Financial Operations

Define Operating Budgets to Master Your Company's Finances

Stop guessing and start growing. Define operating budgets to gain financial clarity, control costs, and make data-driven decisions for your business.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··13 min readTrying to scale your business without a real operating budget is like flying blind into a storm. It's the single tool that separates predictable, profitable growth from a painful, unexpected cash crunch. For founders and CEOs, the operating budget is your financial GPS—a detailed forecast of day-to-day revenues and expenses that turns your annual goals into a concrete, actionable plan for hiring, marketing, and product development.

Without it, you’re left guessing on the most critical questions. Can you really afford that new sales hire? Should you double down on marketing spend? Do you have enough runway to survive a slow quarter? This uncertainty leads to the common traps that stall growth: uncontrolled spending, messy resource allocation, and a total inability to forecast your cash position.

Why an Operating Budget is Your Financial GPS

A solid operating budget brings absolute clarity. It forces you to align spending with strategic priorities, making sure every dollar pushes your most important goals forward. It gives you the confidence to make decisive moves because you have a clear financial framework backing your decisions.

"Your budget is a living document. It's not a set-it-and-forget-it exercise. It's the pulse of your business, telling you where you stand and helping you adjust course before you drift into trouble." - Dennis Shvartsman, Partner at Jumpstart Partners

This forward-looking view is indispensable. By planning your expenses and projecting your revenue, you create a baseline to measure your actual performance against. You start to see what's working and what isn't—the foundation of data-driven leadership. You can learn more about tracking these numbers by building comprehensive financial dashboards for CEOs.

To transform a simple budget into a true strategic GPS, explore advanced finance FPA data analysis tools for forecasting and scenario planning. This is how you move from reactive accounting to proactive financial strategy.

What Goes Into an Operating Budget?

An effective operating budget isn't just a single number. It’s a financial framework built on three core pillars that work together to paint a clear, honest picture of your day-to-day operations. Get these right, and you have real control over your finances.

1. Revenue Forecasting

This is your starting point. Revenue forecasting is your educated, data-backed projection of all the income your business will generate. For your SaaS company, this is grounded in Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR). Your projections cannot be based on wishful thinking; they must be built on realistic assumptions about new customer acquisition, churn rates, and expansion revenue.

If you run a professional services firm or a digital agency, your forecast is built from your project pipeline, signed contracts, and historical client retention rates. In either case, the key is to be conservative and let the data guide you.

2. Cost of Goods Sold (COGS)

Next are the direct costs of delivering your product or service. This is your Cost of Goods Sold (COGS), and what it includes varies significantly by business model.

- For a SaaS Company: COGS includes your server hosting fees from providers like AWS, third-party data services integrated into your platform, and the salaries of your customer support and implementation teams.

- For a Services Firm: COGS is almost entirely the direct labor costs for client-facing work. This means the salaries for your billable employees and any fees for contractors working on client projects.

Subtracting COGS from your Revenue gives you your Gross Profit—a vital metric for understanding how efficiently you deliver what you sell.

3. Operating Expenses (OPEX)

Finally, you have your Operating Expenses (OPEX). These are all the other costs required to keep the lights on and the business running—everything not directly tied to delivering your product. This is where you track your major investments in growth and infrastructure, typically broken down into three key categories.

Understanding how these expenses impact your profitability is a core part of financial management, which we dive into deeper in our guide to break-even analysis.

The table below breaks down these components with sample figures for a growing SaaS business to make this concrete.

Sample Operating Budget Components for a SaaS Company

| Category | Component | Example Monthly Amount | Notes for Your Business |

|---|---|---|---|

| Revenue | Subscription Revenue (MRR) | $150,000 | Based on current customer base, pipeline, and projected growth. |

| COGS | Server & Hosting Costs | $12,000 | The direct cost to keep your platform running. |

| COGS | Customer Support Salaries | $18,000 | Salaries for the team directly supporting customers. |

| OPEX | Sales & Marketing | $35,000 | Includes ad spend, commissions, and marketing staff salaries. |

| OPEX | Research & Development (R&D) | $40,000 | Engineer salaries and software for product development. |

| OPEX | General & Administrative (G&A) | $25,000 | Includes executive salaries, rent, and office software. |

The budget clearly separates the direct costs of service (COGS) from the broader costs of running the business (OPEX), giving you a layered view of your profitability.

Putting It All Together: A Step-By-Step Example

Let's move from theory to reality. We'll walk through a simplified operating budget for a fictional SaaS company, "ScaleUp Inc.," which is currently at a $2,000,000 Annual Recurring Revenue (ARR) run rate.

