Financial Operations

What Is Series B Funding? A Founder's Guide to Scaling Successfully

What is Series B funding? This guide covers the key metrics, investor expectations, and financial readiness needed to secure your next round and scale.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··23 min readYou’ve made it past the early hurdles. Your Series A round gave you the firepower to prove your business model, hire a killer core team, and win over a loyal customer base.

Now, the game changes completely. The question is no longer "Can we build a great product?" It's "Can we build a massive company?" Answering that question with confidence requires a successful Series B fundraise, and that means proving your business isn't just a promising startup—it's a predictable revenue machine ready for scale.

From Product-Market Fit to Market Dominance

This is what a Series B round is all about. Think of it this way: Series A was for building a powerful, reliable engine. Series B is for building the factory that can mass-produce that engine and put it into thousands of vehicles, completely taking over the highway.

You're making a strategic pivot from finding your niche to achieving market leadership. This stage is less about the grand vision and much more about relentless execution. Investors are betting on your ability to scale a predictable revenue machine.

The Shift from Promise to Predictability

Unlike earlier rounds that run heavily on your story and potential, Series B is grounded in cold, hard data. Investors expect you to show a clear, repeatable go-to-market strategy that can take a significant amount of capital and turn it into a multiple of that in revenue.

The focus shifts to:

- Aggressive Growth: Capturing a huge slice of your target market before competitors can even react.

- Team Expansion: Building out your leadership team by hiring VPs of Sales, Marketing, and Product to execute the growth plan.

- Operational Scale: Investing in the systems, processes, and infrastructure needed to support a much larger customer base and team.

According to data from Fundraise Insider points out in their analysis of Series B startup trends, the median Series B deal size is around $38 million, with many rounds falling between $25 million and $67 million. This isn't just cash to keep the lights on; it's capital deployed to turn your proven model into an unstoppable force.

