Financial Operations

How to Improve Working Capital: A Founder's Guide for SaaS & Service Firms

How to improve working capital: practical tips for SaaS and service firms to unlock cash, boost growth, and gain financial control.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··21 min readImproving your working capital isn’t an accounting exercise—it's about unlocking the cash already inside your business to fund your next growth phase. When you master this, you can hire that key engineer, launch a new marketing campaign, or extend your runway without raising dilutive capital or taking on unnecessary debt.

The entire process boils down to shortening your Cash Conversion Cycle (CCC). This is the time it takes for a dollar you spend on your team or software to return to your bank account from a customer payment. The shorter that cycle, the more cash you have on hand to reinvest in growth.

Your Next Growth Spurt Is Hiding in Your Working Capital

For founders running businesses in the $500K to $20M revenue range, weak working capital management is a silent growth killer. It’s the cash that can fund your next key hire, give you breathing room on your runway, or finally get that new product off the ground.

When you don't manage it proactively, cash gets trapped in slow-paying customers, bloated operational processes, and inefficient payment cycles. Growth stalls. You miss out on opportunities. And you end up raising money you didn't really need to.

This guide cuts through the theory to give you a straightforward, actionable playbook to strengthen your company's financial footing.

“A business that is growing will absorb cash. I cannot think of any exceptions. The faster the growth, the more cash it will absorb.” – Michael E. Gerber, Author of The E-Myth Revisited

Gerber’s point highlights a critical paradox for founders: the very growth you’re celebrating puts a massive strain on your cash if your working capital isn't dialed in. As you scale, you need more and more cash to serve new clients and cover costs before their payments hit your account.

Why This Matters for Service and SaaS Businesses

Most working capital advice is for businesses with physical inventory. But the principles are just as crucial for SaaS, digital agencies, and professional services firms. Your "inventory" isn't a widget on a shelf; it's your team's unbilled time, work-in-progress, or capitalized development costs.

- For SaaS Companies: Long collection cycles on annual contracts or delays in recognizing subscription revenue create a huge cash drag, even when your MRR looks fantastic.

- For Digital Agencies: The gap between finishing a project and getting that final payment stretches your finances dangerously thin, especially with payroll and contractor invoices due every month.

By the end of this playbook, you'll know exactly how to unlock the growth capital hiding on your balance sheet, starting with the three metrics that govern your company's liquidity. For a deeper foundation, review our guide on cash flow forecasting best practices.

Finding Your Baseline with Three Critical Levers

You cannot fix what you don't measure. Before you unlock cash, you need to move beyond gut feelings about your cash flow and get a precise, data-backed starting point. This means calculating the three critical metrics that govern your working capital health.

These aren't abstract accounting terms; they are the core levers you will pull to directly impact how much cash you have on hand. Mastering them turns your financial data into a clear roadmap for improvement.

Let's break down how to calculate each one for your business.

Days Sales Outstanding (DSO): How Fast You Get Paid

Days Sales Outstanding (DSO) measures the average number of days it takes you to collect payment after a sale. A high DSO means your customers are taking a long time to pay you, effectively using your company as a free line of credit. For service and SaaS companies, this is the single most important lever you can pull.

The formula is:

(Accounts Receivable / Total Revenue) x Number of Days in Period

Let’s run the numbers for a digital agency. You had $200,000 in Accounts Receivable at the end of the last quarter, and your total revenue for that 90-day period was $450,000.

- Calculation: ($200,000 / $450,000) x 90 days = 40 days

This means it takes your agency, on average, 40 days to get paid. Every day you shave off that number is cash that goes directly back into your bank account.

Days Payable Outstanding (DPO): How Fast You Pay Others

Days Payable Outstanding (DPO) is the flip side of DSO. It measures the average number of days it takes for you to pay your own bills—invoices to vendors, contractors, and suppliers. A higher DPO means you are holding onto your cash longer, which directly improves your working capital position.

Here’s the formula:

(Accounts Payable / Cost of Goods Sold) x Number of Days in Period

Let's use a growing SaaS company as an example. Your Accounts Payable is $75,000 at the end of a 90-day quarter. Your Cost of Goods Sold (COGS)—which for a SaaS business includes hosting, third-party software licenses, and support staff salaries—was $225,000.

