Financial Operations

What Is Growth Capital and How Does It Fuel Expansion?

Learn what is growth capital, how it differs from venture capital, and when to use it to accelerate your business's expansion and market dominance.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

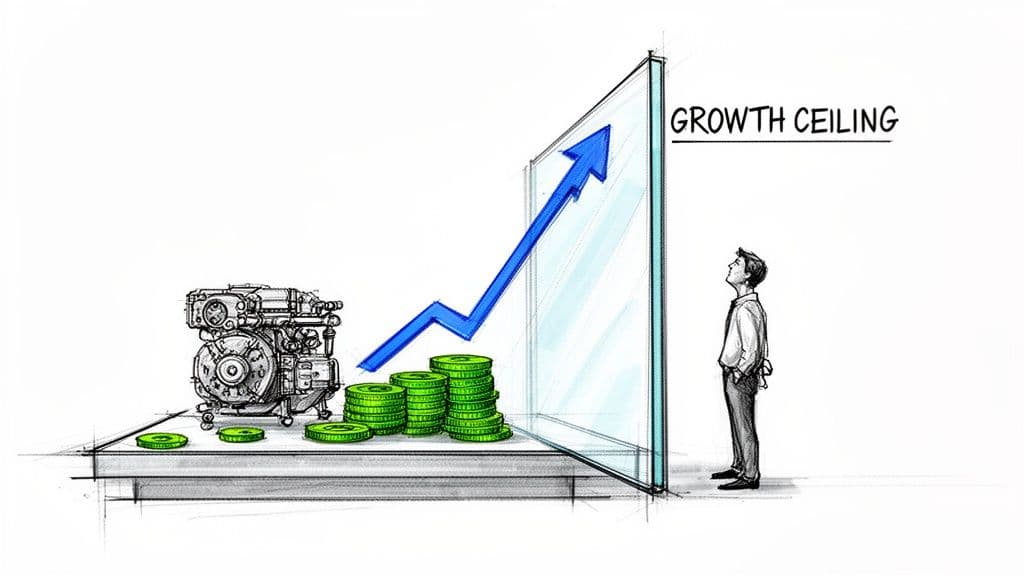

··20 min readYou've built a real business with a proven product and the revenue to show for it. But growth has flatlined. You know the market is there for the taking, but organic expansion is too slow, and you can see well-funded competitors closing in. This is the inflection point where growth capital becomes the rocket fuel to break through that ceiling.

This guide is for founders and CEOs of businesses in the $500K-$20M revenue range. We will skip the academic theory and provide a direct, actionable playbook. You will learn exactly what growth capital is, how it differs from venture capital, and how to position your company to secure it.

A misstep here is costly. Poor capital strategy, like mismanaging your burn rate and runway, can sink even the most promising companies. By the end of this article, you will have a clear, actionable plan to secure the funding you need to not just compete, but dominate your market.

Understanding Growth Capital and How It Works

Growth capital is high-octane fuel for an engine that's already running smoothly. It’s not seed money for an idea on a napkin; it’s a strategic investment in a proven, scalable business model that’s already generating real revenue, often with positive cash flow. This type of funding, also called growth equity, is designed for established companies ready to execute a significant leap in scale.

Unlike venture capital, which bets on future potential, growth capital investors are betting on your demonstrated ability to execute. They provide a substantial cash injection in exchange for a minority equity stake—a crucial distinction. You keep control of your company. This structure makes them a strategic partner, not a new boss. For a deeper look, FSE has a helpful overview of what is growth capital and its role in scaling.

The Mechanics of a Growth Equity Deal

A growth equity deal is about pouring resources into what you already do well, just faster and at a much larger scale. The funds are earmarked for specific, high-ROI initiatives that your organic cash flow cannot support at the required speed.

Common use cases include:

- Aggressive Market Expansion: Launching your services into a new country or tackling a new industry vertical.

- Strategic Acquisitions: Buying a smaller competitor to consolidate market share or acquire valuable technology.

- Scaling Sales & Marketing: Doubling your sales team or launching a major marketing campaign to capture a larger audience.