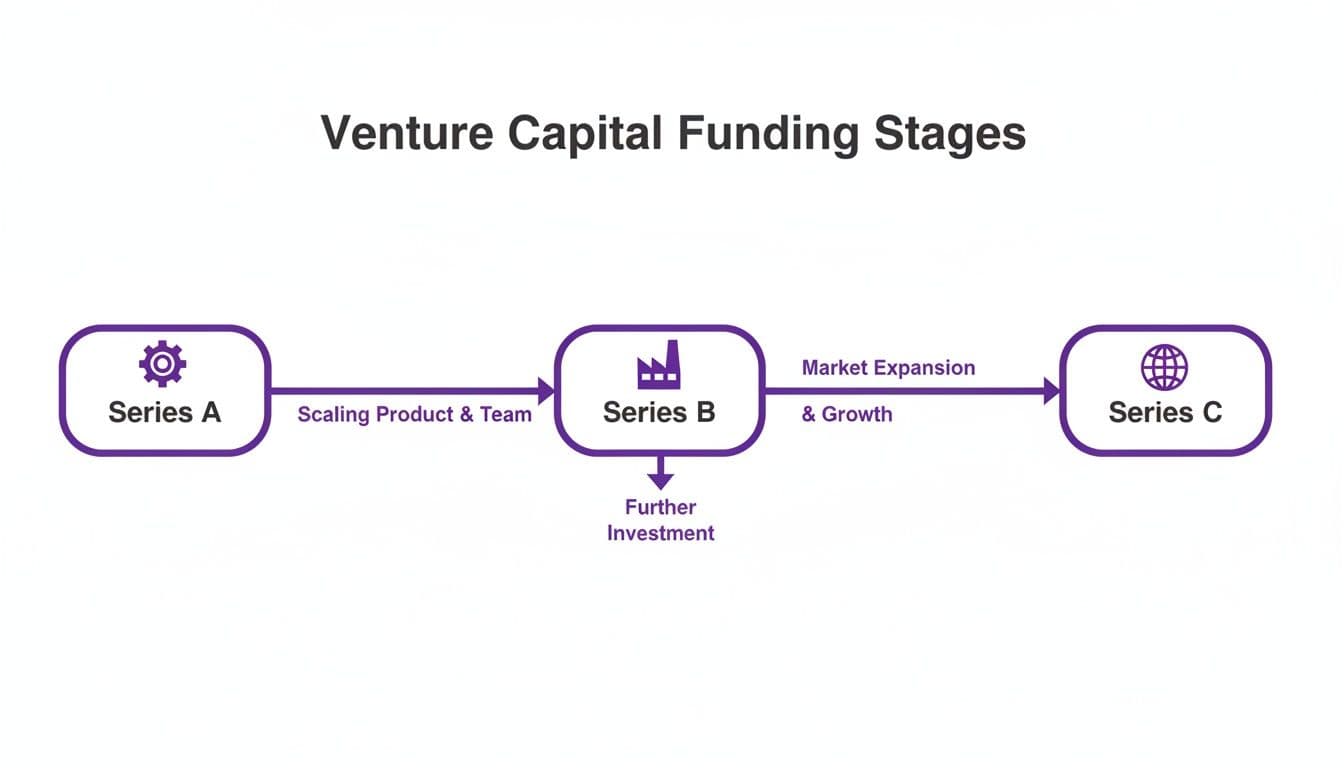

Startup Funding Stages at a Glance

To time your fundraise correctly, you have to understand exactly where Series B fits in the startup lifecycle. Each funding stage has a distinct purpose and a unique set of expectations from investors. Your job is to prove you're ready for the next level of investment and scrutiny that comes with it.

Before you even think about outreach, you need to have your numbers dialed in. Mastering key metrics is the first step, and our guide on how to track Annual Recurring Revenue is the perfect place to start.

Here's a quick breakdown of how the stages compare:

| Funding Stage | Company Status | Primary Goal | Typical Raise Amount |

|---|---|---|---|

| Series A | Product-market fit achieved; early revenue traction ($1M-$3M ARR). | Optimize product and build a repeatable sales process. | $5M - $20M |

| Series B | Repeatable and scalable sales model proven; strong growth metrics. | Aggressively scale operations and capture market share. | $20M - $80M |

| Series C | Established market leader; preparing for late-stage growth or an IPO. | Expand into new markets, develop new product lines, or make strategic acquisitions. | $50M - $250M+ |

As you can see, Series B is the critical bridge between having a great product and owning a significant piece of the market. It's where the real scaling begins.

The Key Metrics That Unlock Series B Funding

Series B investors aren't just buying into your vision anymore; they’re investing in a predictable revenue engine. Your job is to tell a story backed by hard data that proves your growth isn't a fluke—it’s efficient, repeatable, and ready to scale. This means going way beyond high-level revenue figures and digging into the mechanics of your growth.

VCs will put every detail of your financial model under a microscope. They need to see that for every dollar you put into sales and marketing, you're generating several dollars in profitable, long-term revenue. This is where mastering your key performance indicators (KPIs) becomes your most powerful fundraising tool.

Think of it this way: Series A was about building the machine. Series B is the industrialization phase—it's where you prove you can build a factory that manufactures growth at scale, and do it efficiently.

The Non-Negotiable SaaS Metrics

For any SaaS business, a few core metrics are the lifeblood of a Series B pitch. They tell a clear story about how efficiently you acquire customers, how much they love your product, and your path to long-term profitability.

Let's walk through the essentials with a worked calculation for a SaaS company at $5M ARR.

1. Customer Acquisition Cost (CAC) Payback Period This metric answers a simple question: How many months does it take to earn back the money you spent to get a new customer? A shorter payback period means you can recycle your cash faster to fuel even more growth. It’s a direct measure of capital efficiency.

- Formula: (Sales & Marketing Expenses Last Quarter / New Customers Last Quarter) / (Average Revenue Per Account x Gross Margin %)

- Worked Example: Your company spent $450,000 on sales and marketing last quarter and landed 75 new customers. Your average MRR per customer is $5,555 and your gross margin is 85%.

- CAC = $450,000 / 75 = $6,000

- Gross Margin Adjusted Revenue = $5,555 * 85% = $4,722

- Payback Period = $6,000 / $4,722 = 12.7 months (Right in the sweet spot for a healthy Series B candidate).

2. LTV:CAC Ratio (Customer Lifetime Value to CAC) This ratio compares the total value you'll get from a customer over their entire lifetime against the cost to acquire them. Investors need to see a powerful return on your acquisition spend. A ratio of 3:1 is the baseline for a healthy business, but top-tier companies often hit 5:1 or more.