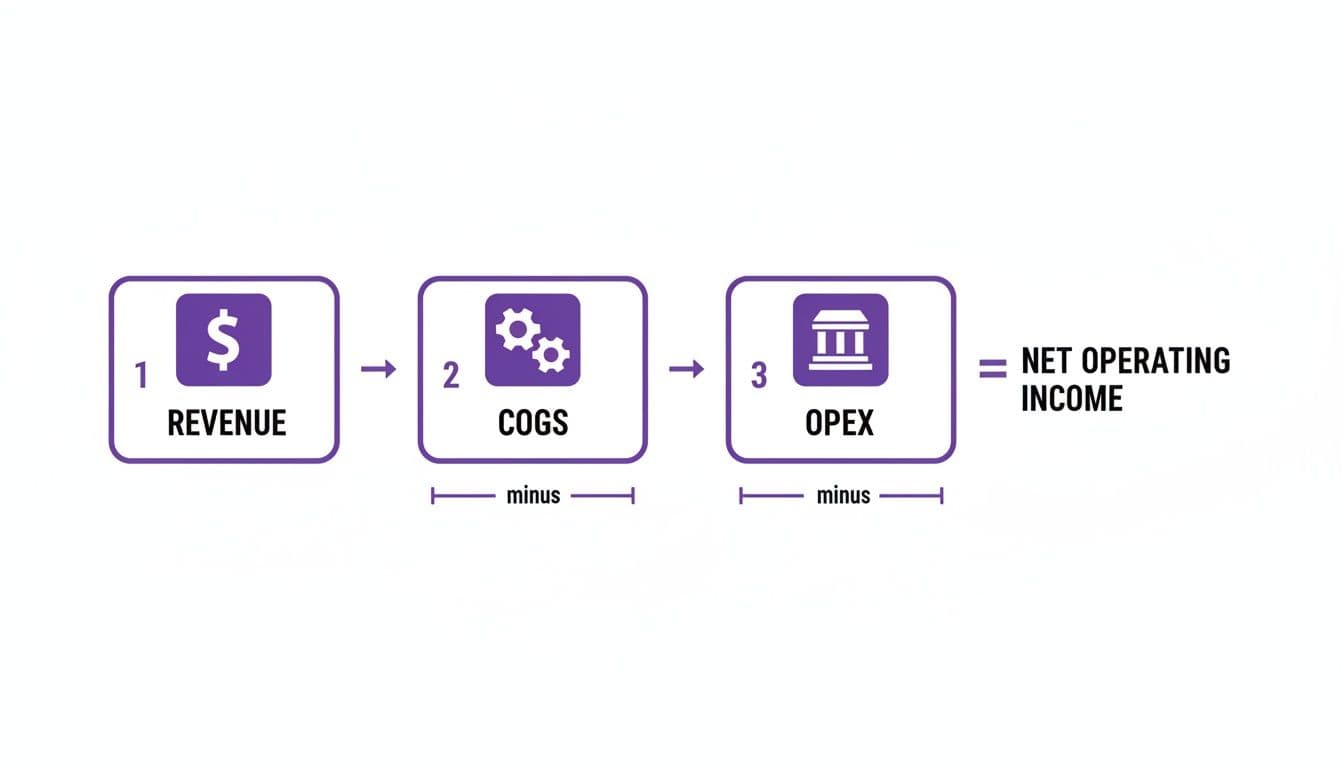

The entire point of this exercise is to calculate your profitability from day-to-day operations. It boils down to this simple formula:

This calculation strips away everything else to show you what’s left after you pay for both the direct and indirect costs of running the business. This is your Net Operating Income.

Step 1: Forecast Revenue

First, project your sales. ScaleUp’s current Monthly Recurring Revenue (MRR) is $166,667 ($2M ARR / 12). Based on their sales pipeline, they're forecasting a conservative 2.5% monthly growth.

- Calculation: $166,667 (Starting MRR) * 1.025 (Growth Rate) = $170,834 (January Projected MRR)

Step 2: Calculate COGS and Gross Profit

Next are the direct costs of delivering the service. For a SaaS business like ScaleUp, this is primarily server hosting and the salaries for the customer support team.

