Financial Operations

How to Improve Profit Margins for Your Growing Business

Discover how to improve profit margins with our expert guide on pricing, cost control, and efficiency. Get actionable strategies for your growing business.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··22 min readImproving your profit margins isn’t just about tweaking numbers. For founders and CEOs, it's a fundamental shift from chasing revenue to building a resilient, valuable business. Weak margins are the root cause of the constant cash flow stress that keeps you up at night. They’re the reason you can't afford the key hires you desperately need and why your company feels "busy but broke."

Strong profitability is the engine that funds sustainable growth, attracts top talent, and dramatically increases your company's valuation. This guide provides a clear, actionable playbook for founders of SaaS, agency, and professional services firms to take control of their financial health. We will move beyond theory and give you the exact financial levers to pull to increase your profit margins, starting today.

Your Profit Margin Is a Health Metric, Not Just a Number

As a founder, you're wired to celebrate hitting the next big revenue milestone. But chasing revenue while your margins bleed out is a trap. It’s like flooring the gas pedal in a car with a leaky fuel tank—you look like you’re moving fast, but you're heading straight for a breakdown.

Think of your profit margin as the most critical vital sign for your company. It tells you not just if you're making money, but how efficiently you're making it. A weak or shrinking margin is a flashing red light signaling deeper issues that will absolutely cripple your growth if you ignore them.

Why Revenue Growth Alone Is a Trap

Too many leaders get stuck in the "growth at all costs" mindset. You chase bigger deals and higher monthly recurring revenue (MRR), yet the cash in the bank never seems to match the top-line excitement. This is a classic symptom of poor margin health.

Healthy margins are the engine that funds everything that matters for building a lasting business:

- Investing in Your Team: You cannot attract or keep A-players without the profit to offer competitive salaries, solid benefits, and real professional development.

- Fueling Future Growth: Margin is the cash that pays for your next big marketing push, sales hire, or product innovation. No margin, no growth engine.

- Building Resilience: Profit creates the cash buffer you need to ride out an economic downturn, an unexpected market shift, or a competitor's aggressive move.

- Increasing Company Valuation: Smart investors and potential buyers value profitable, efficient businesses far more than companies that just burn cash to chase revenue.

Warning Signs of Unhealthy Margins

If any of these sound painfully familiar, your margins are the root cause. It's time to stop just growing revenue and start growing it profitably.

| Symptom | Underlying Margin Problem |

|---|---|

| Constant Cash Flow Stress | Not enough cash is left after paying for your COGS and operating expenses. |

| Inability to Hire Key Roles | You lack the free cash flow to invest in the talent you desperately need. |

| High Customer Churn | Your pricing and the value you deliver are dangerously misaligned. |

| The "Busy but Broke" Feeling | You're swamped with activity, but it's not translating to the bottom line. |

"Most agencies don’t need more work (higher sales). Rather, they merely need a higher quality delivery of said work. It’s like comparing starvation (that being zero work) to indigestion (work that isn’t nearly as profitable as it should be)." — Marcel Petitpas, CEO & Co-Founder of Parakeeto

To get a true picture of your profitability, you have to separate the cost of generating revenue from your general overhead. This all starts with getting a handle on your Contribution Margin, a critical metric we’ll break down throughout this guide. If you're new to the concept, you'll want to check out our deep dive on understanding contribution margin in our detailed article to build a solid foundation first.

Diagnosing Your Margins with Surgical Precision

You cannot fix what you cannot see. Before you even think about raising prices or slashing expenses, you need a precise, data-backed diagnosis of your company's financial health. Trying to improve profit margins without this clarity is like performing surgery blindfolded—it’s messy, dangerous, and guaranteed to fail.

The starting point is analyzing three fundamental profit margins. Each one tells a unique and vital story about a different part of your business. Understanding all three is non-negotiable.

The Three Core Profit Margins

Think of these margins as layers of an onion. Each layer you peel back reveals a more refined truth about your profitability, from the efficiency of your core service delivery all the way down to your ultimate bottom line.

