Financial Operations

The Definitive Financial Due Diligence Checklist for Founders & CEOs

Preparing for a sale or audit? Use our financial due diligence checklist for founders of SaaS, agency, and service businesses to get investor-ready now.

ByJumpstart Partners, CPA, QuickBooks ProAdvisor

··24 min readYou’ve built a business with real traction, hitting that crucial $500K to $20M revenue mark. An investor is interested, an acquirer is knocking, or a formal audit looms. The financial due diligence they are about to kick off will be the most intense financial scrutiny your company has ever faced. This isn't just about handing over a Profit & Loss statement; it’s about proving your numbers are accurate, defensible, and built on a rock-solid accounting foundation.

A disorganized back office isn’t just an internal headache—it’s a direct threat to your valuation and deal certainty. The difference between a smooth, successful transaction and a painful, value-destroying ordeal comes down to one thing: preparation. Investors and buyers don't just look at what you’ve earned; they meticulously analyze how you earned it and accounted for it. Any discrepancy creates doubt, delays timelines, and reduces the value you’ve worked so hard to build.

This is not another generic list. This financial due diligence checklist is your roadmap. We will walk through the ten critical areas that come under the microscope, from ASC 606 revenue recognition and cap table verification to payroll compliance and intercompany transactions. You will learn exactly where investors look, what red flags they search for, and how to fix them before they cost you millions.

1. Revenue Recognition and ASC 606 Compliance

Misstating revenue is the fastest way to destroy trust during due diligence. The standard for revenue recognition, ASC 606, dictates that you recognize revenue when you transfer control of goods or services to customers—not necessarily when you get paid. For SaaS and service companies with recurring revenue or multi-element contracts, this is far from straightforward.

Common Misconception: "Cash collected equals revenue earned." This is incorrect and a massive red flag. Investors value your business based on Generally Accepted Accounting Principles (GAAP), not your cash balance. Getting this wrong means your income statement, balance sheet, and key metrics like Monthly Recurring Revenue (MRR) are fundamentally flawed.

How ASC 606 Works in Practice

The standard follows a five-step model for every customer contract:

- Identify the contract with a customer.

- Identify the separate performance obligations (distinct goods or services).

- Determine the transaction price.

- Allocate the transaction price to the separate performance obligations.

- Recognize revenue as you satisfy each obligation.

Worked Example: You sign a $15,000 annual SaaS contract that includes a $12,000 subscription fee and a $3,000 one-time setup fee. Under ASC 606, if the setup doesn't provide standalone value, it's not a separate performance obligation. You must recognize the entire $15,000 over the 12-month contract term.

- Incorrect (Cash Basis): Recognize $15,000 revenue in Month 1.

- Correct (ASC 606): Recognize $1,250 per month ($15,000 / 12 months), even if you collected all the cash upfront.

Actionable Next Steps

To prepare this crucial area for your financial due diligence checklist, you must implement a robust process.

- Create a Formal Policy: Draft a revenue recognition policy memo detailing how your company applies ASC 606 to your specific contract types. This document is a key diligence request.

- Automate in Your Ledger: Implement ASC 606 workflows in your accounting system to automate the deferral and recognition of revenue. This eliminates error-prone manual spreadsheet calculations.

- Reconcile Metrics: Build a dashboard that clearly reconciles your operational metrics (like MRR/ARR) back to your GAAP-compliant recognized revenue. Investors will always ask for this reconciliation.

For a deeper dive, you can learn more about SaaS revenue recognition and ASC 606 here.

2. Bank Reconciliations and Cash Management

Your cash balance is the most fundamental number on your balance sheet, yet it’s surprisingly easy to get wrong. Bank reconciliations are the non-negotiable process of verifying that your accounting records precisely match your bank statements. Without this control, you have no verifiable proof of your cash position, creating a massive credibility gap and opening the door to undetected errors or fraud.

In due diligence, unreconciled bank accounts are an immediate "stop the presses" red flag. Investors and buyers need absolute confidence that the cash you claim is real and accounted for. Any discrepancy undermines trust in your entire financial reporting process.