- Formula: Customer Lifetime Value / Customer Acquisition Cost

- Worked Example: Using our $6,000 CAC from above, assume your monthly churn is 1.2%.

- Customer Lifetime = 1 / 0.012 = 83.3 months

- LTV = Avg. MRR * Gross Margin % * Customer Lifetime = $5,555 * 85% * 83.3 = $393,342

- LTV:CAC Ratio = $393,342 / $6,000 = 65.5:1 (An exceptionally strong ratio signaling an efficient, highly profitable business model).

3. Net Revenue Retention (NRR) NRR shows how much your revenue from existing customers grows (or shrinks), factoring in upgrades, downgrades, and churn. An NRR over 100% is the holy grail for SaaS—it means your business grows even if you don't acquire a single new customer. It’s a massive signal of product value and a green light for VCs.

Benchmarks You Must Hit

Knowing your numbers is just the first step. You also have to know how they stack up against the best in the industry. For a deeper dive, check out our complete guide to the SaaS financial metrics that matter.

According to OpenView's 2024 SaaS Benchmarks report, the expectations for efficient growth are higher than ever. Here's a look at the typical performance benchmarks VCs expect to see from a SaaS company raising a Series B round.

| Metric | Series B Target Benchmark | Why It Matters to Investors |

|---|---|---|

| ARR Growth Rate | 2.5x - 3x Year-over-Year | Proves intense market demand and your ability to execute on it. |

| Gross Margin | >75% (ideally 80%) | Shows a profitable core business with a low cost of service. |

| CAC Payback Period | < 12 months | Demonstrates capital efficiency and your ability to scale acquisition profitably. |

| LTV:CAC Ratio | > 3:1 (top tier is 5:1+) | Confirms the long-term profitability of your customer base. |

| Net Revenue Retention | > 110% | Signals powerful product-market fit and built-in growth from existing customers. |

Having these metrics dialed in is the absolute baseline for building an unassailable financial narrative for your Series B pitch. It shows you're not just growing—you're building a durable, valuable company.

Understanding how sophisticated investors are using advanced datasets can also give you a big advantage. For more on this, check out this article on the rise of alternative data in private equity sourcing.

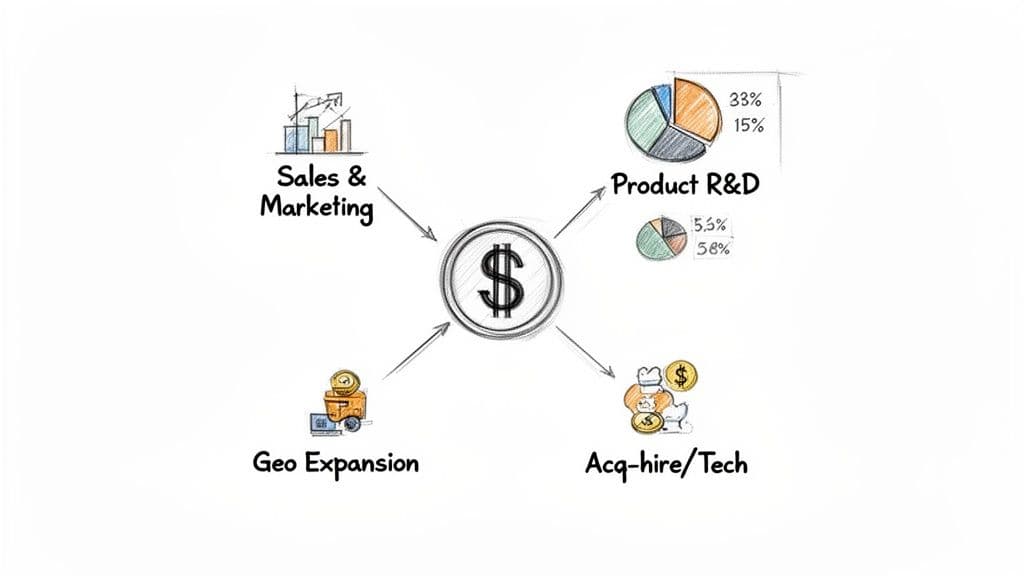

Deploying Your Series B Capital for Maximum Impact

That multi-million dollar check in the bank isn't the finish line—it's the starting gun. Vague plans to simply "grow the business" won't cut it with the sophisticated VCs and growth equity funds backing your Series B. They expect a detailed, strategic plan for every dollar that ties directly back to your financial model and shows a clear path to market leadership.

