Financial Operations

Bookkeeper vs Controller: When to Upgrade Your Finance Function

Confused about bookkeeper vs controller roles? This guide clarifies responsibilities, costs, and when to hire each to fuel your business growth.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··18 min readYou're running a fast-growing business, but your financials feel like a black box. You have a bookkeeper, and the bills get paid, but you’re still making critical decisions on gut feel instead of hard data. This is a classic—and dangerous—scaling problem.

The issue isn't your bookkeeper. The issue is that you’re asking them to do a job they weren’t hired for. A bookkeeper's role is to record the past. A controller’s role is to use that history to build a predictable future. Confusing the two is a direct threat to your profitability, cash flow, and ability to secure funding.

Why Your Financial Blind Spot Is Limiting Your Growth

As your business pushes past the $500K revenue mark, you cross an invisible threshold where financial complexity grows exponentially. Relying on basic bookkeeping alone is like navigating a maze blindfolded. You can feel the walls, but you have no map to find the exit. This gap between recording history and planning the future is a massive financial blind spot for growing companies.

The historical data a bookkeeper provides is essential, but it’s not enough to make smart, forward-looking decisions. It tells you what you spent, not what you should spend next quarter. This limitation directly impacts your most important operations:

- Cash Flow Management: Without strategic forecasting, you're constantly reacting to cash shortages instead of proactively managing your runway. A bookkeeper reconciles bank statements; a controller builds a predictive cash flow model like a 13-week cash flow forecast.

- Profitability Analysis: Are you pricing your services correctly? Is one client segment secretly draining your resources? Bookkeeping can't answer these questions. A controller runs the cohort analysis you need to optimize your margins.

- Investor Readiness: Investors don't fund messy books—they fund predictable, scalable models. A controller ensures your financials are not just clean but are also presented in a way that tells a compelling growth story, all while conforming to GAAP standards.

The True Cost of Inadequate Financial Oversight

The danger isn't just what you can't see; it's the real cost of inaction. For a SaaS company, improper revenue recognition under ASC 606 leads to compliance nightmares and restated financials, destroying investor confidence. For a digital agency, failing to track project profitability leads directly to overworked teams and razor-thin margins.

"Many founders confuse being 'good with numbers' with having strategic financial control. A bookkeeper keeps you compliant. A controller makes you competitive. The latter is what unlocks scalable growth." - David V. Lorenzo, Founder of The 6-Figure CEO

Choosing between a bookkeeper vs controller isn’t an HR decision. It's a strategic choice that determines your ability to make informed decisions, secure funding, and navigate the path from a growing business to a market leader. Understanding this distinction is the first step toward building a resilient financial foundation.