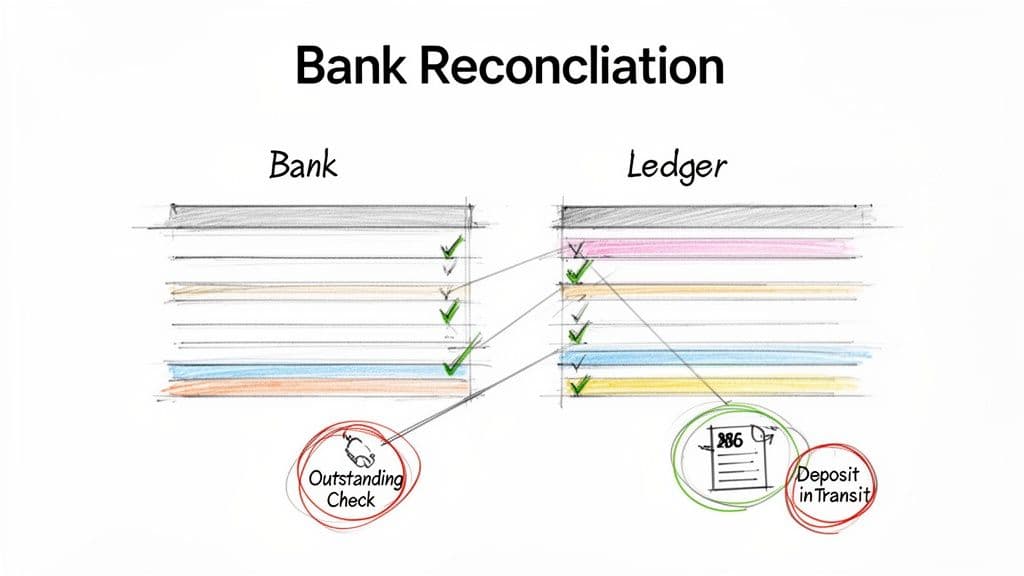

How Bank Reconciliations Work in Practice

The goal is to match every deposit, withdrawal, and fee on your bank statement to a corresponding transaction in your accounting system.

- Compare Deposits: Match deposits on the bank statement to cash receipts in the general ledger.

- Compare Withdrawals: Match checks and electronic payments on the bank statement to disbursements in the ledger.

- Identify Bank Charges: Record bank service fees or interest income not yet in your books.

- Account for Timing Differences: Identify outstanding checks (sent but not cashed) and deposits in transit (recorded but not yet cleared).

- Verify Balances: The adjusted bank balance must equal your general ledger's cash balance. To ensure accuracy, master your bank account reconciliation process.

Worked Example: Your ledger shows a cash balance of $150,000. Your bank statement shows $155,000. During reconciliation, you find a $5,000 check you paid to a vendor hasn't been cashed yet (outstanding check). The reconciliation proves both balances are correct once you account for this timing difference.

Actionable Next Steps

To prepare this foundational area for your financial due diligence checklist, you need a disciplined, repeatable monthly process.

- Establish a Timely Cadence: Reconcile all bank, credit card, and payment processor accounts (like Stripe) within five business days of the month-end close. This prevents errors from compounding.

- Leverage Automation: Use your accounting software’s bank feed and reconciliation tools to automatically match the majority of transactions. This drastically reduces manual work.

- Investigate Reconciling Items Immediately: Create a policy that any reconciling item older than 30 days must be investigated and resolved. Aging items often hide deeper accounting problems.

For a step-by-step guide, you can learn how to reconcile your bank accounts here.

3. Accounts Receivable Aging and Collection Analysis

Your Accounts Receivable (AR) balance represents cash you've earned but haven't collected. An unmanaged AR balance is a direct threat to your working capital. During due diligence, investors scrutinize your AR aging report to assess the quality of your revenue, the effectiveness of your collections, and the risk of uncollectible "bad debt" hiding in your financials.