This isn't just about spending money. It’s about making calculated investments to scale your proven revenue engine into an industry-dominating machine. Your allocation strategy is a direct reflection of your priorities and your command of what it takes to build a scalable company.

Pouring Fuel on the Go-to-Market Fire

The biggest chunk of your Series B capital, usually around 40-60%, will go straight into scaling your sales and marketing teams. You’ve already proven you have a repeatable go-to-market motion; now it’s time to hire aggressively and expand your footprint.

This is where you move beyond your scrappy founding team and start building a structured, multi-layered commercial organization. Your budget here should support:

- Hiring Quota-Carrying Reps: Directly expanding the team that brings in the revenue.

- Building a Leadership Layer: Bringing in experienced VPs of Sales and Marketing who know how to manage and scale their functions.

- Investing in Demand Generation: Scaling paid acquisition channels, content marketing, and brand-building that keep the top of the funnel full.

Let’s say you raised a $40 million Series B. Allocating $20 million to sales and marketing is a standard move. That could fund hiring 40 new account executives, 8 marketing managers, and a new sales VP, while also cranking your ad spend from $150k to $600k per month.

Widening Your Competitive Moat Through Product

While sales gets the largest slice of the pie, investing in your product is critical for building a long-term, defensible business. Allocating 20-30% of your funds to R&D ensures you stay ahead of the competition and keep increasing the value you deliver to customers.

This capital isn't for finding product-market fit—you already did that. It's for building a fortress around it.

"Series B isn't about funding a product; it's about funding a company. We look for a leadership team that has moved from being great individual contributors to becoming great managers of managers. Without that, the operational wheels will fall off." — Anonymous Growth Equity Partner

This insight from a veteran investor underscores the core mission of a Series B: building an organization, not just a product. Smart R&D spending focuses on enhancing core features, developing new product lines to increase LTV, and beefing up your infrastructure to handle a massive influx of users. This proactive investment is key to managing your growth and avoiding the pitfalls of a strained balance sheet. You can learn more about how to improve working capital in our detailed guide.

Strategic Expansion and Acquisitions

The final 10-20% of your Series B is often earmarked for bigger, strategic bets that set the stage for your next phase of growth. These are the moves that can seriously accelerate your timeline to market dominance.

Common Strategic Uses of Capital:

- Geographic Expansion: Planting a flag in new regions or countries, which requires cash for localization, local sales teams, and navigating new regulatory hurdles.

- Acqui-hires: Buying smaller companies primarily for their talented engineering or product teams to quickly plug skill gaps.

- Technology Acquisitions: Purchasing a smaller company for a specific piece of tech that would take too long or be too expensive to build from the ground up.

Your ability to lay out a clear, data-driven plan for deploying this capital is just as important as the metrics you hit to raise it. It shows investors you’re not just a founder, but a disciplined capital allocator ready to lead a high-growth company.

