Financial Operations

A Founder's Guide to Improving Your Accounts Payable Process

Learn how improving accounts payable process can boost cash flow, cut costs, and reduce fraud with practical, founder-focused steps.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··19 min readWhen you're scaling a SaaS company or digital agency, that growing stack of invoices isn't just an administrative headache. It's a direct threat to your cash flow. A manual accounts payable (AP) process is a silent liability that breeds financial uncertainty, opens the door to costly mistakes, and locks your team into tedious, low-value work.

If you're constantly chasing approvals, getting hit with late fees, and have zero visibility into upcoming payments, you don't have an admin problem—you have a strategic growth problem.

Your Manual AP Process Is Silently Costing You Growth

The real problem is that these costs are almost invisible, bleeding your business dry one tiny papercut at a time. It’s the missed 2% early payment discount that seems minor on its own but adds up to thousands over a year. It’s the duplicate payment on a $5,000 invoice that slips through because of a simple data entry error.

These aren't hypotheticals; they are the everyday reality of a manual AP process that can no longer keep up with your business.

Calculating The Real Financial Drag

Let's put some real-world numbers on this. Imagine your digital agency has $5 million in annual revenue and processes around 150 invoices per month.

A common vendor term is "2/10, net 30," which offers a 2% discount if you pay within 10 days. But your manual approval process—getting the invoice to the right person, getting it signed, and cutting a check—takes 15-20 days. You miss out every single time. Let's assume 40% of your vendor spend ($100,000/month) offers these terms.

- Monthly Spend with Discount Terms: $100,000

- Potential Discount (2%): $2,000 per month

- Annual Lost Savings: $2,000 x 12 = $24,000

That’s just one leak. Now, add a conservative 1% error rate for duplicate or overpayments due to human error. On a total non-payroll spend of $2.5 million, that’s another $25,000 gone.

All told, you’re looking at over $49,000 in direct, preventable losses. That's cash that could have funded a new marketing hire or paid for critical software.

The table below breaks down these hidden costs in more detail.

| Cost Area | Calculation Example (Annual) | Annual Financial Impact |

|---|---|---|

| Lost Early Payment Discounts | $1.2M in eligible spend × 2% discount | $24,000 |

| Duplicate & Overpayments | $2.5M non-payroll spend × 1% error rate | $25,000 |

| Excess Labor Costs | 1 employee × 10 hours/week × $35/hr loaded rate × 52 weeks | $18,200 |

| Late Payment Fees | $250K in late payments × 1.5% average fee | $3,750 |

| Total Annual Waste | - | $70,950 |

When you see the numbers laid out like this, the financial drag becomes impossible to ignore. This isn't just about being inefficient; it's about actively throwing away money that could be fueling your growth.

You’re not alone in this fight. An astonishing 68% of companies still enter invoice data by hand, according to research from HighRadius. Improving your accounts payable process isn't a "nice-to-have" back-office project. It's a critical lever for improving profitability and funding future growth.

Red Flags: Is Your AP Process Broken?

Before you can fix your AP process, you need a brutally honest assessment of where it’s actually broken. Gut feelings don’t cut it. You need hard data to pinpoint the bottlenecks and quantify the damage. Too many founders accept a slow, frustrating AP process as a cost of doing business. It's not.

These are critical warning signs that your financial foundation is cracked:

- Constant "Where's my payment?" emails from vendors.

- No visibility into near-term cash outflows without a manual scramble.

- Finance team members spending hours on manual data entry and follow-ups.

- Surprise late fees appearing on vendor statements.

- A "days to close the books" metric that keeps getting longer.

If any of these sound familiar, your AP process is holding your business back.

Measuring What Really Matters in Your AP Process

To move past anecdotes, you must track specific Key Performance Indicators (KPIs). These metrics tell the true story of your AP health and let you see how you stack up against best-in-class companies.

Start by tracking these three essentials:

- Invoice Processing Cost: This is your all-in cost to handle a single invoice. To get this number, add up the salaries of your AP staff (including benefits), the cost of a manager's time for oversight, and any software or material costs. Then, divide that total by the number of invoices you processed in a month.