We’ll use common industry benchmarks here:

- Hosting Costs: 8% of Revenue → $170,834 * 0.08 = $13,667

- Support Salaries: 10% of Revenue → $170,834 * 0.10 = $17,083

- Total Monthly COGS: $13,667 + $17,083 = $30,750

- Gross Profit: $170,834 (Revenue) - $30,750 (COGS) = $140,084

Step 3: Detail OPEX and Find Your Net Operating Income

Finally, map out your Operating Expenses (OPEX). This is where you budget for all investments in growth and administration—sales, marketing, and R&D. Planning here is critical, because runaway spending evaporates profits in a heartbeat.

According to OpenView's 2024 SaaS Benchmarks, companies in the $1M-$20M ARR range typically allocate their OPEX like this:

- Sales & Marketing: 40-60% of Revenue

- Research & Development: 20-35% of Revenue

- General & Administrative: 10-20% of Revenue

Here’s ScaleUp's planned OPEX for January:

- Sales & Marketing: $40,000

- Research & Development (R&D): $55,000 (they're bringing on a new engineer)

- General & Administrative (G&A): $20,000

- Total Monthly OPEX: $115,000

Now we get to the bottom line:

- Net Operating Income Calculation: $140,084 (Gross Profit) - $115,000 (OPEX) = $25,084

This single number is the result of every operational decision you made for the month. Mastering this process is a cornerstone of effective profit and loss management.

Operating, Capital, and Cash Flow Budgets: What's the Difference?

It’s incredibly easy to get your financial plans tangled up. You have your operating budget for day-to-day profitability, but you also need a capital budget and a cash flow budget to see the whole picture. Confusing them is a fast track to serious financial trouble.

- An operating budget answers, "Are we profitable on paper this month?" It sticks to revenues and expenses directly tied to your core business operations within a set period.

- A capital budget is for major, long-term investments—a new office build-out, buying a suite of high-end servers, or a massive software platform overhaul. Keeping these big-ticket items separate provides a clean and accurate view of your day-to-day operations.

- A cash flow budget is the ultimate reality check. It tracks the actual money moving in and out of your accounts. A healthy P&L doesn't mean you have cash in the bank, and this budget shows you the truth.

This separation isn't just accounting hygiene; it's strategic. Find more insights on budgeting strategies from FinQuery.

Operating vs. Capital vs. Cash Flow Budgets

| Budget Type | Primary Purpose | Typical Timeframe | Example Items |

|---|---|---|---|

| Operating | Manages day-to-day profitability. | Monthly, Quarterly, Annually | Salaries, marketing spend, software subscriptions, revenue. |

| Capital | Plans for major, long-term assets. | 1-5+ Years | New equipment, office renovations, major tech infrastructure. |

| Cash Flow | Tracks actual cash movement. | Weekly, Monthly, Quarterly | Customer payments, payroll, vendor bills, loan payments. |

You cannot run your business effectively without all three. The operating budget sets your profit goals, the capital budget plans for future growth, and the cash flow budget ensures you have the money to make it all happen. Getting a handle on your real-time cash position is vital, which is why a 13-week cash flow forecast is such a powerful tool for any business leader.

Red Flags: Common Budgeting Mistakes That Sink Companies

Putting an operating budget on paper is the easy part. The real test is avoiding the common, often fatal, traps that turn a financial plan into a roadmap to a cash crunch. We’ve seen countless promising companies stumble over these avoidable errors.

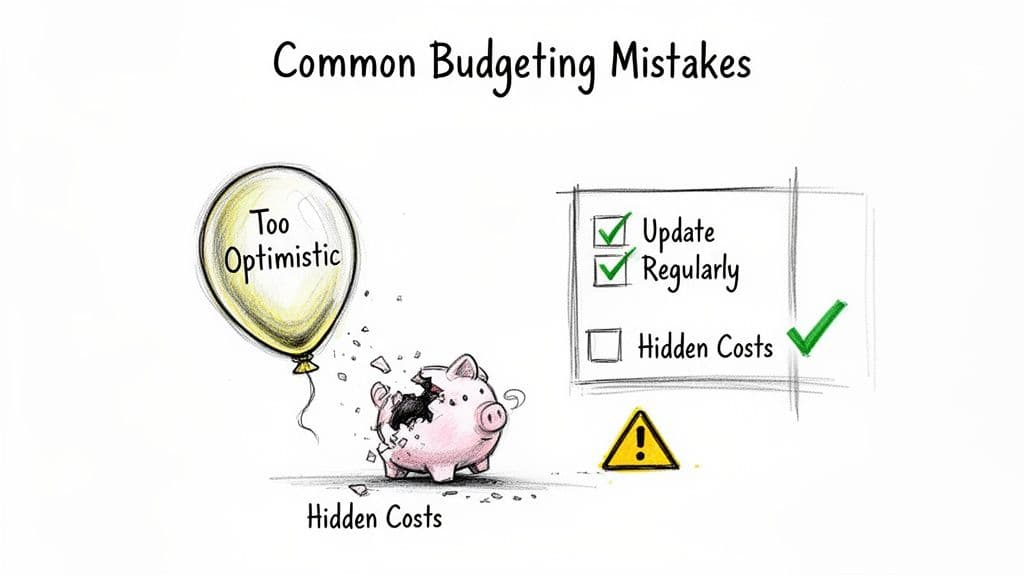

Misconception: "A budget is just a forecast based on our best-case scenario."

