding

Pilot's "Essentials" plan starts at a transparent monthly price, designed for businesses with less than $30,000 in monthly expenses. The "Core" plan pricing is customized based on your monthly expenses, transaction volume, and overall complexity. While not fully transparent online, this tailored approach ensures you pay only for the services you need.

The onboarding process is particularly friendly for new companies, with options to support businesses formed on platforms like Stripe Atlas or banking with Mercury.

Website: https://pilot.com

Pros & Cons

| Pros | Cons |

|---|---|

| Clear Scalability Path: Move from AI-driven cash-basis to expert-led accrual accounting as needed. | Essentials Plan Limitations: Cash-basis only, which is unsuitable for most SaaS models. |

| Investor-Grade Reporting: Delivers the financial rigor and reporting VCs and boards expect. | Opaque Core Pricing: Custom quotes make direct price comparisons difficult. |

| Startup Ecosystem Focus: Integrations and onboarding are tailored to the modern tech stack. | Less Suited for Non-Tech: Businesses outside SaaS or e-commerce may not maximize its value. |

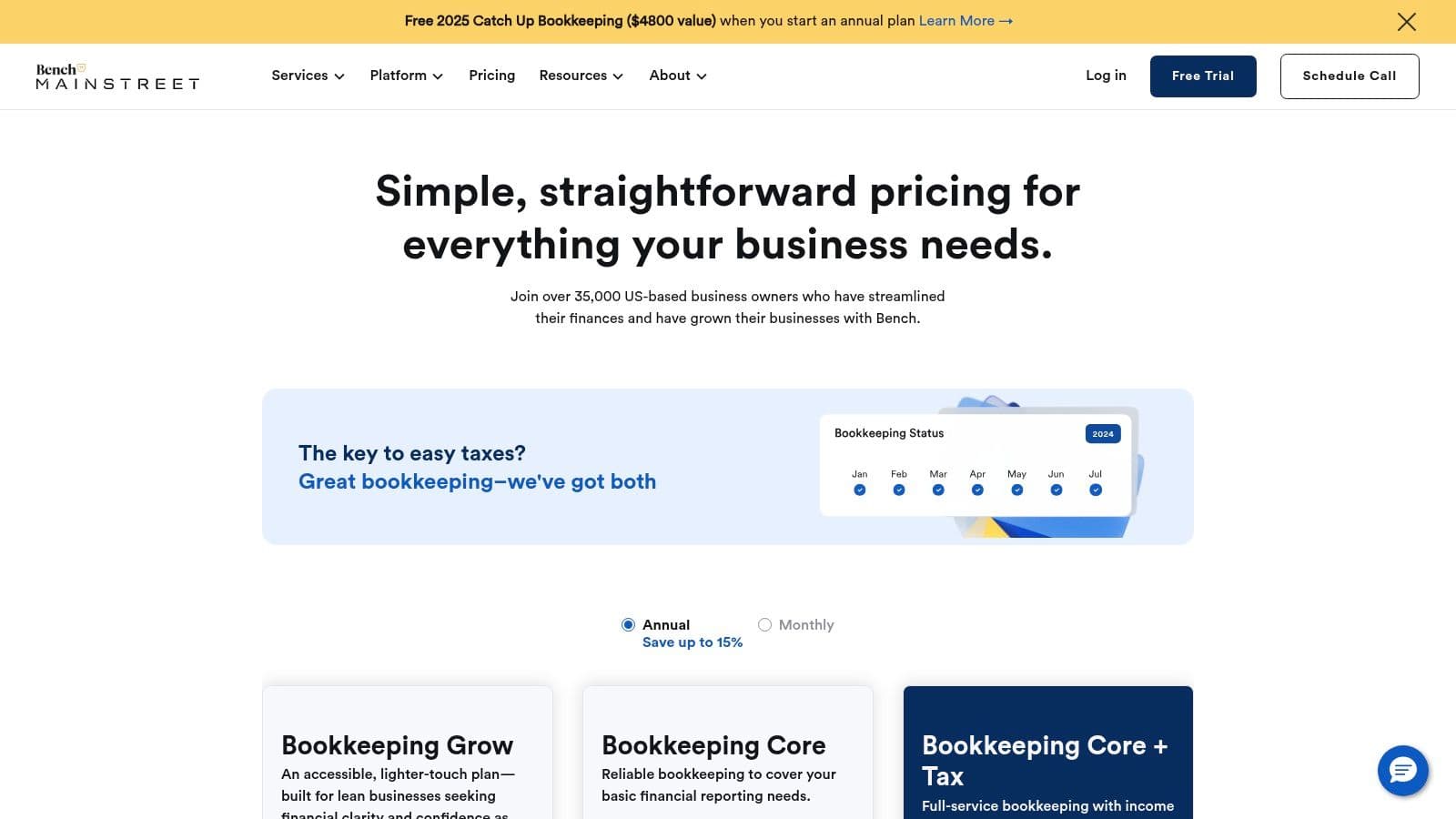

3. Bench

Bench delivers a streamlined, tech-enabled bookkeeping service designed for small to mid-size businesses that need reliable monthly financials and optional tax support without the complexity of a full-stack finance team. It is ideal for service-based businesses, freelancers, and small e-commerce stores that prioritize a hands-off, productized solution. What makes Bench one of the best outsourced accounting services is its fusion of a user-friendly software platform with a dedicated, US-based human bookkeeping team, offering a predictable and turnkey financial management experience.

This model removes the burden of day-to-day transaction management, providing you with a clear set of monthly financial statements and year-end reports. For business owners who want their bookkeeping and annual tax filing handled under one roof, Bench’s integrated service provides a simple, all-in-one solution.

Key Features and Ideal Fit

Bench offers a straightforward service package focused on core bookkeeping and tax needs.

- Dedicated Bookkeeping Team: You are assigned a dedicated team of bookkeepers who learn your business, categorize transactions, and prepare your monthly financial statements. This human-in-the-loop approach ensures accuracy and provides a consistent point of contact.

- Integrated Tax Services: As an optional add-on, Bench provides a specialized tax team to handle your annual business and personal income tax returns. This bundling simplifies your year-end process, as your bookkeepers and tax preparers work in sync.

- Intuitive Software Platform: The Bench platform gives you a real-time view of your financial health with clear dashboards, downloadable reports (income statement, balance sheet), and direct messaging with your bookkeeping team.