- Invoice Cycle Time: This measures the average time from the moment an invoice hits your inbox to when it's fully paid. A long cycle time is a direct sign of inefficiency and a major reason you’re missing out on early-payment discounts.

- Invoices Processed Per Employee: This KPI is all about team efficiency. It helps you understand if your current process can scale, or if you'll need to keep hiring more people just to keep up with invoice volume as your company grows.

How Do Your Numbers Stack Up? Industry Benchmarks

Knowing your own numbers is the first step. The second is comparing them to industry benchmarks to see just how far behind you are. This comparison provides undeniable proof that there's a much better way to operate.

For a SaaS company or digital agency, here's what "good" looks like:

| KPI Metric | Top Performers (Automated) | Average Performers (Manual) |

|---|---|---|

| Invoice Cycle Time | 3.2 Days | 17.6 Days |

| Invoice Processing Cost | $2.05 per invoice | $12.41 per invoice |

| Early Payment Discounts Captured | 85% or higher | 18% or lower |

| Straight-Through Processing Rate | Over 60% | Less than 10% |

Source: Data compiled from Ardent Partners' "State of ePayables 2023" and other industry reports.

If your invoice cycle time is hovering around 20 days, you’re not just slow—you are nearly 6x slower than top-performing companies. That lag directly impacts your cash flow, a topic we dive deep into in our guide to the 13-week cash flow forecast. The data makes it crystal clear: a broken AP process is costing you money and competitive advantage.

Unfortunately, many finance teams have hit a wall with manual processes. Recent data shows that 63% of teams spend over 10 hours a week just on invoice management. The good news is that leaders are finally looking to AI to break through this plateau. You can see more insights on how forward-thinking companies are adopting AI in AP.

This diagnostic phase is about building an unshakeable, data-backed case for turning your AP process from a liability into a strategic asset.

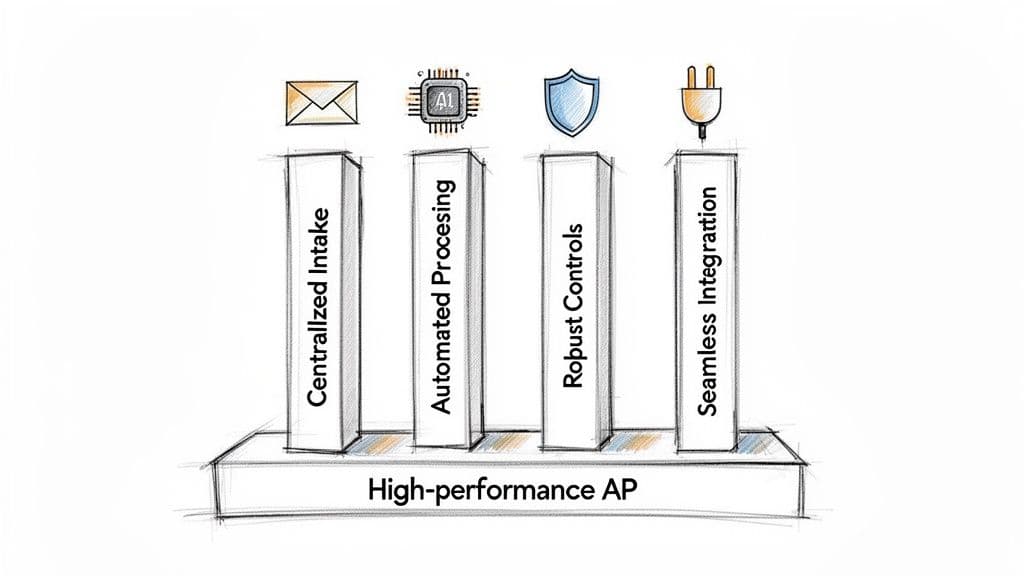

The Four Pillars of a High-Performance AP System

Shifting your accounts payable from a chaotic cost center into a strategic asset isn’t about buying a single piece of software. It's a complete redesign of your workflow, built on four core pillars. Get these right, and you create a system that’s not just efficient but also scalable and secure.