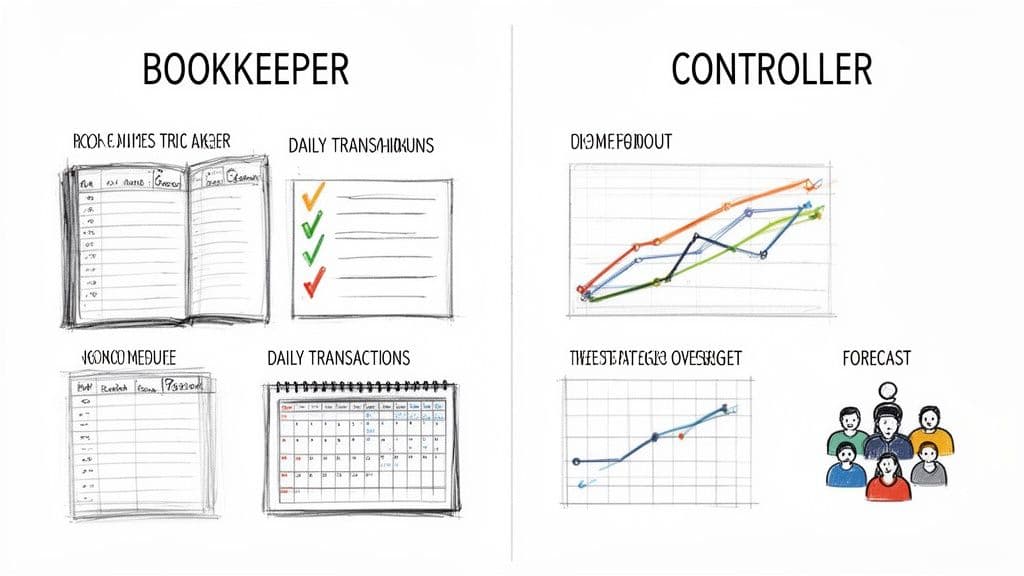

Defining the Roles: Bookkeeper vs. Controller

To scale your business, you must get one thing straight: the fundamental difference between a bookkeeper and a controller. It's a common and costly mistake to lump them together.

Think of it this way: your bookkeeper builds the financial foundation by meticulously recording what happened. Your controller uses that foundation to draw up a strategic blueprint for the future.

One role is tactical and backward-looking; the other is strategic and forward-looking. Both are critical, but they solve completely different business problems. Let’s break down where one role ends and the other begins.

The Bookkeeper: The Financial Historian

A bookkeeper’s main job is to keep a precise, organized record of every financial transaction your company makes. They are the guardians of your general ledger, ensuring every dollar is accounted for. Their work is the bedrock of your financial system—without it, everything else crumbles.

Key responsibilities are all about the day-to-day details:

- Recording Daily Transactions: Logging all sales, expenses, cash receipts, and payments.

- Managing Payables and Receivables: Sending invoices to customers (A/R) and making sure your company’s bills get paid (A/P).

- Processing Payroll: Ensuring your team is paid correctly and on time, including managing tax withholdings.

- Reconciling Bank Accounts: Methodically matching transactions in your accounting software to your bank statements to catch errors.

The bookkeeper operates in daily, weekly, and monthly cycles focused on accuracy and compliance. If your books aren’t clean, any higher-level financial analysis is impossible. Getting these basics right is non-negotiable, which is why we've detailed the core bookkeeping services for small businesses that set you up for success.

The Controller: The Financial Strategist

A controller takes the clean, accurate data from the bookkeeper and transforms it into actionable business intelligence. They manage the entire accounting function, establish crucial financial controls, and deliver the analysis that empowers you to make smarter, data-driven decisions.

A controller doesn't just report what happened—they explain why it happened and help you figure out what to do next.

Their core functions are strategic:

- Financial Reporting: Preparing GAAP-compliant financial statements like the Income Statement, Balance Sheet, and Statement of Cash Flows.

- Budgeting and Forecasting: Building detailed financial models to project future performance, manage cash flow, and set realistic targets.

- Internal Controls: Designing and implementing processes to prevent fraud, minimize errors, and ensure the integrity of your financial data.

- Management and Analysis: Overseeing the accounting team and analyzing financial data to spot trends, identify opportunities, and flag risks.

For a SaaS company, a controller moves beyond just tracking revenue. They build dashboards for key metrics like MRR, ARR, and CAC, providing the context that drives growth.

Role and Responsibility Breakdown: Bookkeeper vs. Controller

| Attribute | Bookkeeper (The Historian) | Controller (The Strategist) |

|---|---|---|

| Primary Focus | Recording past transactions accurately | Analyzing financial data to guide future decisions |

| Time Horizon | Backward-looking (Daily, Weekly, Monthly) | Forward-looking (Monthly, Quarterly, Annually) |

| Core Tasks | Data entry, bank reconciliation, payroll, A/P & A/R | Financial statement preparation, budgeting, forecasting, internal controls |

| Key Deliverable | A clean, up-to-date general ledger | GAAP-compliant financial reports and variance analysis |

| Strategic Impact | Ensures tax-readiness and basic financial visibility | Provides insights to improve profitability and cash flow |

| Typical Question Answered | "Did we pay this vendor's invoice?" | "Why is our gross margin decreasing this quarter?" |

A bookkeeper gives you the "what," while a controller delivers the "so what." Understanding this difference is the first step toward building a finance function that doesn't just keep score but helps you win.