This is the single most common mistake: overly optimistic revenue forecasting. It’s tempting to build your spending plan around hockey-stick growth, but when those rosy projections don’t materialize, you’re left funding a cost structure your revenue can't support. Your budget must be anchored in conservative, data-backed assumptions from your sales pipeline, not wishful thinking.

Warning Sign: Your budget ignores small, recurring expenses.

A classic blunder is forgetting about the small, relentless expenses that quietly bleed you dry. These are the so-called "hidden costs"—credit card transaction fees, auto-renewing software you forgot about, and the true burden of payroll taxes. They add up fast and must be explicitly itemized in your OPEX. For SaaS businesses, strategies like cloud cost optimization are no longer optional; they are essential for protecting your margins.

Red Flag: You treat the budget as a "set it and forget it" document.

The deadliest mistake of all is treating your budget like a static document you create once and then file away. A budget that isn't reviewed and updated at least monthly is just a historical artifact. It has zero value as a real-time decision-making tool.

"A budget is not a financial straitjacket. It's a dynamic guide. Regular variance analysis isn't just an accounting exercise; it's the core discipline that lets you pivot before a small issue becomes a crisis." - Financial Planning & Analysis Expert

Top-quartile SaaS firms don't get their budget perfect on day one; they succeed by obsessively tracking their numbers and adjusting course. Constantly comparing your plan to reality by analyzing your actual performance versus your budget is non-negotiable for survival and growth.

Action Plan: Take Control of Your Financial Future

An operating budget is a living document, not some static report you create once a year. It's time to build a dynamic financial plan that gives you the visibility and control needed to scale your company with confidence. Here’s what you need to do next.

Your Immediate Next Steps:

- Pull Your Data: Log into your accounting system (QuickBooks, Xero) and export your last 12 months of financial statements. This gives you a realistic baseline for revenue and spending patterns—no wishful thinking, just facts.

- Involve Department Heads: Schedule meetings with your sales, marketing, and product leaders. Have them build their own expense forecasts for the next 12 months. They are closest to the ground and know what resources their teams need to hit company goals. This creates buy-in and turns the budget into a shared accountability tool.

- Schedule Monthly Reviews: Put a recurring "Budget vs. Actuals Review" meeting on the calendar for your leadership team, scheduled for the 5th business day of every month. This forces the discipline of regular analysis and course correction.

This entire process—from pulling clean data to forecasting and managing the budget month-to-month—is exactly what an outsourced controller service automates. Instead of losing your valuable time buried in spreadsheets, you get a seamless, expert-led process that just works.

At Jumpstart Partners, our team delivers a 5-day month-end close, producing the investor-ready financials and cash flow visibility you need to make critical decisions. We don't just hand you a spreadsheet; we build and manage a robust operating budget that serves as your strategic guide.

Stop navigating your company's finances alone. Book a consultation today to see how we can build the financial engine that fuels your growth.

Common Questions About Operating Budgets

How Often Should I Update My Budget?

You must review your operating budget monthly. The best practice is to compare your budgeted numbers to your actual results in what's called a "budget vs. actual" variance analysis. Doing this every month lets you catch small deviations before they balloon into major cash flow problems. An annual check-in is far too slow to effectively steer a growing business.

What's the Difference Between a Static and a Flexible Budget?

A static budget is completely fixed. You set it at the beginning of the year, and it never changes, no matter how your revenue or business activity fluctuates. It’s simple, but it becomes irrelevant almost immediately.

A flexible budget, on the other hand, is designed to adapt. It adjusts for changes in your actual revenue or activity levels, giving you a much more realistic picture of how your expenses should scale. For any growing SaaS, agency, or services firm, a flexible budget is the far superior tool for managing your finances.

An expert team can turn your budgeting from a painful chore into a real strategic advantage. Jumpstart Partners delivers the investor-ready financials and real-time visibility you need to drive growth.