Key Profit Margin Formulas and What They Reveal

| Margin Type | Formula | What It Measures |

|---|---|---|

| Gross Profit Margin | (Revenue - COGS) / Revenue | The profitability of your core product or service, stripped of all other business expenses. It answers: "How efficiently do we deliver value to our customers?" |

| Operating Profit Margin | (Operating Income / Revenue) | The profitability of your day-to-day business operations before interest and taxes. It answers: "How well are we managing our operational costs to generate profit?" |

| Net Profit Margin | (Net Income / Revenue) | The final, all-in profitability after every single expense, including interest and taxes, has been paid. It answers: "How much of each dollar in revenue do we actually keep?" |

Calculating these numbers is step one, but the real magic is in the interpretation. For service-based and SaaS businesses, a high Gross Margin is everything; it’s the fuel that powers the rest of the engine. According to OpenView's 2024 SaaS Benchmarks, a healthy Gross Margin is 75-85% or higher. If yours is lagging, you have an urgent problem with either your pricing or your Cost of Goods Sold (COGS).

Your Margins in Action: A SaaS Company Example

Let’s make this real. Imagine a SaaS company, "ScaleUp AI," with $2,000,000 in Annual Recurring Revenue (ARR).

- COGS: Their server hosting, third-party data APIs, and customer support team salaries total $400,000.

- Operating Expenses: Sales, marketing, R&D, and administrative salaries come to $1,100,000.

- Interest & Taxes: These amount to $50,000.

Here’s how their math breaks down:

- Gross Profit: $2,000,000 (Revenue) - $400,000 (COGS) = $1,600,000

- Gross Margin: $1,600,000 / $2,000,000 = 80% (This is a healthy, best-in-class gross margin).

- Operating Income: $1,600,000 (Gross Profit) - $1,100,000 (OpEx) = $500,000

- Operating Margin: $500,000 / $2,000,000 = 25%

- Net Income: $500,000 (Operating Income) - $50,000 (Taxes/Interest) = $450,000

- Net Margin: $450,000 / $2,000,000 = 22.5%

ScaleUp AI’s diagnosis is strong. Their core product is highly profitable, leaving them plenty of cash to fund operations, R&D, and growth.

Beyond Margins: Unit Economics and Future Profitability

While profit margins give you a snapshot of your past performance, unit economics predict your future. For SaaS companies and agencies, the most critical metric is the ratio of Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC).

LTV to CAC Ratio: This is the leading indicator of your business model's long-term health and scalability. A healthy ratio—typically 3:1 or higher—proves you have a profitable growth engine.

Let's say ScaleUp AI determines their average customer lifetime value is $25,000 and it costs them $7,500 in sales and marketing to acquire that customer. Their LTV to CAC ratio is $25,000 / $7,500 = 3.33. This confirms their customer acquisition strategy is sustainable and profitable.

Understanding this balance is crucial. For instance, a detailed comparison of your actuals vs. budget will reveal if your acquisition costs are spiraling out of control, which directly threatens future margins.

The broader economic context matters, too. Over the past three decades, U.S. corporations have seen significant profit margin expansion, driven by a shift to a service-based economy that lowered the cost of goods sold. This trend highlights the immense opportunity for businesses like yours to optimize cost structures and operational efficiency. You can discover more insights about this profitability landscape from T. Rowe Price.

Actionable Next Step: Pull up your Profit & Loss statement for the last quarter. Run the calculations for Gross, Operating, and Net Margin. If you don't have clean, reliable data to do this, that is your first and most urgent problem to solve. A precise diagnosis is impossible with messy data.