A high percentage of old receivables is a major red flag, suggesting weak internal controls and potentially overstated assets. It forces investors to question the true value of your reported earnings and can lead to a significant downward valuation adjustment.

How AR Analysis Works in Practice

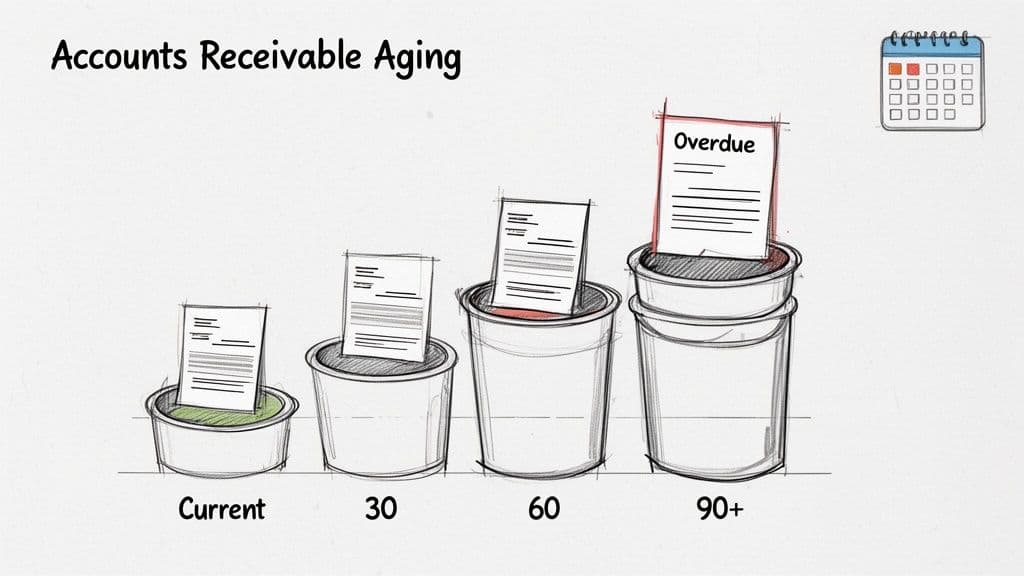

The AR aging report categorizes outstanding invoices into time buckets: typically Current, 1-30 days past due, 31-60, 61-90, and 90+ days. This immediately highlights which customers are late.

Worked Example: Your digital agency has $200,000 in total AR. The aging report shows:

- Current: $150,000

- 1-30 Days: $20,000

- 31-60 Days: $10,000

- 61-90 Days: $5,000

- 90+ Days: $15,000

Your policy is to reserve 50% for receivables over 90 days. You must book a bad debt reserve of $7,500 ($15,000 * 50%), reducing the carrying value of your receivables and hitting your income statement.

Actionable Next Steps

To get your collections process ready for due diligence, you need to systematize your approach.

- Establish a Formal Collections Policy: Document your collections cadence—when automated reminders are sent, when personal follow-up occurs, and when an account is escalated. Enforce payment terms (e.g., Net 30) consistently.

- Implement Weekly AR Reviews: Hold a weekly meeting with finance and account management to review the AR aging report, assign follow-up actions, and identify at-risk accounts before they become major problems.

- Calculate and Book a Bad Debt Reserve: Analyze historical write-offs to create a data-driven policy for your allowance for doubtful accounts. This demonstrates financial prudence and adherence to GAAP.

4. Accounts Payable and Expense Accruals

Understating your liabilities is just as dangerous as overstating revenue. A sloppy Accounts Payable (AP) and expense accrual process hides the true cost of doing business, making your company appear more profitable than it is. Proper accrual accounting demands you record expenses when they are incurred, not when you pay them.

For investors, a weak AP process is a major operational red flag. It suggests poor internal controls and a potential cash flow crisis waiting to happen. If you can't accurately track what you owe, you can't effectively manage your working capital.