"Growth capital allows a proven business to compress time. What might take five years to achieve organically can be accomplished in 18 months. It's about pulling future success into the present." — Johnathan Dane, Founder of KlientBoost

This is the core value proposition: growth capital empowers you to make bold, calculated moves you couldn't otherwise afford. It compresses your timeline for major milestones from years down to months. This stage has a different set of goals compared to earlier rounds, which you can read more about in our guide to Series B funding.

Calculating the Impact of Growth Capital

Let's walk through a specific calculation. Imagine your SaaS company is at $3M in ARR with a solid, predictable financial model. A growth equity firm invests $5M for a 20% stake.

- Pre-Money Valuation: $5M / 20% = $20M

- Post-Money Valuation: $20M (Pre-Money) + $5M (Investment) = $25M

Your primary goal with that capital is to triple your ARR to $9M. Here’s a smart way you might allocate those funds:

| Investment Area | Capital Allocated | Expected Outcome |

|---|---|---|

| Sales Team Expansion | $2,000,000 | Hire 10 new Account Executives with an OTE of $200k to increase market reach. |

| Product Development | $1,500,000 | Build enterprise-level features to move upmarket and increase ACV. |

| Marketing & Brand Building | $1,500,000 | Launch targeted campaigns to reduce Customer Acquisition Cost (CAC) by 15%. |

This is a calculated investment designed to build a more valuable, defensible business. The investor's goal is to help you turn that $5M into an additional $30M+ in enterprise value, setting the stage for a profitable exit for everyone involved.

Growth Capital vs Venture Capital vs Debt Financing

Choosing how to fund your company's next phase is one of the most significant decisions you will make as a leader. The right partner is a jetpack, accelerating your vision. The wrong one is an anchor, derailing it entirely.