- Calculation: ($75,000 / $225,000) x 90 days = 30 days

Your company pays its bills in 30 days. Strategically extending this timeline without damaging vendor relationships is a key tactic we'll explore. For a deeper dive, read our guide on improving your accounts payable process.

Days Inventory Outstanding (DIO): How Fast You Move "Inventory"

For professional services and SaaS firms, "inventory" is an abstract concept, but it's still critically important. Instead of physical goods, your inventory is your team’s unbilled work-in-progress or capitalized software development costs. Days Inventory Outstanding (DIO) measures how long it takes to convert this work into recognized revenue.

The formula is:

(Average Inventory / Cost of Goods Sold) x Number of Days in Period

Calculating this for a service business requires a clear definition of "inventory"—it's often the value of unbilled time or project costs sitting on your books. A high DIO signals inefficiency in your project delivery or billing cycle. Because this metric is less standardized for service firms, we focus primarily on DSO and DPO as your main levers for quick wins.

Putting It All Together: Your Cash Conversion Cycle (CCC)

These three metrics combine to form your Cash Conversion Cycle (CCC)—the total time it takes for a dollar you invest in your operations to return to your bank account as cash.

CCC = DSO + DIO - DPO

It's the financial gap you have to fund out of your own pocket. Shortening it is the ultimate goal of improving working capital.

Calculating Your Cash Conversion Cycle: A SaaS Example

| Metric | Formula | Example Calculation (SaaS Co.) | Result (Days) |

|---|---|---|---|

| DSO | (Accounts Receivable / Revenue) x Period | ($150,000 / $500,000) x 90 | 27 Days |

| DIO | (Avg. Inventory / COGS) x Period | ($25,000 / $125,000) x 90 | 18 Days |

| DPO | (Accounts Payable / COGS) x Period | ($50,000 / $125,000) x 90 | (36 Days) |

| CCC | DSO + DIO - DPO | 27 + 18 - 36 | 9 Days |

In this scenario, the company has a 9-day cash gap. For 9 days, it has paid for its operational costs but has not yet collected the cash from its sales. That's the period it needs to self-fund.

Recent trends show this gap is widening. According to working capital trends at KPMG, the median CCC for US public companies in the Information Technology sector is a staggering 118 days, highlighting the immense pressure on cash flow.

Now that you have your baseline numbers, you can see exactly where the friction is. The next step is to take targeted action to improve each one.

Quick Wins to Free Up Cash in the Next 90 Days

You've got your baseline KPIs. Now it's time for action. Improving working capital doesn't require a six-month strategic slog. You can make high-impact changes this quarter that put cash back in the bank, fast. The goal here is smart, swift moves that deliver measurable results.

This isn't about tired advice like "invoice faster." It's about implementing specific, modern tactics that directly shorten your cash conversion cycle. We're going to focus on the two levers you control completely: speeding up your Accounts Receivable (AR) and smartly managing your Accounts Payable (AP).