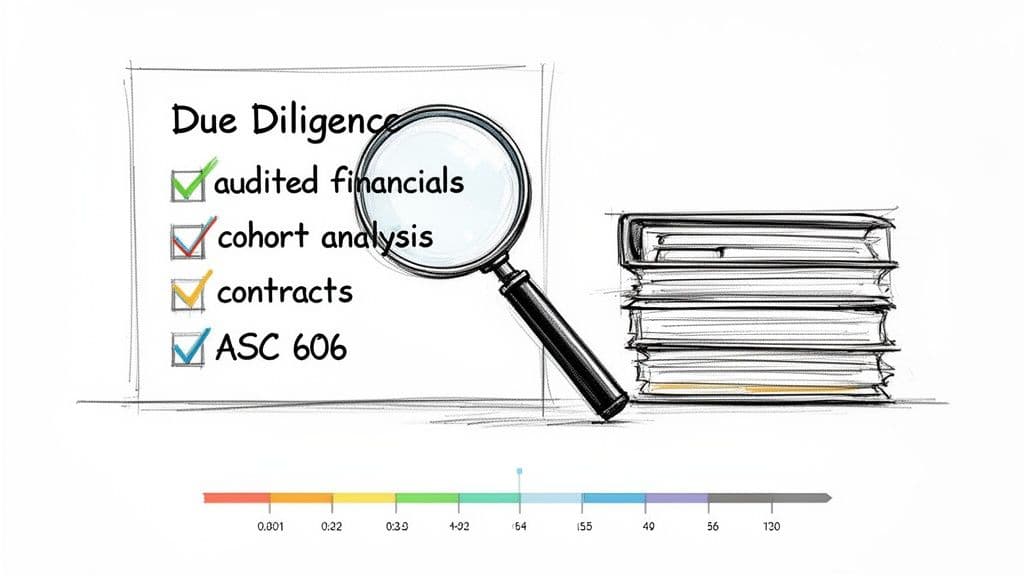

Navigating the Intense Series B Due Diligence Process

If your Series A due diligence felt like a thorough check-up, get ready for a full-body MRI. Series B is a whole different ballgame. The scrutiny is exponentially higher because the checks are bigger, the stakes are higher, and investors expect a business that’s already scaling predictably. They aren’t just kicking the tires; they’re deploying teams of accountants, lawyers, and industry specialists to dissect every fiber of your company.

Your financial house can’t just be tidy—it has to be immaculate. This process is engineered to find any weakness, inconsistency, or hidden risk in your numbers and operations. The only way to get through it is with proactive, meticulous preparation that starts months before the first term sheet even lands.

This level of rigor isn’t just investors being difficult; it's a direct response to a changing venture landscape. As analysis from Crunchbase shows, mega-rounds are capturing an outsized chunk of all deployed capital. This means fewer deals are happening, but investors are placing massive bets on companies with clear leadership potential and flawless financial controls. Passing this intense diligence process is now the barrier to entry for a top-tier valuation.

Your Due Diligence Document Checklist

Investors will ask for access to a secure data room loaded with every critical document about your company. Having this ready to go from day one signals you’re a pro and dramatically speeds up the whole process.

At a minimum, your data room needs to include:

- Audited Financial Statements: Forget about reviewed financials. At this stage, investors will demand at least one, and often two, years of financials audited by a reputable CPA firm.

- A Robust Financial Model: A bottoms-up, three-statement financial model projecting at least three years forward is non-negotiable. It must clearly outline all your assumptions for growth, hiring, and how you'll spend the new capital.

- Detailed Cohort Analyses: You need to show month-by-month cohort data proving customer retention, expansion revenue, and churn. This is the hard evidence that proves the long-term value and stickiness of your customer base.

- ASC 606 Compliant Revenue Recognition: For any SaaS business, this is a deal-breaker. You absolutely must demonstrate that your revenue is recognized according to GAAP standards, not just based on when cash hits the bank.

- Key Customer Contracts: VCs will want to see your top customer agreements to look for non-standard terms, concentration risk, or any potential liabilities hiding in the fine print.

- Corporate and Legal Documents: This includes everything from your articles of incorporation and board minutes to your cap table and all documentation of your intellectual property (IP) protections.

Getting ready for an audit is a heavy lift. For a detailed guide on what to expect and how to prepare, check out this comprehensive checklist for auditors.

Red Flags: The Deal-Killers to Watch For

So many promising Series B rounds fall apart during diligence, often because of unforced errors. Remember, investors are actively looking for reasons to say no, and sloppy preparation is the easiest excuse you can hand them. These are the warning signs that will send VCs running for the hills.

| Red Flag Category | Specific Example | Why It Scares Investors |

|---|---|---|

| Financial Inconsistency | Your P&L shows revenue of $4M, but your ASC 606 model shows $3.5M. | It screams "lack of financial control" and makes them question every other number you've presented. |

| Sloppy Bookkeeping | Unreconciled bank statements, poorly categorized expenses, and a messy general ledger. | If you can’t manage basic bookkeeping, how can they possibly trust you to manage $40M in venture capital? |

| Weak Unit Economics | A cohort analysis reveals that your LTV:CAC ratio for recent customer cohorts is declining sharply. | It suggests your growth is getting less efficient and your go-to-market strategy might not be scalable after all. |

| Unresolved Legal Issues | Pending litigation, employee classification disputes, or poorly documented IP ownership. | These are ticking time bombs that create massive future liabilities and will distract your team from actually growing the business. |

The only way through the due diligence gauntlet is to tackle these issues head-on. It’s not about hiding problems; it’s about presenting clean, accurate, and defensible data that tells a compelling story of scalable, predictable growth.