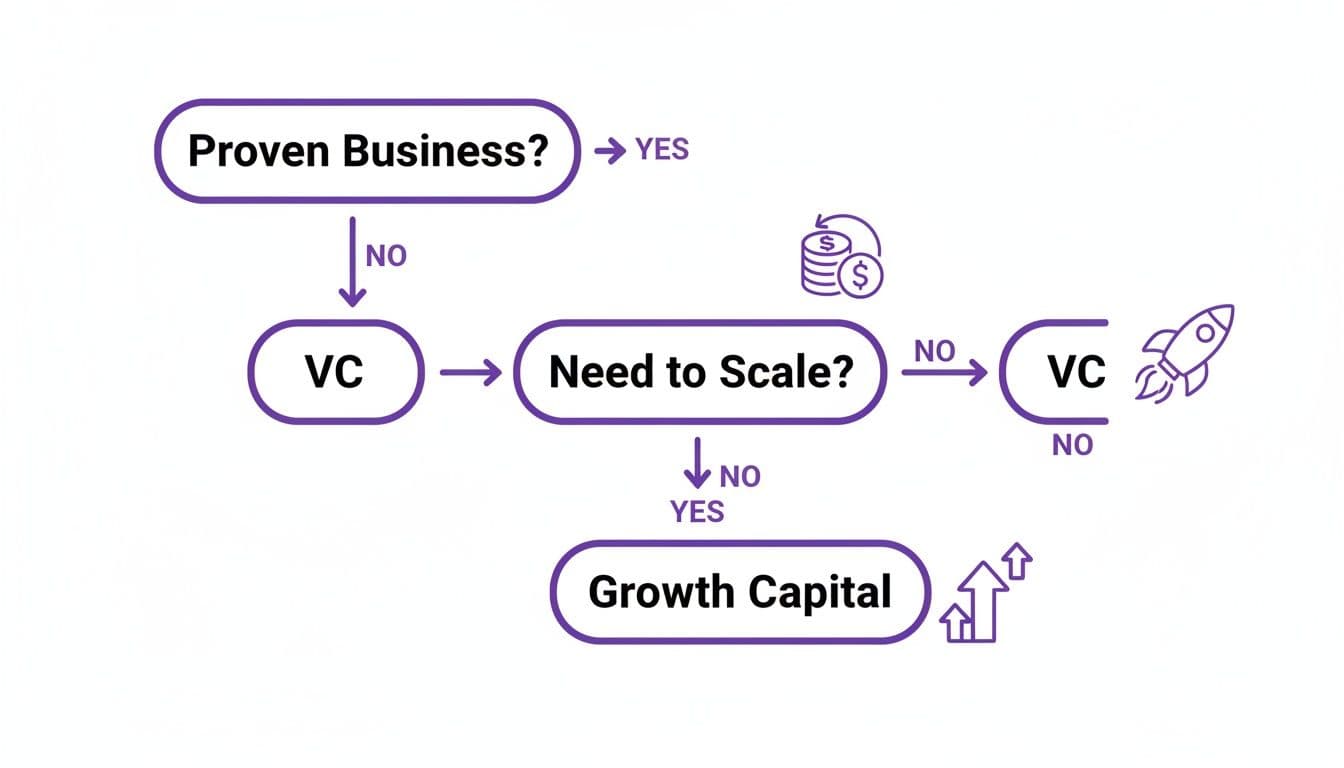

Let's cut through the jargon and compare the three main paths: growth capital, venture capital, and debt financing. Each serves a different purpose and comes with its own rules, expectations, and trade-offs. The question isn't which one is "best"—it’s about finding the right fit for your company’s stage, your goals, and your vision.

This decision tree helps visualize the main fork in the road for founders who already have a working business model.

The simplest way to think about it is this: growth capital is for pouring gasoline on a fire that’s already burning brightly. Venture capital is often about getting the fire started in the first place.

The Critical Differences In Control and Expectations

Venture capital (VC) is high-risk fuel for early-stage companies, often before they're profitable. A VC firm invests knowing most of its bets will fail, so they need a massive 10x or greater return on the few that succeed. This pressure means they often take a board seat and push a "go big or go home" strategy. You give up a significant chunk of equity and a lot of control for a shot at hyper-growth.

Growth capital (or growth equity) is a different game. Investors are backing a proven winner—your profitable, growing business. Their goal is a lower-risk return, typically in the 3-5x range, by helping you scale a model that already works. You will give up a minority stake, but they act more as strategic advisors than operators. Critically, you keep control.

Then there’s debt financing. This is simply borrowing money that you must pay back with interest. It's the least dilutive option because you don't give up any ownership, but it demands strong, predictable cash flow to handle the payments. Debt is perfect for funding specific, shorter-term needs like buying inventory or financing receivables, not for company-wide transformation. For those weighing different structures, it's also worth looking into options like Revenue Based Financing: Debt Like Growth Capital to get a full picture.

A Head-to-Head Comparison

To make the choice clearer, here's a direct comparison of the three funding types. This table breaks down the key attributes to help you map your company's needs to the right capital source.

Funding Options Compared: Growth Capital vs Venture Capital vs Debt

| Attribute | Growth Capital (Equity) | Venture Capital | Debt Financing |

|---|---|---|---|

| Ideal Company Stage | Established, scaling ($500K-$20M Revenue) | Early-stage, high-potential | Stable, predictable cash flow |

| Typical Use of Funds | Market expansion, acquisitions | Product development, finding PMF | Working capital, equipment |

| Equity Dilution | Minority stake (10-30%) | Significant stake (20-50%+) | Zero equity dilution |

| Control Impact | Founder retains control | VCs often take board seats | Covenants may restrict actions |

| Investor Expectation | 3-5x return on investment | 10x+ "home run" potential | Repayment of principal + interest |

| Risk Profile | Low to moderate | Very high | Low for the lender |

Ultimately, your decision comes down to your appetite for risk, how much control you want to keep, and the specific growth path you envision for your business. Growth capital offers a powerful middle ground—it gives you the funding and strategic expertise you need to scale without forcing you to bet the entire company on a single, high-stakes outcome.

How to Deploy Growth Capital for Maximum Impact

Getting a wire transfer for millions of dollars is a milestone. But it's the starting pistol, not the finish line. The real work starts the moment that cash hits your bank account.