The Financial Impact of Hiring the Right Expertise

When you're growing, the decision between a bookkeeper and a controller has massive implications for your bottom line. Stop thinking about it as a cost and start seeing it as an investment. A bookkeeper is a necessary expense to keep your history straight; a controller is an investment in your company’s future profitability.

The salary gap tells a huge piece of the story. A bookkeeper typically earns between $45,000 and $65,000. A high-caliber controller commands a median salary closer to $150,000, and often more in high-cost-of-living areas. This isn't about a fancier title—it's about the controller's direct responsibility for financial reporting, compliance, and strategic planning that actively drives the business forward.

The real difference isn't the salary paid; it's the tangible return that salary brings back into the business.

From Cost Center to Profit Driver: A Controller's ROI

You have to move past seeing finance as just a cost center. A great controller generates value that dwarfs their own salary.

Let's walk through a real-world example for a $5M ARR professional services firm.

Worked Calculation: Controller ROI

You hire a fractional controller for $60,000/year. Within their first six months, they tackle two straightforward initiatives:

-

Profitability Analysis: The controller analyzes project profitability and discovers that 20% of your clients are generating only 5% of the gross margin and consuming 30% of your team's time. By strategically pricing these clients up or out, you increase your average gross margin from 40% to 45%.

- Annual Profit Increase: $5,000,000 ARR * 5% margin improvement = $250,000

-

Cash Flow Improvement: The controller implements a more disciplined accounts receivable collections process and shortens billing cycles. This cuts the average Days Sales Outstanding (DSO) from 60 days to 45. That accelerated cash collection frees up working capital and eliminates the need for a $200,000 line of credit, saving an estimated $16,000 annually in interest payments (at an 8% rate).

The total annual financial impact from just these two projects is $266,000—a 4.4x return on their cost. This doesn't even touch the value they add through accurate forecasting or getting the company investor-ready. For a deeper look, check out our full controller services ROI analysis.

The Hidden Costs of Under-Hiring

On the flip side, asking a bookkeeper to do a controller's job creates huge financial risks. These costs don't show up on your P&L; they appear as expensive mistakes and missed opportunities.

A classic—and damaging—example is improper revenue recognition for SaaS companies under ASC 606. A bookkeeper might just record cash when it hits the bank. A controller knows to correctly defer that revenue and recognize it as the service is delivered, painting an accurate picture of performance.

Getting this wrong is a disaster during an audit or due diligence, potentially killing a fundraise or an acquisition deal. The cost to restate your financials and fix the mess will always be far higher than the salary difference between a bookkeeper and a controller. Understanding these roles isn't just for internal efficiency; it's critical for presenting a credible financial story to stakeholders like potential accounting investors.

Key Triggers Indicating You Need a Controller

The jump from a bookkeeper to a controller is a defining moment. It’s not about hitting a magic revenue number; it’s about the complexity of the questions you’re asking. When your focus shifts from recording history to strategically planning the future, your bookkeeping function has hit its ceiling.

You Are Preparing for a Fundraise or Audit

Investors and auditors demand far more than a clean transaction history. They need to see GAAP-compliant financial statements, sophisticated cohort analysis, and a financial model you can defend under pressure.

A bookkeeper gets your data ready for tax season. A controller gets your data ready for the intense scrutiny of due diligence. This means:

- Audit-Ready Financials: Ensuring your books are structured correctly to pass an independent audit without expensive delays or restatements.

- SaaS Metrics Integrity: For SaaS companies, this is huge. It means implementing proper revenue recognition under ASC 606 and building dashboards for MRR, ARR, and LTV that you can trust. A bookkeeper records a Stripe payment; a controller ensures that payment is recognized correctly over the life of the contract.

The ability to create financial projections that directly impact a business's future is precisely what investors are betting on.