How AP and Accruals Work in Practice

The goal is to match expenses to the period in which the benefit was received. This is achieved by processing vendor invoices and recording accruals for expenses incurred but not yet invoiced. A proper "cutoff" procedure at month-end is vital.

Worked Example: Your agency uses a contractor who performed $10,000 worth of work in March but doesn't submit their invoice until April 5th.

- Incorrect (Cash Basis): The $10,000 expense is booked in April, distorting both months' profitability.

- Correct (Accrual Basis): You create an accrued expense journal entry in March. This recognizes the expense in the proper period and ensures your March financials accurately reflect all costs.

Actionable Next Steps

To build a diligent AP and accrual process, you need to systematize how you handle liabilities. This is a critical component of any financial due diligence checklist.

- Establish an AP Cutoff Procedure: Create a formal process for your month-end close. Review all goods and services received before the period ends to ensure a corresponding invoice or accrual is recorded.

- Create a Recurring Accrual Checklist: Identify predictable monthly expenses like rent, software subscriptions, and payroll. Use this checklist to ensure these are accrued consistently, even if an invoice hasn't arrived.

- Implement AP Automation: Use tools like Bill.com or Tipalti to automate invoice capture, coding, and approval workflows. This reduces manual errors, prevents duplicate payments, and provides a clear audit trail.

For more details on streamlining this function, you can explore ways of improving the accounts payable process here.

5. Fixed Assets and Depreciation Analysis

Inaccurate fixed asset records are a common but serious oversight. For growing companies, fixed asset schedules are often incomplete or nonexistent. This directly impacts the accuracy of your balance sheet, taxable income, and overall valuation.

Getting this wrong means your assets are misstated, depreciation expense is incorrect, and your net income is skewed. Diligence teams scrutinize these schedules to ensure assets are properly capitalized versus expensed, useful lives are logical, and depreciation is applied consistently. A messy fixed asset ledger signals weak financial controls.

How Fixed Asset Management Works in Practice

Proper fixed asset management involves tracking an asset from acquisition to disposal. This includes determining its cost, assigning a useful life, selecting a depreciation method (like straight-line), and recording depreciation expense periodically.

Worked Example: Your tech company buys new servers for $15,000. Your capitalization policy is to capitalize assets over $2,500 with a useful life of 3 years using the straight-line method.

- Annual Depreciation Expense: $5,000 ($15,000 / 3 years)

- Monthly Depreciation Expense: $416.67 ($5,000 / 12) Each month, you record a $416.67 depreciation expense, and the book value of the servers decreases until it reaches zero.

Actionable Next Steps

To ensure your fixed asset records are audit-ready, establish a clear and consistent process.

- Establish a Capitalization Policy: Create a formal policy memo defining the threshold (e.g., capitalize assets over $2,500 with a useful life exceeding one year) for capitalizing vs. expensing purchases.

- Build a Detailed Fixed Asset Schedule: Maintain a schedule listing each asset's description, acquisition date, cost, useful life, depreciation method, and accumulated depreciation. This is a primary diligence request.

- Conduct a Physical Asset Audit: Perform a physical audit to identify "ghost assets" (assets on the books that are missing) or unrecorded assets, and update your schedule accordingly.

For a deeper look at how effectively you utilize your assets, you can learn more about the asset turnover ratio and its implications here.

6. Payroll and Payroll Tax Compliance

Payroll is a minefield of federal, state, and local tax regulations. Getting it wrong creates significant financial and legal liabilities, including steep IRS penalties and employee disputes. During due diligence, any sign of non-compliance is a major red flag, suggesting poor internal controls and hidden risk. For companies with remote employees, the complexity multiplies.

Red Flags in Payroll:

- Misclassifying employees as contractors.

- Failing to register and pay taxes in states where you have employees.

- Late payroll tax deposits.

- Inaccurate W-2s or 1099s.

How Payroll Compliance Works in Practice

Effective payroll management involves a cycle of calculating, withholding, depositing, and reporting taxes, all while adhering to specific timelines.