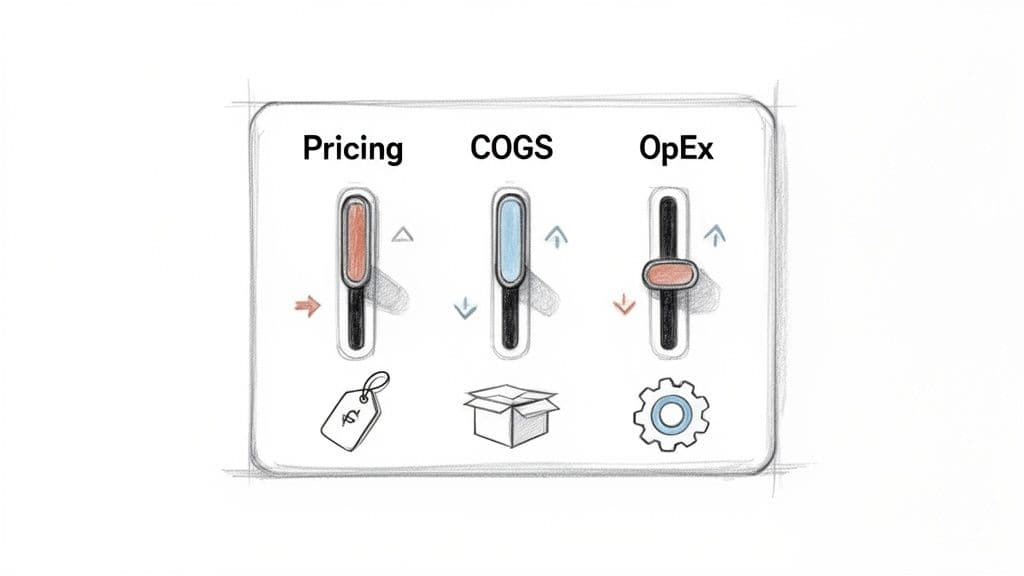

Pulling the Three Levers of Profitability

Once you've diagnosed the issues, it’s time to get to work. Improving your profit margin isn’t about making a hundred tiny, scattered tweaks. It's about applying focused pressure on the three fundamental levers that actually move the needle: Pricing, Cost of Goods Sold (COGS), and Operating Expenses (OpEx).

Think of these as the primary controls for your company’s financial engine. Small, smart adjustments here have an outsized impact on your bottom line. Let's break down the playbook for each one.

Lever 1: Pricing and Packaging

Pricing is the single fastest way to impact your bottom line. Yet, many founders set prices based on what competitors charge or on a simple cost-plus model, leaving a massive amount of value on the table. It's time to stop thinking about your costs and start thinking about your customer's ROI.

This is the shift to value-based pricing. Instead of just covering your costs and adding a small markup, you anchor your price to the tangible financial results your solution provides. For example, if your software saves a client $150,000 a year in operational costs, charging $25,000 is an easy "yes" for them and a huge margin booster for you.

Here are three pricing tactics you can implement this quarter:

- Introduce Tiered Packaging: Stop using one-size-fits-all pricing. Create distinct packages (e.g., Basic, Pro, Enterprise) that serve different customer segments. This lets you capture more value from high-need customers without scaring off smaller ones.

- Offer Annual Pre-Pay Discounts: Give customers a 10-15% discount for paying a full year upfront. This transforms your cash flow and dramatically increases customer lifetime value by locking them in and reducing churn.

- Implement Usage-Based or Add-On Features: Charge extra for premium features, additional seats, or higher usage tiers. This aligns your revenue directly with the value a customer gets as they grow with your product.

Mastering these strategies is critical, which is why we created a dedicated guide on building a stronger agency pricing strategy for better service profitability. For a deeper dive, learning how to increase customer lifetime value can also provide invaluable insights into pulling the revenue lever.

Lever 2: Gross Margin and COGS

Your gross margin is the purest indicator of your core business's health. If it's low, it means the cost to deliver your product or service is too high, and no amount of operational efficiency can fix a fundamentally unprofitable offering.

"I see so many businesses fixated on net profit, but they ignore the gross margin. Your gross margin is your business’s potential. If it’s weak, you have a ceiling on your profitability. Improving it by just a few percentage points has a massive compounding effect on your bottom line." — Jonathan Rasmussen, Fractional CFO, Jumpstart Partners

To improve gross margin, you must get ruthless about analyzing and reducing your Cost of Goods Sold (COGS). This looks different for every business model.

- For a SaaS Company: Your COGS includes server hosting (AWS, Azure), third-party API costs, and the salaries of your customer support and implementation teams.

- For a Digital Agency: COGS is almost entirely the salaries (including benefits and taxes) of your service delivery team—the designers, developers, and strategists doing client work—plus any direct project software or contractor fees.

Let's run a calculation. Imagine your agency has a $50,000 project. Your delivery team’s loaded salary cost for their time on the project is $25,000, and you paid a contractor $5,000.

- Total COGS: $25,000 + $5,000 = $30,000

- Gross Profit: $50,000 - $30,000 = $20,000

- Gross Margin: $20,000 / $50,000 = 40%

A 40% gross margin is a huge red flag for an agency—the target must be 50% or higher. To fix this, you either raise the project price or find ways to shrink that $30,000 COGS, perhaps by improving your team's efficiency or negotiating better contractor rates.

Lever 3: Operating Expenses

Operating Expenses (OpEx) are all the costs required to run the business that are not directly tied to delivering your service. This is where most companies find significant bloat. A full OpEx audit is not about slashing costs indiscriminately; it’s about separating "good costs" that fuel growth from "bad costs" that just drain profit.