Improving your AP process means focusing on: Centralized Intake, Automated Processing, Robust Controls, and Seamless Integration.

Pillar 1: Centralized Intake

The first point of failure in almost every manual AP process is chaos. Invoices arrive via a half-dozen different email inboxes, snail mail, and even random Slack DMs. This scattered approach is a perfect recipe for lost bills, late fees, and paying the same invoice twice.

Centralized intake solves this instantly. You establish a single, dedicated email address—think invoices@yourcompany.com—as the only channel for vendors to submit invoices. This isn’t a suggestion; it's a non-negotiable first step.

This simple change achieves several critical goals:

- Creates a Single Source of Truth: No more hunting through different inboxes or asking, "Hey, did you ever see that invoice from Acme Corp?"

- Establishes a Clear Audit Trail: You get a time-stamped record of when every invoice was received, which is crucial for managing payment timelines.

- Enables Automation: This dedicated inbox becomes the trigger for your automation software to pull in new bills automatically, kicking off the entire process without human intervention.

Make this policy clear in your vendor onboarding documents and on every purchase order you issue.

Pillar 2: Automated Processing

Once you've funneled all invoices into one place, you must remove the human bottleneck from processing them. Manual data entry is not only painfully slow—costing an average of $12 or more per invoice—but it’s also where most costly errors happen.

AP automation platforms like Bill.com or Dext use optical character recognition (OCR) and AI to do the heavy lifting. When an invoice lands in your dedicated inbox, the system automatically:

- Extracts Key Data: It reads the invoice and pulls out the vendor name, invoice number, due date, and line-item amounts.

- Codes to the General Ledger (GL): Based on past invoices from that vendor, the AI suggests the correct expense account, saving your team from manually selecting it every time.

- Routes for Approval: The system automatically sends the invoice to the right manager for approval based on pre-set rules you define.

This transforms a multi-day, error-prone task into a hands-off process that takes minutes.

Manual vs. Automated AP Workflow Comparison

The table below breaks down just how much friction is involved in a traditional AP process compared to a modern, automated one. The difference isn't incremental; it's a fundamental shift in efficiency and control.

| AP Stage | Manual Process (The Old Way) | Automated Process (The New Way) |

|---|---|---|

| Invoice Receipt | Arrives in multiple inboxes, mail, or Slack. Manually forwarded. | Sent to a single, dedicated invoices@ email address. |

| Data Entry | AP clerk manually keys in vendor, date, amount, and line items into accounting software. Prone to typos. | Software automatically scans the invoice using OCR, extracts data, and creates a draft bill. |

| GL Coding | Clerk must remember or look up the correct expense account for each line item. | AI suggests the GL code based on vendor history, requiring only a quick review. |

| Approval Routing | Clerk emails the invoice to a manager, who may forget or miss it. Follow-up is manual. | System automatically routes the bill to the pre-defined approver based on rules (e.g., department, amount). |

| Payment | Clerk manually prints checks or logs into a bank portal to initiate ACH/wire transfers. | Approved bills are paid with a few clicks within the AP platform. Payment syncs automatically. |

| Reconciliation | Payment is manually recorded in the accounting system. Reconciliation is a separate, time-consuming month-end task. | Bill and payment records are synced to the GL in real-time, eliminating manual reconciliation. |

Automation doesn't just speed up a few steps—it removes entire categories of manual work, freeing up your team for more valuable analysis.

Pillar 3: Robust Controls

As your company grows, so does the risk of fraud and error. The casual "just email me the invoice for approval" process that worked with five employees becomes a serious liability with twenty. This is where robust controls become critical.

"Internal controls are not bureaucratic red tape; they are the guardrails that protect your company's cash. For a growing business, implementing segregation of duties in the AP process isn't optional—it's essential for preventing fraud and ensuring the integrity of your financial data." — Amanda Thompson, CPA and Fractional CFO

Implementing strong controls means establishing clear rules and separating duties. Even with a small team, you can achieve this effectively:

- Segregation of Duties: The person who enters a bill into the system must not be the same person who approves it, and neither should be the person who authorizes the final payment. AP automation platforms enforce this with user permissions.