How you deploy that capital separates the companies that deliver a 3-5x return for investors from those that burn through it with little to show. This isn't about spending money; it's about making surgical investments into specific, high-leverage areas that generate measurable enterprise value. Every dollar needs a job, and every job needs a KPI.

Modeling the Impact for a SaaS Company

For a SaaS business, growth comes down to two things: getting more customers and making each customer more valuable. A capital injection lets you pour gasoline on both of those fires.

Let's walk through a real-world scenario. Imagine your SaaS company is at $5M in Annual Recurring Revenue (ARR) and you’ve just closed a $2M growth round. The board has signed off on a plan to hit $15M ARR within 24 months. Time to put that $2M to work.

Here’s a breakdown of how a smart CFO would model that deployment:

| Investment Initiative | Capital Allocated | Action & Rationale | Projected ROI |

|---|---|---|---|

| Sales Team Expansion | $1,200,000 | Hire 8 new Account Executives with an On-Target Earnings (OTE) of $150K. This directly increases your capacity to close new logos. | Each AE is expected to bring in $500K in new ARR annually, generating $4M in new ARR per year once fully ramped. |

| Demand Generation | $500,000 | Invest in targeted paid acquisition and content marketing to lower your Customer Acquisition Cost (CAC) from $15K to $12K. | A 20% reduction in CAC means you can acquire more customers for the same spend, accelerating growth without torching your unit economics. |

| Product Development | $300,000 | Add key enterprise features to your platform. This allows you to move upmarket and increase your Average Contract Value (ACV). | Increase ACV by 25%, boosting overall revenue and improving net dollar retention as you land larger, stickier customers. |

In this model, a $2M investment isn't just "spent"—it's directly tied to generating over $4M in new ARR annually, plus efficiency gains that make future growth even more profitable. Of course, tracking these metrics religiously is non-negotiable. You can dive deeper into the mechanics in our guide on Annual Recurring Revenue.

A Playbook for a Digital Agency

For a professional services firm like a digital agency, the fastest way to grow is often to buy it. Strategic M&A is one of the most powerful uses of growth capital, allowing you to acquire new capabilities or client lists almost overnight.

Picture a digital agency doing $3M in annual revenue. They secure a $1M growth investment. The founder has been eyeing a smaller, specialized SEO agency with $750K in revenue and a fantastic client roster. That agency is available for a 1.2x revenue multiple, or $900K.

- Investment: $900,000 to acquire the SEO firm.

- Immediate Impact: Revenue instantly jumps from $3M to $3.75M.

- Strategic Value: The agency can now cross-sell its existing services (like PPC and web design) to the newly acquired client base while offering SEO to its original clients. The revenue synergies are immediate.

The remaining $100K covers integration costs. This single transaction can accelerate growth by years compared to the slow, painful process of building an SEO division from the ground up. This is exactly how the big players operate, and you can learn more about how industry leaders are leveraging capital for growth.

Red Flags: Common Misuses of Growth Capital

Misusing growth capital is a fatal, and surprisingly common, mistake. Watch out for these traps:

- Premature Scaling: You hire a dozen salespeople before your product is truly repeatable or your sales playbook is dialed in. You end up with a high burn rate and missed quotas.

- Vanity Spending: That flashy new office downtown or excessive G&A costs that feel good but don't contribute a single dollar to the top line.

- Ignoring Unit Economics: You pour money into marketing without a crystal-clear understanding of your Customer Acquisition Cost (CAC) and Lifetime Value (LTV). You can grow yourself straight into bankruptcy.

The smartest founders treat growth capital less like a windfall and more like a heavy responsibility. Every dollar must be deployed with discipline and a relentless focus on creating a clear, measurable return.

Is Your Company Ready for a Growth Equity Investment?

Trying to raise growth capital before your business is ready is one of the most common—and costly—mistakes a founder can make. It’s not just about wanting the money; it’s about proving you have the operational and financial maturity to handle it. Investors are not writing checks for potential at this stage. They're looking for a predictable, scalable machine they can pour fuel into.

Before you even think about a pitch deck, you need to conduct a brutally honest assessment of your company's readiness. Investors are searching for very specific signals that your business is built on solid ground.