Here's how to think about it strategically:

| Expense Category | Good Cost (Invest) | Bad Cost (Cut or Reduce) |

|---|---|---|

| Payroll | A top-performing salesperson who consistently blows past quota. | An underperforming employee in a non-critical role. |

| Software | A CRM that provides clear ROI by making your sales team more efficient. | Multiple, redundant project management tools that just create confusion. |

| Marketing | A paid ad campaign with a proven 4:1 LTV to CAC ratio. | Sponsoring a low-engagement event that generates zero measurable leads. |

Actionable Next Step: Start your audit with your three biggest OpEx line items: payroll, software subscriptions, and marketing spend. Go through each one and ask a simple question: "Does this expense directly contribute to revenue or essential operations?" If the answer is a fuzzy "maybe" or a clear "no," it’s a candidate for reduction.

Building Systems for Sustainable Margin Growth

One-off fixes provide a quick bump, but they don't build a durably profitable company. Slashing a single software subscription or bumping up a price for one client is just patching holes in a leaky boat.

Real, sustainable margin growth comes from weaving financial discipline and efficiency into the very fabric of your company. It's about building systems for your financial operations and your tech stack that lock in your gains and create a foundation for scale. Focus on these two high-impact areas first.

Master Your Cash Conversion Cycle

Your Accounts Receivable (AR) and Accounts Payable (AP) processes are the arteries and veins that keep cash flowing through your business. When those processes are sloppy and manual, you create cash gaps that force you into reactive, often unprofitable, decisions.

The goal is to shorten your cash conversion cycle—the time it takes to turn your investments in products or services back into cash in your bank. The shorter that cycle, the faster you get paid and the longer you hold onto your own cash, which directly improves your ability to operate profitably without leaning on debt.

Here’s how to tighten things up:

- Automate Your Invoicing: Stop creating invoices by hand. Use your accounting software to set up recurring invoices for retainers and subscriptions. They go out on the same day every month, no exceptions.

- Offer Early Payment Incentives: A simple "2/10, net 30" term, which offers a 2% discount if the bill is paid in 10 days, works wonders for your AR. That small discount is almost always cheaper than the interest on a line of credit.

- Systematize Your Collections: Do not wait until an invoice is 60 days past due to start making calls. Set up automated email reminders that trigger at 3, 15, and 30 days past the due date. The tone is professional but persistent.

- Negotiate Better AP Terms: Just as you want clients to pay you quickly, you should aim to pay your vendors on longer cycles. Pushing for net 45 or net 60 terms is a straightforward way to improve your working capital.

Red Flags in Your Financial Operations

If any of these sound familiar, your financial operations are actively eating into your profit margins. These are not minor headaches; they are systemic problems that demand your immediate attention.

| Red Flag | The Real Cost to Your Business |

|---|---|

| No standardized invoicing process | Inconsistent billing leads to delayed payments and significant revenue leakage. |

| Manual expense reports (spreadsheets) | Wastes dozens of hours of employee time and invites costly data entry errors. |

| Delayed bank reconciliations | You're flying blind, making critical decisions with an inaccurate picture of your cash position. |

| Relying on a single person for all finance tasks | Creates a major operational risk and a bottleneck that slows down the entire business. |

Leverage Technology as a Margin Multiplier

A common objection from founders is, "I can't afford new systems or a professional finance service." This thinking is flawed. The real question is, "Can you afford the cost of manual errors, wasted time, and poor financial visibility?"

Modern financial technology is not an expense; it's an investment with a clear and compelling ROI. For sustained margin growth, implementing systems like customer services automation can significantly reduce operational costs and enhance customer loyalty.

"Many founders see automation as a cost center, but it’s the complete opposite. Every manual financial task you automate is a direct investment back into accuracy, efficiency, and—most importantly—strategic focus. You can't make smart decisions about profitability when you're buried in spreadsheets." — Financial Controller at a Series A SaaS Company

Systematic margin expansion is a hallmark of the world’s most successful companies. Research from Bridgewater shows that over the past two decades, rising profit margins have driven nearly half of all equity returns in the developed world. This wasn't an accident. It was the result of structural shifts toward technology and efficiency that allow businesses to scale with lower marginal costs. You can read the full research on this global trend from Bridgewater. Your path to higher margins follows the same principle: build structural advantages through systems.

Implementing financial reporting automation is a powerful first step. Automating bookkeeping and expense management doesn't just save a few hours. It eliminates the risk of human error that can cost you tens of thousands in misreported revenue or missed deductions. This accuracy gives you financial statements you can trust to make critical decisions about hiring, marketing spend, and pricing.