Common Misconceptions That Derail a Series B Raise

The road to a Series B round is paved with the ghosts of companies that made predictable mistakes. Too many founders get tripped up by outdated advice, completely misjudge what investors are looking for now, or just assume the playbook that got them through Series A will work again.

It won’t.

Let's get one thing straight: if your plan is to "clean up the books" during due diligence, you’ve already lost. By the time investors are digging in, a messy financial house isn't a cleanup job; it’s a giant red flag that screams "operational chaos." Trust evaporates instantly.

Here are the most common myths and missteps we see founders make—and how you can sidestep them.

Misconception 1: "Growth at all costs is still the goal."

This is easily the most dangerous belief in the market today. While top-line revenue growth is obviously important, Series B investors have shifted their focus entirely to efficient growth. They need to see that your Customer Acquisition Cost (CAC) isn’t secretly a runaway train. If you’re pouring more and more money into acquiring each new customer and your LTV:CAC ratio is getting worse with every cohort, you’re not scaling a business. You’re just scaling your burn rate.

How to Avoid It:

- Get Obsessed with Cohort Analysis: Stop looking at a blended CAC. You need to break down your CAC and LTV:CAC for each monthly customer cohort. This is the only way to prove your go-to-market strategy is getting more efficient as you grow, not less.

- Showcase Net Revenue Retention (NRR): An NRR above 110% is magic. It proves your existing customer base isn't just sticking around—it's actively growing. That’s the cheapest, most efficient growth you can possibly find.

Misconception 2: "Our valuation will be based on the same multiples as everyone else."

Another critical mistake is failing to see how wildly different the benchmarks are across sectors. You can't just assume your SaaS company will be valued like every other one when the entire market has been reshaped by certain trends. Just look at the AI space. It's completely rewritten the rules for what a Series B can look like.

Companies like Anthropic (raising a $2 billion Series B) and Together AI ($305 million Series B) are perfect examples of how sector-specific momentum can lead to massive outlier rounds. The valuation metrics and growth expectations for a standard B2B SaaS business are a world away from what's happening in a hyper-growth category. To get a better feel for these dynamics, check out this analysis of how AI infrastructure is dominating mega-rounds.

Misconception 3: "The team that got us here will get us there."

The scrappy, brilliant team that got you to product-market fit might not be the executive team that can steer the ship to $50 million in ARR. That’s a hard truth many founders don't want to face. At this stage, investors are betting just as much on your leadership's ability to manage complexity as they are on your product. This means having proven leaders who know how to build and run entire departments, manage multi-million dollar budgets, and install the systems and processes needed to operate at scale.

Red Flags Investors Look For:

- The Founder Bottleneck: The CEO is still signing off on marketing copy, approving every hire, and getting pulled into minor product decisions.

- Lack of Functional Leadership: The company is missing experienced VPs of Sales, Marketing, or Product who have actually scaled a business past your current stage.

- Poor Financial Acumen: The leadership team gets fuzzy when asked about anything beyond top-line revenue. They can't speak fluently about the key financial drivers of the business.

Avoiding these traps comes down to foresight and discipline. It means building the company for the scale you want to achieve long before you ask investors for the capital to get there.

Your Action Plan for Investor-Ready Financials

Knowing the theory behind Series B is one thing. Actually running a flawless fundraising process is a different beast entirely. Success demands a focused, deliberate action plan that starts months before you ever talk to an investor. This is where you move from theory to execution, turning your financial operations from a simple back-office function into your most strategic asset.

Your goal is to build a financial narrative that’s so compelling and so buttoned-up that it anticipates every investor question and sails through due diligence. It’s not just about having good numbers; it’s about presenting them with a level of professionalism that screams competence and builds trust.