Worked Example: You hire a remote employee in California. You must register with the California Employment Development Department (EDD), withhold California state income tax, and pay into California's State Disability Insurance (SDI) and Unemployment Insurance (UI) programs. Failing to do so can result in back taxes, penalties of up to 25%, and interest.

Actionable Next Steps

To ensure your payroll is clean and ready for scrutiny, establish and document a clear, repeatable process.

- Integrate Your Payroll System: Use modern payroll software like Gusto or Rippling that integrates directly with your accounting system. This automates journal entries and reduces manual errors.

- Establish a Payroll Checklist: Create and follow a detailed checklist for every payroll run, including verifying employee tax forms (W-4s), confirming state tax rates, and reconciling cash.

- Reconcile Tax Forms Quarterly: Reconcile your payroll register to your filed Form 941 each quarter. The total wages and taxes reported must match your internal records perfectly.

- Document Contractor Classifications: Maintain a clear file justifying why each 1099 contractor is classified as such, based on IRS and state-specific criteria. This is your first line of defense against reclassification risk.

7. Debt and Loan Obligations Analysis

Mismanaged debt is a silent killer and a massive red flag during due diligence. Lenders and investors scrutinize your debt to understand your company's leverage, risk profile, and cash flow obligations. An incomplete picture of your borrowings signals poor financial controls and can jeopardize a deal.

Failing to properly track loan terms, monitor covenants, and accrue interest distorts your balance sheet and income statement. This isn't just a bookkeeping error; it's a fundamental misrepresentation of your financial health.

How Debt Analysis Works in Practice

A comprehensive debt analysis involves creating a master schedule of all borrowings and actively monitoring compliance. You must track principal, interest, covenants, and maturity dates for every single obligation.

Worked Example: Your company has a $500,000 loan with a covenant requiring a Debt Service Coverage Ratio (DSCR) of at least 1.25x, tested quarterly.

- EBITDA for the quarter: $100,000

- Total debt service (principal + interest) for the quarter: $75,000

- DSCR Calculation: $100,000 / $75,000 = 1.33x This calculation shows you are in compliance. You must be able to produce this calculation for diligence.

Actionable Next Steps

To build a robust debt management process, centralize and systematize your tracking.

- Create a Master Debt Schedule: Build a spreadsheet that lists every loan with its key terms: lender, original amount, origination date, interest rate, term, monthly payment, maturity date, and covenants.

- Automate Interest Accruals: Set up recurring journal entries in your accounting system to accrue interest expense monthly for each loan. This ensures your expenses are recognized in the correct period.

- Monitor Covenants Proactively: Calculate and track all financial covenants (e.g., Debt/EBITDA, DSCR) on a monthly basis. This provides an early warning system to address potential violations.