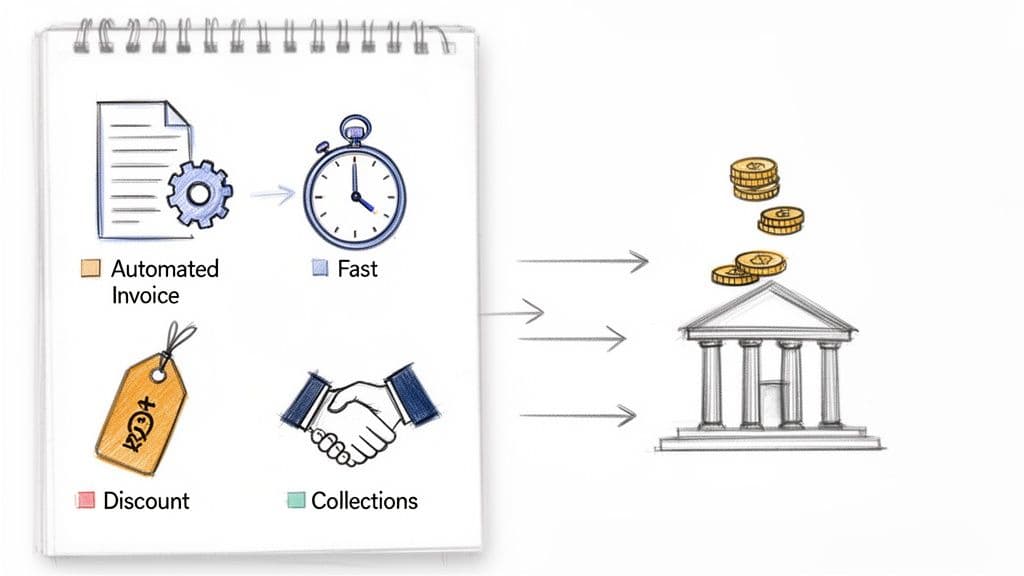

Accelerate Your Accounts Receivable

Every day you shave off your Days Sales Outstanding (DSO) is cash in your pocket. For service and SaaS businesses, the AR process is the biggest opportunity for an immediate cash injection.

Your first move is to stop sending invoices manually. Set up automated, recurring invoices in a tool like QuickBooks or Stripe for all retainer clients and subscription customers. This single change eliminates human error and ensures invoices go out like clockwork, starting the payment clock the moment work is complete.

Next, offer a calculated early payment discount. A common structure is "2/10, net 30," which gives clients a 2% discount if they pay within 10 days; otherwise, the full amount is due in 30.

But you must run the numbers. Let's say you have a $25,000 invoice.

- The Discount: A 2% discount costs you $500.

- Cost of Capital: If your annual cost of capital is 8%, the cost of waiting an extra 20 days for that payment is only about $110.

In this scenario, paying $500 to get your cash 20 days sooner is an expensive loan. But—and this is a big but—if getting that $24,500 now lets you make a critical hire or avoid tapping a high-interest credit line, the strategic value is well worth the cost. You have to weigh the cost against your immediate need for liquidity.

"The single biggest mistake I see founders make with collections is being passive. They send an invoice and just hope for the best. You need a proactive, systematic process that escalates gently but firmly. Your cash flow depends on it." – Sarah Johnson, Fractional CFO

Finally, build an automated-yet-personal collections process. A simple, tiered system works wonders while preserving client relationships: a soft reminder 3 days before the due date, a firm one the day it's late, and a personal call from an account manager at 15 days past due.

Strategically Manage Your Accounts Payable

While you want to get paid as fast as possible, the flip side is just as important: you should pay your own bills as slowly as your terms ethically allow. This is about strategically managing your Days Payable Outstanding (DPO) to hold onto your cash longer. You're effectively using your vendors' capital to fund your operations.

This does not mean becoming "that client" who always pays late. That damages relationships and your reputation. It means professionalizing your AP process.

Start by reviewing the contracts for your top five vendors. What are your current payment terms? Many founders accept net 15 or net 30 by default without asking for more.

The next time you renew a contract or sign a major new vendor, negotiate for net 45 or even net 60 terms from the very beginning. Frame it as a standard part of building a strong, long-term partnership. Shifting just one $10,000/month contract from net 30 to net 60 instantly injects $10,000 of permanent working capital into your business.

This discipline is a key differentiator. According to The Hackett Group's working capital research, top-performing companies unlocked $1.7 trillion in excess working capital, largely by increasing their DPO through savvy supplier negotiations.

When you combine these AR and AP strategies, you create a powerful pincer movement on your cash conversion cycle. To see the future impact of these changes, use a 13-week cash flow forecast to model it out.

Building Long-Term Financial Control and Visibility

Quick wins get you breathing room, but sustainable working capital comes from building robust, repeatable systems. This is where you move from reactive fire-fighting to proactive financial management—creating a disciplined financial rhythm that gives you a true, timely picture of your company’s health.

This transition starts with your month-end close. Many founders see it as a painful, backward-looking accounting chore. You must see it as the foundation for every forward-looking strategic decision you make.

Warning Signs: Your Financial Operations Are Holding You Back

If any of these sound familiar, your current processes are a significant business risk:

- Your month-end close takes more than 15 days.

- You are consistently surprised by your cash balance at the end of the month.

- You spend more than five hours a week on financial admin tasks.

- You can't produce an accurate AR aging report in under 10 minutes.

Institute a Fast 5-Day Close

A slow, chaotic month-end close that drags on for 20 or 30 days isn't just an annoyance; it’s a critical business risk. By the time you get the numbers, they're too stale to be useful for making decisions about hiring, marketing spend, or cash management.