- Modified Cash-Basis Accounting: Bench primarily uses a modified cash-basis system, which is suitable for many small businesses that don't require the complexities of GAAP-compliant accrual accounting. If you're looking for a simple way to manage your finances, exploring different bookkeeping services for small businesses can clarify which accounting method fits your needs.

Pricing and Onboarding

Bench is known for its transparent, flat-rate monthly pricing, a major advantage for businesses that need predictable costs. Plans are tiered based on your average monthly expenses, and you can choose to pay monthly or annually for a discount. They frequently offer free trials, allowing you to experience the service before committing.

The onboarding process is simple. You connect your bank accounts, credit cards, and payment processors to the Bench platform, and the team takes care of the historical bookkeeping and ongoing monthly closes.

Website: https://www.bench.co/pricing?utm_source=openai

Pros & Cons

| Pros | Cons |

|---|---|

| Transparent, Flat-Rate Pricing: Predictable monthly costs with no surprises. | Modified Cash-Basis Only: Unsuitable for SaaS or businesses requiring accrual accounting for investors. |

| All-in-One Bookkeeping and Tax: Simplifies year-end with an integrated team. | Not a Controller/CFO Service: Lacks strategic financial advice, forecasting, or cash flow management. |

| Dedicated Human Support: A consistent team understands your business context. | Limited Integrations: Less robust integration with complex startup tech stacks compared to competitors. |

4. QuickBooks Live Full-Service Bookkeeping

For businesses already deeply embedded in the Intuit ecosystem, QuickBooks Live Full-Service Bookkeeping offers a natural extension for outsourcing your accounting. It's designed for small to medium-sized businesses that use QuickBooks Online (QBO) and want the convenience of a bookkeeping service that lives directly inside their primary accounting software. This seamless integration is its core value proposition, eliminating the need to grant third-party access or manage separate platforms.

QuickBooks Live pairs you with a QuickBooks-certified, US-based bookkeeper who handles ongoing transaction categorization, reconciliations, and monthly financial reporting. This makes it one of the best outsourced accounting services for founders who prefer to keep their operations consolidated within a single, familiar environment, ensuring a low learning curve and straightforward communication.

Key Features and Ideal Fit

The service is built to be an easy add-on for existing QBO users, providing essential bookkeeping without the complexity of a full-stack finance team.

- Dedicated, Industry-Specific Bookkeeper: QuickBooks matches you with a bookkeeper who has experience in your industry, ensuring they understand the nuances of your business, whether you're a digital agency or a local service provider.