8. Equity Structure and Cap Table Verification

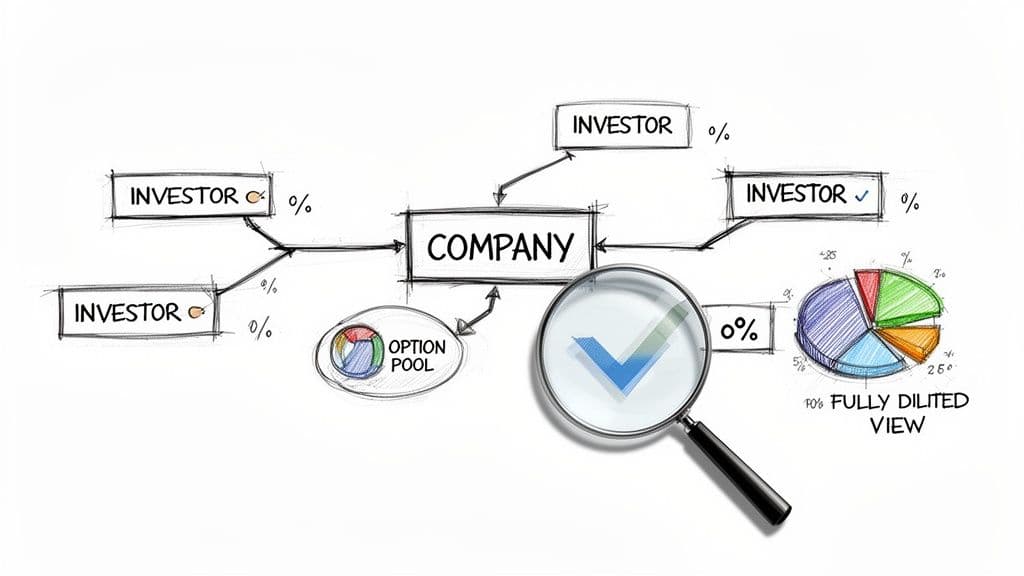

Your capitalization table (cap table) is the single source of truth for company ownership. An inaccurate cap table creates significant legal and financial risk, threatening your valuation and potentially killing a deal. It documents every share of stock, option, and convertible instrument. Any discrepancy leads to painful corrections and a loss of investor confidence.

A messy cap table is a major red flag, suggesting poor governance and a lack of financial control that can derail a transaction entirely.

How Cap Table Verification Works in Practice

The verification process involves tracing every equity transaction back to its source documentation and ensuring all calculations are correct.

- Document & Reconcile: Gather all stock purchase agreements, board consents, option grant agreements, and convertible notes.

- Model the Fully-Diluted State: Build a model showing ownership assuming all outstanding options and convertible securities are exercised.

- Verify Key Terms: For preferred stock, confirm terms like liquidation preferences and anti-dilution provisions match the legal documents.

- Audit Stock Compensation: Re-calculate stock-based compensation expense (ASC 718), ensuring vesting schedules and fair value assumptions are correct.

Worked Example: You granted 120,000 stock options with a total fair value of $60,000 that vest over 4 years. The annual stock compensation expense is $15,000 ($60,000 / 4 years). If you failed to record this, your operating expenses are understated by $15,000 per year, directly impacting your reported profitability and EBITDA.

Actionable Next Steps

To ensure your cap table is diligence-ready, you need to establish rigorous controls.

- Centralize with Software: Transition from a spreadsheet to a dedicated cap table management platform like Carta or AngelList. These tools act as a central repository and automate complex calculations.

- Document Everything: Ensure every equity issuance is supported by signed board resolutions and stock purchase agreements. Store these documents in an organized data room.

- Perform Regular Audits: Conduct a quarterly internal audit of your cap table. Reconcile the fully-diluted share count and verify new grants against board approvals.

- Create a Summary for Investors: Prepare a clean, one-page summary cap table showing ownership percentages by major investor, founder, and the employee option pool on a fully-diluted basis.

9. Intercompany Transactions and Consolidation Analysis

For businesses with multiple legal entities (e.g., a holding company and an operating subsidiary), intercompany transactions are a major point of scrutiny. These transactions—such as loans, management fees, or shared services—must be properly eliminated in consolidated financial statements. Failure to do so inflates revenue and assets, providing a distorted view of the company's overall financial health.

Misrepresenting your consolidated performance is a significant red flag. It suggests a lack of sophisticated financial controls and directly impacts valuation by creating a financial picture that isn't real.

How Consolidation Works in Practice

The goal is to remove the effect of any transaction that occurs between entities you control. This prevents double-counting of revenue, expenses, assets, and liabilities. The process involves identifying, reconciling, and then creating eliminating journal entries for these transactions.

Worked Example: Your holding company lends its operating subsidiary $500,000. On a consolidated basis, this is just moving cash from one corporate pocket to another.

- The intercompany loan receivable on the parent's books and the intercompany loan payable on the subsidiary's books must be eliminated.

- If the loan carries interest, the interest income recognized by the parent and the interest expense recognized by the subsidiary must also be fully eliminated.

Actionable Next Steps

To ensure your consolidated financials are accurate and defensible, implement a rigorous intercompany accounting process.

- Document Everything: Maintain formal, signed agreements for all intercompany activities, including loan agreements with stated interest rates and management fee agreements.