The goal is to shrink this entire process down to five business days.

Getting to a 5-day close forces discipline across your entire financial operation. It demands clean bank reconciliations, on-time expense reporting, and accurate revenue recognition. When you have reliable financials by the fifth business day of the month, you gain a massive competitive advantage: you can act on fresh, accurate data while your competitors are still guessing.

Build a Rolling 13-Week Cash Flow Forecast

With timely data from your fast close, you can now build the single most powerful tool for managing liquidity: the 13-week cash flow forecast. This isn't your high-level annual budget; it's a granular, week-by-week projection of every dollar coming in and going out of your business for the next quarter.

This forecast is your early warning system. It shows you precisely when a cash shortfall might occur, giving you weeks—not days—to react. You can decide to delay a big expense, ramp up collections, or draw on your line of credit proactively and calmly, not in a panic.

Here’s a simplified snapshot of what the first week looks like:

| Cash Flow Item | Week 1 Forecast |

|---|---|

| Beginning Cash Balance | $150,000 |

| Cash Inflows | |

| Client A Payment (Invoice #123) | $25,000 |

| Stripe Payout (Subscriptions) | $18,500 |

| Total Cash In | $43,500 |

| Cash Outflows | |

| Payroll & Taxes | ($35,000) |

| Rent & Utilities | ($5,000) |

| Software Subscriptions (AWS, etc.) | ($2,500) |

| Total Cash Out | ($42,500) |

| Ending Cash Balance | $151,000 |

By updating and rolling this forecast forward every week, you maintain constant visibility. This practice transforms cash management from a constant source of anxiety into a strategic asset, letting you make confident calls on growth and investment.