- Monthly Closes and Reporting: Your dedicated bookkeeper will close your books each month, reconcile accounts, and generate key financial reports like the Profit & Loss statement and Balance Sheet directly within your QBO dashboard.

- One-Time Cleanup Services: If your books have fallen behind, QuickBooks Live offers a one-time cleanup to get your accounts organized and accurate before starting the ongoing monthly service. For more complex historical issues, it's often wise to explore specialized QuickBooks cleanup services to ensure a solid foundation.

- Seamless In-Product Experience: From onboarding to monthly collaboration, every step happens inside your QuickBooks Online account. This integrated approach simplifies communication and document sharing.

Pricing and Onboarding

Pricing for QuickBooks Live is based on your average monthly expenses over a three-month period. It starts at a set monthly fee for businesses with lower expenses and scales up in clear tiers. This transparent pricing model is a significant advantage, as you know exactly what your costs will be upfront.

However, a subscription to a QuickBooks Online plan (Simple Start, Essentials, Plus, or Advanced) is a prerequisite, making it an additional cost to consider. The onboarding process is streamlined and begins directly within your QBO account after you sign up for the service.

Website: https://quickbooks.intuit.com/live/full-service-bookkeeping/?utm_source=openai

Pros & Cons

| Pros | Cons |

|---|---|

| Effortless for Existing QBO Users: No need to learn a new system or manage separate logins. | Requires QBO Subscription: The service is an add-on and not a standalone product. |

| Backed by Intuit Ecosystem: Leverages the robust support and resources of the QuickBooks brand. | Bookkeeping Only: This is not a full tax-filing or advisory service within the plan. |

| Transparent Tiered Pricing: Clear pricing based on monthly expenses makes budgeting easy. | Less Suited for High Complexity: Not robust enough for companies with complex revenue recognition or multi-entity structures. |