Your Financial Reporting Is Untrustworthy or Too Slow

How long does it take to get accurate financials after the month ends? If the answer is more than 10 business days, you have a problem. According to OpenView's 2024 SaaS Benchmarks, top-performing finance teams close their books in under 5 days. A slow month-end close is a symptom of broken financial processes. A controller doesn't just close the books faster; they build the systems and internal controls that produce reliable numbers, fast.

Warning Signs Your Bookkeeping Is Failing You

Sometimes, the need for a controller isn’t a single event but a series of small, persistent frustrations. These are red flags that your current system is cracking under the pressure of your growth.

- Month-End Close Takes Weeks: Your close should be a well-oiled machine, not a chaotic fire drill. A controller implements a process to get your books closed in 5 business days.

- You Can't Get Basic SaaS Metrics: If you can’t confidently report on your Customer Acquisition Cost (CAC) or Lifetime Value (LTV), your bookkeeper is likely focused on basic cash-in, cash-out recording.

- Financial Surprises Are Common: Are you constantly blindsided by unexpected cash shortages or expenses you didn't budget for? This points to a lack of forecasting and variance analysis—a core controller function.

- No Confidence in Your Financial Data: You avoid looking at your P&L because you know it's probably wrong. This is the ultimate sign you need a higher level of oversight.

When scaling a business from $1M to $20M in revenue, the choice between a bookkeeper and a controller dramatically affects growth. Controllers are essential for ASC 606 compliance and audit prep, and their strategic edge yields significant returns through cash flow gains and error detection. Discover more insights about how controllers fuel growth on YouTube.

If these warning signs feel familiar, it's a clear indicator that your business has reached a new level of financial complexity. Learn more about the specific signs you’ve outgrown your bookkeeper and what to do next.

The Smart Alternative: Outsourced Controller Services

For most businesses in the $500K-$20M revenue range, the math on a full-time, in-house controller doesn't add up. The six-figure salary, benefits, and overhead create a massive financial drag for expertise you might only need for a fraction of the month. You’ve outgrown your bookkeeper but can't justify the cost of a full-time strategic hire.

This is exactly where outsourced and fractional controller services come in. The model gives you immediate access to high-caliber strategic financial expertise for a fraction of the cost of a full-time hire.

The Fractional Model Advantage

An outsourced controller isn't just a cheaper option; for most scaling businesses, it's a better one. Instead of hiring one person with a specific background, you get access to an entire team of experts with collective knowledge in tricky areas like SaaS revenue recognition, agency project profitability, and e-commerce inventory accounting.

This model directly solves the biggest headaches you face:

- Fast Financials: An optimized outsourced team, like ours at Jumpstart Partners, delivers a 5-day month-end close, giving you accurate financials when you need them to make decisions.

- Cost-Effectiveness: You get the strategic oversight needed to drive growth without the $150,000+ annual burden of a W-2 employee. You only pay for the expertise you need.

- On-Demand Scalability: As your business grows, your financial needs change. An outsourced partner lets you scale your service level up or down seamlessly, giving you flexibility a fixed salary can't match.