- Approval Hierarchies: You must set clear, automated approval rules. For instance, any invoice under $1,000 can be approved by a department manager, but anything over $5,000 requires CEO approval. You configure this once, and it's enforced automatically every time.

- Vendor Management: Implement a formal process for adding new vendors that includes verifying their bank details through a secure portal. This prevents payments to fraudulent or incorrect accounts.

These controls are foundational for understanding your company's cash outflows. You can learn more in our guide on what is a cash disbursement.

Pillar 4: Seamless Integration

The final pillar is ensuring your AP system does not operate in a silo. A high-performance AP system must connect directly with your core accounting software, whether that's QuickBooks, Xero, or NetSuite.

This seamless integration is what unlocks real-time financial visibility.

When an invoice gets approved in your AP platform, it syncs instantly to your general ledger, creating the bill and updating your accounts payable balance. When you send the payment, that also syncs, creating the corresponding cash transaction. No more manual exports and imports.

This two-way sync eliminates manual reconciliation and delivers two huge benefits:

- Real-Time Cash Visibility: You always have an accurate, up-to-the-minute view of your liabilities and overall cash position.

- Faster Month-End Close: With your AP data already coded and reconciled throughout the month, you dramatically speed up your closing process from weeks to just days.

These four pillars work together to build a system that is efficient, secure, and provides the financial intelligence you need to make smart decisions as you scale.