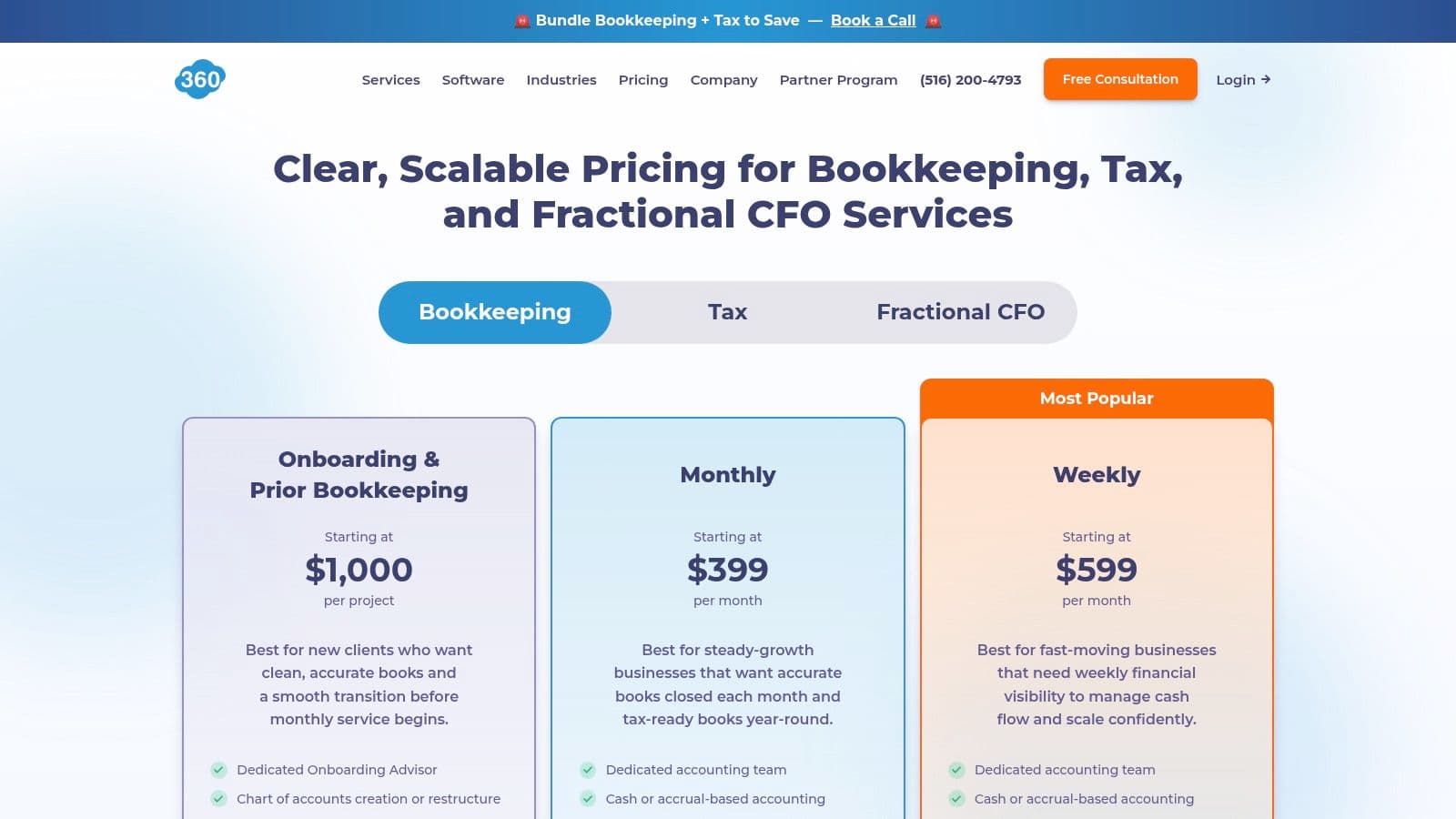

5. Bookkeeper360

Bookkeeper360 provides a comprehensive, US-based accounting solution ideal for growth-stage SMBs that need an integrated back-office partner. It stands out by combining dedicated human expertise with its proprietary software dashboard, giving you a real-time view of your financial health. This service is best for businesses that have outgrown basic bookkeeping and now require accrual-basis accounting, tax advisory, payroll management, and fractional CFO guidance all under one roof.

Unlike pure software platforms, Bookkeeper360 delivers a full-service experience with a dedicated accounting team that supports both QuickBooks Online and Xero. Its strength lies in its modular, menu-style pricing, allowing you to build a custom service package that scales from core bookkeeping to strategic financial oversight as your operational complexity increases.

Key Features and Ideal Fit

Bookkeeper360’s offerings are designed for businesses seeking a one-stop-shop for their financial operations.

- Dedicated Accounting Team: You are assigned a consistent team for either monthly or weekly bookkeeping services, ensuring they understand the nuances of your business. This allows for either cash or accrual-basis accounting.

- Proprietary KPI Dashboard: The Bookkeeper360 app and dashboard provide live financial data and key performance indicators, offering at-a-glance insights without needing to log into your accounting software. This is particularly valuable for e-commerce and SaaS businesses tracking metrics like MRR or COGS.

- Broad Tech Stack Integrations: The platform connects with essential business tools, including Shopify, Stripe, PayPal, and Gusto. This automation streamlines data flow from sales and payroll directly into your financial records, reducing manual errors.

- Modular Service Add-ons: Beyond bookkeeping, you can add services like tax preparation, payroll administration, accounts receivable/payable management, and fractional CFO advisory. This a la carte model lets you access senior expertise without a full-time commitment.

Pricing and Onboarding

Bookkeeper360 uses a transparent, tiered pricing model based on your monthly expenses and desired service frequency (monthly or weekly). Plans are clearly laid out on their website, which simplifies budget planning. Add-on services like payroll, tax, and CFO advisory are priced separately, giving you control over your total spend.

Be aware that most new clients will require a one-time onboarding and cleanup project, which comes with an additional fee. While this is an extra upfront cost, it ensures your books are accurate and properly structured from the start.

Website: https://bookkeeper360.com

Pros & Cons

| Pros | Cons |

|---|---|

| Transparent, Menu-Style Pricing: Easily understand costs for each service. | Onboarding/Cleanup is an Extra Fee: Most new clients face an upfront cost. |

| All-in-One Solution: Consolidates bookkeeping, tax, payroll, and CFO services. | Can Become Costly: CFO and advanced advisory projects can increase the price. |

| Proprietary Dashboard: Offers a user-friendly app for real-time KPI tracking. | Less Specialized for Deep Verticals: Not as niche-focused as startup-only firms. |