Making the Right Decision for Your Stage

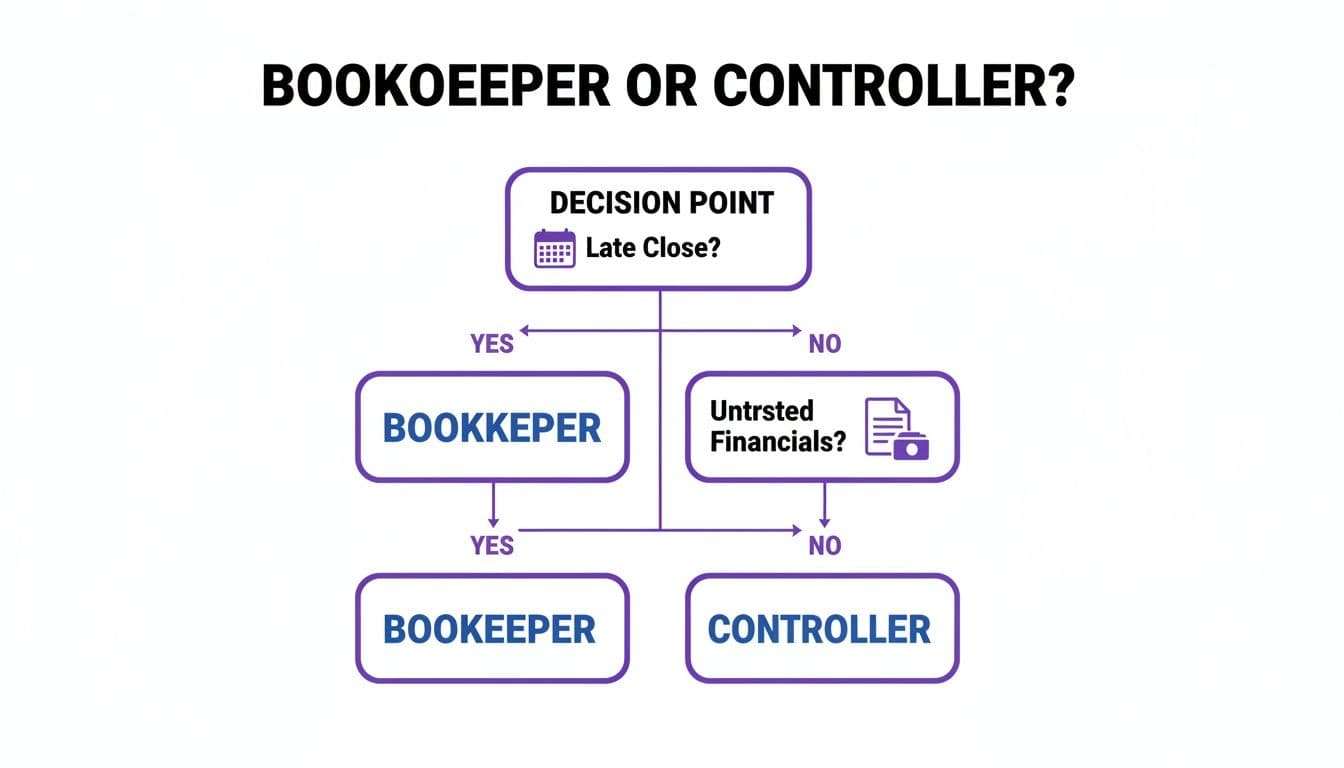

The choice between DIY accounting, a bookkeeper, a controller, or an outsourced partner comes down to your current challenges. The two most common triggers that force a decision are untrustworthy financials and a slow month-end close.

This flowchart maps out the decision-making process based on those common financial pain points.

Once your financial reporting becomes unreliable or slow, sticking with a basic bookkeeping solution is no longer a viable option. An outsourced controller acts as the perfect bridge, providing the systems and strategic analysis you need to stabilize your finances and prepare for the next phase. To see how this works in practice, check out our guide on what a fractional controller actually does for businesses like yours.

"The single biggest mistake I see founders make is waiting too long to upgrade their financial oversight. They treat it like a cost to be minimized instead of an investment that unlocks growth. An outsourced controller de-risks that investment and delivers an immediate ROI." - Anonymous, SaaS Finance Expert

For an ambitious company that needs strategic financial guidance without the six-figure overhead, the outsourced model is the logical, effective choice. It solves the immediate problem of untrustworthy data while building the foundation for long-term success.

Your Action Plan for a Finance Function That Drives Growth

Knowing the difference between a bookkeeper and a controller is step one. Step two is turning that knowledge into a real plan. This isn't about filling a seat; it's about building the financial engine your business needs to scale.

Step 1: Assess Your Current Financial Process

Before you build anything new, get brutally honest about what's broken. Ask yourself these pointed questions:

- Speed: How many business days does it take to close the books each month? Anything over 7 days means your process is lagging. Top-tier functions close in 3-5 days.