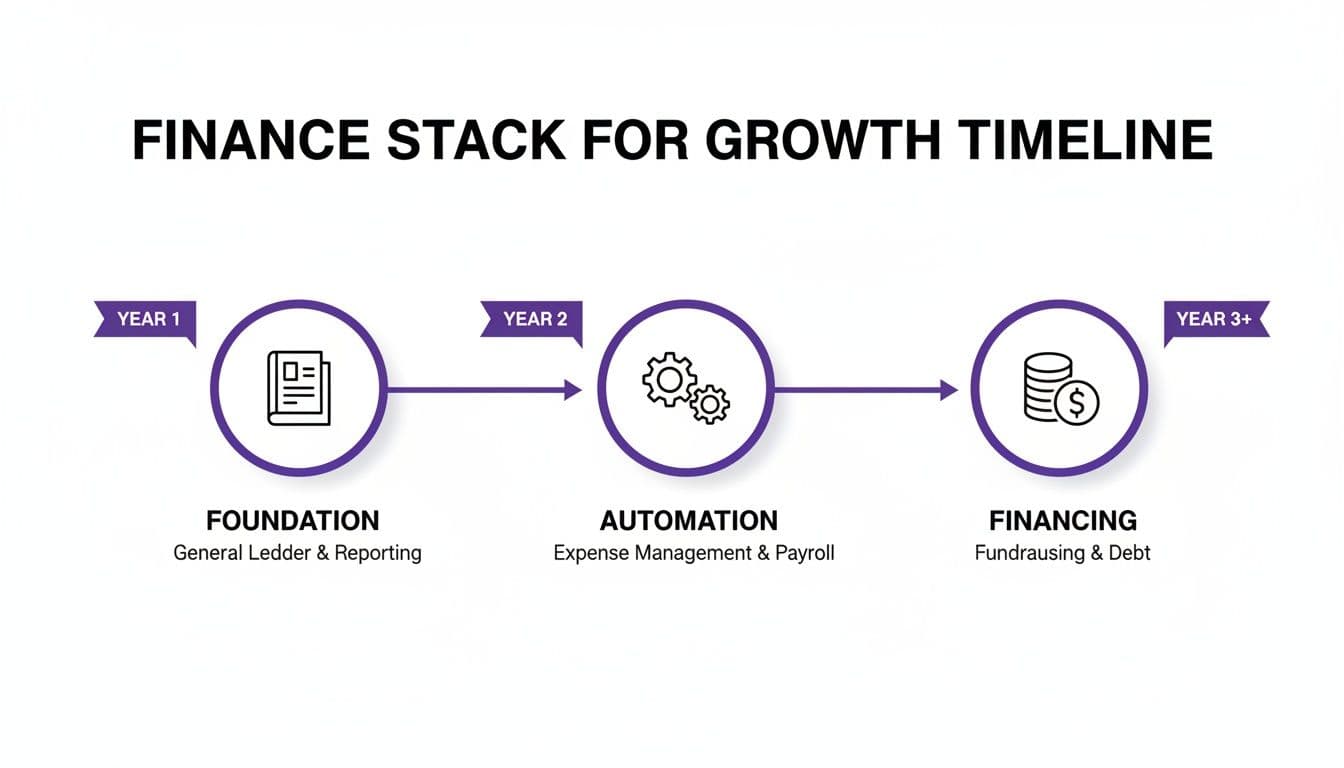

Using Technology and Financing for Scalable Growth

Operational discipline is your foundation. But the right technology and financing options act as force multipliers, turning good habits into systems that can scale.

Once you cross the $1M revenue mark, spreadsheets and manual processes break. They become bottlenecks that actively sabotage your efforts to improve working capital. It’s time to build a modern finance stack that supports your growth instead of slowing it down.

This isn't about buying expensive, complex software. It’s about intelligently connecting the tools you already use—like QuickBooks, Xero, and Stripe—to automate workflows, kill human error, and get the real-time visibility you need to make faster, smarter decisions.

Build Your Modern Finance Stack

Your goal is to create a seamless flow of data from the point of sale all the way to your financial statements. When your systems talk to each other, manual data entry disappears, reconciliations get faster, and your numbers are always current.

This is the key to maintaining a fast month-end close and an accurate cash flow forecast as your transaction volume explodes. A well-integrated stack gives you a single source of truth. You can see your cash position, accounts receivable aging, and burn rate right now, without waiting for a month-end report. That level of clarity is non-negotiable for scaling from $1M to $10M.

For a deeper look at building these workflows, our guide to financial reporting automation breaks it down.

"Many companies fall into a trap where they view working capital as a finance-only problem. In reality, the biggest gains come from operational and technological improvements—automating the quote-to-cash cycle or using financing to smooth out lumpy revenue. Technology connects finance to the entire business." – Sarah Johnson, Fractional CFO

Evaluate Smart Financing Options

Even with perfectly tuned operations, you will face moments where you need external capital to bridge a gap or seize an opportunity. This is where strategic financing comes in, not as a last resort, but as a deliberate tool for managing liquidity.

Two of the most effective options for working capital are lines of credit and invoice financing.

-

Revolving Line of Credit: Think of it as a credit card for your business, but with much better terms. It gives you a flexible pool of cash you can draw on as needed to cover payroll during a slow collections month or to fund a new marketing campaign. You only pay interest on what you use, making it a cost-effective safety net.

-

Invoice Financing (or Factoring): This lets you sell your outstanding invoices to a third party for a fee, giving you immediate access to that cash—often up to 80-90% of the invoice value. It's a powerful way to smooth out cash flow if you have large, creditworthy clients who are on slow net 60 or net 90 payment terms.

The key is to understand the true cost. A line of credit has a lower stated interest rate, but invoice financing provides faster access to larger sums tied directly to your sales growth. Choose the tool that best fits your specific cash conversion cycle challenge.

The impact of combining operational rigor with smart tech is huge. According to Visa's Working Capital Index, top-performing growth companies prioritize DSO cuts through A/R automation and strategic vendor negotiations to significantly improve their financial standing. This is how you unlock the capital needed for real, sustainable growth.

Your Implementation Roadmap: From DIY to an Outsourced Controller

All the theory in the world doesn't mean much without a clear, phased plan to turn these ideas into reality. This roadmap lays out what to tackle over the next six months—moving from quick wins to sustainable systems—so you can build a truly resilient financial engine for your business.

The journey to financial maturity isn't a sprint; it's a steady progression. You must master the basics before layering on more complex strategies.

Here's a practical timeline you can follow, breaking down a big goal into manageable chunks.