- Use a Consolidation Worksheet: Create a master spreadsheet or use consolidation software that clearly shows each entity's trial balance, the specific eliminating entries, and the final consolidated figures. This provides a clear audit trail.

- Reconcile Intercompany Balances Monthly: At each month-end, confirm that intercompany accounts receivable and payable balances match perfectly. Any discrepancy indicates an accounting error that must be resolved immediately.

10. Accrued Liabilities and Period-End Cutoff Procedures

Failing to properly accrue for expenses is a direct path to overstating profitability. Accrued liabilities are expenses your business has incurred but not yet paid. Correctly recording these in the period they occur—a process known as cutoff—is fundamental to accrual accounting and a key area of scrutiny.

Getting this wrong means your financial statements do not accurately reflect the company's performance or obligations. For example, if you fail to accrue for a large consulting project completed in December, your December profit will be artificially high, and your January profit will be artificially low. This distortion misleads investors.

How Accruals and Cutoff Work in Practice

The core principle is matching expenses to the period in which they helped generate revenue, regardless of when cash changes hands. You must identify services received by the end of the accounting period for which you have not yet received an invoice.

Worked Example: A contractor completes $8,000 worth of work for you in March. They don't send their invoice until April 5th. To ensure March's financials are accurate, you must record an accrual on March 31st:

- Debit (Increase) Contractor Expense: $8,000

- Credit (Increase) Accrued Liabilities: $8,000

When the invoice is paid in April, the accrued liability is reversed, and cash is paid, avoiding double-counting the expense.

Actionable Next Steps

To build a reliable accrual and cutoff process, you must create systematic controls.

- Implement a Cutoff Review: Systematically review all invoices received in the first 10 business days of a new month. Scrutinize the service dates to identify any that belong to the prior period and need to be accrued.

- Create an Accrual Checklist: Maintain a checklist of recurring, un-invoiced expenses to review each month. This should include items like contractor fees, estimated legal bills, sales commissions, and bonuses.

- Document and Reverse: For every accrual, document the basis for the estimate (e.g., vendor email, contract terms). Use your accounting software to set up auto-reversing journal entries for the first day of the next period to ensure a clean slate.

For a comprehensive guide, you can learn more with our month-end close checklist and template.

10-Item Financial Due Diligence Checklist Comparison

| Due Diligence Item | Key Objective & Red Flags | Business Impact if Ignored | Actionable Next Step | Industry Benchmark / Source |

|---|---|---|---|---|

| 1. Revenue Recognition | Ensure GAAP compliance (ASC 606); avoid recognizing cash as revenue. | Deal-killer; material restatements; massive loss of trust. | Create a formal ASC 606 policy memo and automate recognition in your ledger. | SaaS businesses with <$20M ARR should have a 95%+ renewal rate. (Source: OpenView 2024 SaaS Benchmarks) |

| 2. Bank Reconciliations | Verify cash balance is real and accounted for; unreconciled accounts are a huge red flag. | Undetected fraud/errors; zero confidence in financial statements. | Reconcile all cash and credit accounts within 5 business days of month-end. | Best-in-class finance teams complete reconciliations by Day 3. (Source: APQC) |

| 3. AR Aging | Assess collection efficiency and bad debt risk; high % of old AR is a major concern. | Overstated assets; poor working capital management; valuation haircuts. | Implement a weekly AR review meeting and establish a data-driven bad debt reserve policy. | Days Sales Outstanding (DSO) for SaaS should be under 45 days. (Source: RevOps Co-op) |

| 4. AP & Accruals | Ensure all expenses are recorded in the correct period (accrual basis). | Understated liabilities; artificially inflated profits; surprise cash crunches. | Implement a month-end cutoff procedure and a recurring accrual checklist. | N/A - This is a fundamental GAAP requirement for all businesses. |

| 5. Fixed Assets | Verify assets exist and are depreciated correctly; avoid expensing capital items. | Inaccurate balance sheet; incorrect net income and tax liabilities. | Create a formal capitalization policy (e.g., capitalize items >$2,500). | N/A - The capitalization threshold is company-specific but must be documented. |