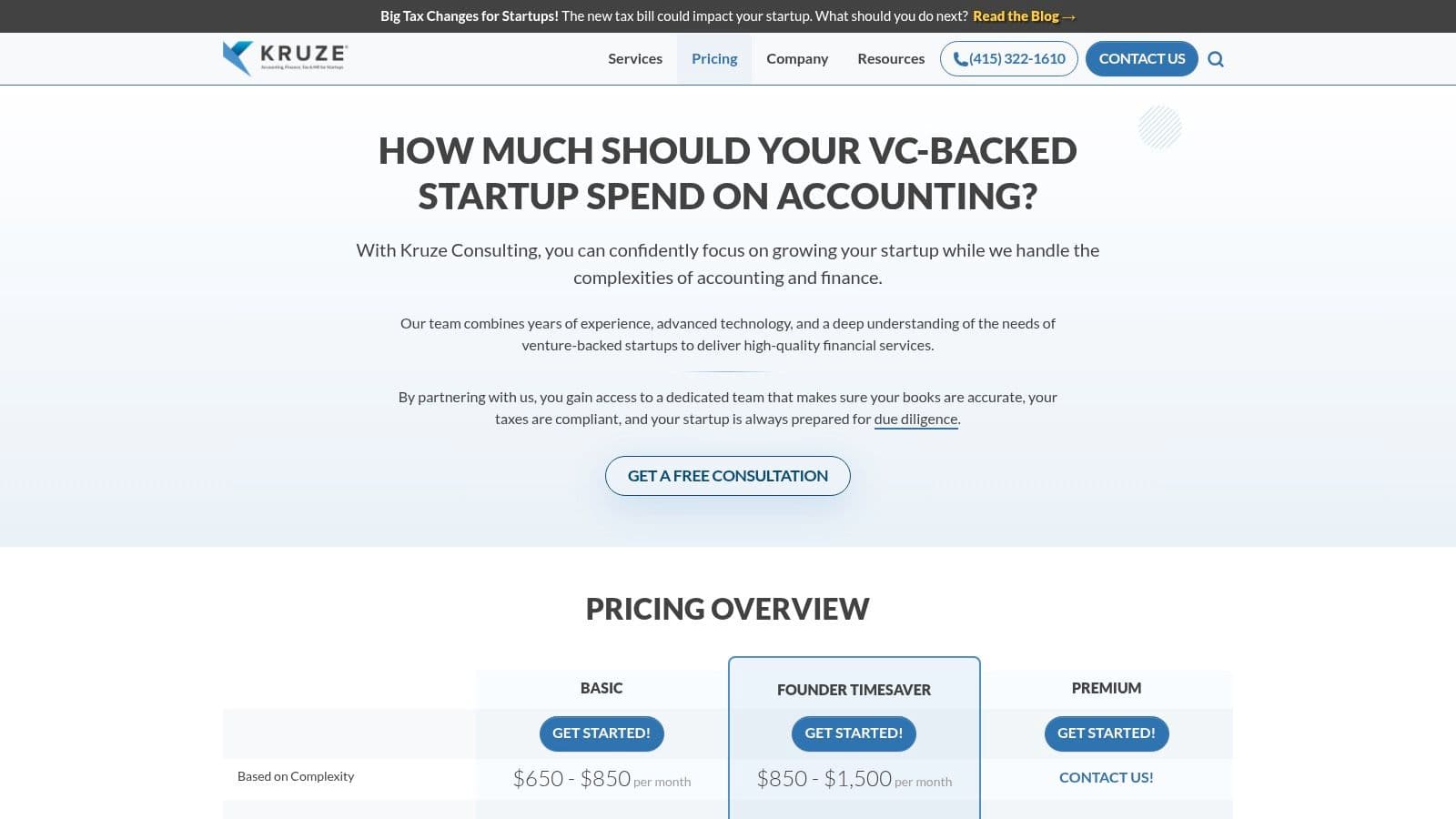

6. Kruze Consulting

Kruze Consulting is a highly specialized CPA-led firm built exclusively for venture-backed startups. It targets companies that have raised significant capital (typically $500k or more) and require institutional-grade financial reporting and tax expertise. If your goal is to secure the next funding round, prepare for due diligence, and maximize tax incentives like the R&D credit, Kruze offers a focused and expert-driven solution. Their key differentiator is a deep, narrow focus on the VC ecosystem, making them one of the best outsourced accounting services for startups on an aggressive growth trajectory.

This model ensures that from day one, your books are managed with investor expectations in mind. Kruze handles the core accounting and tax compliance, freeing up your leadership team to focus on product development and market traction while ensuring financial operations are ready for scrutiny at a moment's notice.