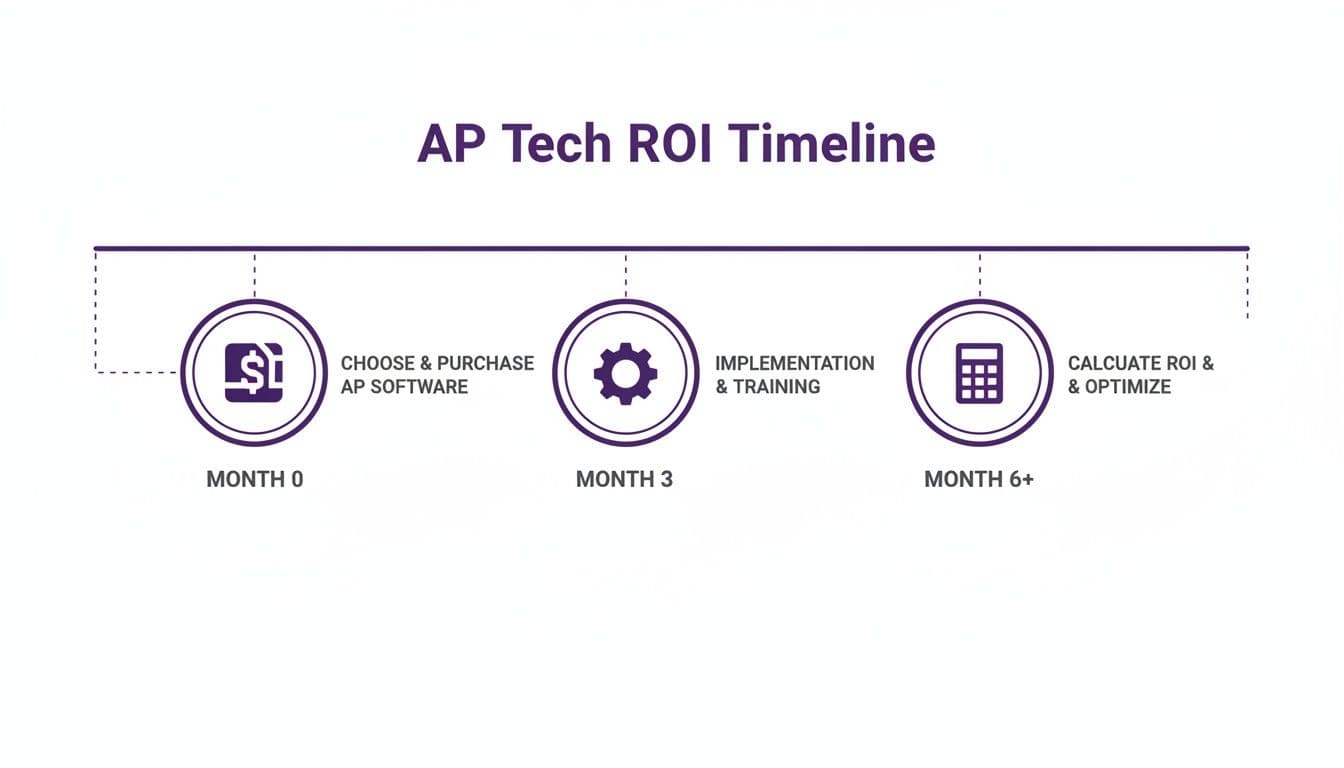

Picking Your AP Tech Stack and Calculating the ROI

You've diagnosed your AP health and you know what a high-performance system looks like. Now it's time to choose your tools and prove that the investment is a no-brainer. For founders and finance leaders, the real question is always, "Will this actually save us money?"

The answer is a definite yes, and you don't have to guess. A clear Return on Investment (ROI) calculation shows you exactly how a small monthly software fee unlocks massive annual savings.

Comparing the Top AP Automation Platforms

For most growing companies using platforms like QuickBooks, Xero, or NetSuite, the choice usually boils down to a few key players. The best fit depends on your specific needs—like international payments, corporate cards, or expense management.

Here’s a practical breakdown to get you started:

| Platform Comparison for Growing Businesses | |

|---|---|

| Platform | Bill.com |

| Best For | Companies needing a dedicated, robust AP and AR solution with strong approval workflows and multiple payment options, including international. |

| Key Features | - Automatic data capture (OCR/AI) - Customizable approval rules - Multiple payment methods (ACH, check, virtual card) - Direct QuickBooks/Xero/NetSuite sync |

| Platform | Dext (formerly Receipt Bank) |

| Best For | Businesses with a high volume of receipts and invoices that need best-in-class data extraction accuracy before syncing to accounting software. |

| Key Features | - Industry-leading OCR accuracy - Simple, user-friendly mobile app - Automatically splits line items and suggests coding - Deep integration with accounting platforms |

| Platform | Ramp |

| Best For | Companies looking for an all-in-one spend management platform that combines corporate cards, expense reports, and bill payments into a single system. |

| Key Features | - Integrated corporate cards with automated expense matching - Bill pay functionality with approval workflows - Built-in savings insights and vendor management |

When you’re making your choice, pay close attention to how deeply the tool integrates with your existing financial systems. Check out our guide on choosing accounting software to make sure your entire tech stack plays nicely together.

The ROI of AP Automation: A Worked Example

Now, let's run the numbers for a professional services firm that processes 200 invoices per month.

The ROI calculation is simple: you compare the total cost of the software to the savings it generates from less manual labor, captured early-pay discounts, and eliminated late fees.

Your Investment (The "I" in ROI)

A platform like Bill.com or Dext might run you about $79 per month for a plan that can handle this volume.

- Annual Software Cost: $79/month x 12 months = $948

Your Savings (The "R" in ROI)

Next, let's tally up the annual savings, assuming a finance team member has a loaded hourly rate of $40.

-

Labor Savings: Automating data entry and approvals easily saves 30 hours per month.

- 30 hours/month x $40/hour x 12 months = $14,400 annually

-

Early Payment Discounts: Assume 25% of your vendors offer a 2% discount (2/10, net 30 terms). If your monthly vendor spend is $50,000, this is a huge, often missed, opportunity.

- $50,000 spend x 25% eligible x 2% discount x 12 months = $3,000 annually

-

Eliminated Late Fees: By never missing a payment deadline, you stop burning cash on penalties. A conservative estimate is cutting $100 in fees each month.

- $100/month x 12 months = $1,200 annually

Total Annual Savings: $14,400 + $3,000 + $1,200 = $18,600

Your Net Return and ROI Multiple

Finally, let's put it all together.