Your 180-Day Working Capital Improvement Plan

This table provides a step-by-step game plan, showing you exactly where to focus your energy from day one to the six-month mark.

| Timeframe | Key Actions | Primary Goal |

|---|---|---|

| First 30 Days | Calculate baseline DSO, DPO, and CCC. Automate invoicing for all recurring clients. Establish a basic collections reminder sequence. | Establish your starting KPIs and stop cash leaks from manual processes. |

| First 90 Days | Implement a 13-week cash flow forecast. Review and renegotiate payment terms with your top three vendors. | Gain forward-looking visibility into your cash position and improve your DPO. |

| First 180 Days | Institute a consistent 5-day month-end close. Explore AP automation tools and strategic financing options (e.g., line of credit). | Create a disciplined financial rhythm and build a scalable operational infrastructure. |

By following this phased approach, you ensure that foundational improvements are locked in before you move on to more advanced financial operations.

When to Move From DIY to an Outsourced Controller

As a founder, your time is your most valuable asset. In the early days, you might handle the books yourself or lean on a part-time bookkeeper. But as you scale, you’ll hit an inflection point where that approach actively holds your business back.

The tipping point isn’t a specific revenue number; it's about complexity and opportunity cost. So, how do you know you've outgrown your current setup? The signs are usually clear:

- You're spending more than five hours a week on financial admin.

- You’re preparing for an audit, seeking investment, or applying for significant debt financing.

- Your month-end close consistently takes longer than 15 days.

- You are consistently surprised by your cash balance at the end of the month.

These are bright red flags signaling you need more than just bookkeeping. You need a strategic partner to implement the robust systems we've talked about in this guide. To help you decide, explore our detailed breakdown of an in-house vs. outsourced controller for a deeper analysis.

Ready to build a custom plan to improve your company’s working capital? Schedule a consultation with our team to see how our outsourced controller services can unlock cash and give you back your time.

Common Objections & Misconceptions About Working Capital

Even with the best playbook, founders still have those nagging "what if" questions when it's time to get serious about financial operations. Let's tackle the most common ones.

Misconception 1: "My revenue is growing, so my cash flow must be fine."

This is the most dangerous assumption a founder can make. Profitability on your P&L statement does not equal cash in the bank. You can have record-breaking revenue and still run out of cash because your customers are paying you in 60 days while you have to make payroll every 15 days. This is how fast-growing, "successful" companies go bankrupt. Your cash conversion cycle, not your revenue growth, determines your liquidity.

Misconception 2: "Extending my payment terms will hurt vendor relationships."

This is a classic founder fear, but it almost never hurts relationships if you're smart about it. The goal isn't to become a deadbeat who pays late. It's to formalize longer, mutually agreed-upon terms as part of your standard process.

Don't just send a blanket email to everyone. Start with your largest, most established vendors—the ones you have a real partnership with. Frame the conversation around your long-term relationship and negotiate for net 45 or net 60 terms. Once you agree, the critical next step is to use an automated AP system to pay them exactly on that new due date. This actually builds trust and shows you’re reliable, just on a new schedule.

Misconception 3: "I'll hire a controller when I hit $5M in revenue."

Waiting for a specific revenue milestone is a mistake. The tipping point is operational pain, not revenue. It’s time to bring in an outsourced controller if you're:

- Spending more than five hours a week of your own time on financial admin.

- Gearing up for a financial audit or trying to raise your next round.

- Constantly surprised by how much (or how little) cash is in the bank at the end of the month.

An outsourced controller implements the critical systems we’ve been talking about—like a 5-day close and a reliable cash forecast. Think of it as a direct investment in the financial visibility you need to make smart, strategic decisions.

What Is a Good Cash Conversion Cycle for a SaaS Company?

For a SaaS business, "good" is often negative. This is the holy grail—it means you’re collecting cash from customers (usually through annual upfront deals) long before you have to pay for big-ticket items like hosting or payroll.

A realistic target for a growing SaaS company is between 0 and 30 days. Once your CCC starts creeping past 60 days, that's a major red flag. It tells you that too much of your cash is tied up in slow-paying enterprise customers or inefficient billing.

According to OpenView's 2024 SaaS Benchmarks, the top-quartile SaaS companies all maintain a negative CCC. This creates a powerful float, letting them use customer cash to fund day-to-day operations and fuel growth without needing to raise more capital.

Ready to stop worrying about your cash balance and start building a financial foundation that can support your growth? Jumpstart Partners provides the expert outsourced controller services you need to unlock working capital, get investor-ready financials, and gain complete visibility into your business.

Schedule your free consultation today and let's transform your financial operations in the next 90 days.