The Non-Negotiable Financial Metrics

Investors speak the language of numbers. If your metrics are not in order, the conversation is over before it begins. To be taken seriously, you must show a clear and consistent track record.

Here are the table-stakes metrics you absolutely must have dialed in:

- Consistent Revenue Growth: You need a clear, repeatable growth trajectory. According to OpenView's 2024 SaaS Benchmarks, companies seeking growth capital should demonstrate at least 30-50%+ year-over-year growth.

- Strong Gross Margins: This proves your core business is profitable and can scale without collapsing. For SaaS companies, investors want to see gross margins of 75% or higher. For services businesses, anything above 40-50% demonstrates strong operational efficiency.

- A Predictable Sales Funnel: You have to prove you have a repeatable process for acquiring customers. This means knowing your Customer Acquisition Cost (CAC) and Lifetime Value (LTV) inside and out, with a healthy LTV:CAC ratio of at least 3:1.

These numbers tell a story. They show an investor that your success isn't a fluke—it's the result of a well-oiled system that's ready for a capital injection.

The Litmus Test: Investor-Ready Financials

Having strong metrics is one thing. Presenting them in a clean, professional, and auditable format is entirely different, and it's where many promising companies fall flat.

Misconception: "My QuickBooks reports are good enough for investors." Reality: "Messy books" is the number one deal-killer in growth equity. Period.

Your financial reporting is the product you're selling to investors. It must be pristine. This means moving beyond basic bookkeeping and running a sophisticated financial operation. A critical benchmark for your operational maturity is your month-end close process. If it takes your team weeks to close the books, you're not ready. The gold standard is a five-day month-end close. This proves you have the systems in place to produce accurate, timely data—a non-negotiable for any institutional investor and a core part of solid financial reporting best practices.

The market for growth capital has matured. As detailed in McKinsey's 2024 private markets report, top-tier funds are larger and more selective than ever. Only the most prepared companies make the cut.

Warning Signs That Scare Investors Away

Investors are trained to spot red flags from a mile away. If your business has any of these issues, you must fix them long before you start taking meetings.

Here’s a checklist of common deal-breakers:

| Red Flag | Why It Scares Investors | How to Fix It |

|---|---|---|

| Messy or Inaccurate Financials | Signals a lack of discipline and makes it impossible to verify your claims. It's the fastest way to lose all credibility. | Engage an outsourced controller to clean up your books, implement proper revenue recognition (e.g., ASC 606), and establish a fast close. |

| Unpredictable Cash Flow | Shows the business lacks a stable foundation. Investors are here to fund growth, not your next payroll emergency. | Implement a 13-week cash flow forecast and build a disciplined process for managing working capital. |

| Founder Dependence | If the entire business hinges on you for every key decision and relationship, it isn't a scalable asset—it's just a job. | Build a strong leadership team, document key processes, and prove the business can run without your daily intervention. |

| No Clear Use of Funds | Asking for millions without a data-backed plan on how you'll use it just shows you haven't done the strategic work. | Develop a detailed financial model that shows exactly how the capital will be used to generate a 3-5x return for investors. |

If you've spotted some gaps in your financial operations, that’s not a failure—it's an opportunity. Recognizing where you are weak is the first step toward building an investable company.

Navigating the Due Diligence Process

Once you’ve received a term sheet from an interested investor, the real work begins. You are now entering the due diligence phase—an intense, forensic examination of every facet of your business. Being unprepared here isn’t an option; it's the fastest way to kill a promising deal and burn your reputation.

This process is less about selling your vision and more about proving its foundation is rock-solid. Investors will bring in teams to scrutinize your financials, legal records, and market position to validate the story you told in your pitch deck. Your job is to make this process seamless and transparent, building the trust needed to get to a successful close.

Key Areas of Scrutiny

Due diligence typically breaks down into three core workstreams. Expect deep dives into each of these areas from the investor's team of accountants, lawyers, and industry experts.

- Financial Diligence: This is ground zero. Investors will pore over your historical financials, tax returns, and the detailed financial model underpinning your growth projections. Every number will be questioned.