- Accuracy: How often do you find major errors in financial reports after they’ve been sent out? If you’re constantly restating numbers, you have a control problem.

- Confidence: On a scale of 1-10, how much do you trust your numbers to make a big decision—like greenlighting a new hire or doubling your marketing budget? An answer below an 8 is a massive red flag.

If you can't give a confident "yes" to all three, you've outgrown your current system. It’s not that your bookkeeper is failing; it's that you're asking them to fly a jumbo jet when they were trained on a Cessna. It’s time for a pilot with controller-level skills.

Step 2: Identify the Right Expertise

Once you’ve decided to upgrade, the next challenge is finding the right partner, whether in-house or outsourced. You're not looking for a historian; you need a forward-looking operator.

These interview questions separate tactical accountants from strategic controllers:

-

"Walk me through your 90-day plan for our finance function. What are the first three things you would fix or build?"

- What you want to hear: A great answer is about building systems. They’ll talk about shortening the month-end close, implementing internal controls, and creating a management dashboard that helps you run the business. A weak answer is "I'd get to know the books."

-

"Our gross margin dropped by 5% over the last two quarters. Talk me through your process for figuring out why."

- What you want to hear: They should immediately dig into the components—analyzing cost of goods sold, reviewing pricing, and running profitability reports by customer or product line. A vague answer like "I'd check the numbers" is a sign they lack strategic depth.

Step 3: Take Action

You now have a clear picture of your needs and know what to look for. The final step is to execute. Don't let another quarter go by making critical decisions with unreliable data. The cost of inaction is far greater than the investment in a proper finance function.

Ready to see what controller-level guidance could do for your business? Book a free consultation with Jumpstart Partners and get a personalized assessment of what your finance function truly needs to scale.

Frequently Asked Questions

Even with a clear breakdown, you likely have specific questions about making the bookkeeper vs controller decision. Here are the straight answers to the most common ones we hear.

Can a bookkeeper grow into a controller role?

It’s extremely rare in a high-growth environment. A bookkeeper's role revolves around accurately recording historical transactions. A controller needs to live and breathe GAAP, financial strategy, forecasting, and team leadership. This isn’t just about learning new skills; it's a fundamental mindset shift from tactical data entry to strategic oversight. Your company’s financial complexity will outpace their development every time.

Objection: "But my bookkeeper is loyal and knows my business." Reality: That’s valuable, but loyalty doesn't replace the technical expertise required for GAAP compliance, building a three-statement financial model, or preparing for an audit. Keep them in their role of strength and bring in a controller to lead the strategy.

At what revenue milestone should I hire a controller?

There’s no magic number, but most SaaS and service-based businesses start feeling serious pain around the $2M-$5M ARR mark. Business triggers are a much better indicator than revenue alone.

You need a controller if you are:

- Seeking outside investment or gearing up for an audit.

- Struggling with unreliable cash flow forecasts.

- Getting financial reports late, or finding they’re full of errors.

If you’re nodding your head at any of these, it's time, whether you’re at $1M or $10M in revenue. The pain is the signal.

What is the difference between a controller and a CFO?

Think of it this way: a controller looks inward and backward, while a CFO looks outward and forward.

A controller owns the accounting function. Their job is to ensure the historical financial data is accurate, timely, and compliant. They maintain internal controls and answer the "how" of your finances.

A CFO, on the other hand, is focused on the future. They handle fundraising strategy, investor relations, long-term capital planning, and high-level strategic decisions. They answer the "why" and "what if."

A controller ensures the data is perfect; a CFO uses that perfect data to guide the company's future. Many growing businesses use an outsourced controller for day-to-day strategic accounting and bring in a fractional CFO for specific projects like a capital raise. This gives you a cost-effective, high-impact financial leadership team.

Ready to stop guessing and build a finance function that accelerates your growth? The expert team at Jumpstart Partners provides the strategic oversight you need, from a 5-day month-end close to investor-ready financials. Book a free consultation today to get a clear action plan for your business.