- Net Annual Return: $18,600 (Savings) - $948 (Cost) = $17,652

- ROI Multiple: $17,652 / $948 = 18.6x

The Bottom Line: In this scenario, for every $1 you invest in AP automation, you get $18.60 back within the first year. This isn't a marginal improvement; it's a massive financial win.

This calculation doesn't even touch on the "softer" benefits like better team morale, stronger vendor relationships, and the strategic edge you get from real-time financial data. When you present this kind of business case, the decision to automate becomes undeniable.

Your 90-Day AP Transformation Plan

An idea without a plan is just a wish. This is a concrete, 90-day roadmap to transform your AP process from a liability into a high-performance engine. This isn't a theoretical exercise—it's your week-by-week playbook for immediate results.

Actionable Next Steps: The 3-Phase Rollout

| Phase | Timeline | Key Actions |

|---|---|---|

| Phase 1: Foundation | Days 1-30 | 1. Map Your Current Process: Document every step, from invoice receipt to payment. 2. Establish New Policies: Create your single invoices@ email. 3. Select Your Software: Use the ROI framework to make a data-backed decision. |

| Phase 2: Implementation | Days 31-60 | 1. Configure the System: Set up your accounting software integration and approval rules. 2. Run a Pilot Program: Start with your top 5-10 vendors to work out any kinks. 3. Train the Team: Hold dedicated training sessions for finance and key approvers. |

| Phase 3: Optimization | Days 61-90 | 1. Go Live: Roll out the new process to all vendors. 2. Document Everything: Create clear Standard Operating Procedures (SOPs). 3. Measure & Refine: Track your KPIs (Cycle Time, Cost per Invoice) and compare them to your baseline. |

"The biggest mistake companies make is underinvesting in training. You can buy the best software in the world, but if your team doesn't understand the 'why' behind the change and how to use the tool effectively, you'll never achieve the promised efficiency gains." — John Doe, Finance Automation Consultant

This structured 90-day plan makes a complex project manageable. If you're looking for expert guidance to speed this up and ensure a flawless rollout, check out our specialized AP setup and automation projects. We handle the heavy lifting so you can focus on running your business.

Answering Your Toughest AP Questions

Even when you know the process is broken, changing a core financial system feels daunting. Let's tackle the common objections and misconceptions head-on.

"My company is small. Isn't AP automation overkill?"

This is the most common myth. Small, growing companies feel the pain of manual AP the most because their teams are already stretched thin. Your best people should not be wasting their time on data entry.

Putting a system in place early, even when you're only processing 50-100 invoices a month, builds the foundation you can scale on. It stops bad habits before they take root and establishes strong financial controls from day one. The monthly fee for an AP platform is almost always less than the cost of one significant overpayment caused by human error.

"Will I lose control over payments if I automate?"

No. In fact, you gain more control and visibility. Modern AP automation isn't about letting a robot run wild with your bank account; it's about enforcing the rules you set.

These platforms are built around custom approval workflows that you define. For example, you decide:

- Who can approve invoices based on their department or project.

- What the dollar thresholds are for each level of approval (e.g., a manager approves up to $1,000, but the CEO signs off on anything over $5,000).

- Who has the final authority to schedule and send the payment.

Instead of chasing paper signatures, you get a crystal-clear, digital audit trail of every single action. This gives you far tighter control than any manual system ever could.

"How long does this actually take to set up?"

For most businesses in the $500K-$20M range using systems like QuickBooks Online or Xero, the core setup is surprisingly fast—often just a few weeks. The main steps are syncing your accounting software, mapping out your ideal approval chains, and showing the team the new, simpler process.

A phased, 90-day rollout like the plan we outlined is the key to a smooth transition that doesn't disrupt your daily operations. You start with a small group of trusted vendors to iron out any kinks before you move the entire AP process over. With an expert guiding you, it’s a seamless, error-free launch.

Ready to stop wasting money and time on a broken AP process? The team at Jumpstart Partners specializes in designing and implementing automated accounts payable systems that give you back control and fuel your growth.

Schedule a free consultation today to get your custom AP transformation plan.