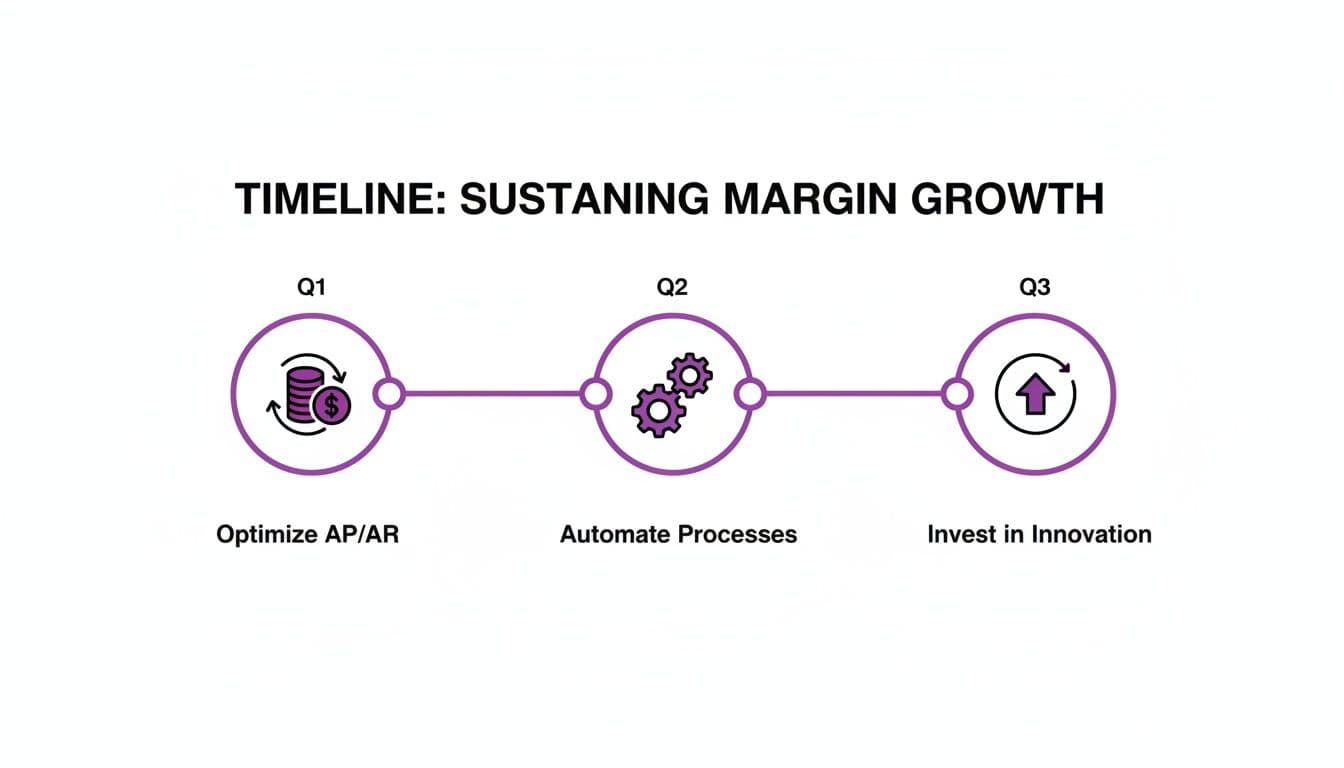

Your 90-Day Margin Improvement Action Plan

Analysis is worthless without action. The previous sections gave you the diagnostic tools and the playbook; this is where we turn those insights into real financial impact. Improving your profit margins for good requires a disciplined, focused plan that builds momentum over a single business quarter.

This is not about trying to fix everything at once. It's about making a series of smart, high-leverage moves that compound over time. We’ve broken this down into a 90-day sprint, designed to get you the biggest wins first.