| 6. Payroll Compliance | Verify tax withholdings, deposits, and filings are accurate for all jurisdictions. | Steep IRS/state penalties; legal liability; hidden back-tax obligations. | Reconcile your payroll register to your quarterly Form 941 filings. | Misclassifying an employee can result in back-tax liabilities of 20-40% of their wages. (Source: IRS) |

| 7. Debt & Covenants | Confirm all debt is recorded and all loan covenants are being met. | Surprise loan defaults; misstated liabilities; inaccurate risk profile. | Create a master debt schedule and monitor covenants on a monthly dashboard. | N/A - Covenants are specific to each loan agreement. |

| 8. Cap Table | Ensure 100% accuracy of ownership on a fully diluted basis. | Legal disputes; deal-killer; incorrect stock compensation expense. | Move from a spreadsheet to cap table software like Carta and perform a quarterly audit. | N/A - Accuracy is paramount; there is no room for error. |

| 9. Intercompany Items | Eliminate all intercompany transactions for a true consolidated view. | Inflated revenue/assets; distorted view of company performance. | Reconcile intercompany balances monthly and maintain a formal elimination worksheet. | N/A - This is a fundamental GAAP requirement for multi-entity companies. |

| 10. Period-End Cutoff | Ensure all expenses are captured in the period they were incurred. | Distorted monthly profitability; unreliable financial trends. | Review invoices received in the first 10 days of the month for prior-period expenses. | Best-in-class companies close their books within 5 business days. (Source: Ventana Research) |

From Checklist to Close: Your Next Steps

You've navigated the comprehensive financial due diligence checklist. This process is more than a box-ticking exercise; it’s a strategic deep dive that exposes the true financial health and operational integrity of your business. It tells investors or buyers whether your company is built on a solid foundation or a house of cards.

Your greatest strategic advantage is proactive preparation. A clean, audit-proof set of financials isn't just a defensive measure. It's an offensive tool that empowers you to negotiate from a position of undeniable strength, accelerate deal timelines, and command a higher valuation. The difference between a smooth close and a deal that falls apart often comes down to the rigor you apply to this checklist months in advance.

Your Actionable Path Forward

Treating this checklist as a one-time project is a critical mistake. Instead, integrate these diligence principles into your ongoing financial operations.

- Prioritize Ruthless Reconciliation: Make your monthly bank, credit card, and balance sheet reconciliations non-negotiable. This is the bedrock of financial accuracy.

- Systematize Your Data: Move beyond scattered spreadsheets. Implement systems for contract management, revenue recognition, and cap table administration to create a "single source of truth."

- Build Your Data Room Now: Don't wait for a request. Begin creating a virtual data room and populating it with the documents outlined here. Organize it logically by category (e.g., Financials, Corporate, Contracts). This forces you to confront missing information before it becomes an urgent problem.

While this checklist is critical, a successful transaction involves legal, operational, and commercial reviews as well. For a broader perspective, the Mergers and Acquisitions Due Diligence Checklist from Kons Law offers valuable context on the interlocking legal and business components.

"The most successful founders don't just 'pass' due diligence; they use the preparation process to gain a deeper, more objective understanding of their own business. They uncover inefficiencies, de-risk operations, and emerge with a clearer strategic vision, whether they close a deal or not." –– Cameron W. Smith, CPA & Founder of Jumpstart Partners

Ultimately, this entire process is about building a business that is not only valuable but provably valuable. Your numbers must be defensible, your processes scalable, and your financial story coherent. By embracing the discipline this checklist demands, you are building a more resilient, predictable, and successful company.

Going through this checklist often reveals gaps in your financial operations. If you’ve uncovered unreconciled accounts or messy revenue recognition, partner with Jumpstart Partners. Our US-based, CPA-certified team delivers guaranteed 5-day month-end closes and audit-proof financials that accelerate your growth, instead of holding it back. Book a consultation today to get your financials investor-ready.