Key Features and Ideal Fit

Kruze’s service packages are designed to support a startup’s financial journey from seed stage through later funding rounds.

- Accrual-Basis Bookkeeping: All plans are built on accrual accounting, the standard required by investors. Each package includes monthly financial statements and regular check-ins with a controller, providing a higher level of oversight than typical bookkeeping-only services.

- Startup Tax and R&D Credits: Kruze has deep expertise in startup-specific tax issues, including state nexus, sales tax, and maximizing the R&D tax credit. They offer tools and calculators to help you estimate potential savings, a critical source of non-dilutive funding for early-stage tech companies. For example, a qualifying startup with $500K in R&D payroll expenses could see a federal tax credit of around $50,000.

- Fundraising and Diligence Support: The firm excels at preparing companies for the rigors of fundraising. Their team helps assemble the financial data rooms, answers investor questions, and ensures your financials are clean and defensible, which significantly smooths the due diligence process.

- Scalable Service Tiers: As your startup grows, Kruze’s services scale with you. Higher tiers add support for GAAP-compliant revenue recognition (essential for SaaS), multi-entity consolidation, and more complex financial modeling, ensuring you don’t outgrow their capabilities.

Pricing and Onboarding

Kruze offers transparent, tiered pricing based on your startup's stage and complexity. The "Seed" package provides foundational accrual accounting and tax services for early-stage companies. Pricing for more advanced "Series A" and "Series B+" tiers is customized based on factors like transaction volume, international operations, and specific compliance needs.

Their onboarding process is structured to get new clients up and running quickly, focusing on cleaning up any historical bookkeeping issues and establishing a robust chart of accounts that will scale for future reporting needs.

Website: https://kruzeconsulting.com/pricing/?utm_source=openai

Pros & Cons

| Pros | Cons |

|---|---|

| Deep Focus on VC-Backed Startups: Unmatched expertise in investor reporting. | Not for Bootstrapped Businesses: The model is not a fit for non-VC companies. |

| Integrated Tax and R&D Services: A holistic approach to startup finance. | Core Features are Add-Ons: GAAP rev-rec costs extra on lower-tier plans. |

| Transparent Entry-Level Pricing: Clear costs for early-stage companies. | Overkill for Simple Businesses: Can be too robust for companies with basic needs. |

7. Paro

Paro operates as a high-end marketplace, connecting businesses with a rigorously vetted network of freelance finance experts. It is designed for companies that require specialized, on-demand talent rather than a one-size-fits-all subscription service. Paro excels at matching businesses with US-based bookkeepers, controllers, and fractional CFOs for project-based work, interim leadership, or ongoing advisory roles. This makes it one of the best outsourced accounting services for founders who need to quickly fill a specific expertise gap—such as M&A due diligence or specialized industry accounting—without the long-term commitment of a full-time hire.

The platform uses an AI-powered matching system to connect you with professionals from what it markets as the "top 2%" of finance talent. This model provides immense flexibility, allowing you to scale financial oversight up or down in response to specific business needs like a funding round, an audit, or a seasonal peak.

Key Features and Ideal Fit

Paro’s strength lies in its ability to deliver custom-fit expertise for precise business challenges.

- Vetted Freelance Talent: You gain access to a curated pool of US-based finance professionals, from full-charge bookkeepers to strategic fractional CFOs. This is ideal when you need proven experience in a niche like construction accounting, nonprofit fund management, or SaaS revenue recognition.

- AI-Powered Matching: The platform takes your project requirements and uses an algorithm to recommend the best-fit experts. This significantly shortens the typical hiring cycle for specialized finance roles.

- Flexible Engagement Models: You can hire experts for short-term projects, interim roles (e.g., covering for a controller on leave), or ongoing retainer-based work. This adaptability is perfect for companies with fluctuating financial management needs.

- Full Spectrum of Services: Paro’s network covers everything from foundational bookkeeping and financial reporting to complex financial planning and analysis (FP&A), capital raising strategy, and M&A support.

Pricing and Onboarding

Paro does not have standardized public pricing. Costs are entirely dependent on the scope of your project, the level of expertise required, and the specific professional you engage. The process begins with a consultation to define your needs, after which Paro provides a custom quote based on matched expert rates.

This marketplace model requires you to be actively involved in scoping the work and managing the relationship to prevent scope creep. However, it also gives you direct control over the budget and deliverables.