The Investor-Ready Checklist: Your Next Steps

Getting your financial house in perfect, audit-ready order is your first priority. This isn't a task you can hand off to a junior bookkeeper or squeeze in between leadership meetings. It requires dedicated, expert attention. Here are the non-negotiable next steps you must take.

| Action Item | Why It's Critical for Your Series B | Deadline |

|---|---|---|

| Implement ASC 606 Revenue Recognition | Mandatory for SaaS/services. Proves you understand GAAP and aren't just counting cash. | 6 months pre-raise |

| Build a Dynamic 3-Statement Financial Model | A bottoms-up model linking ops to financials is non-negotiable. It's the blueprint for your growth. | 4 months pre-raise |

| Prepare a Secure Data Room | Gather all critical docs now—audited financials, contracts, cohort analyses. Being ready signals professionalism. | 3 months pre-raise |

| Achieve a Fast, Accurate Month-End Close | A sloppy, 20-day close is a massive red flag. A 5-day close proves you have tight operational control. | 3 months pre-raise |

The Unfair Advantage Your Competition Has

You might think your only option is to hire a full-time, six-figure CFO to manage all of this. That’s a critical miscalculation. A full-time executive is not only expensive but often underutilized before you hit a much larger scale.

This is where an expert partner becomes your unfair advantage. Instead of the high cost and painful, months-long search for a full-time hire, our outsourced controller services give you on-demand, CPA-certified expertise that’s built for the intensity of a Series B raise.

When you show up with professionalized financial operations, it sends a powerful signal that you’re ready to manage their capital effectively.

We deliver the exact outputs that VCs demand:

- A 5-Day Month-End Close: We get you fast, accurate financials, giving you and your investors a real-time view of business performance.

- Audit-Ready Financials: Our team ensures your books are clean, compliant, and ready to withstand the deepest due diligence scrutiny. You can learn more about how to prepare financial statements in our comprehensive guide.

- Critical KPI Dashboards: We build and maintain the reports that truly matter for a Series B—MRR/ARR waterfalls, cohort analysis, LTV:CAC, and Net Revenue Retention.

This approach frees you from drowning in the financial details, letting you focus on what you do best: building your product, serving your customers, and scaling your company.

Your Top Series B Questions, Answered

When you’re staring down the barrel of a Series B, a whole new set of questions pops up. The stakes are higher, the diligence is deeper, and the process feels a lot more intense. Here are the answers to the most common questions we get from founders who are gearing up for this next big step.

How Long Does a Series B Fundraising Process Take?

Plan for a three to six-month marathon, not a sprint. This isn't your Series A. The first one to two months are all about prep—this is where you obsessively refine your pitch deck, build an ironclad financial model, and get your data room organized to perfection.

Once you’re ready, you’ll spend the next one to two months in the trenches, doing investor outreach and taking meeting after meeting. The final one to two months are for the deep-dive due diligence and the inevitable legal back-and-forth. The single best way to shrink this timeline? Have immaculate, well-organized financials from day one. It cuts out weeks of scrambling.

What Is a Typical Valuation for a Series B Company?

Valuations can be all over the map depending on your industry, growth trajectory, and the current market mood, but most fall somewhere between $50 million and $200 million.

For SaaS companies, the math usually starts with a multiple of your Annual Recurring Revenue (ARR). For a high-growth business with killer unit economics and fantastic net revenue retention, that multiple is often in the 10x to 20x ARR range. But be prepared—investors will poke and prod every single metric to justify whatever number they land on.

Who Typically Leads a Series B Round?

Your Series B will almost certainly be led by a new institutional venture capital (VC) firm that specializes in this growth stage. Think of them as the new quarterback for this phase of your company’s life; they weren’t on the field for your Series A.

Of course, your existing investors are expected to follow on and put more capital in to protect their stake. But it’s the new lead investor who really runs the show. They’ll set the terms, perform the most exhaustive due diligence, and almost always take a board seat. If you're new to this world, understanding how to get venture capital funding by building real traction and nailing your pitch is absolutely essential.

Navigating the complexities of a Series B raise requires flawless financial execution. Instead of hiring a full-time CFO, let Jumpstart Partners provide the expert, on-demand support you need to impress investors and close your round.

Schedule a consultation today to get your financials investor-ready.