Your 90-Day Margin Improvement Checklist

Use this checklist to guide you through the next three months, moving from quick tactical wins to more foundational, strategic changes. This is your roadmap to building a more profitable business, one step at a time.

| Timeframe | Action Item | Key Objective |

|---|---|---|

| This Week | Schedule a Pricing Review Meeting | Get your key people (sales, product, finance) in a room to challenge your current pricing. The goal is to kickstart the conversation based on the value you're really delivering to customers. |

| This Week | Audit Top 5 Expense Categories | Pull up your P&L and put your five biggest non-payroll expenses under a microscope. Question every single subscription and vendor. The objective is simple: find at least one "bad cost" to cut immediately. |

| This Month | Implement a Financial Dashboard | You cannot improve what you do not measure. Set up a straightforward dashboard that tracks Gross Margin, Operating Margin, and LTV to CAC. Make it a non-negotiable weekly review. |

| This Month | Roll Out an Annual Pre-Pay Option | Offer a 10-15% discount for customers who pay for a full year upfront. This is a game-changer for cash flow. Ensure your sales team leads with this option on every new deal and renewal. |

| This Quarter | Renegotiate One Major Vendor Contract | Pick your biggest COGS or OpEx vendor—think hosting, primary software, or a key contractor. Start a conversation to renegotiate terms based on your volume and loyalty. You will be surprised what you can get just by asking. |

| This Quarter | Automate Your Invoicing and Collections | Set up automated invoicing and follow-up emails for any past-due accounts. This one system will drastically shorten your cash conversion cycle and free up countless hours of manual chasing. |

By following this checklist, you are not just hoping for better margins—you are systematically building them into your operations.

The Inflection Point for Your Business

You're standing at a clear fork in the road.

One path is sticking with the status quo—managing your business from a messy P&L, stressing about cash flow, and accepting that shrinking margins are a cost of doing business. This is the path to stagnation. It’s the "busy but broke" cycle that traps far too many promising companies.

The other path is deciding that financial discipline is a core strategic advantage. It means putting the systems, processes, and expert support in place to enable scalable, profitable growth. This path is about building a business that doesn't just grow, but thrives, generating the cash you need to invest in your team, your product, and your long-term vision.

This is your chance to stop letting your finances happen to you and start making them work for you. A huge part of that shift is creating a forward-looking financial strategy. A great next step is learning how to build a 13-week cash flow forecast, which is an invaluable tool for taking control of your financial future.

This journey shows how the initial wins from optimizing your cash flow are locked in and amplified by embedding automation and making smart, data-driven investments back into the business.

Answering Your Toughest Margin Questions

Even when you’re fired up to improve profitability, a few nagging questions always pop up. Founders get stuck on these same points time and time again. Let's clear them up right now, because getting these answers straight is what separates analysis from confident, decisive action.

Common Misconception: "I need more customers to be more profitable."

This is the most common and dangerous misconception. In many cases, adding more customers at your current price point or cost structure will only make you less profitable. If your gross margin is weak, each new sale actually digs you into a deeper hole.

The truth is, you often need better customers, not more of them. Profitability comes from increasing the margin on your existing revenue streams and acquiring new customers who fit your ideal, high-value profile. Focus on fixing your unit economics before you step on the gas for customer acquisition.

What Is a Good Profit Margin for My Industry?

This is the most common question, and the answer is always: it depends. A generic benchmark is worse than useless. Comparing a SaaS company's margins to a digital agency's is like comparing apples to suspension bridges. You must compare your numbers to the right peer group.

Based on our experience and established industry data, here are the targets you should be aiming for:

| Industry | Gross Margin Target | Operating Margin Target | Source |

|---|---|---|---|

| SaaS | 75-85%+ | 20-30%+ (at scale) | OpenView's 2024 SaaS Benchmarks |

| Digital Agencies | 50-60%+ | 15-25% | Industry Averages |

| Prof. Services | 40-50%+ | 15-20% | Industry Averages |

If your numbers are significantly below these targets, it’s a blaring alarm bell. Something is fundamentally broken in your pricing, your cost of delivery, or both.

How Often Should I Review My Pricing?

Your pricing should never be a "set it and forget it" activity. At an absolute minimum, you must conduct a formal, in-depth pricing review once per year.

However, certain events trigger an immediate re-evaluation:

- You launch a major new feature or service offering.

- A key competitor makes a big, public change to their pricing.

- Your win rate on new proposals climbs above 50%. (This is a classic sign you're too cheap.)

- You realize you have not raised prices on some legacy clients in over 18 months.

Leaving your pricing static while you continually add value is a direct path to margin erosion.

Stop wrestling with messy spreadsheets and financials that raise more questions than they answer. Jumpstart Partners provides the expert bookkeeping and controller services you need to build a true profitability engine. We deliver investor-ready financials with a guaranteed 5-day month-end close so you can make decisions with confidence. Schedule your free consultation today and build the financial foundation your business deserves.