Website: https://paro.ai

Pros & Cons

| Pros | Cons |

|---|---|

| Access to Niche Expertise: Quickly find specialists for complex industries or specific financial events. | Variable Pricing: Lack of transparent, standardized pricing makes it hard to budget without a consultation. |

| High Flexibility: Scale financial support up or down based on immediate business needs. | Management Overhead: The marketplace model requires you to define scope and manage the expert relationship. |

| US-Only Expert Base: Ensures alignment on compliance, communication, and time zones. | Less Ideal for Basic Bookkeeping: Can be overkill if you only need simple, recurring bookkeeping services. |

Red Flags: Warning Signs an Outsourced Provider Isn't a Fit

As you evaluate potential partners, be aware of these common red flags. Misalignment here can lead to costly errors, wasted time, and strategic blind spots.

- They can't explain concepts clearly. A great finance partner demystifies complex topics like accrual accounting or deferred revenue. If a potential provider uses excessive jargon without explaining the "why" behind it, they will be a poor strategic partner.

- Lack of industry-specific benchmarks. When asked about key metrics, a top-tier firm for SaaS companies should be able to cite relevant benchmarks. For instance, "According to OpenView's 2024 SaaS Benchmarks, the median gross margin for companies at your stage is 78%. Let's look at how your COGS are structured to see if we can optimize that." A generic answer signals a lack of specialized expertise.

- No discussion of security protocols. You are handing over the keys to your financial kingdom. A provider that doesn't proactively discuss their security measures, such as SOC 2 compliance, data encryption, and access controls, is not taking your risk seriously.

- Opaque, hourly billing for core services. For standard monthly accounting, you should receive a fixed-fee quote. Hourly billing for routine work creates unpredictable costs and misaligned incentives. It is only appropriate for ad-hoc, project-based work like due diligence support.

As Scott Pezza, founder of a B2B SaaS company, states, "The moment you start fundraising, your financials go from being a historical record to a forward-looking asset. If your accounting partner can't provide both a clean history and a defensible forecast, they are putting your entire round at risk."

Your Next Steps: How to Choose the Right Partner and Get Started

You've reviewed the detailed comparisons and understand the landscape. The core takeaway is clear: the right financial partner does more than balance your books. They provide the strategic insights and operational horsepower you need to drive growth, secure funding, and maintain compliance. Your choice should not be based on price alone but on the total value and strategic alignment with your long-term goals.

A Practical Checklist for Making Your Final Decision

To move from evaluation to action, use this structured checklist. This is about finding the right-fit partner for your specific stage and industry.

-

Define Your Primary Problem. Are you solving a bookkeeping mess, or do you need strategic guidance for your Series A?

- Bookkeeping & Tax: Services like Bench or QuickBooks Live offer cost-effective solutions for clean, compliant financials.

- Strategic Finance & Growth: Firms like Jumpstart Partners and Kruze Consulting provide the controller and CFO services essential for fundraising, M&A, and complex financial modeling.

-

Schedule Due Diligence Calls. Book consultations with your top two choices. Prepare specific questions that address your biggest pain points.

- Team: "Who will be my primary point of contact? What is their experience with B2B SaaS companies in the $5M ARR range?"

- Technology: "What is your tech stack? How do you handle document sharing and communication securely?" Many top providers use sophisticated client portal software to streamline these interactions.

- Deliverables: "Can you provide a redacted example of a monthly financial package you deliver to a client similar to us?"

-

Check References in Your Industry. Don't skip this. Ask for references from clients in your industry and at a similar revenue stage.

- Ask the reference: "Can you share an example of a time this firm provided a strategic insight that directly impacted a business decision?" This gets to the heart of their value beyond just delivering reports on time.

-

Review the Service Level Agreement (SLA). Before you sign, understand the specifics.

- What is the guaranteed response time for inquiries?

- What is the exact scope, and what is explicitly excluded (e.g., state sales tax filings, 409A valuations)?

- What are the terms for scaling services up or down as your needs change?

Choosing your financial partner is one of the most critical decisions you'll make as a founder. This is not a vendor; it is a strategic partnership that provides the foundation for sustainable growth.

Ready to build a finance function that accelerates your growth? Jumpstart Partners provides the specialized outsourced accounting, controller, and CFO services that scaling companies need to thrive. Schedule a free consultation to see how our dedicated team can provide the financial clarity and strategic guidance your business deserves.