- Legal Diligence: Lawyers will review all corporate records, board minutes, customer contracts, employee agreements, and intellectual property filings to uncover any hidden liabilities.

- Commercial Diligence: Here, they validate your market opportunity. This involves pressure-testing your total addressable market (TAM), analyzing the competitive landscape, and assessing customer concentration and churn.

Growth capital is designed for this exact stage, bridging the gap between early venture rounds and a full exit. Unlike VC, it injects substantial sums—often $10-$100 million—into companies with proven models to fuel expansion without giving up majority ownership. For more on this funding stage, see SIFMA's research.

The Quality of Earnings Report

For any serious growth equity deal, investors will commission a Quality of Earnings (QoE) report. This is not a standard audit; it’s a deep financial investigation conducted by an independent accounting firm to verify the sustainability and accuracy of your reported EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

The QoE process will adjust your reported earnings for any non-recurring revenue, one-time expenses, or aggressive accounting practices to present a truer picture of your company's core profitability. A clean QoE is a massive vote of confidence and can directly impact your valuation. An unclean one can kill the deal.

Preparing Your Data Room

A well-organized virtual data room is your single source of truth during due diligence. It’s non-negotiable. Having all the necessary documents uploaded, neatly organized, and ready for review before the process begins shows you’re a professional and drastically accelerates the timeline.

Here is a foundational checklist for your data room:

| Category | Documents Required |

|---|---|

| Corporate Records | Articles of incorporation, bylaws, cap table, and all board meeting minutes. |

| Financial Documents | At least three years of historical financial statements (P&L, Balance Sheet, Cash Flow), your detailed financial projections, and tax returns. |

| Customer & Sales | Contracts for top customers, sales pipeline reports, and analysis of customer concentration and churn. |

| Employee & HR | Key employment agreements, benefits summaries, and any stock option plans. |

| Legal & IP | All material contracts, patents, trademarks, and any information on pending or past litigation. |

Making sure your financial documents are "audit-ready" is paramount. If that sounds daunting, our guide provides a detailed checklist for auditors that can help you get your books in order.

Your Actionable Next Steps to Land Growth Capital

Knowing what growth capital is and actually landing it are two totally different things. The real goal isn't just to find investors—it's to build a business that's so dialed-in, it's undeniably investable. This is your three-step game plan to get your company ready for a serious fundraising conversation.

1. Get Your Financial House in Order

Before you draft a single email to an investor, your financials must be airtight. We’re talking audit-ready books, proper revenue recognition locked down (that means you know ASC 606), and a disciplined, five-day month-end close. Anything less screams operational immaturity and will get you a "no" before you start your pitch.

You also need a rock-solid, defensible financial model. This isn't just a spreadsheet; it's the blueprint that proves how their capital injection will ignite your growth. It must clearly show your historical performance and lay out a data-backed story for the future.

2. Craft a Data-Backed Growth Story

Your pitch must be more than a big vision. It needs to be a compelling narrative backed by hard numbers. You must articulate exactly how you will deploy the capital to generate a 3-5x return for your new partners.

Whether you're expanding into a new market or acquiring a competitor, every single claim must be supported by market data and your own proven unit economics. You're showing them you've already built a repeatable engine—you just need them to add the fuel.

“When we talk to businesses using Capital, we can see this effect in action: a new initiative, followed by significant growth.” – Tanay Jaeel, Product Lead, Stripe Capital

This is exactly what investors need to see: a clear, direct line between their money and your company's takeoff.

3. Build Relationships Before You Need Them

The absolute worst time to start networking with investors is when you need their money. You should be connecting with potential growth equity partners six to twelve months before you plan to raise.

Get on their radar. Share progress updates, ask for advice, and build a genuine rapport. This long-game approach transforms fundraising from a series of cold pitches into warm conversations with people who already understand your business and believe in what you're building. It gives them a chance to watch you execute, building the trust you'll need to close the deal.

Ready to get your financials investor-ready? Jumpstart Partners provides outsourced controller services to help you lock in a fast 5-day close, build a powerful financial model, and walk into due diligence with total confidence. Schedule a consultation today and let's build your investable business.